Highlights from the 2021 Flexera "State of $MSFT's World Dominance" report, a survey of 474 large enterprises IT spending: https://info.flexera.com/SLO-REPORT-State-of-Tech-Spend?lead_source=PPC&utm_source=google&utm_medium=cpc&utm_campaign=NB-State-Tech-Spend&campaignid=10764910724&adgroupid=111812835731&utm_term=+state%20+of%20+tech%20+spend&gclid=CjwKCAiAl4WABhAJEiwATUnEF9bfZJL2VSWwUmWkrsbHXKpMdNl5miP6KLJ6LUIvCz8wQNWQxs25FhoCW4AQAvD_BwE

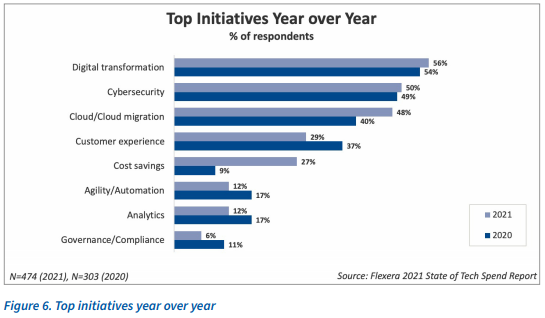

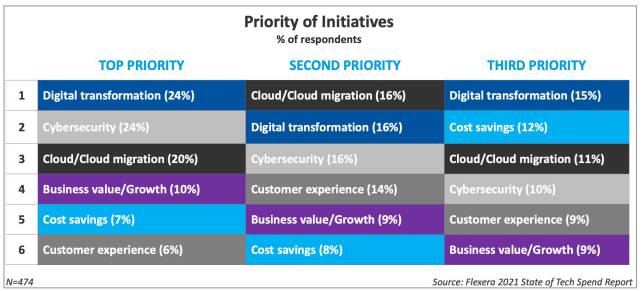

Digital transformation, cybersecurity, and cloud migration continue to accelerate as top priorities for IT execs. No surprise. But the biggest y/y jump in focus is in cost saving initiatives.

Despite "Two years of digital transformation in two months," Satya Nadella highlighted in April, there is no sign of slowing or taking a step back in 2021, as ~86% of respondents intent to increase their pace of digital transformation:

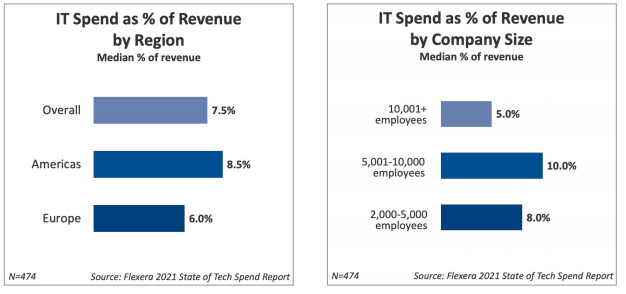

American co's appear to outspend European peers on IT budget as a share of revenues. I expect that has some competitive consequences. Small businesses might be underspending? Perhaps an example of the strong getting stronger during COVID - easier to make the necessary investments

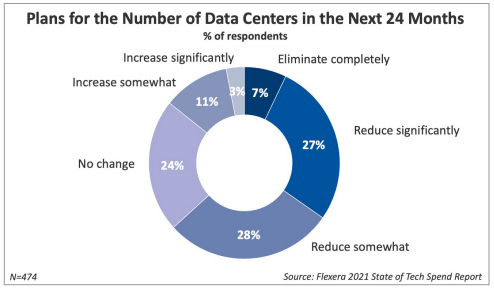

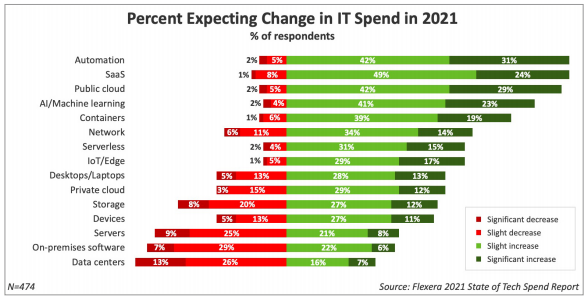

On premises hardware/software vendors will continue to fight the brutal headwind of customers retiring datacenters and moving to the cloud. 62% of respondents intend to reduce their # of datacenters in the next 24mos. No bueno $ORCL, $IBM, $VMW, $SWI, $CSCO, many others.

Meanwhile, both COVID specific and broader secular trends support a continuation of the strong tailwinds behind SaaS, AI, Automation, and cloud.

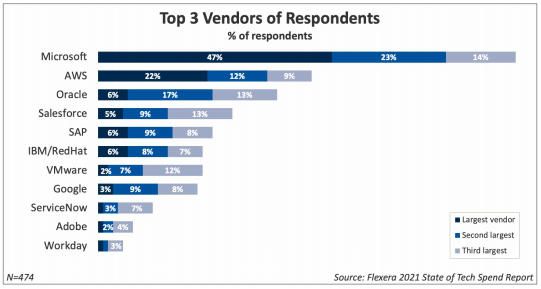

This is why I somewhat-jokingly call this report the "State of MSFT world dominance." $MSFT is the most frequent #1, #2, and #3 vendor these large enterprises.

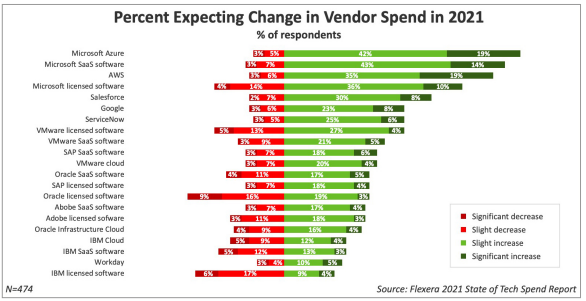

and, $MSFT dominates the top of this chart for expected increases in spend. Not looking so hot for $IBM, $ORCL, or even for Wall St.'s beloved $ADBE or $WDAY.

Be sure to tune in January 2022 for more of the same. That's all for now folks.

Read on Twitter

Read on Twitter