THREAD/ some thoughts on why I'm skeptical of the net lending (savings & investment imbalance) / corporate savings glut / 'financializaiton" discussion as it pertains to the decline of biz investment 1/n

Whether it's Summers talking about secular stagnation, many great economists exploring a corporate savings glut or Marco Rubio arguing that we're seeing the "financialization" of the economy theres a suggestion of a big savings / investment imbalance

Basically, it posits that a declining labor share begat rising profits and saving… and without investment it begat a net lending corporate sector. Rubio has even claimed that we are in the midst of a disorder in the institutional arrangement of the American economy"

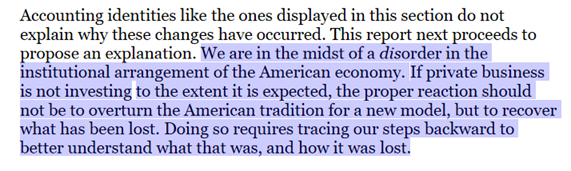

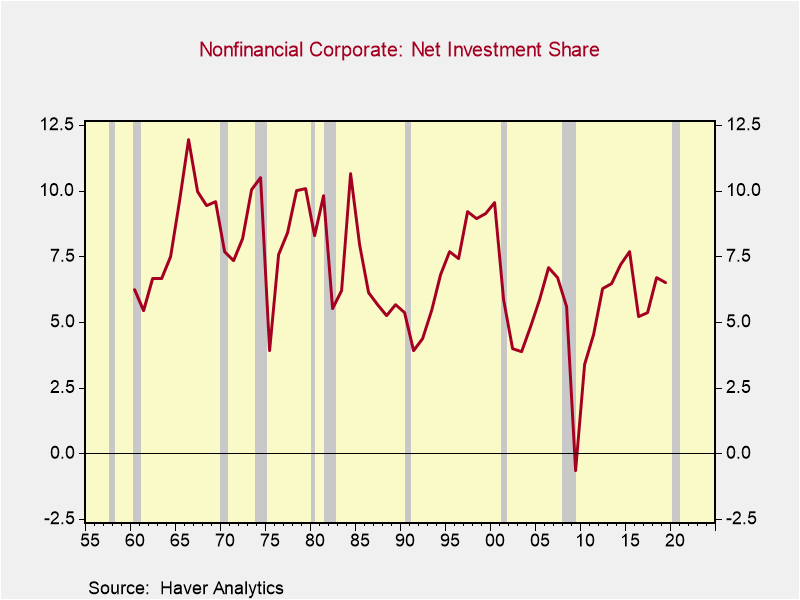

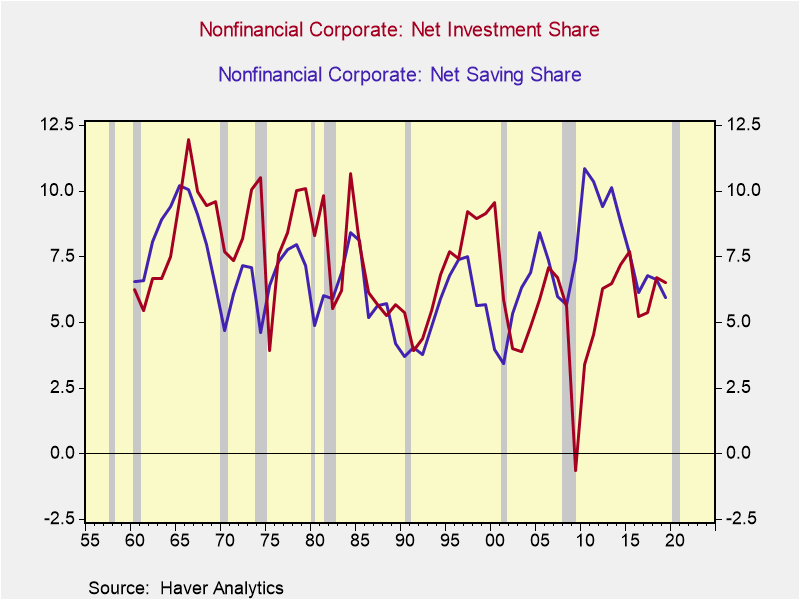

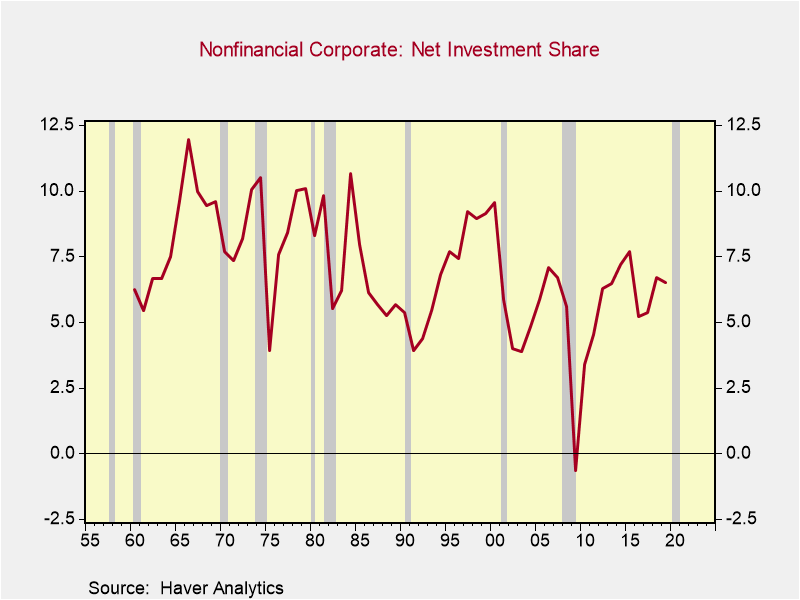

So what's actually happening? Here's net investment and net saving as a % of net value added in the nonfinancial corporate sector. If saving exceeds investment that means the corporate sector is "net lending"

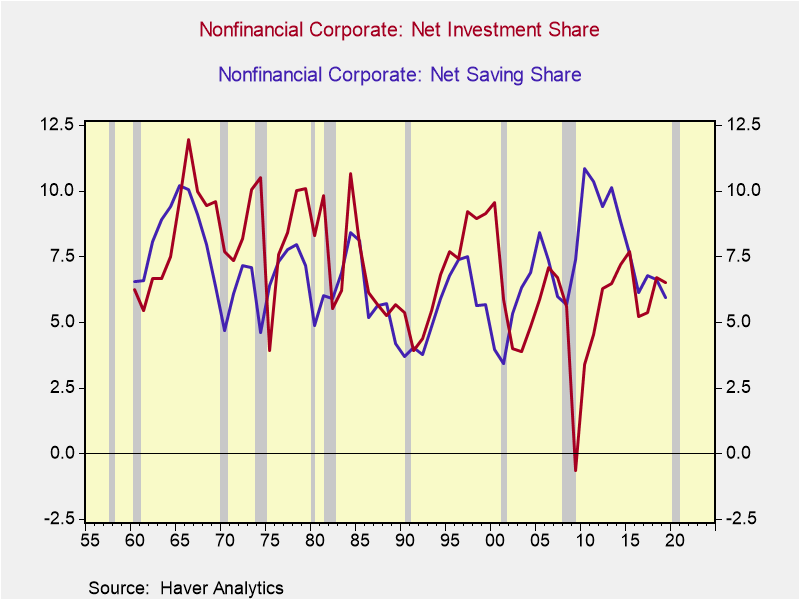

Here's net lending. Somewhat positive in the 2000s and sharply rose post GFC but is at historically normal levels now

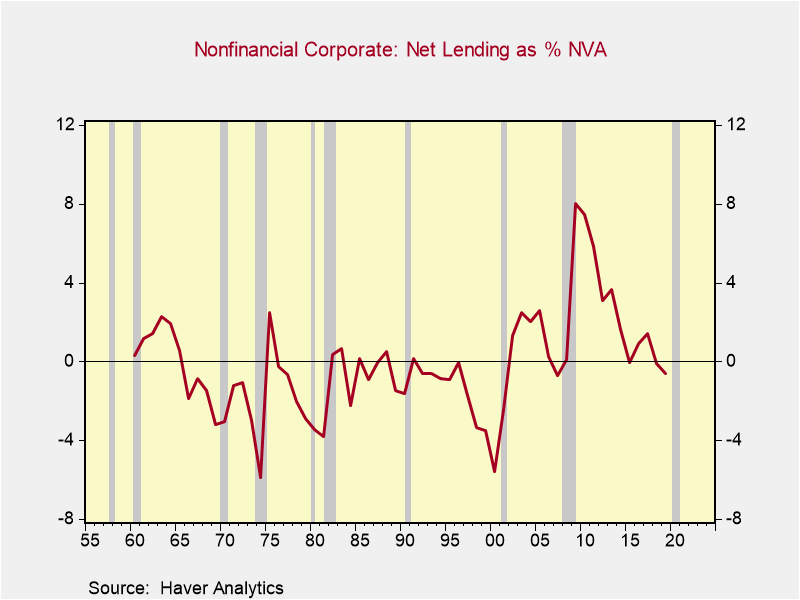

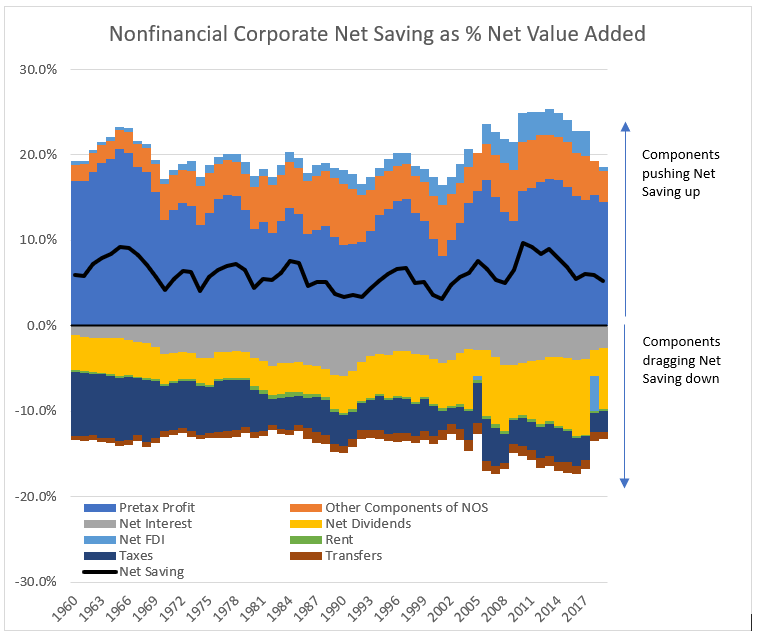

Net savings are largely driven by the net operating surplus of businesses which is mostly driven by pretax profits. Net saving is reduced by taxes and the net use of property income (interest, dividends, rent etc)

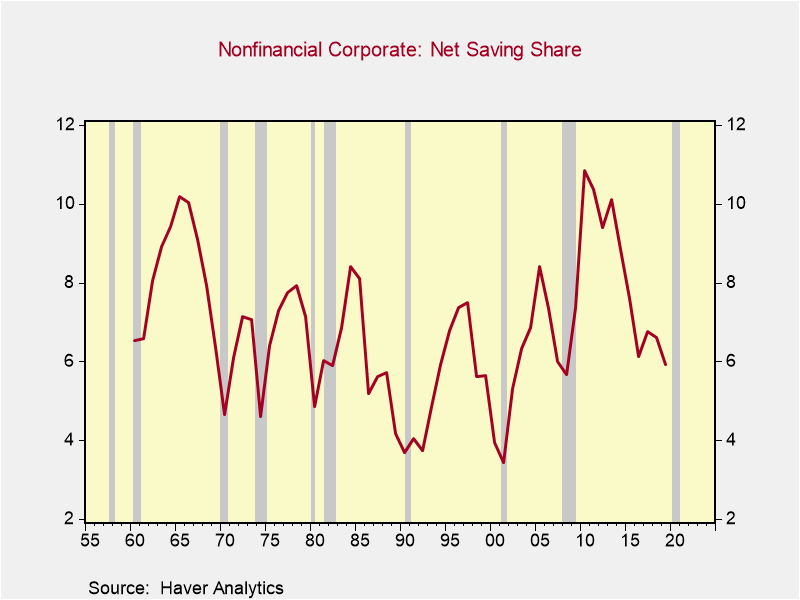

Meanwhile net investment, the other side of the net lending ledger has a modest downward trend (more on why this may be later)

Going back to this chart, what we basically see is a temporary pop in net lending in the 2000s and a large one right after the GFC... that doesn't look structural to me - looks much more like a precautionary surge in saving and reduction in investment (higher risk aversion)

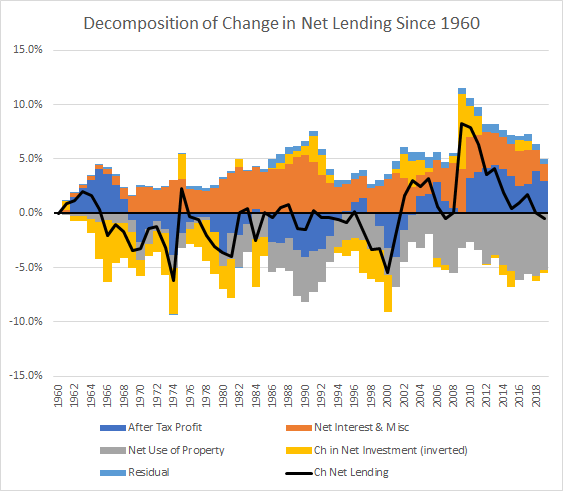

We can decompose these changes in net lending to learn more about what is going on. Indeed that spike immediately post 2008 was from reduced investment and income received from property growing at a faster rate than uses of property...

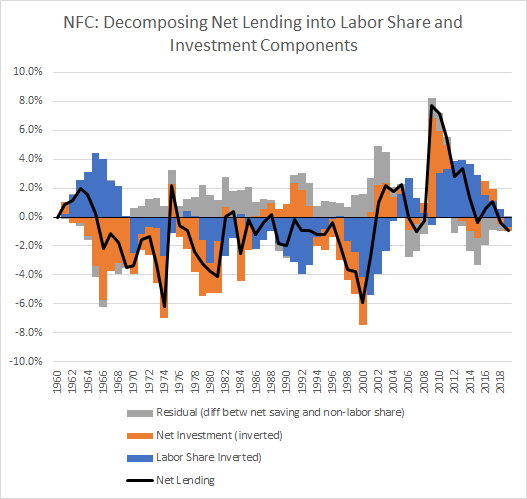

Here's a different and more interesting way of decomposing net lending (and i think novel). Initially net lending spiked because the labor share and investment declined... but again as the economy recovered & investment & labor share normalized the net lending issue went away

We can decompose net lending into two big components this way (labor share and investment) because net saving is driven mostly by 1 minus the labor share (which is the net operating surplus)

Here's the key take home point: net lending / corporate savings glut post 2008 was a cyclical issue. Investment collapsed but has since recovered. Same thing for the labor share. And these were the two factors initially propping up net corporate saving.

So what about this decline in net investment? After setting aside this "financialization" argument there are a few other common explanations:

1. corporate short termism

2. offshoring

3. market power

4. intangibles / mismeasurement

5. risk

1. corporate short termism

2. offshoring

3. market power

4. intangibles / mismeasurement

5. risk

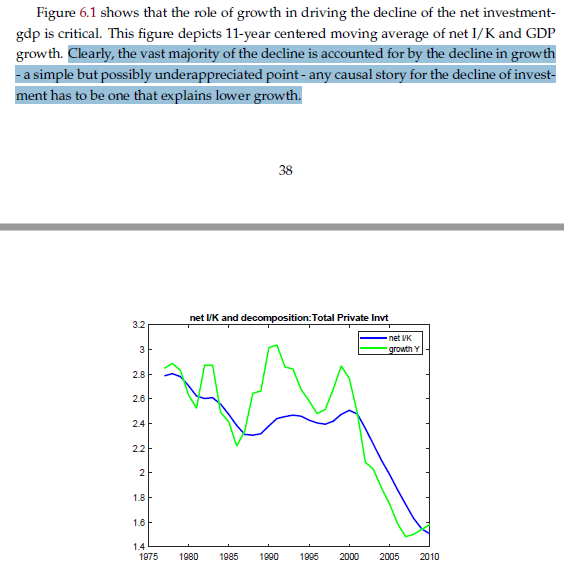

I think 4 & 5 are the most compelling. But to borrow from Rognlie & @FrancoisGourio in their most recent paper any explanation is going to have to explain how the same causal factor is also slowing growth as well

Read on Twitter

Read on Twitter