Everybody’s talking about why stocks could be in a bubble.

But there are two big reasons why stocks AREN’T in a bubble that we should be paying attention to.

But there are two big reasons why stocks AREN’T in a bubble that we should be paying attention to.

Remember, a bubble = when a market rises much faster than its fundamental traits are improving (earnings, cash flows, the economy, etc).

Think of it like blowing up a balloon. You can fill it with more air, but it’ll eventually pop

Think of it like blowing up a balloon. You can fill it with more air, but it’ll eventually pop

So, is this market a big ole balloon about to pop?

There’s a legit argument for why this is the case, but there’s an (IMO) equally legit argument for why not.

There’s a legit argument for why this is the case, but there’s an (IMO) equally legit argument for why not.

THE FED.

THE FED.The Fed has kept rates historically low since the beginning of the pandemic.

They’ve done that to encourage people to spend and borrow money because the economy needed some CPR.

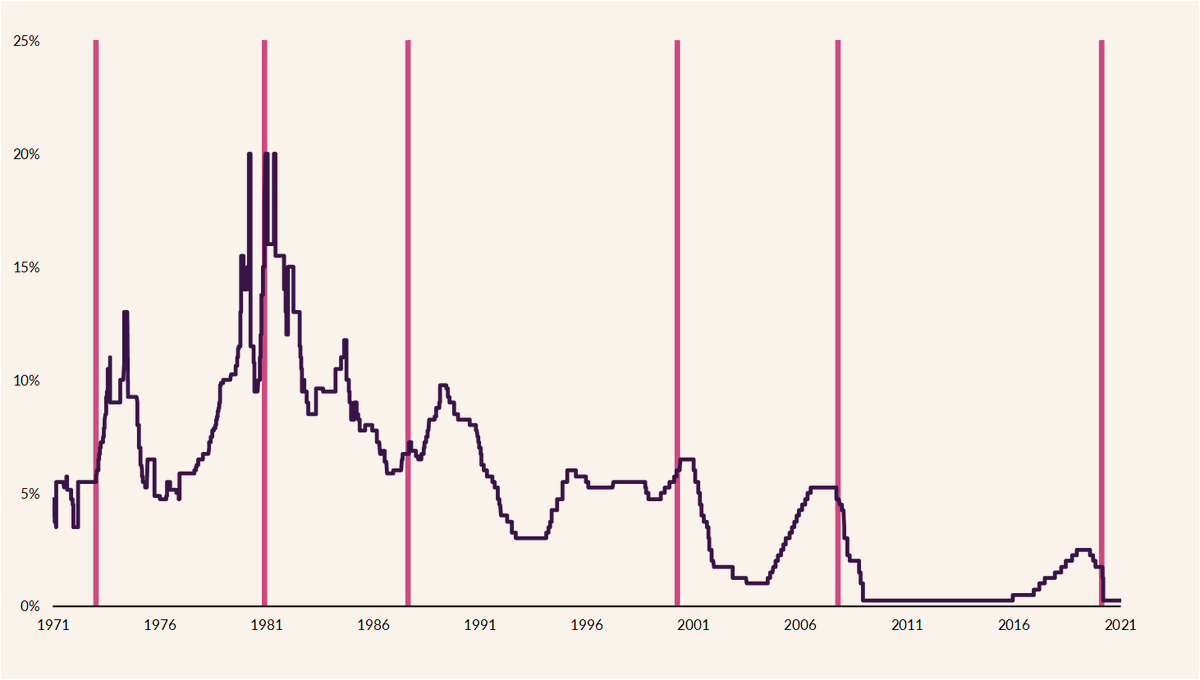

If you look at recent history, you'll see that most big market drops have happened after big Fed rate hikes.

Purple line = Fed policy rate

Pink shading = market tops before a >20% S&P 500 drop

Purple line = Fed policy rate

Pink shading = market tops before a >20% S&P 500 drop

Guess what the Fed has said it’s not doing for a while? HIKING RATES.

In fact, Fed chair Jay Powell said just last week it’s not happening any time soon (and like any good internet steward, we have receipts). https://www.cnbc.com/2021/01/14/powell-sees-no-interest-rate-hikes-on-the-horizon-as-long-as-inflation-stays-low.html

In fact, Fed chair Jay Powell said just last week it’s not happening any time soon (and like any good internet steward, we have receipts). https://www.cnbc.com/2021/01/14/powell-sees-no-interest-rate-hikes-on-the-horizon-as-long-as-inflation-stays-low.html

Of course, plans can change, but there are a bunch of good reasons for the Fed to keep rates low for now.

Biggest reason why: the economy is still healing and the pandemic is still raging.

Biggest reason why: the economy is still healing and the pandemic is still raging.

THE MARKET’S MAKEUP

THE MARKET’S MAKEUPNo sector is clearly running away from the rest of the market. And TBH, this is starting to look like a classic economic rebound rally.

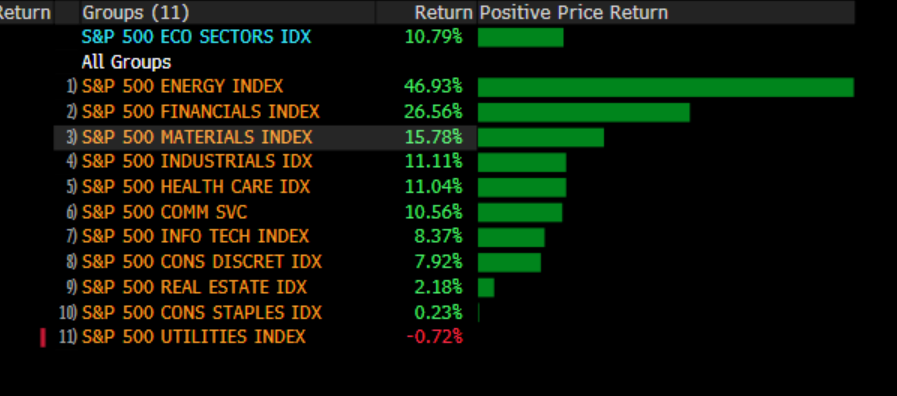

Here’s a snapshot of which sectors have led the market over the past three months.

Energy, materials and financials are up the most.

Energy, materials and financials are up the most.

Tech hasn’t been blowing the market away like it did last year, either.

FAANG stocks are up about 2.9% over the past three months, compared to the S&P 500’s 10.9% gain.

FAANG stocks are up about 2.9% over the past three months, compared to the S&P 500’s 10.9% gain.

Value stocks (the market's slow-and-steady members) are up 17.4% over that period, compared to the 10.1% gain in growth stocks. https://www.ally.com/do-it-right/trends/weekly-viewpoint-august-14-2020-value-stocks-rise/

(that's a primer we wrote on value vs. growth, btw)

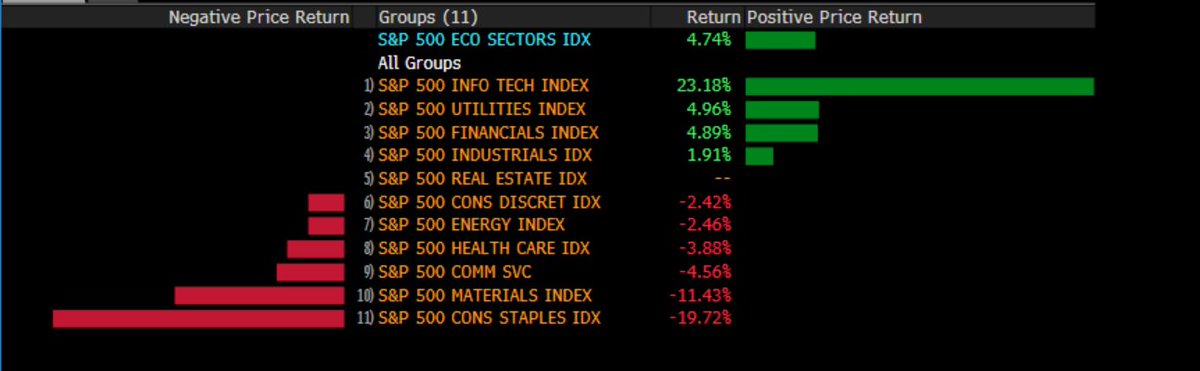

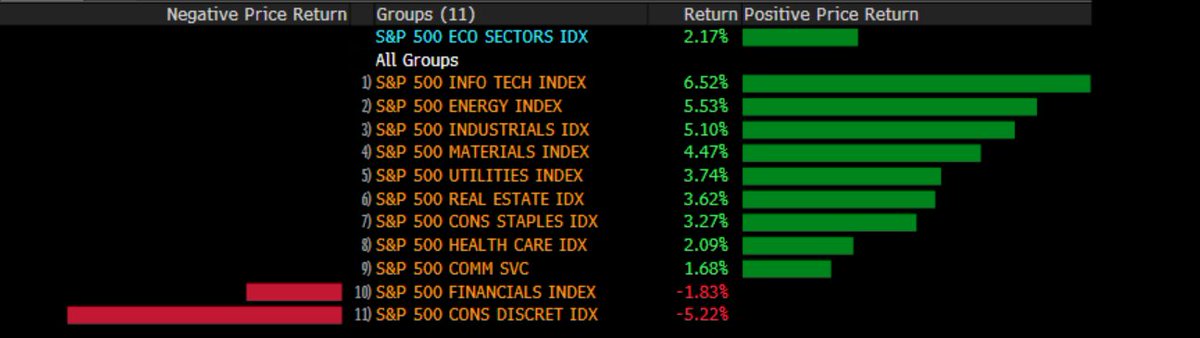

If you want to compare notes, here are the market scorecards from the three months before the 2000 & 2007 peaks.

Look, I could obviously be wrong here, and explaining away bubbles is a ~classic~ symptom of a bubbly environment.

But those are two big dynamics that look pretty darn supportive of the market.

But those are two big dynamics that look pretty darn supportive of the market.

. @justLBell and I wrote more about those here: https://www.ally.com/do-it-right/trends/weekly-viewpoint-january-15-2021-stock-market-bubble/

...and if you're getting worried about the market (because nobody knows what the future holds), here's a little thread I wrote JUST for you. https://twitter.com/callieabost/status/1349794014241976329?s=20

Read on Twitter

Read on Twitter