Okay here's my thread on UT. It's gonna be a long one and it may not be entirely comprehensive because there's a lot to talk about. Come back in an hour while I create this thread.

Like and retweet this if you enjoyed reading this!

Like and retweet this if you enjoyed reading this!

UT is basically where u put money into a fund and you have a professional to manage ur money in exchange for management fees and sales fee (will talk about fees later in the thread as i will talk about how to invest in UT first).

This is similar to ASB. (ASB has no fees)

This is similar to ASB. (ASB has no fees)

When you invest in UT, it's very important to determine the difference between a "core fund" and a "tactical fund".

A core fund is a fund that it'd be very unlikely for you to lose money if you can hold on for a long period of time (i.e. 3-5 years).

A core fund is a fund that it'd be very unlikely for you to lose money if you can hold on for a long period of time (i.e. 3-5 years).

A tactical fund is a fund that only does well during certain periods of time.

For example, a fund that invests in gold.

Gold is a commodity that only does well in certain periods (like march-nov due to corona).

But during its time, it does tremendously well.

For example, a fund that invests in gold.

Gold is a commodity that only does well in certain periods (like march-nov due to corona).

But during its time, it does tremendously well.

So right now, you see ppl selling gold or gold funds like crazy because this is their time. Because they're easy to sell right now. Everyone is talking about it

So back to your core fund. These are seperated into 3 major types. 1) equities (high risk), 2) mixed assets and 3) bonds. These are called "asset classes".

Studies have shown that the main contributor for your portfolio is through picking the right asset class. Very important.

Studies have shown that the main contributor for your portfolio is through picking the right asset class. Very important.

Bonds being the lowest risk *

So how do you choose your asset allocation? Although there are many ways, the easiest way is just 100 less your age. If im 30, I'd be needing 70% equties and 30% bonds. But if im a rich 30 year old, I can go with 80% equities and 20% bonds. It's really on your preference.

I'm going to skip talking about bonds because i know my primary followers are young bumiputera. So u can change your bond funds with ASB. I might talk about bonds a bit more if i have the time. Let's talk equities.

So in equities, you are spoiled with options. You have malaysia equities, china equities, asean equities, india equities, japan equities, developed market equities, emerging markets equities and the list goes on.

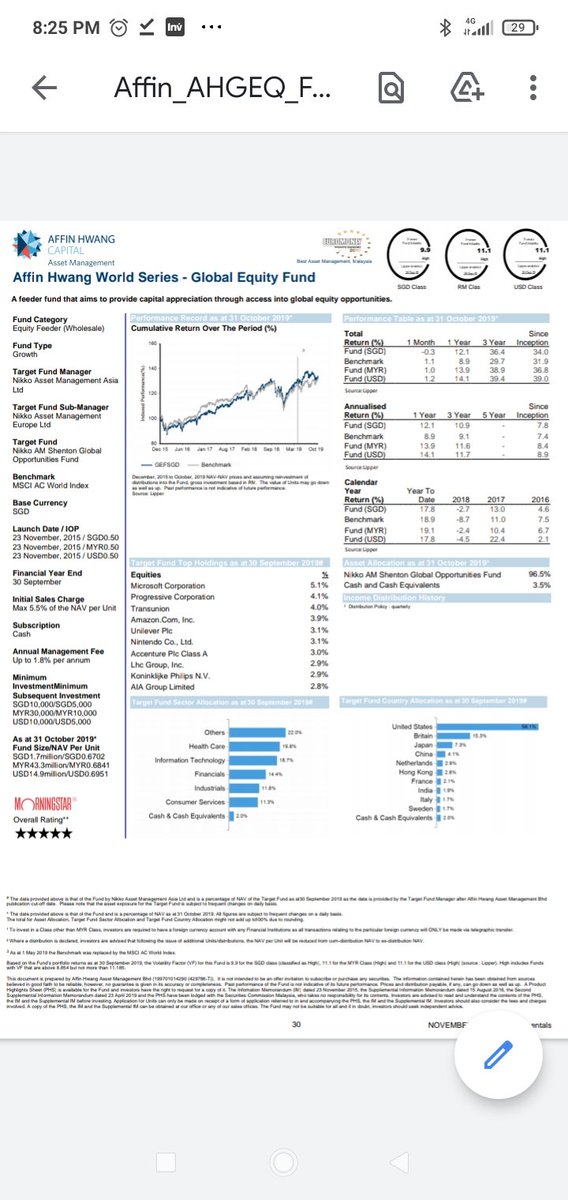

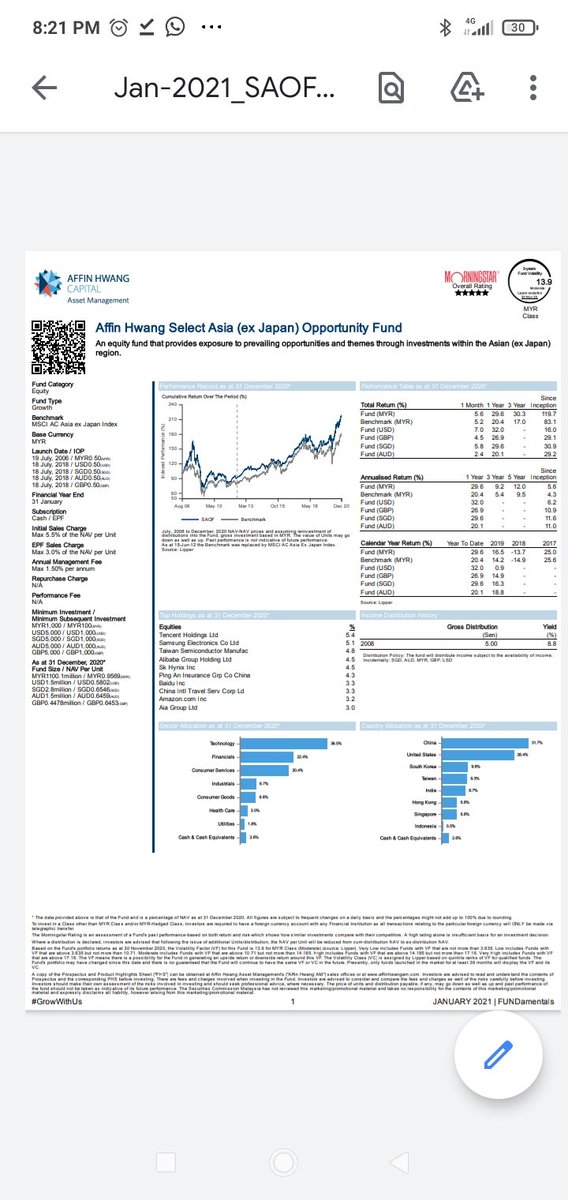

But to make it easier for you, you really just need two. One developed market equities and one asian equities. Here's an example of funds from Affin Hwang. (I will teach you how to read a factsheet later. Please remind me if i forget)

The reason I say that you only need two is that just by having those two, you already have a very well diversified portfolio that can pretty much invest anywhere in the world. Doesn't necessarily you need to buy from affin hwang, there are other fund houses too.

The most popular is Public Mutual (I'm not a fan of them because of their high fees but sometimes fees are justified if your agent is good) But other fund houses are just as great.

Affin Hwang, Principal (cimb), Maybank AM, Eastspring, Opus, TA, Kenanga Invest, RHB Invest

Affin Hwang, Principal (cimb), Maybank AM, Eastspring, Opus, TA, Kenanga Invest, RHB Invest

You can have access to all funds at either.

http://Www.eunittrust.com

http://Www.fundsupermart.com

These are good if you want to do it yourself because the sales charge are lower. But consulting an agent that charge you sales charge may be good if they give you guidance.

http://Www.eunittrust.com

http://Www.fundsupermart.com

These are good if you want to do it yourself because the sales charge are lower. But consulting an agent that charge you sales charge may be good if they give you guidance.

But be wary, i can tell you that a big chunk of agents and even bankers are just shit. My suggestion, if you approach an agent, approach 2 or 3 at the same time and you compare their recommendations. But trust me, after 2 or 3 years investing, you wouldn't need them anymore.

So now you have your core portfolios. Honestly from there, you just buy consistently the same fund over and over. Unit trust is designed for you to just buy and never to sell. The concept of cutting loss is a relatively foreign thing. That's the fund manager's job, not yours

Disclaimer: the statement above is true most of the time but you never really know when shit hits the fan

Okay I want to highlight this next part so I'd appreciate if you press like more on this post so that others can read this

Often you see people promising the moon and the stars with UT. Things like

"alhamdullilah, saya buat client 15% dalam masa 3 bulan.".

#DengarSiniSiBodoh , markets goes up and down. Those that dont tell you that 15% returns is unrealistic expectations, just push them aside.

"alhamdullilah, saya buat client 15% dalam masa 3 bulan.".

#DengarSiniSiBodoh , markets goes up and down. Those that dont tell you that 15% returns is unrealistic expectations, just push them aside.

Often, the reasonable expectation per year is like this.

Bonds 3-4%

Mixed assets 4-7%

Equities 6-12%

And for equities, there are years where you're down by 10% but the next year you do 25%. That is roughly 6.5% per annum.

Bonds 3-4%

Mixed assets 4-7%

Equities 6-12%

And for equities, there are years where you're down by 10% but the next year you do 25%. That is roughly 6.5% per annum.

So if you happen to buy at the wrong time. It's okay. You just hold (as long as it's a core fund).

Tactical funds are fun when you have a bit more experience. Like for example, I tactically put in a technology fund and a china fund into my portfolio because I have a view that in the future we're gonna live under our chinese overlord in a technology driven world (kidding)

Anyways, these are just basic explanation on UT. There's a lot more to be talked about honestly but I think the thread has gotten too long. Feel free to ask questions below.

Read on Twitter

Read on Twitter