THREAD: On why eliminating the unlimited capital gains exemption on primary residence is common sense right now & what happens when a country decides to go all in, changing a 'place where you live' into a special asset class #ToRE #VanRE

Fundamentals whack: Despite a record shock to aggregate demand, unemployment and plummeting immigration Canadian housing is bananas. As @StephenPunwasi pointed out, this is what happens when you make money free and lock people in their houses.

Socialized losses, privatized gains: for last 20yrs central bank policy has been kicking the can down the road (tech '00, GFC, COVID) which has overly benefited one cohort above all (boomers). Also known as moral hazard. In Canada, this has especially manifested in RE prices.

Free lunch: Without CMHC (to say nothing about the BoC's emergency powers) mortgage rates are higher and home prices lower. Full stop the end. Every taxpayer bears this risk.

Net drain: When a young family pays $1.6 million for a semi that should cost, say, $1.2 million, that is a direct wealth transfer between generations. It's a net drain on the economy as well if on average the millennial is more likely to SPEND extra money than SAVE on average.

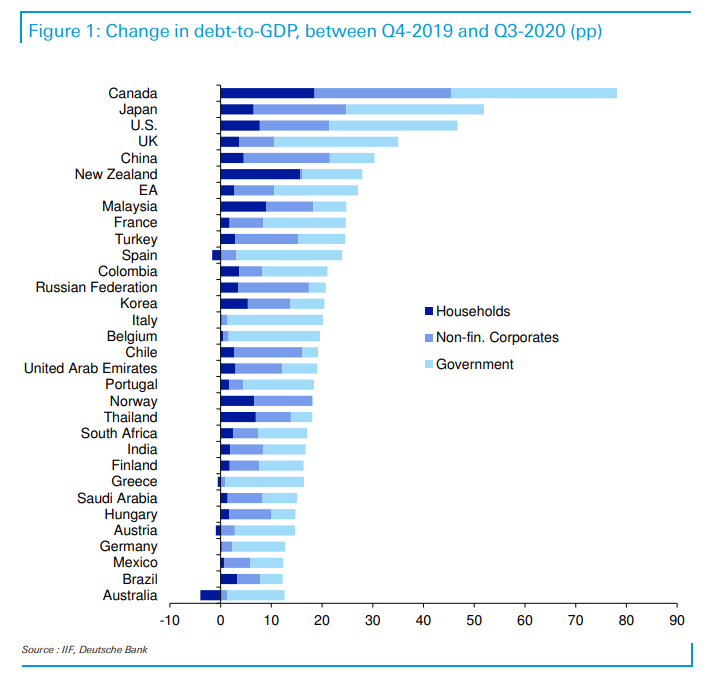

Govt saved homeowners: Response from the Feds was the greatest of any G20 country. The impact of replacing $2 or $3 (depending what you look at) for every $1 lost has knock on effects, and money finds a home (no pun) like a stream finds a river.

Substitutions: people aren't stupid. Why pay +25% tax (top bracket) on capital gains when I get 20:1 leverage and pay ZERO tax? #yolo At least when you participate in capital markets you may (theoretically) lower the cost of capital for said company.

Dead weight: Housing is not a productive asset (ex the boost from the build). The real return of housing in the US from 1900-2000 is ~0.2% real return per year (Shiller). And why should it be more? Housing doesn't DO anything. It just sits there.

Our priorities don't make sense: Our country has become a scientific backwater as R&D spending has been plummeting for years. Few smart engineering students from Waterloo want to stay here.

Can't stop the party: The Canadian economy has become a pseudo ponzi scheme dependent on massive immigration to keep housing inflated and entitlements solvent (held mostly by the same cohort who benefited most from asset inflation). Especially now since HELOC balances look full.

Community: good friend of mine is a HS phys-ed teacher. He coaches 2 sports per term including several OFSAA finishers. This is the person you want around. Gives way more than he takes. A mentor to many of his students. Will he ever be able to afford a home in Toronto?

Money laundering: our politicians fcked us by turning a blind eye and tacitly allowing this for years. For illiquid assets like RE, the ONLY thing that matters is the marginal buyer. And they can do some serious damage. https://betterdwelling.com/how-a-little-money-laundering-can-have-a-big-impact-on-real-estate-prices/

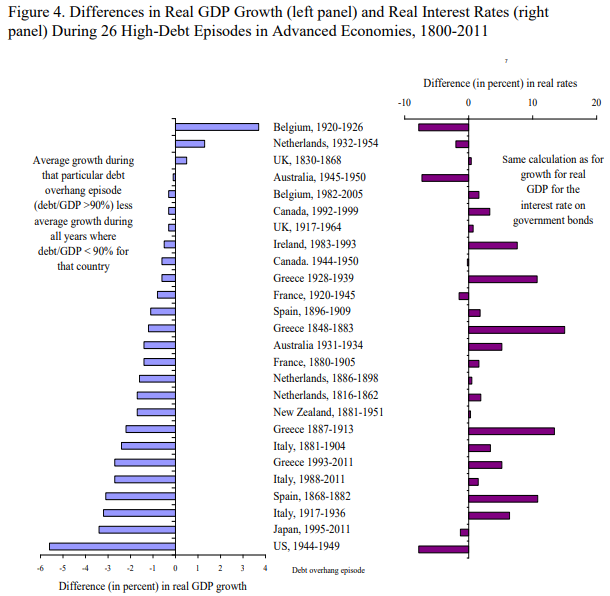

The government needs money: do I even need to talk about the deficit? Empirical evidence shows that highly indebted countries suffer through lower growth going forward. You can't solve a debt problem with more debt.

System is rigged for detached homeowners in cities: @alexbozikovic has gone over this ad naus. NIMBYism is a cancer; many places in Toronto that are seeing negligible or decreasing population density for most of their territory. Other organizations act like this, like the mafia.

So there you have it. Make the exemption limit $1 million. 99% of Canadians won't ever use that much. Problem solved. Full time speculators need to find new jobs. Country can start to focus on other things and actually build a diversified economy.

Unintended consequences? Maybe limit supply of houses sitting on +$1 million of cap gains in a few swank locales. I don't have these stats there but that is not an issue for the vast majority of the country. /end rant

Read on Twitter

Read on Twitter