I started a position in $IPOE @SoFi last week. I think its an amazing company and I’m super excited for it’s future

Here is my investment thesis !

!

[THREAD]

[THREAD]

Here is my investment thesis

!

!  [THREAD]

[THREAD]

1/ Mission-driven company

SoFi (Social Finance) is a mission-driven and value oriented company that has been built on “trust and integrity”.

SoFi’s Mission Statement: Help people reach financial independence to realize their ambitions

SoFi (Social Finance) is a mission-driven and value oriented company that has been built on “trust and integrity”.

SoFi’s Mission Statement: Help people reach financial independence to realize their ambitions

everything SoFi does is geared toward helping their members “get their money right”.

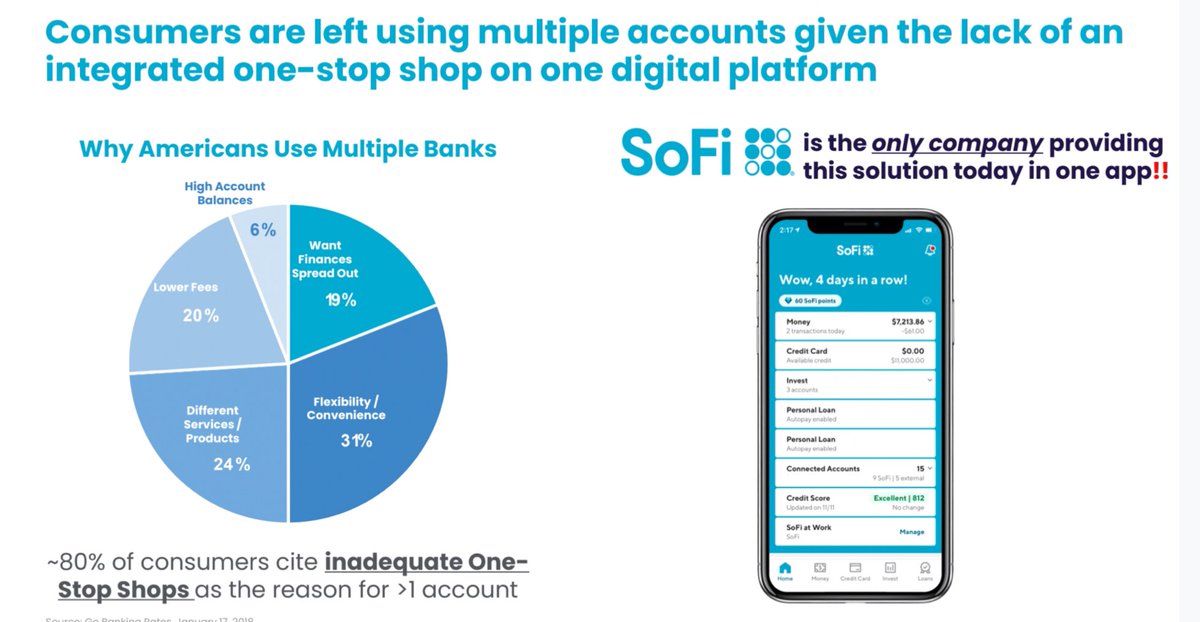

2/ Industry Opportunity

According to their S-4, SoFi predicts the TAM for financial services to be $2 Trillion. Representing a huge opportunity for them to attract members to their digital native platform

According to their S-4, SoFi predicts the TAM for financial services to be $2 Trillion. Representing a huge opportunity for them to attract members to their digital native platform

The fintech industry is rapidly growing as legacy banks have been in stagnation coming out of the Great Recession due to a combination of strict regular and old-fashion technology. In doing, so consumer satisfaction has went down

There are over 500 million bank accounts in US still attached to legacy banks. 50% of those banks have reportedly more than one bank. And 80% of consumers state the reason for having more than “one bank us a lack of an adequate one-stop shop provider” This is where SoFi comes in

3/ One-Stop Shop

SoFi offers a full-suite of financial products and services from lending to investing.

- I have been doing some hands on DD and I am super impressed by their platform. The app is super comprehensive and offers everything I would need in a bank in one place

SoFi offers a full-suite of financial products and services from lending to investing.

- I have been doing some hands on DD and I am super impressed by their platform. The app is super comprehensive and offers everything I would need in a bank in one place

Galileo

Galileo is a fintech infrastructure company that powers SoFi as and other top companies such as Robinhood, Chime, etc

As stated in their investor call, Galileo is responsible for 90% of the new account creation among Neobanks in US. So as other banks win, SoFi does too

Galileo is a fintech infrastructure company that powers SoFi as and other top companies such as Robinhood, Chime, etc

As stated in their investor call, Galileo is responsible for 90% of the new account creation among Neobanks in US. So as other banks win, SoFi does too

Enables SoFi with the ability for fast and flexible development & innovation at a lower cost scale. Having an outdated backend infrastructure has been a critical issue for traditional banks as they try to compete with fintech companies.

Galileo is touted as the “AWS” of fintech

Galileo is touted as the “AWS” of fintech

Sofi is on its way to operating as a legitimate national bank as it has received regulatory approval for a bank charter in 2020.

By becoming a national bank, SoFi would be able to lend and accept money without partner banks which will drive cost down significantly

By becoming a national bank, SoFi would be able to lend and accept money without partner banks which will drive cost down significantly

4/ Competitive Advantage

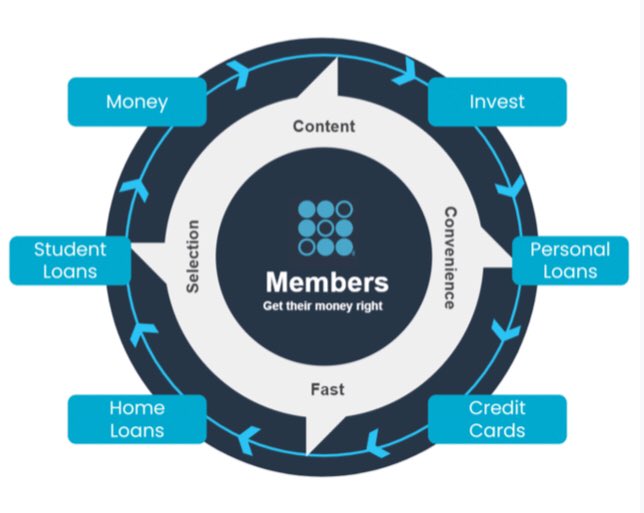

SoFi has a strong flywheel that they call the “Financial Service Product Loop” (FSPL). Their FSPL gives them strong competitive advantage and cross-selling opportunities.

SoFi builds their products so that they are “better when used together”

SoFi has a strong flywheel that they call the “Financial Service Product Loop” (FSPL). Their FSPL gives them strong competitive advantage and cross-selling opportunities.

SoFi builds their products so that they are “better when used together”

Vertical Integration:

Through the acquisition of Galileo, SoFi is able to vertically integrate their financial services which is a huge advantage

SoFi’s vertical Integration supports faster innovation (launched 5 products in 12 months) at a lower cost scale, higher velocity

Through the acquisition of Galileo, SoFi is able to vertically integrate their financial services which is a huge advantage

SoFi’s vertical Integration supports faster innovation (launched 5 products in 12 months) at a lower cost scale, higher velocity

Data

Through members’ financial data, SoFi is able to build better risk models, which sloe them to have more competitive pricing for their lending business

- Traditional banks of today have restricted lending practices and often have a poor customer experience

Through members’ financial data, SoFi is able to build better risk models, which sloe them to have more competitive pricing for their lending business

- Traditional banks of today have restricted lending practices and often have a poor customer experience

By using data from their members usage, SoFi is able to curate and personalize each of their their members’ home feed page further reinforcing their FSPL

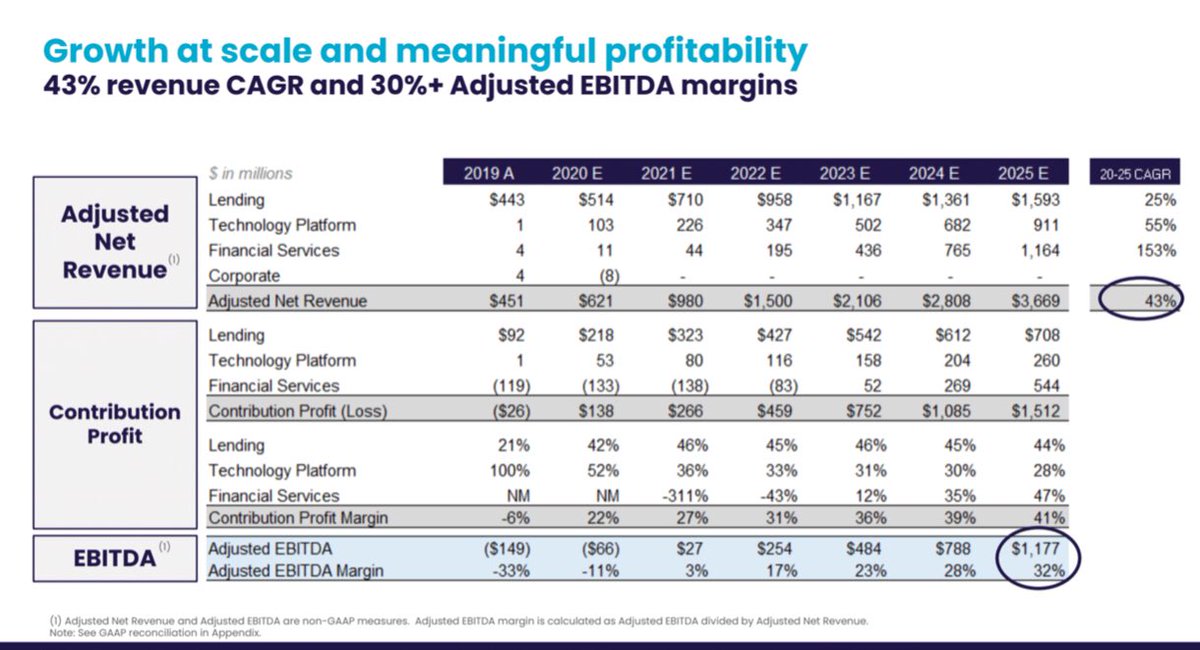

5/ Strong growth

- over 75% YoY member growth. Expected to hit 3M in 2021

- Revenue growth is expected to grow at a 5y 43% CAGR

- Forecasted 5y 30+% EBITDA margins

- SoFi predicts they will achieve profitability in 2021

- over 75% YoY member growth. Expected to hit 3M in 2021

- Revenue growth is expected to grow at a 5y 43% CAGR

- Forecasted 5y 30+% EBITDA margins

- SoFi predicts they will achieve profitability in 2021

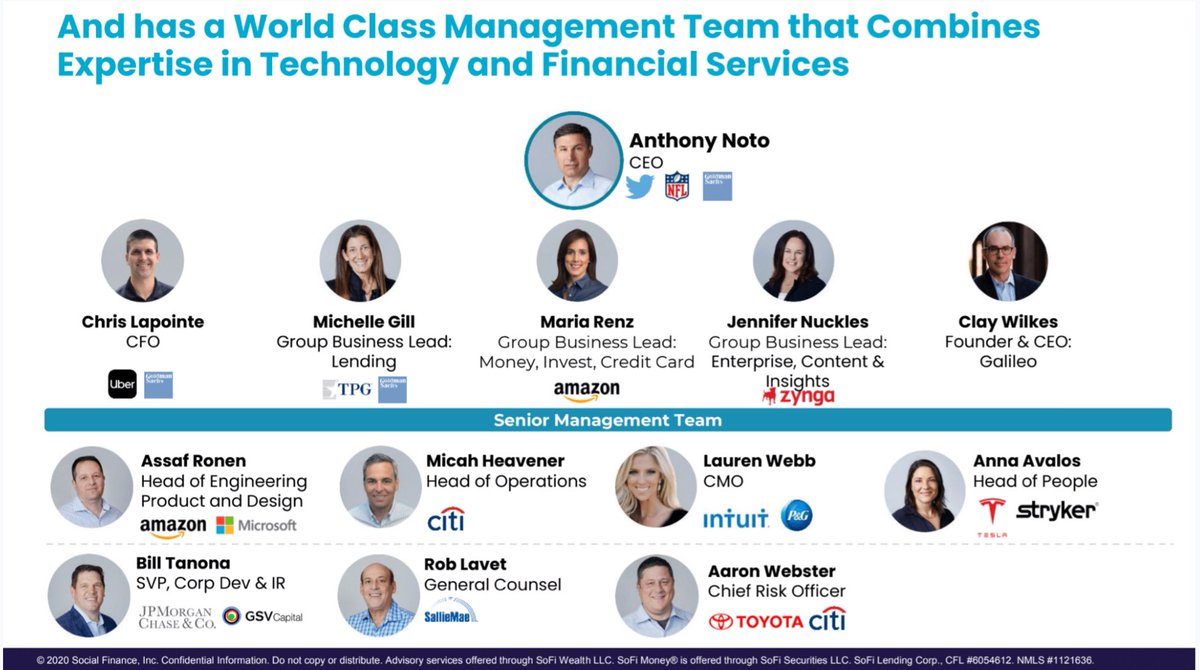

6/ Strong management team

- Mission-driven company rooted in ethical values

- Very passionate, driven CEO @anthonynoto that has shown strength as a leader and strong election

- Backed by @chamath the

- Mission-driven company rooted in ethical values

- Very passionate, driven CEO @anthonynoto that has shown strength as a leader and strong election

- Backed by @chamath the

I would love to get your thoughts on my bull thesis as well. Please let me know if I missed anything @RihardJarc @StockMarketNerd @AmitayYaniv @saxena_puru @jiggytrades

Read on Twitter

Read on Twitter![I started a position in $IPOE @SoFi last week. I think its an amazing company and I’m super excited for it’s futureHere is my investment thesis ! [THREAD] I started a position in $IPOE @SoFi last week. I think its an amazing company and I’m super excited for it’s futureHere is my investment thesis ! [THREAD]](https://pbs.twimg.com/media/EsDHRZPUYAIRzI_.jpg)