1) Avalara $AVLR thread

Co motto is “Tax compliance done right”

Nearly every business globally has to comply with some kind of mandatory indirect transaction tax system (sales tax in US, VAT or GST globally)

$AVLR address this issue via its suite of cloud software solutions

Co motto is “Tax compliance done right”

Nearly every business globally has to comply with some kind of mandatory indirect transaction tax system (sales tax in US, VAT or GST globally)

$AVLR address this issue via its suite of cloud software solutions

2) $AVLR automates transaction tax business processes, inc determining taxability, IDing tax rates, calc & collect taxes & preparing/filing returns

8k core customers >80% of revenue

8.5m tax determinations processed every day in '19

Already seems to be a category defining asset

8k core customers >80% of revenue

8.5m tax determinations processed every day in '19

Already seems to be a category defining asset

3) Brief History

Founded by current CEO Scott McFarlane in 2004, along with Jared R. Vogt & Rory Rawlings (left 2016), but did not complete an IPO until June 2018

Before IPO, the company raised a total of $341m in funding over 10 rounds with backers including Warburg Pincus

Founded by current CEO Scott McFarlane in 2004, along with Jared R. Vogt & Rory Rawlings (left 2016), but did not complete an IPO until June 2018

Before IPO, the company raised a total of $341m in funding over 10 rounds with backers including Warburg Pincus

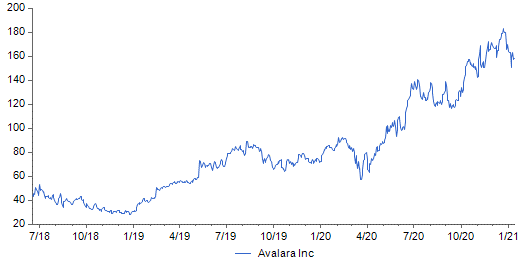

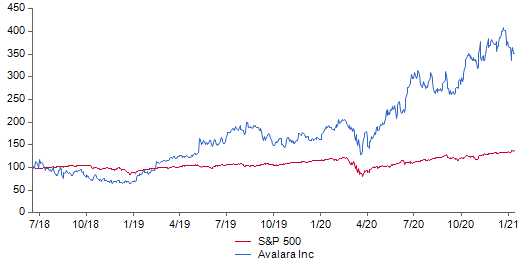

4) Returns

Despite this, the shares fell >30% in their first 6 months. But since then $AVLR has been on a tear, with the shares now up ~3.5x from listing price over ~2.5 years, providing a cool IRR of 63% and handily beating the S&P 500 by quite some margin

Despite this, the shares fell >30% in their first 6 months. But since then $AVLR has been on a tear, with the shares now up ~3.5x from listing price over ~2.5 years, providing a cool IRR of 63% and handily beating the S&P 500 by quite some margin

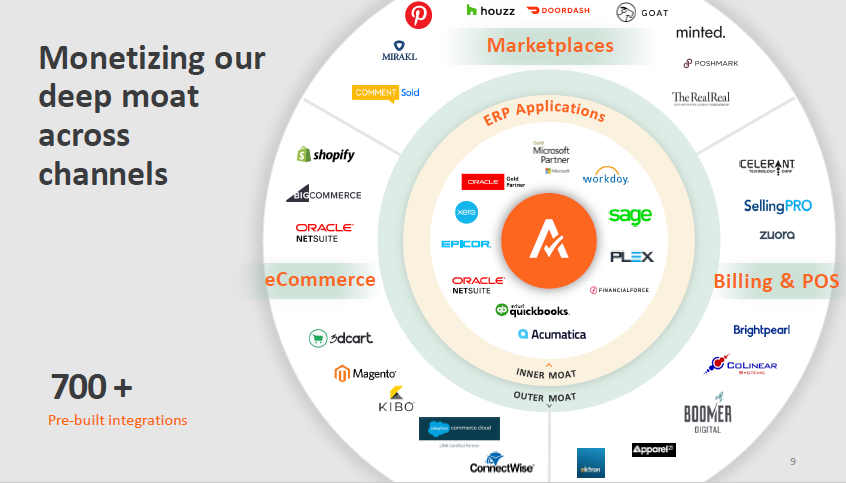

5) Market Backdrop

Responsibility for determining transaction tax falls on the seller

But e-commerce and globalisation, coupled with changing tax obligations imposed by a patchwork of local, regional, state and national tax authorities has created massive complexity

Responsibility for determining transaction tax falls on the seller

But e-commerce and globalisation, coupled with changing tax obligations imposed by a patchwork of local, regional, state and national tax authorities has created massive complexity

6) In the US alone, there are ~12k different tax jurisdictions. They do not operate under any sort of consistent framework and regularly make changes to the tax code, with AVLR estimating 25% of their tax code content changing every year (rate changes, modifying boundaries etc)

7) Product classification and location are more important than ever, e.g. music downloads are taxable in NJ but not in IA

Differences can even arise in a state re similar products. In NYC a sliced and toasted bagel, is taxable, while a bagel to go is exempt ($AVLR 10-K 2019)

Differences can even arise in a state re similar products. In NYC a sliced and toasted bagel, is taxable, while a bagel to go is exempt ($AVLR 10-K 2019)

8) Post IPO, $AVLR was handed a regulatory boost. US Supreme court upheld a ruling in the S Dakota v. Wayfair case (Jun 18) which allowed states to charge tax on purchases made from out-of-state sellers, even if the seller did not have a physical presence in the taxing state

9) This provided a precedent for other states to follow and gradually move to charge sales tax on all purchases made by their residents, firmly pushing sales tax up the agenda of US businesses

10) In my mind $AVLR is benefiting from 4 primary tailwinds

1) ROI from automation

2) Rise of both e-commerce and omnichannel in a multiplatform world

3) Growth of cross border transaction

4) Govt incentives to enforce collection

1) ROI from automation

2) Rise of both e-commerce and omnichannel in a multiplatform world

3) Growth of cross border transaction

4) Govt incentives to enforce collection

11) ROI

Many businesses still run manual transaction tax compliance processes, leading to miscalculations & incorrect collections, which can cause customer dissatisfaction & lead to tax penalties

Many businesses still run manual transaction tax compliance processes, leading to miscalculations & incorrect collections, which can cause customer dissatisfaction & lead to tax penalties

12) $AVLR’s software solutions fully automate these processes for businesses meaning they require fewer personnel and thereby allowing the business to focus on its core operations

13) Ecommerce/Omnichannel

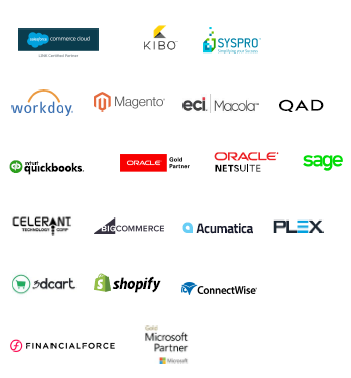

Fragmentation of the commerce landscape has also added to businesses’ tax problems. Business now use a plethora of platforms to sell their goods & services: store, own website(s), $AMZN, $ADBE Magneto, $SHOP, $BIGC etc. This adds complexity and process..

Fragmentation of the commerce landscape has also added to businesses’ tax problems. Business now use a plethora of platforms to sell their goods & services: store, own website(s), $AMZN, $ADBE Magneto, $SHOP, $BIGC etc. This adds complexity and process..

14) ..to transaction tax procedures.

$AVLR provides a solution by aggregating all of the information from the different sources, via ~750 integrations with ERP providers ($SAP, $ORCL, NetSuite etc) & major commerce platforms, & automating the transaction tax compliance process

$AVLR provides a solution by aggregating all of the information from the different sources, via ~750 integrations with ERP providers ($SAP, $ORCL, NetSuite etc) & major commerce platforms, & automating the transaction tax compliance process

15) Globalisation/Cross Border

Growth of cross border sales is adding more complexity. More transactions are subject to import taxes. Businesses now have to be able to deal with individual boxes moving cross border, as opposed to whole containers

Growth of cross border sales is adding more complexity. More transactions are subject to import taxes. Businesses now have to be able to deal with individual boxes moving cross border, as opposed to whole containers

16) Abandonment where buyers refuse to pay customs and duties on products creates issues and additional costs. $AVLR can help resolve any issue by ensuring that the correct customs and duties are paid at the time of sale

17) Enforcement/collection

As they say there are only two certainties in life (death and taxes)… indirect transaction taxes are here to stay and govts are only becoming stricter on enforcement/ collection with gradual moves towards more frequent/ real time reporting

As they say there are only two certainties in life (death and taxes)… indirect transaction taxes are here to stay and govts are only becoming stricter on enforcement/ collection with gradual moves towards more frequent/ real time reporting

18) Business Model

$AVLR provides a suite of cloud software solutions, key products include

AvaTax (~60% of sales) performs a series of functions to deliver tax determination and compliance functionality in real time, including sales and use tax, VAT, excise tax, lodging tax etc

$AVLR provides a suite of cloud software solutions, key products include

AvaTax (~60% of sales) performs a series of functions to deliver tax determination and compliance functionality in real time, including sales and use tax, VAT, excise tax, lodging tax etc

19)

Avalara Returns (~30% of sales) automates and streamlines the process of transaction tax return preparation, filing, and remittance

Other products (~10% of sales) inc CertCapture, MatrixMaster, VAT Expert & professional services

Avalara Returns (~30% of sales) automates and streamlines the process of transaction tax return preparation, filing, and remittance

Other products (~10% of sales) inc CertCapture, MatrixMaster, VAT Expert & professional services

20)

$AVLR sells its products via subscription based on a max no. of transactions/returns over term. Customers u/g subscription tier as they grow, so $AVLR grows as its customers grow.

Per transaction prices decreases as volume increase. RPI price increases

$AVLR sells its products via subscription based on a max no. of transactions/returns over term. Customers u/g subscription tier as they grow, so $AVLR grows as its customers grow.

Per transaction prices decreases as volume increase. RPI price increases

21)

Necessary collection & curation of tax/legal content means $AVLR business is more labour intensive than SaaS peers. With >1k employees (of 2.7k total) sit within CoGS, GMs currently fall in the low 70s. Further automating its own business processes is a key focus

Necessary collection & curation of tax/legal content means $AVLR business is more labour intensive than SaaS peers. With >1k employees (of 2.7k total) sit within CoGS, GMs currently fall in the low 70s. Further automating its own business processes is a key focus

22)

For distribution $AVLR relies on its technology partners, which include ERP vendors, ecommerce platforms, and Billing & POS providers

Partners send customers to $AVLR for their transaction tax compliance needs & build/maintain the software integrations

For distribution $AVLR relies on its technology partners, which include ERP vendors, ecommerce platforms, and Billing & POS providers

Partners send customers to $AVLR for their transaction tax compliance needs & build/maintain the software integrations

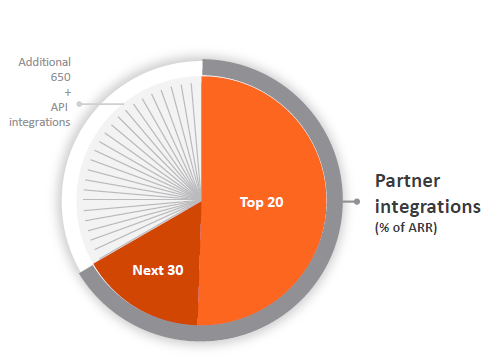

23)

In exchange $AVLR pays its partners a recurring revenue share (~8% of group subscription revs), thereby ensuring their interests are aligned

Majority of $AVLR’s ARR (2/3s) comes from its top 50 Tier 1 partners

In exchange $AVLR pays its partners a recurring revenue share (~8% of group subscription revs), thereby ensuring their interests are aligned

Majority of $AVLR’s ARR (2/3s) comes from its top 50 Tier 1 partners

24)

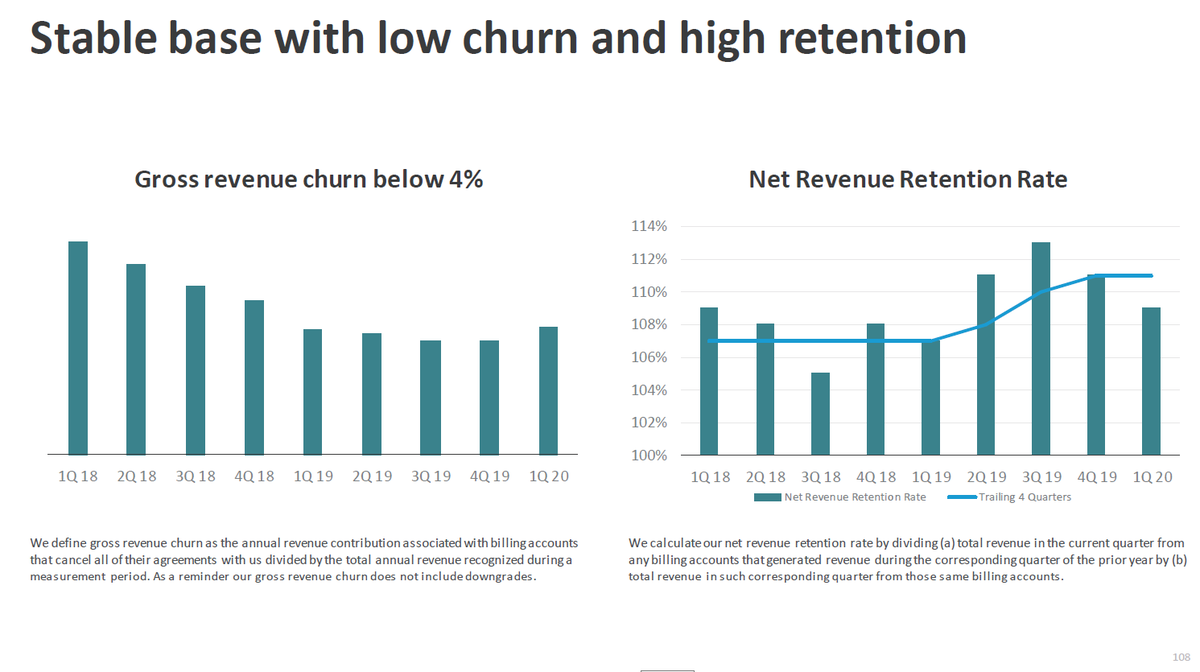

$AVLR ‘s role in completing a non-core yet critical/govt required business process, its integration with customer workflows and small % of total costs mean that $AVLR solutions benefit from low churn (gross annual churn <4%; primarily business failure)

$AVLR ‘s role in completing a non-core yet critical/govt required business process, its integration with customer workflows and small % of total costs mean that $AVLR solutions benefit from low churn (gross annual churn <4%; primarily business failure)

25)

Net revenue retention rate is >100% with customers upgrading their subscriptions (transaction limit) as they grow, RPI price increases & upsell of returns/new products

Net revenue retention rate is >100% with customers upgrading their subscriptions (transaction limit) as they grow, RPI price increases & upsell of returns/new products

26) Industry

Despite the obvious benefits of automation, $AVLR believes penetration of such solutions is still running in the single digits (<10%), leaving an ocean of green space for growth

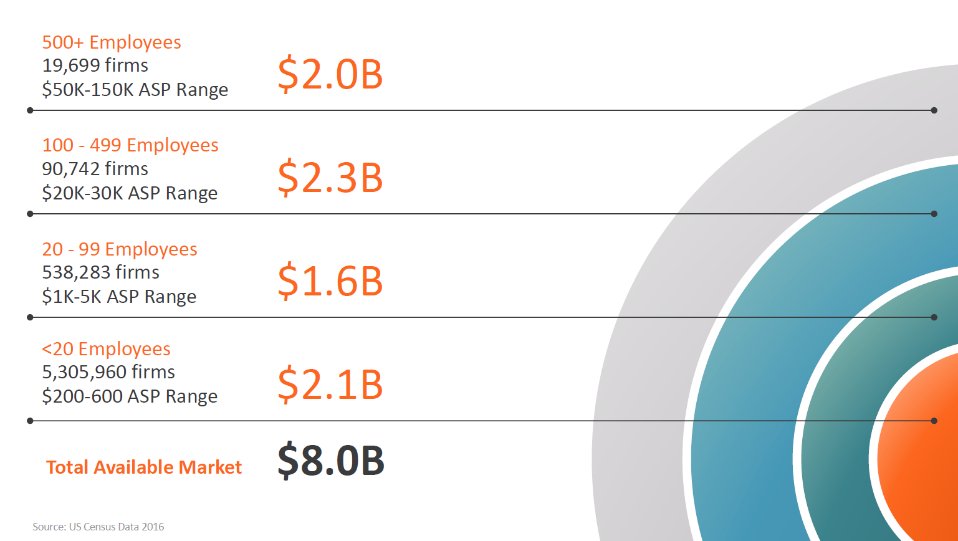

$AVLR estimates a core TAM is ~$8bn, encompassing all US businesses paying sales tax

Despite the obvious benefits of automation, $AVLR believes penetration of such solutions is still running in the single digits (<10%), leaving an ocean of green space for growth

$AVLR estimates a core TAM is ~$8bn, encompassing all US businesses paying sales tax

27)

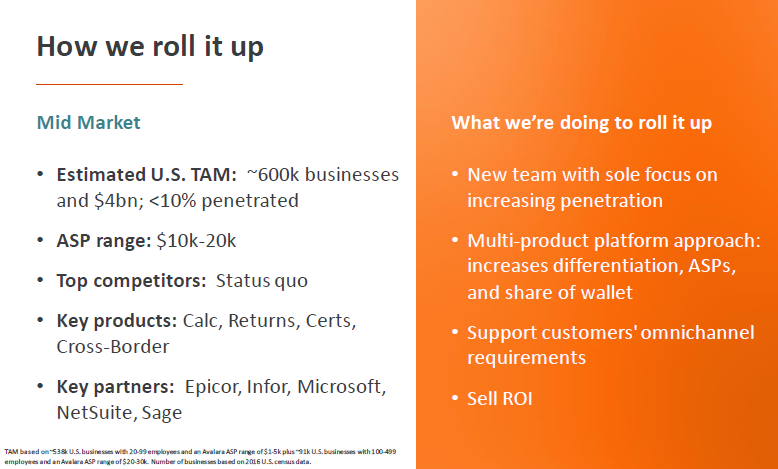

This breaks down into 3/4 segments: Enterprise (>500 Empl), Mid & Small (<20 Empl)

$AVLR main focus is on mid-market, encompassing ~600k firms, where the status quo remains running manual process (time intensive/errors). Estimated TAM ~$4bn

This breaks down into 3/4 segments: Enterprise (>500 Empl), Mid & Small (<20 Empl)

$AVLR main focus is on mid-market, encompassing ~600k firms, where the status quo remains running manual process (time intensive/errors). Estimated TAM ~$4bn

28)

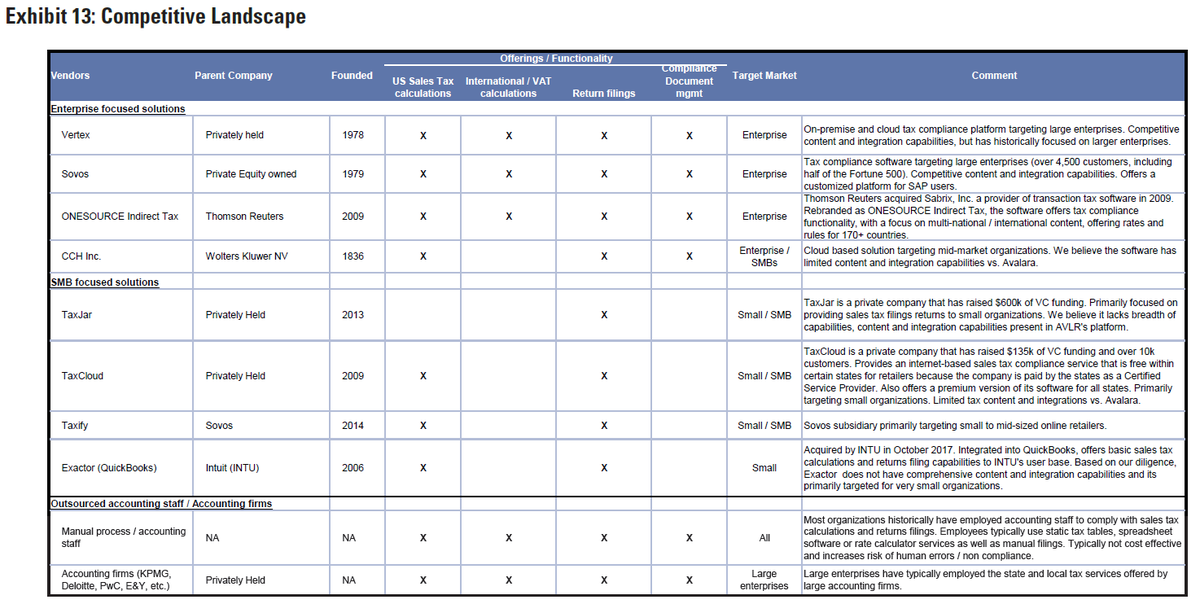

Despite the size of the prize, $AVLR’s direct competition is limited

Within the Small business subsegment, there are a few players (inc TaxJar, TaxCloud & Taxify) who sell basic products with ASPs in $200-600 per customer

Despite the size of the prize, $AVLR’s direct competition is limited

Within the Small business subsegment, there are a few players (inc TaxJar, TaxCloud & Taxify) who sell basic products with ASPs in $200-600 per customer

29)

These products are only sufficient for the smallest businesses. $AVRL primarily competes in this segment through its partnerships with marketplaces ($SHOP, $BIGC, $ETSY etc) and general tax software providers ($INTU & Xero)

These products are only sufficient for the smallest businesses. $AVRL primarily competes in this segment through its partnerships with marketplaces ($SHOP, $BIGC, $ETSY etc) and general tax software providers ($INTU & Xero)

30)

Large legacy vendors (Sovos/Vertex) focus on the Fortune 2000 where ASPs are $100-300k per customers, multiples higher than $AVLR’s core product

$AVLR is competing & winning clients but the sales cycle is slow b/c large co.s do not often chg transaction tax software

Large legacy vendors (Sovos/Vertex) focus on the Fortune 2000 where ASPs are $100-300k per customers, multiples higher than $AVLR’s core product

$AVLR is competing & winning clients but the sales cycle is slow b/c large co.s do not often chg transaction tax software

31)

$AVLR is adding capabilities designed to target Enterprise customers, including giving enterprise customers the ability to customise $AVLR software to their specific needs/situations and adding content (inc new verticals)

$AVLR is adding capabilities designed to target Enterprise customers, including giving enterprise customers the ability to customise $AVLR software to their specific needs/situations and adding content (inc new verticals)

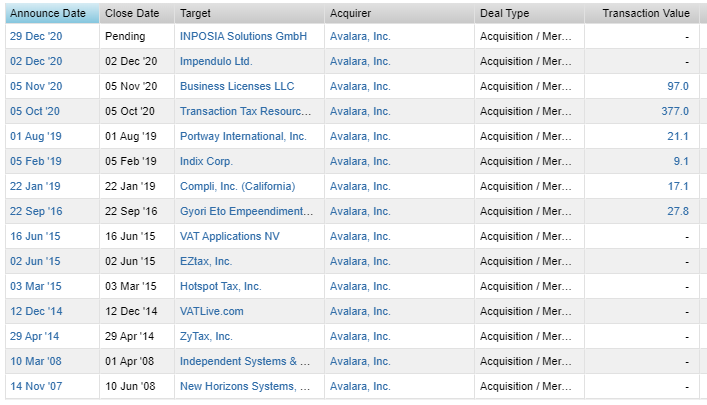

32)

Recent acquisition of TTR ($377m) in Oct 2020 was an enterprise play. TTR sells subs to a tax research portal, with >30% of the F500 as customers. Provided $AVLR with more/better content (trusted by tax experts & new verticals) & direct relationships with ~150 F500 clients

Recent acquisition of TTR ($377m) in Oct 2020 was an enterprise play. TTR sells subs to a tax research portal, with >30% of the F500 as customers. Provided $AVLR with more/better content (trusted by tax experts & new verticals) & direct relationships with ~150 F500 clients

33)

Accounting firms also play an important role in the space, with 90k in the US doing ~40% of returns prep and filing.

In 2019, $AVLR launched a new products aimed at the accounting firms, providing greater automation &

established a partnership program (i.e. revenue share)

Accounting firms also play an important role in the space, with 90k in the US doing ~40% of returns prep and filing.

In 2019, $AVLR launched a new products aimed at the accounting firms, providing greater automation &

established a partnership program (i.e. revenue share)

34) Competitive Adv

Similar to most/all digital marketplaces, I expect winner takes all dynamics to play out whereby CFs can be reinvested in improving product (automation/content) to widen its lead over peers, which helps to acquire new customers etc creating a virtuous cycle

Similar to most/all digital marketplaces, I expect winner takes all dynamics to play out whereby CFs can be reinvested in improving product (automation/content) to widen its lead over peers, which helps to acquire new customers etc creating a virtuous cycle

35)

In my view, $AVLR possesses a clear competitive advantage founded on a combo of 1) its position as a neutral 3rd party aggregator, 2) its economically aligned distribution partners and 3) its expanding library of content (organically/M&A)

In my view, $AVLR possesses a clear competitive advantage founded on a combo of 1) its position as a neutral 3rd party aggregator, 2) its economically aligned distribution partners and 3) its expanding library of content (organically/M&A)

36)

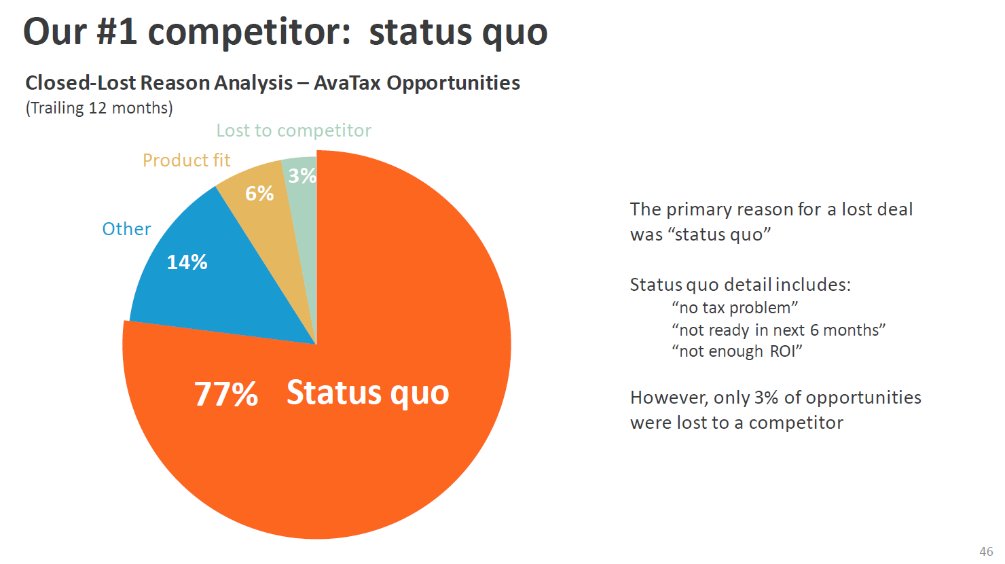

The market place dynamics also represent another hurdle for new entrants. Inertia amongst the customer is very high. Changing transaction tax software is low down customers’ priority lists and they do not do it frequently

$AVLR has found this an impediment to growth

The market place dynamics also represent another hurdle for new entrants. Inertia amongst the customer is very high. Changing transaction tax software is low down customers’ priority lists and they do not do it frequently

$AVLR has found this an impediment to growth

37)

It's tough getting people to change. Simply offering customers a solid ROI is often not sufficient to incentivise adoption

$AVLR has listed out various triggers for the purchase decision. Bottom line it just takes time

It's tough getting people to change. Simply offering customers a solid ROI is often not sufficient to incentivise adoption

$AVLR has listed out various triggers for the purchase decision. Bottom line it just takes time

38)

For competitors to successfully challenge $AVLR, they would need to have all the content & integrations, whilst offering a lower price

Providing the incentive for both integration partners & customers would likely make the start-up economics difficult

For competitors to successfully challenge $AVLR, they would need to have all the content & integrations, whilst offering a lower price

Providing the incentive for both integration partners & customers would likely make the start-up economics difficult

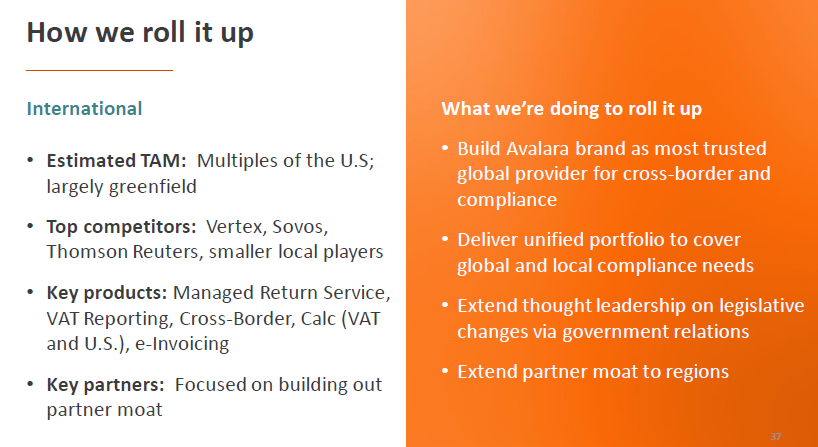

39) International

$AVLR International business (ex N America) represents ~6% of sales. Group is expanding to support transaction tax compliance in Europe, S America & Asia

Whilst small, the potential TAM is multiples of US opportunity with 165 countries using VAT, or similar

$AVLR International business (ex N America) represents ~6% of sales. Group is expanding to support transaction tax compliance in Europe, S America & Asia

Whilst small, the potential TAM is multiples of US opportunity with 165 countries using VAT, or similar

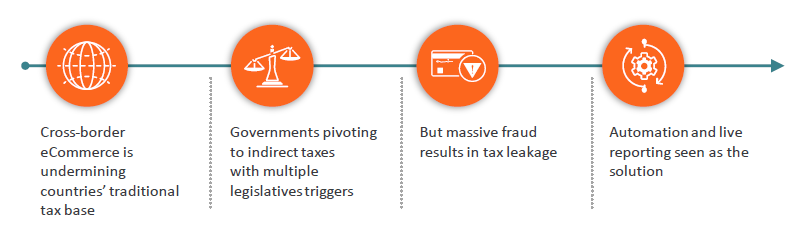

40)

Rapid rise of cross border e-commerce, which is undermining tax bases, means major legislative changes are on horizon. Real time reporting will be the end goal, which can only be achieved with automation

Rapid rise of cross border e-commerce, which is undermining tax bases, means major legislative changes are on horizon. Real time reporting will be the end goal, which can only be achieved with automation

41) Future

Looking forward, $AVLR stills seemingly sits near the start of a long growth runway. CEO McFarlane believes the group can grow at 20-25% for many years. The group appears to offer the best in class solution, at a lower price point than the incumbents

Looking forward, $AVLR stills seemingly sits near the start of a long growth runway. CEO McFarlane believes the group can grow at 20-25% for many years. The group appears to offer the best in class solution, at a lower price point than the incumbents

42)

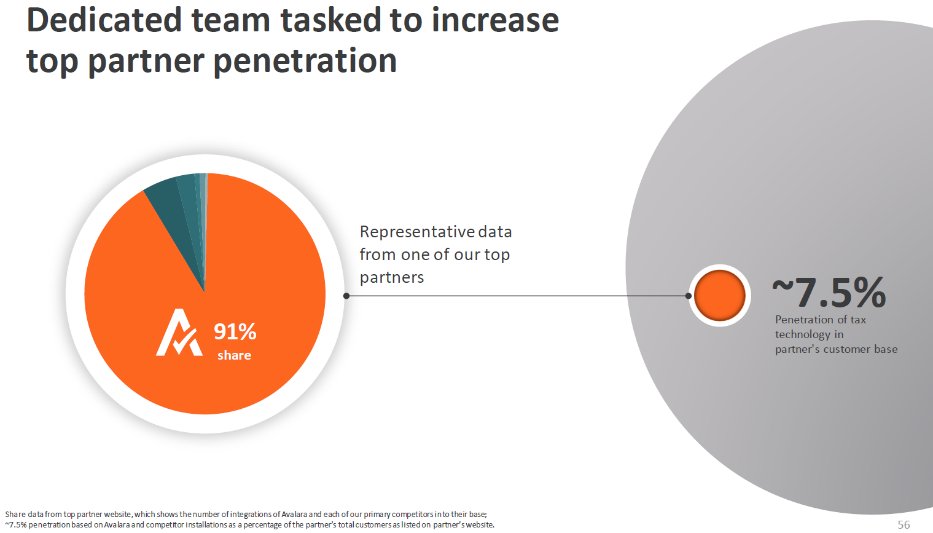

Significant running room exists within $AVLR current partners. For example, automated transaction tax software is only 7.5% penetrated within one of their biggest partners, of this $AVLR’s share is >90%!

Significant running room exists within $AVLR current partners. For example, automated transaction tax software is only 7.5% penetrated within one of their biggest partners, of this $AVLR’s share is >90%!

43)

The key driver of lost deals was companies’ decision to maintain the status quo (i.e. manual process), not losing to competitors

The key driver of lost deals was companies’ decision to maintain the status quo (i.e. manual process), not losing to competitors

44)

Range of outcomes for $AVLR’s base business seems relatively narrow. Position (via partnerships) should mean that the pull of automation, & push of tax collecting govts, combined with (cross border) digital commerce, translate into sustained growth over the next decade (plus)

Range of outcomes for $AVLR’s base business seems relatively narrow. Position (via partnerships) should mean that the pull of automation, & push of tax collecting govts, combined with (cross border) digital commerce, translate into sustained growth over the next decade (plus)

45)

With current market penetration still in single digits, current US TAM ($4-8bn) and bigger International opportunity seem to readily support a possible 20% CAGR over the next decade (i.e. >6x)

With current market penetration still in single digits, current US TAM ($4-8bn) and bigger International opportunity seem to readily support a possible 20% CAGR over the next decade (i.e. >6x)

46)

But $AVLR appear to want to augment this with incremental compliance service

Vision statement statement was changed in FY19 10-K from being “part of every transaction in the world” to being “the global cloud compliance platform”

But $AVLR appear to want to augment this with incremental compliance service

Vision statement statement was changed in FY19 10-K from being “part of every transaction in the world” to being “the global cloud compliance platform”

47)

Clear intention is to leverage its existing transaction tax compliance relationships to cross sell other/new automated compliance services

This is a playbook which has been done before and I believe it could work again in a fragmented wider compliance market

Clear intention is to leverage its existing transaction tax compliance relationships to cross sell other/new automated compliance services

This is a playbook which has been done before and I believe it could work again in a fragmented wider compliance market

48)

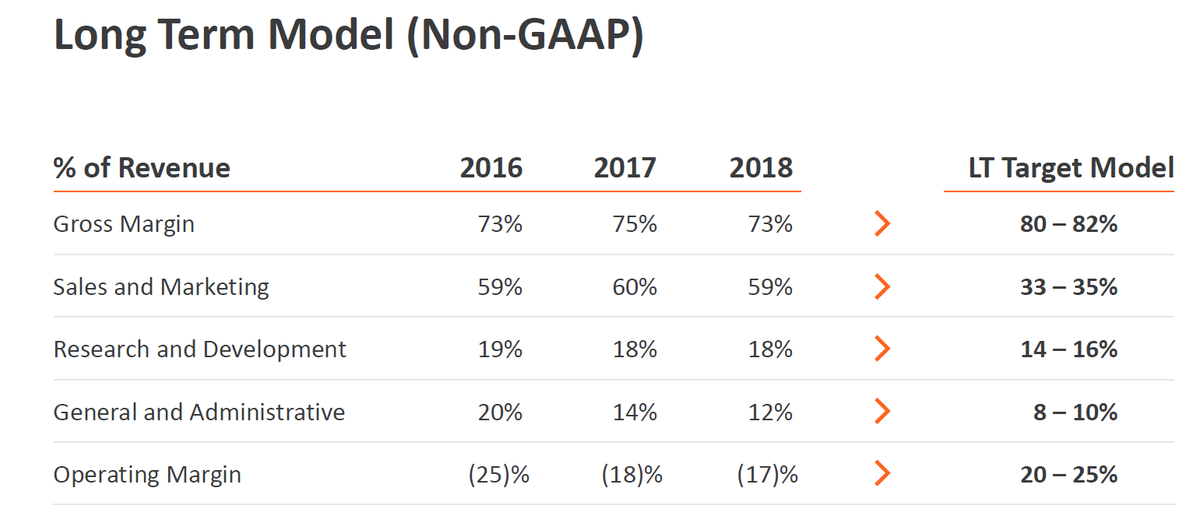

With $AVLR trading on an EV/Sales >20x, I'll leave everyone to do their own valuation work. For reference, mgmt. do provide a l-t margin target

Congratulations & thanks if you've made it this. Shout with any thoughts/comments

With $AVLR trading on an EV/Sales >20x, I'll leave everyone to do their own valuation work. For reference, mgmt. do provide a l-t margin target

Congratulations & thanks if you've made it this. Shout with any thoughts/comments

Read on Twitter

Read on Twitter