A Distant Force: Teledyne Thread

(yes, THAT Teledyne)

(yes, THAT Teledyne)

$TDY

(yes, THAT Teledyne)

(yes, THAT Teledyne) $TDY

Teledyne gained some fame among value investors given it was profiled in The Outsiders. Long-time CEO Dr. Henry Singleton was also praised by Buffett calling him the best capitol allocator in America. That was 40 years ago, I’m gonna talk about the Teledyne of today.

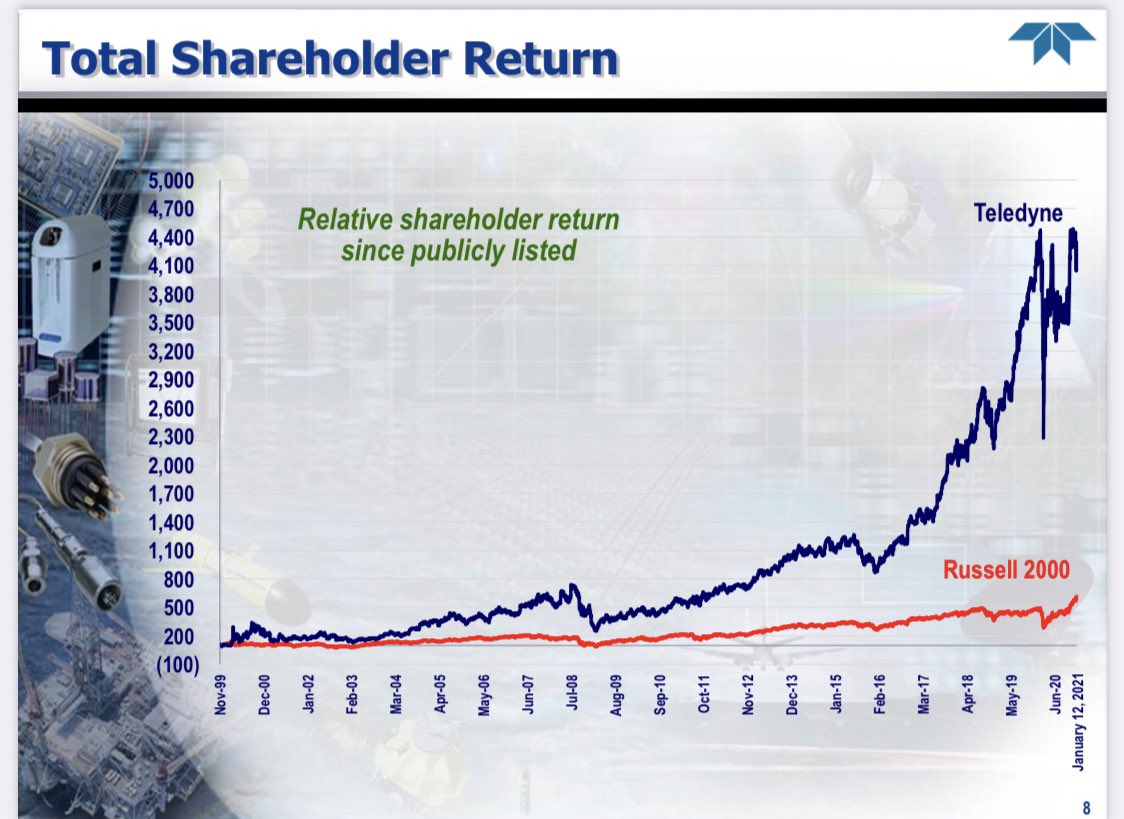

After Singleton, Teledyne divested many of its divisions and after some hostile takeover attempts, it ended up merging with Allegheny. It was spunoff in 1999 and here’s what has happened since:

The company has changed a lot since it was spunoff, originally mostly Aerospace components and DoD exposed, it is now mainly a Digital Imaging and Instrumentation company after deploying $3.6B into 63 acquisitions since 2000. 50% of revenues outside of US, 25% US govt.

What does it do? literally rocket science, among other things. High tech industrial with 4 segments: Digital Imaging, Instrumentation, A&D Electronics and Engineered Systems. It’s also a acquisitive, a Berkshire Hathaway of high tech industrials of sorts (they don’t pay dividend)

Their businesses share a couple of traits: highly engineered, mission critical components that are typically expensive and integrated into a larger system and must be reliable. Customers care more about quality than price. Most products sense, analyze or transmit information.

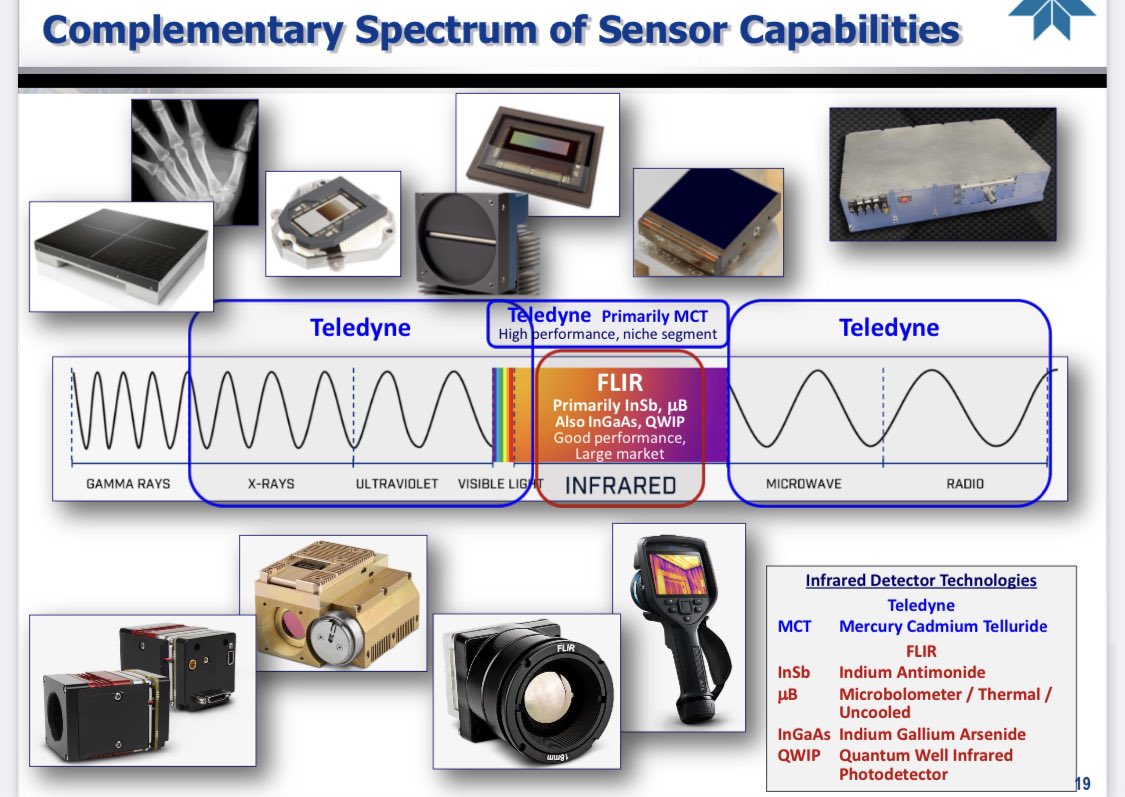

Segment detail: Digital Imaging (60%) — high performance sensors/cameras like X-ray, machine vision, thermal detectors, and everything accross the e/m spectrum; Instrumentation (20%) — test&measurement, monitoring and control instruments for marine, environmental and industrial;

A&D electronics (12%) — sophisticated electronic components, subsystems, communication products and interconnect for harsh environments. Used in aviation, satellite, submarines, UAVs etc;Engineered Systems (8%) — similar to A&D, but mostly cost-plus businesses contracts with DoD

Management has a splendid track record of acquisitions and conservative guides and accounting (missed EPS 3 quarters in 20 years) Execs are paid on LT outperformance of the Russell 2000. CEO Al Picelli succeeded Robert Mehrabian in 2019 who is now Chairman but still very involved

Oh, and they just bet the house on their most recent acquisition (pending close) On Jan 4 they announced they were buying FLIR Systems for $8B, that’s 40% of TDY’s marketCap (!!!) Leverage will kick up to 3.5x and go back <2x in 18mo. Paid 17x EBITDA, adds ~$5 FCF/sh and growing

FLIR primarily builds and sells infrared sensors to industrial and defense customers. High tech cameras ideal for detecting varying temperatures (covid airport cameras), “seeing” at night for ADAS, robot guidance, quality control, predictive maintenance and they also sell UAVs

Valuation: company reports GAAP earnings w/no adjustments, which makes it unfair to compare to other industrials that adj for things like amort. On FCF basis it will prob earn $18 p/sh in ‘22. I think they can grow FCF at midteens from a combination of topline, margin and acq.

I’d say fair value around $400-450 (and growing) right now vs stock at $380

Read on Twitter

Read on Twitter