1/x The Path of Maximum Pain

A mind game from Mr. Market’s perspective.

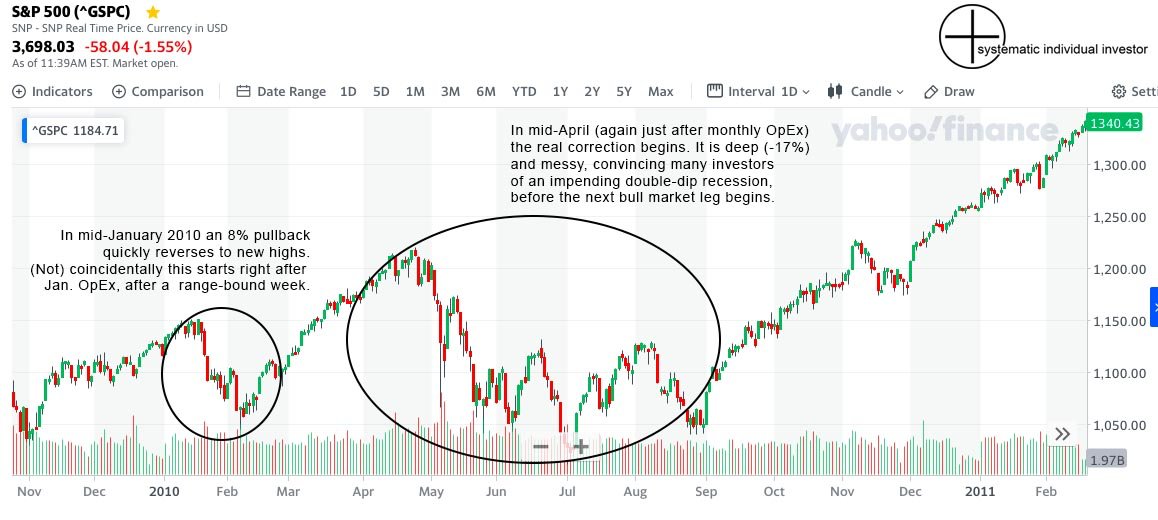

Given current, obviously stretched positioning and sentiment extremes, a 2010-style $SPX double pullback / correction may cause most distress to most market participants.

Do read on

A mind game from Mr. Market’s perspective.

Given current, obviously stretched positioning and sentiment extremes, a 2010-style $SPX double pullback / correction may cause most distress to most market participants.

Do read on

2/x Why would Mr. Market be so cruel?

Highly leveraged positions are inherently “weak” and any small adverse move against strong expectations can start a self-reinforcing selling (or buying) panic.

The current situation:

Highly leveraged positions are inherently “weak” and any small adverse move against strong expectations can start a self-reinforcing selling (or buying) panic.

The current situation:

3/x The trading world is divided into two main camps:

1 ) Traders, who see only blue skies ahead — the Robinhood, YOLO crowd is on a call buying frenzy, and trades over a very short time horizon.

2 ) Traders, who expect a correction, because of leveraged short-term positioning.

1 ) Traders, who see only blue skies ahead — the Robinhood, YOLO crowd is on a call buying frenzy, and trades over a very short time horizon.

2 ) Traders, who expect a correction, because of leveraged short-term positioning.

4/x Opposite positioning suggests one should be a winner. However, because they operate over different time horizons, Mr. Market can still dupe both of them.

Here’s what I would do if I were Mr. Market:

Here’s what I would do if I were Mr. Market:

5/x A quick pullback would hurt short-term traders and cause contrarians to start shorting as the start of a larger correction seems confirmed. But, if this pullback fails to reach their targets and quickly recovers to new highs, it would cause losses to the correction crowd.

6/x Animal spirits would reignite quickly and could then be hurt again by an extended, messy correction. Contrarians would be more insecure to go short the second time around, because we just went through the anticipated correction — only a little shallower than expected.

7/7 This is not a prediction, but simply a mental exercise. However, I do see the beginning of 2010 as being very similar to today (post-GFC rally & strong year-end).

More details, and how to navigate the start of 2021 in this week's members report: https://systematicindividualinvestor.com/2021/01/17/probability-map-january-18/

More details, and how to navigate the start of 2021 in this week's members report: https://systematicindividualinvestor.com/2021/01/17/probability-map-january-18/

Read on Twitter

Read on Twitter