Opendoor: The Rise of The iBuyer

-- In September 2020, Opendoor went public by merging with a SPAC launched by Chamath Palihapitiya. The deal closed in December and Opendoor now trades under the ticker $OPEN.

-- In September 2020, Opendoor went public by merging with a SPAC launched by Chamath Palihapitiya. The deal closed in December and Opendoor now trades under the ticker $OPEN.

-- $OPEN uses technology to transform the home sale process.

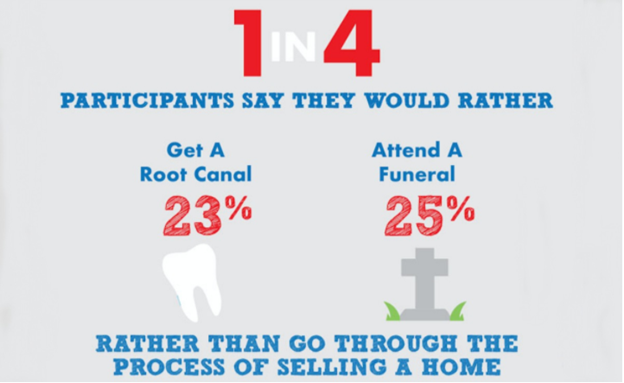

-- The Opportunity: the residential real estate market is massive with ~5M homes sold per year totaling $1.6 trillion. However, customer satisfaction is low because the process is slow, uncertain, and consuming.

-- The Opportunity: the residential real estate market is massive with ~5M homes sold per year totaling $1.6 trillion. However, customer satisfaction is low because the process is slow, uncertain, and consuming.

-- For example, just about 25% of homeowners in Atlanta would rather get a root canal than go through the process of selling their home.

-- Paypal Mafia alum and $OPEN cofounder Keith Rabois has been eyeing this opportunity for years: "Back in 2003, Peter Thiel said, Come up with an idea that's gonna innovate in residential real estate. It's the largest part of the US economy that's been unaffected by technology."

-- That's what $OPEN did. In 2014, it launched in Phoenix, disrupting an industry that's operated largely unchanged for decades.

-- For sellers, $OPEN offers online instant buying (iBuying). A seller submits information about their home and receives an offer within 24 hours.

-- For sellers, $OPEN offers online instant buying (iBuying). A seller submits information about their home and receives an offer within 24 hours.

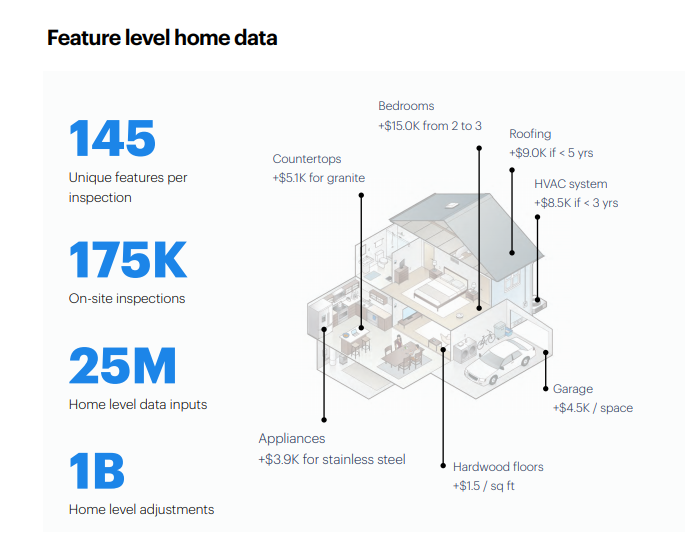

-- $OPEN uses its proprietary automated valuation model to price the home, based on a massive amount of data collected over the last 6 years.

-- If the seller accepts the offer, an $OPEN inspector visits the home to confirm its condition before finalizing the price.

-- If the seller accepts the offer, an $OPEN inspector visits the home to confirm its condition before finalizing the price.

-- $OPEN charges sellers a 6% fee plus a variable fee of 0-6% depending on the riskiness of the home. The average fee is around 7.5%.

-- In exchange, sellers receive 1) convenience, 2) price certainty, and 3) time certainty.

-- In exchange, sellers receive 1) convenience, 2) price certainty, and 3) time certainty.

-- For buyers, $OPEN offers a housing marketplace with homes for sale. Buyers can schedule and tour homes without an agent, unlocking the home through $OPEN's app, and can make digital offers. $OPEN also offers services like mortgage and title to close the home transaction.

-- On CNBC, Chamath identified several tailwinds that he believes will drive $OPEN's business going forward, including 1) Underbuilding of homes since the housing crisis leading to high home prices in major cities which in turn is causing people to move to more affordable areas.

-- 2) The "work from home" trend and increased digital connectedness are fundamentally changing the nature of work, meaning more people will work from home to some degree meaning in turn that more people will invest more in finding and buying a home that they love.

-- 3) 75M digitally native millennials (soon to be followed by Gen Zs and so on) are entering the housing market with expectations of a speedy, easy, and convenient digital first service.

-- 4) Interest rates are likely to remain low for an extended period of time.

-- 4) Interest rates are likely to remain low for an extended period of time.

-- After launching in Phoenix, $OPEN has expanded into 21 new markets, like Dallas, Las Vegas, and Atlanta, with promising results. For 1Q20, its revenue run rate for all markets was $5B. Its aim is to expand to 100 markets in the coming years.

-- Positive unit economics: $OPEN's contribution margin per home is 3.1% before interest and 1.9% after. This improves the longer $OPEN's in a market. For example, in Phoenix, the contribution margin is 4% before interest and 3% after.

-- $OPEN has also improved its strategy for entering new markets. For example, in Phoenix, $OPEN had .8% market share after 12 months. In the last 15 markets entered, it had an average of 1.3% market share after 12 months.

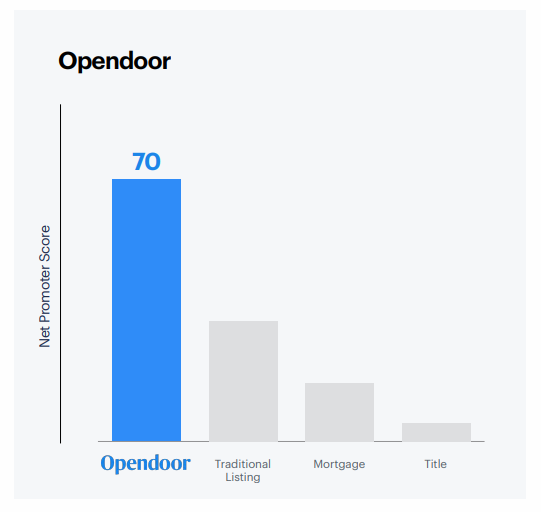

-- $OPEN's products delight customers, increasing its ability to expand. In November 2020, $OPEN reported a net promoter score (a metric that describes the likelihood a customer will recommend a product) of 70. Put another way, $OPEN's customers are providing free advertising.

-- Since day one, $OPEN has built a culture of frugality. A guiding tenant is: "We eat basis points for breakfast."

-- $OPEN is constantly looking for ways to lower costs because lower costs mean that customers receive lower prices and are more satisfied.

-- $OPEN is constantly looking for ways to lower costs because lower costs mean that customers receive lower prices and are more satisfied.

-- From 2018 to 2020, $OPEN increased the number of fully automated offers that it made from 41% to 63%, using technology to drive down costs. $OPEN has also built networks of contractors for home repairs. As a result, $OPEN spends 2% of revenue on repairs versus Zillow's 5%.

-- Still, while $OPEN's results are promising in many respects, it also faces numerous risks and challenges, including 1) pricing model accuracy, 2) ability to access capital, 3) increased competition, 4) housing market volatility, and 5) ability to scale to profitability.

-- Despite these risks and uncertainties, there are reasons to be optimistic about $OPEN's ability to execute, such as 1) years of pricing data, 2) executive team laser-focused on lowering costs for consumers, and 3) the increasing use of mobile technology for all parts of life.

-- Point 3 is especially worth noting. Smart phones have become the platform through which younger generations interface with the world, ranging from insurance (e.g. $LMND) to transportation (e.g. $UBER) to dining (e.g. $DASH) to banking (e.g. SoFi aka $IPOE).

-- The reason is simple: mobile technologies simplify headache-inducing processes by removing friction and increasing ease of use. Consumers have demonstrated a willingness to pay a premium for these features (e.g. ubering over a bus or ordering DoorDash instead of picking up).

Read on Twitter

Read on Twitter