CHART THREAD: As the market finally pulled back a tad from recent highs, it's given some really nice opportunities chart-wise. When the markets are still elevated but beginning to be less strong, I hunker down by putting 70%+ in SPAC units near NAV and trading....

...the rest of the capital, but based on company or sector specific news, or technical set ups that look strong or show the start of a trend shift in the name. It's all math, this whole damn game is. Opportunity cost of capital. SPX was over 3800, uncertainty started at least...

...to some degree, which is more than the last two months when uncertainty was to no degree since there was only euphoria. Very possible the market pulls back to $3640, maybe $3580 here, but, this does not necessarily mean the names we discuss a lot on Fintwit in general or...

... on @PoundingDaTable will as bad. We've had huge runs in small caps and banks recently, which is what really took the market up into space. The Russel 2000 is well over 2,000 now, an all time high for the index most affected negatively by the ongoing pandemic...

...at the same time, Fed's Evans says likely rate hike not until mid 2024, giving us around 2 years more of expansionary growth (if this actually is true in time) than we expected for low rates, frothy markets, and expansionary conditions for multiples and the markets...

...What can throw this off? Tax policies and other possible mandates the administration makes for big tech and other industries, and of course, shit we dont even know yet. However, I am not going to change my price target of $SPX 5000 by the end of 2022. In the mean time...

...the markets will of course move up and down, nothing goes straight up. I like to load the fast growth movers, leaps, leverage etc on market dips between 8-12%, but after that, I move those winnings into SPACs the higher we go and end up only really using 1/3-1/4 of my...

...capital, which is the point I am at now. With that being said, let's see some chart set ups! I drew arrows on predictions based on the charts where first targets are, but I left a few in I'll discuss to show you when you need to wait for set ups and how to know when it's time:

$BABA. Watch what happens once the new Administration takes place. I'm pretty sure China names will be all the name again, as they have been starting to be for the last few weeks already... Incredible amount of bad news priced into $BABA. Gonna rip like $BIDU after EV news...

$CMPS. Basing and basing, $52 once it perks its head up.

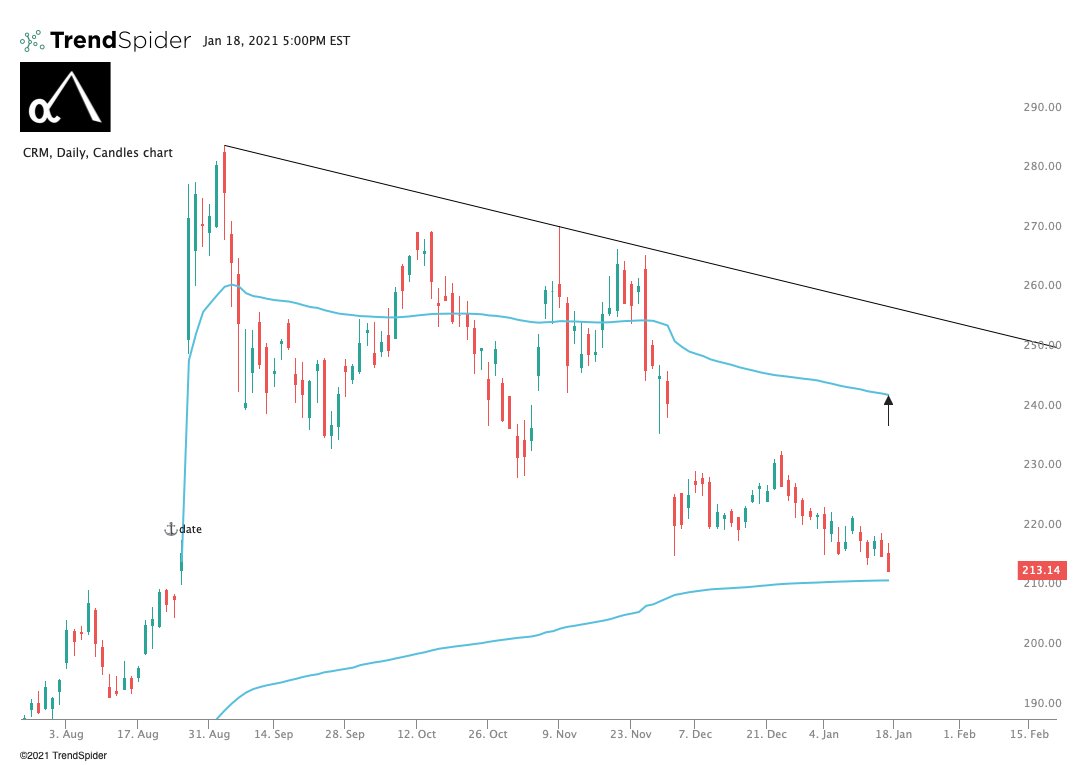

$CRM. Sold off for weeks on the $WORK acquisition. This company turns buyouts into stock breakouts over time. People don't understand they are 100% historical hitters on this from buyouts.

$DM. Cathie now loves, makes me love it more. You know what happens to a name I chart when it hits this initial high horizontal resistance. $30 next.

$EDIT. When things go parabolic cause people finally wake up and realize they are the future, there are points along the way that let you get back in or start a position. Patience pays if you miss something. I hate FOMO buying, now, quietly got to load. $100 next.

$EH. My next $TSLA of the sky investment. From $8. $100 is so easy to get to in the next 6-12 months, but as parabolic runners do, he needs to find footing. This is an example of "I didn't get in when can I," follow the blue-line road. Mean regression is the entire universe.

$FLGT. Smaller market cap, easy to fly name. The other genomics companies have gone way more parabolic with larger market caps than this Mini Monster. No idea why it's not over $100 today.

$FTCH. I love this name, I don't love the price so fast. I think it gets many $100s in time, but this institutional buying needs to settle out. Wait for the volume weighted average price from this move to even out. This is how you fish instead of getting drowned.

$FUTU. Love the name, goes to many $100s in years, but let this baby settle out, and once the dust settles, keep on grinding. Fish, don't drown part: deux.

$INMD. Been watching this set up for a while, finally ready to go. One of my absolute favorite set ups that exist. Similar to Jumia today... which is below.

$JMIA. IPO high was $49, and so was the high the other day. That is an insane insane level. $100 once it breaks and closes over and beings to trade over the half way mark at $50. Psychology flips to $100 especially here.

$MP. Descending wedge into an Anchored-VWAP, count me in. Great long term company, $40 in sight.

$NNOX. In ARK's Israel fund effective 1/22/21. You know how I feel about this one. MOON shot baby.

$NVTA. Looking to see if it clears the level here and runs to all time highs. If so, good chance it's in the $70s.

$TDOC. The longer the base... There's a reason Cathie and other institutions have been loading the boat on this name... 99% of people have no clue how much of a beast this thing is and will continue to be.

$TTD. The flying eagle fell from the sky but man did it get high before that. Chart trending on the higher lows, Anchored-VWAP coming up, starting to wedge, everything regresses. Back to highs next time it turns up.

$XL. Winding and grinding, ready to flow up. Same as $DM post merger and we all know who was right about that one...Check up in the thread to see $DM chart too.

$ZM. Been waiting on this name to find footing for a while. Finally riding the wave. Looks like $485 coming.

Hope you guys enjoyed! Avi and I are working on the @PoundingDaTable newsletter right now to be out by Friday. And... If you haven't heard our most recent episode from yesterday where we talk Space and $ARKX, check it out below!

https://anchor.fm/poundingthetable/episodes/Pounding-The-Table---Season-2-Episode-2-Episode-23-ep3p8o

https://anchor.fm/poundingthetable/episodes/Pounding-The-Table---Season-2-Episode-2-Episode-23-ep3p8o

https://anchor.fm/poundingthetable/episodes/Pounding-The-Table---Season-2-Episode-2-Episode-23-ep3p8o

https://anchor.fm/poundingthetable/episodes/Pounding-The-Table---Season-2-Episode-2-Episode-23-ep3p8o

Read on Twitter

Read on Twitter