11 signs $ETH is going to blow past its all-time high

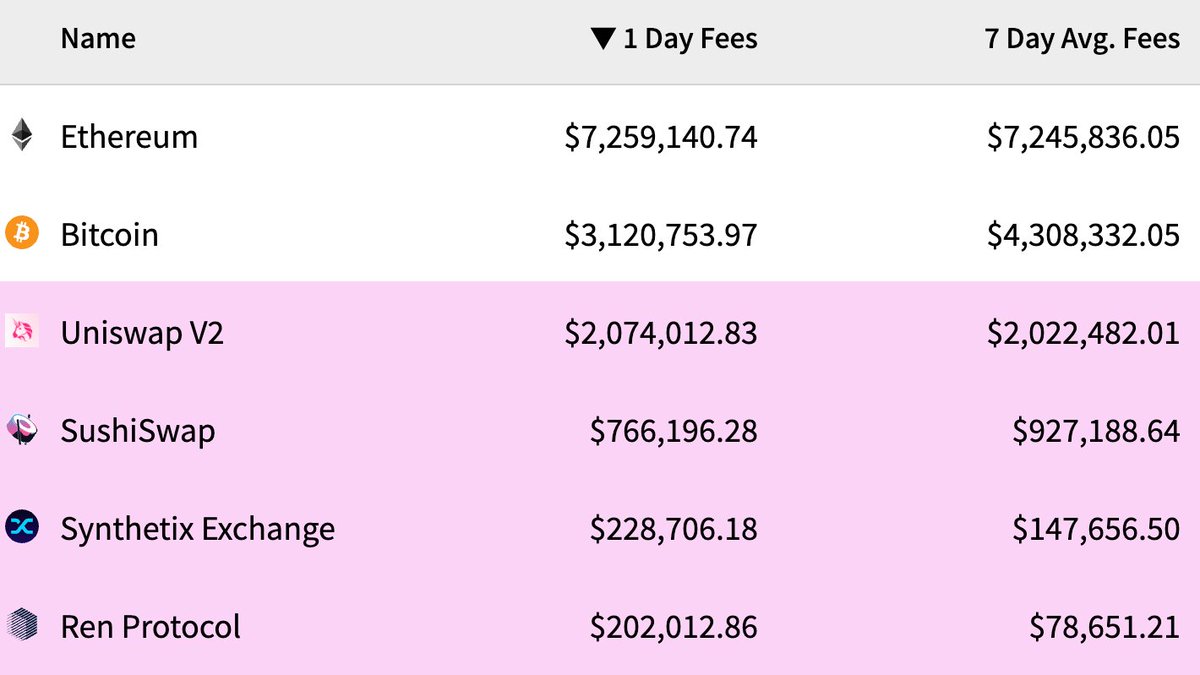

#1: Ethereum continues to dwarf the entire crypto space in terms of fees paid ($7.25m daily avg) -- proving it's the most useful network in the world.

#2: The number of large $ETH transactions (>$100k) is 7x smaller than during its 2018 ATHs -- a sign that whales and institutions still haven't entered the game.

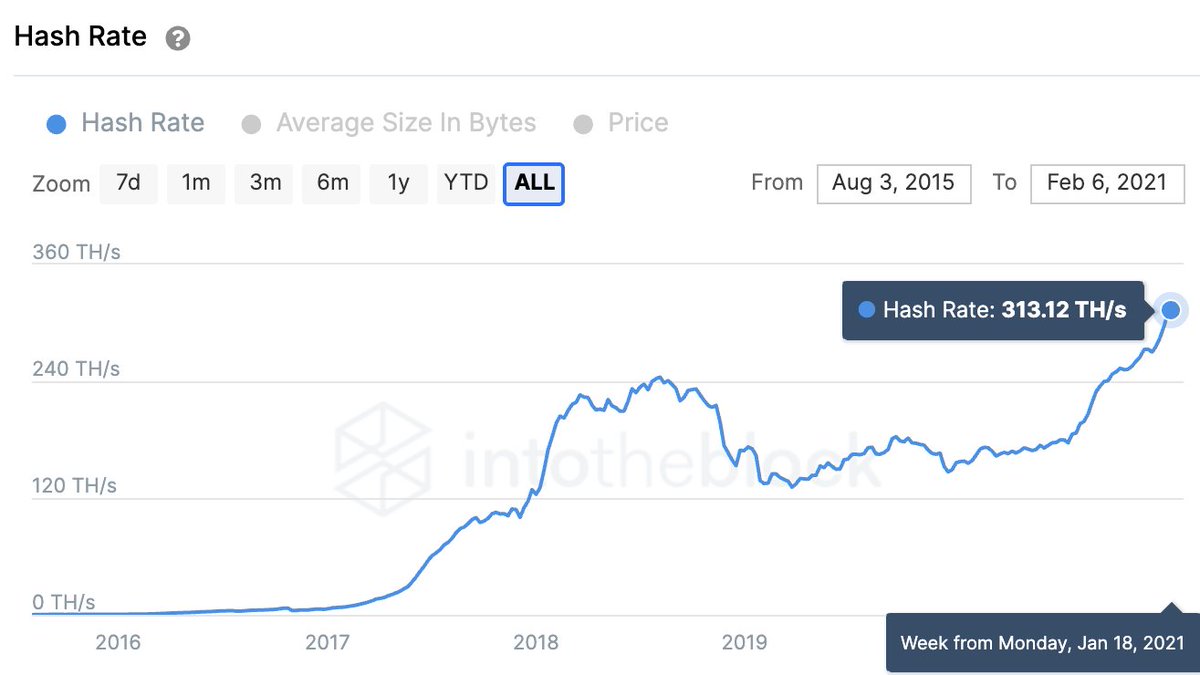

#3: Hash Rate is at an all-time high (313.12 TH/s) -- a sign that miners have never been more confident.

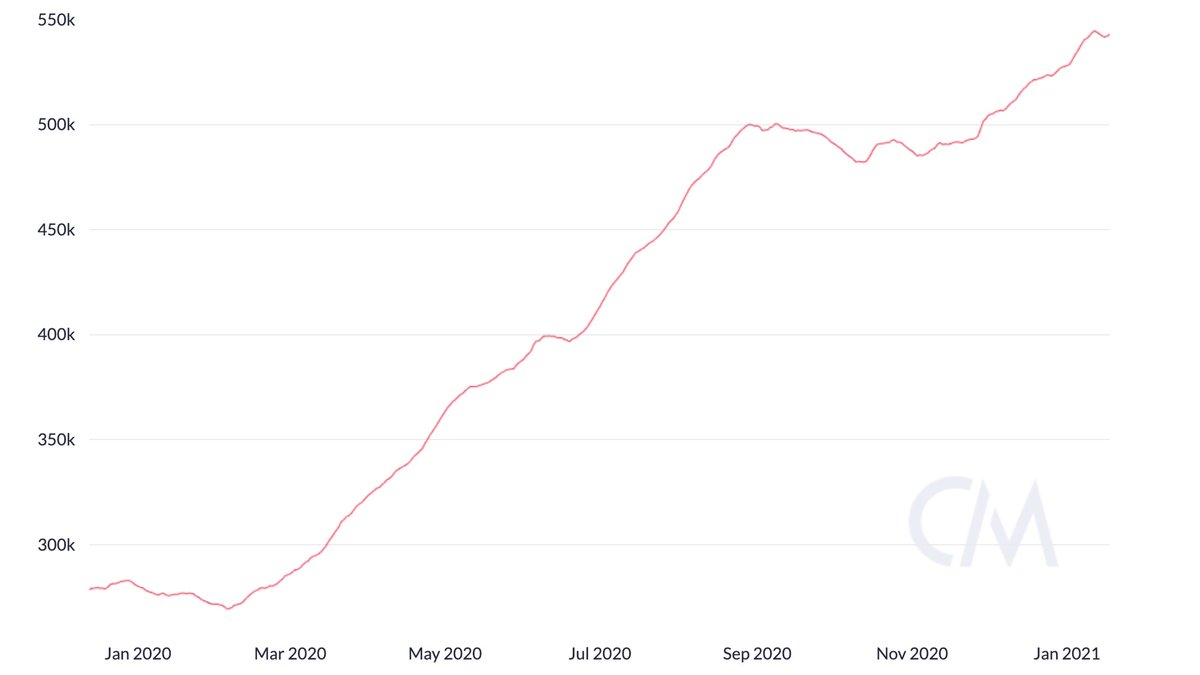

#4: Ethereum has nearly 550k daily active addresses (90-day MA) -- a figure that has doubled YTD and now sits comfortably at ATHs too.

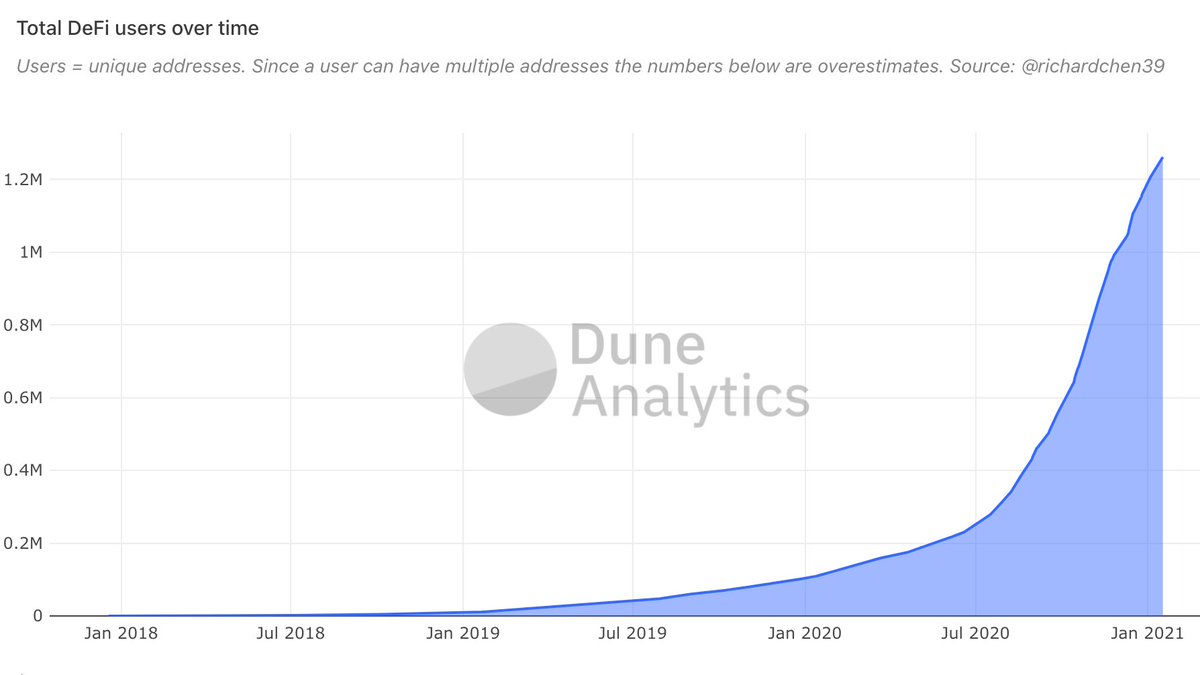

#5: There are now more than 1.25M #DeFi users, a figure that continues its parabolic uptrend -- a sign that Ethereum's biggest use case is on a path towards product-market fit.

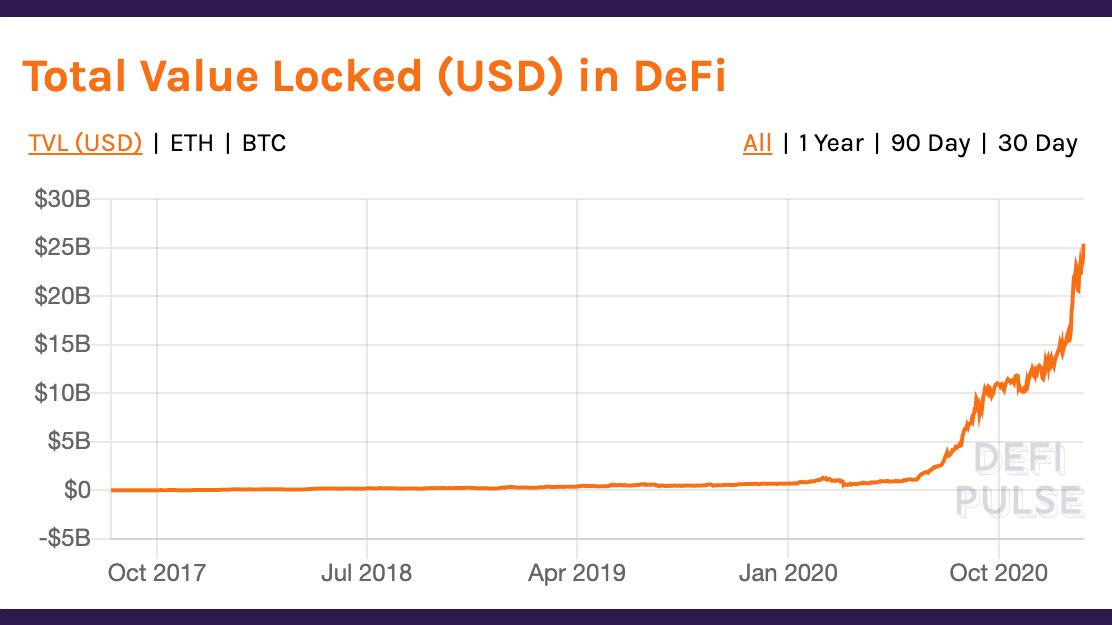

#6: There is now more than $25 billion dollars locked in #DeFi, with 21 different projects having more than $100M TVL -- a sign that the ecosystem is maturing rapidly and becoming institutional-grade.

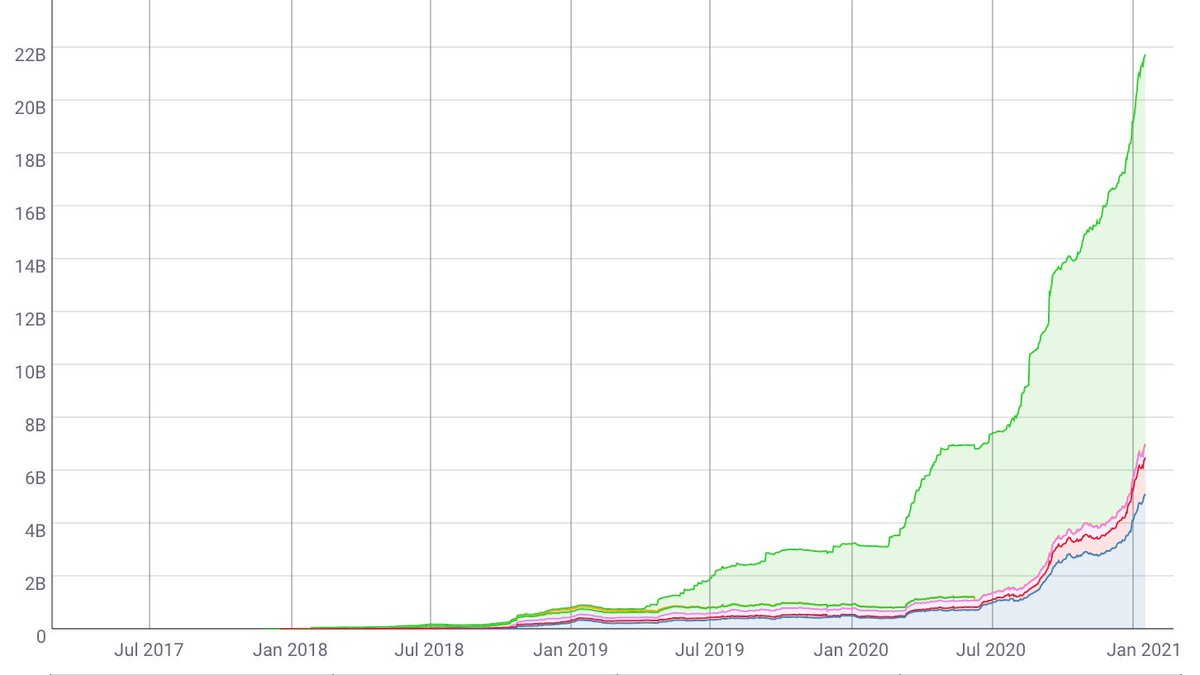

#7: Almost $22 billion in stablecoin supply now exists on Ethereum, an increase of ~$20B in the past year -- a sign of major demand for cryptodollars.

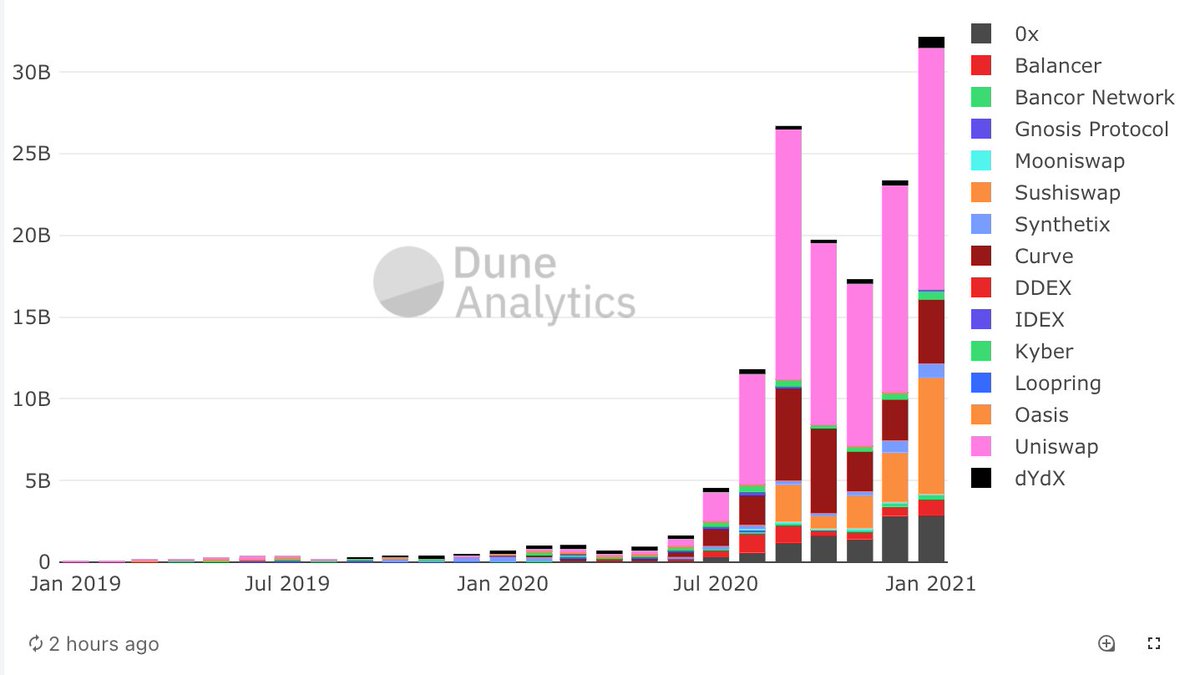

#8: Monthly #DEX volume stands at more than $30B, up ~50x YoY -- a sector where #DeFi is starting to rival #CeFi.

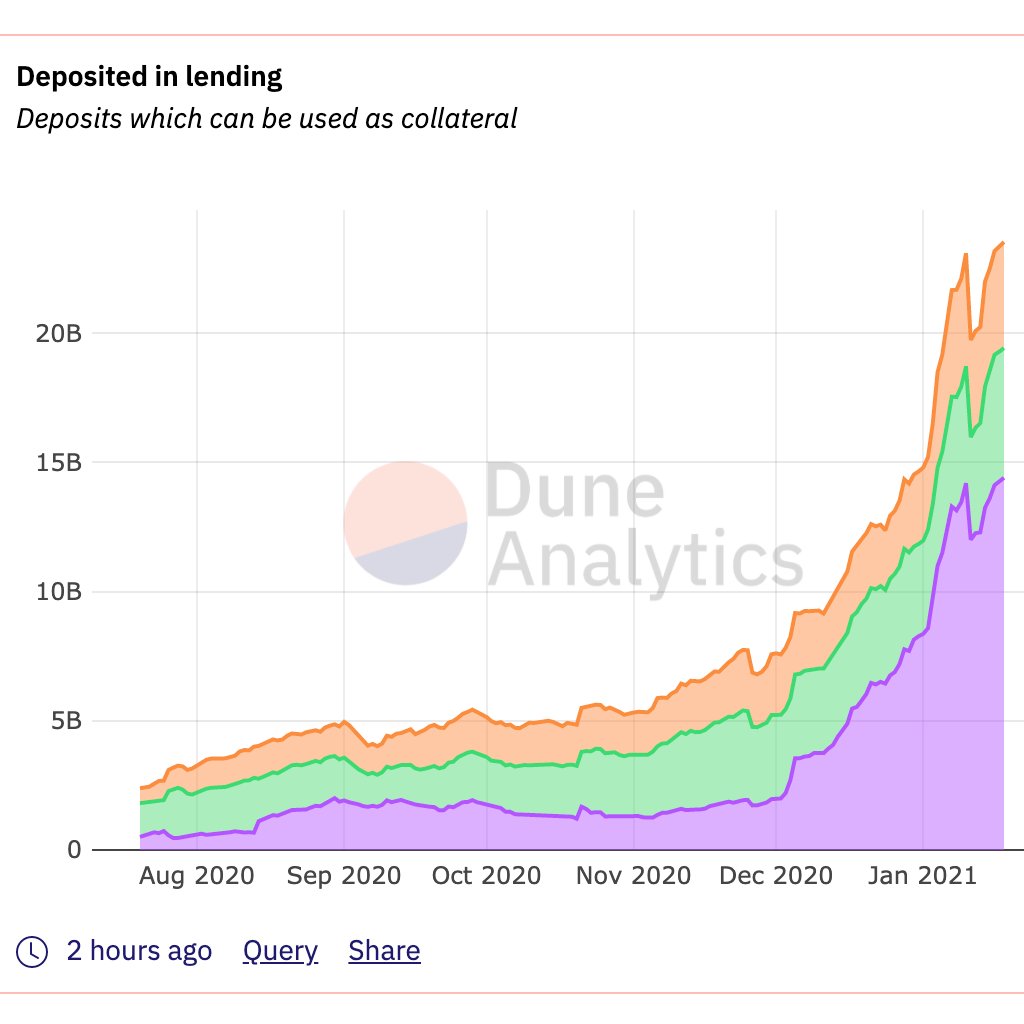

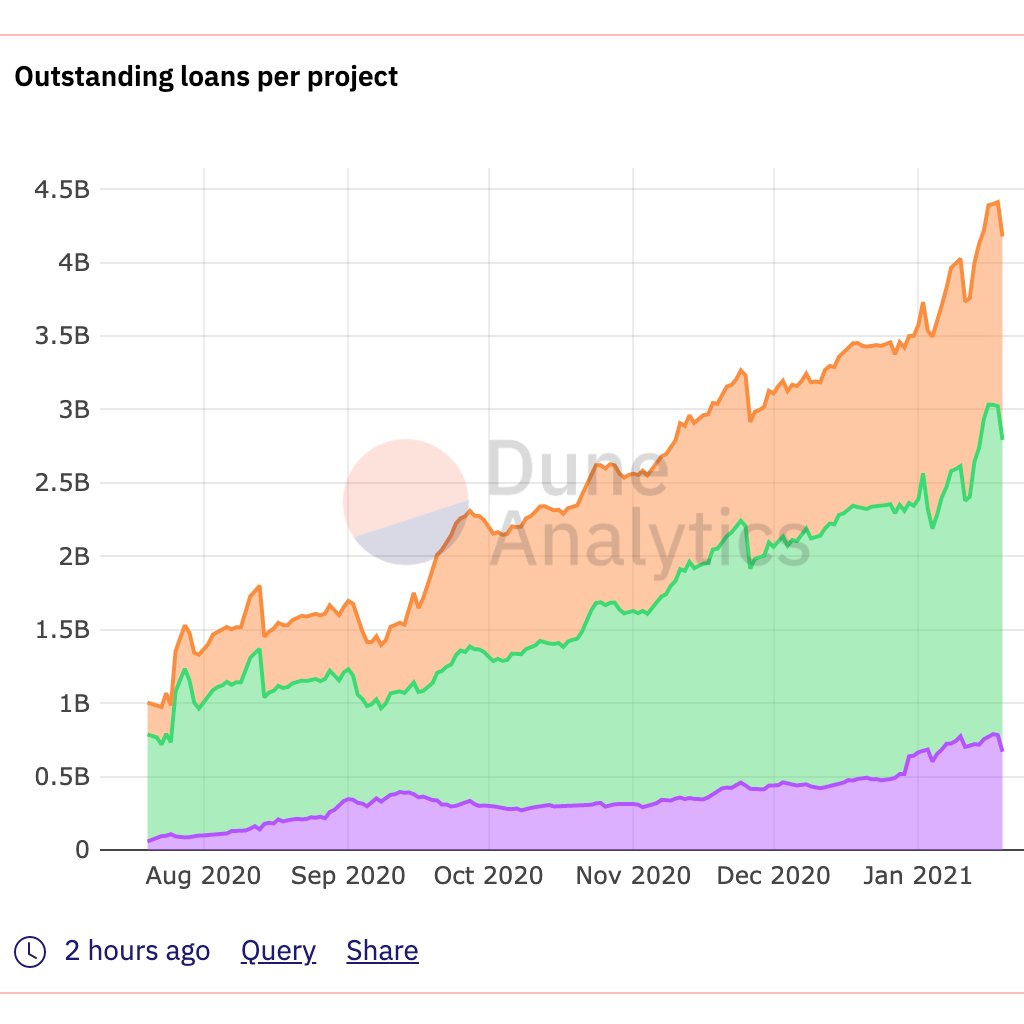

#9: More than $20B has been deposited into lending protocols, with outstanding loans close to $4.5B -- a sign that #DeFi lending is becoming more battle-tested.

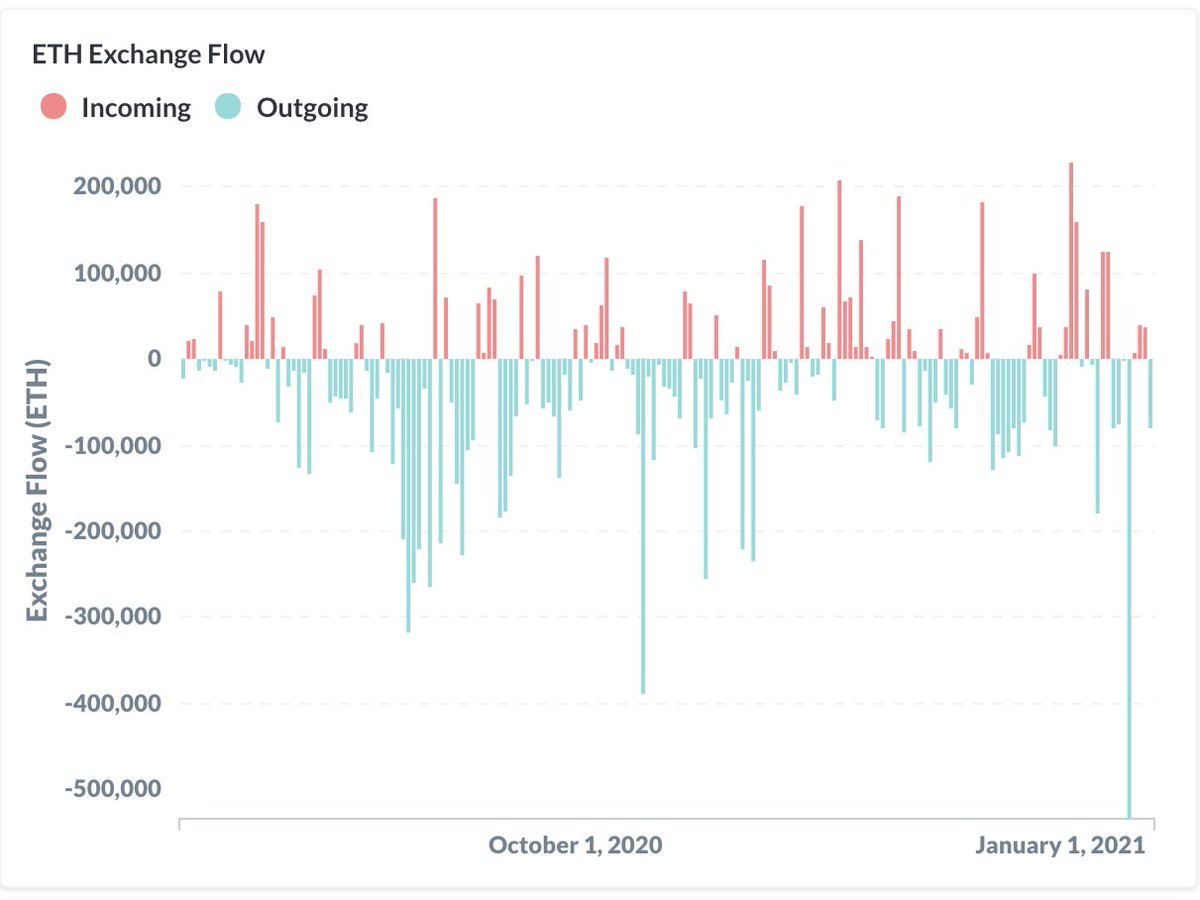

#10: $ETH is steadily flowing out of exchanges, including more than 530k on one day last week (worth ~$740M) -- a telltale sign of accumulation.

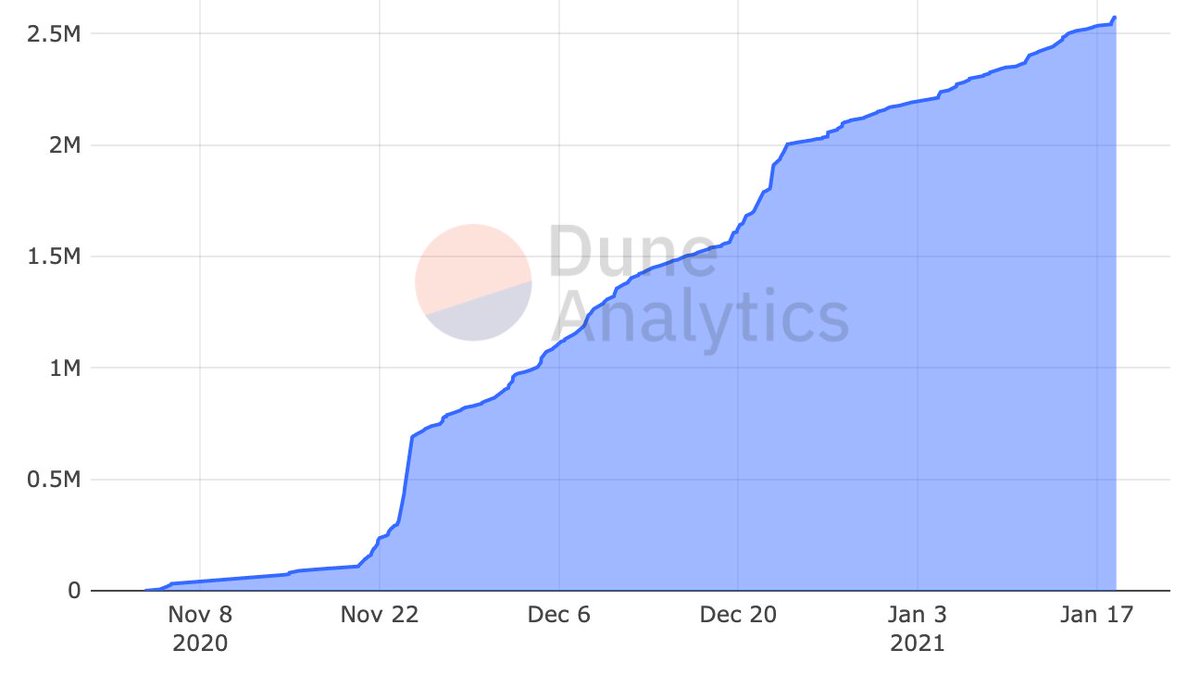

#11: 2.57 million $ETH has been sent to the #Eth2 deposit contract, a figure alone that would be good for the #12 cryptoasset by marketcap -- a sign that confidence in Ethereum's next-generation upgrade is high.

Looking for more $ETH fundamentals? Subscribe to my crypto analytics newsletter @OurNetwork__: https://ournetwork.substack.com/subscribe?utm_source=menu&simple=true&next=https%3A%2F%2Fournetwork

Read on Twitter

Read on Twitter