1/ The price of Bitcoin is driven by two key factors.

1. Increasing Scarcity (stock-to-flow)

2. Society’s understanding of Bitcoin’s existence

1. Increasing Scarcity (stock-to-flow)

2. Society’s understanding of Bitcoin’s existence

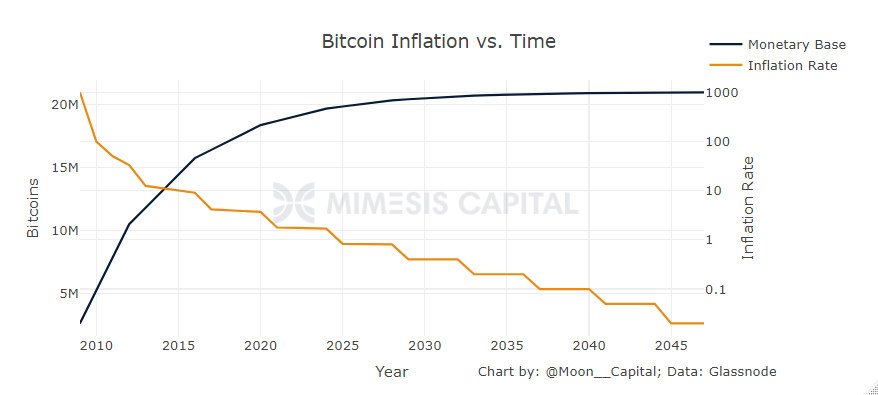

2/ Bitcoin’s programmed algorithmic supply schedule helps circulate Bitcoins to as many individuals as possible while keeping the price low enough to build entrenchment into the existing financial system.

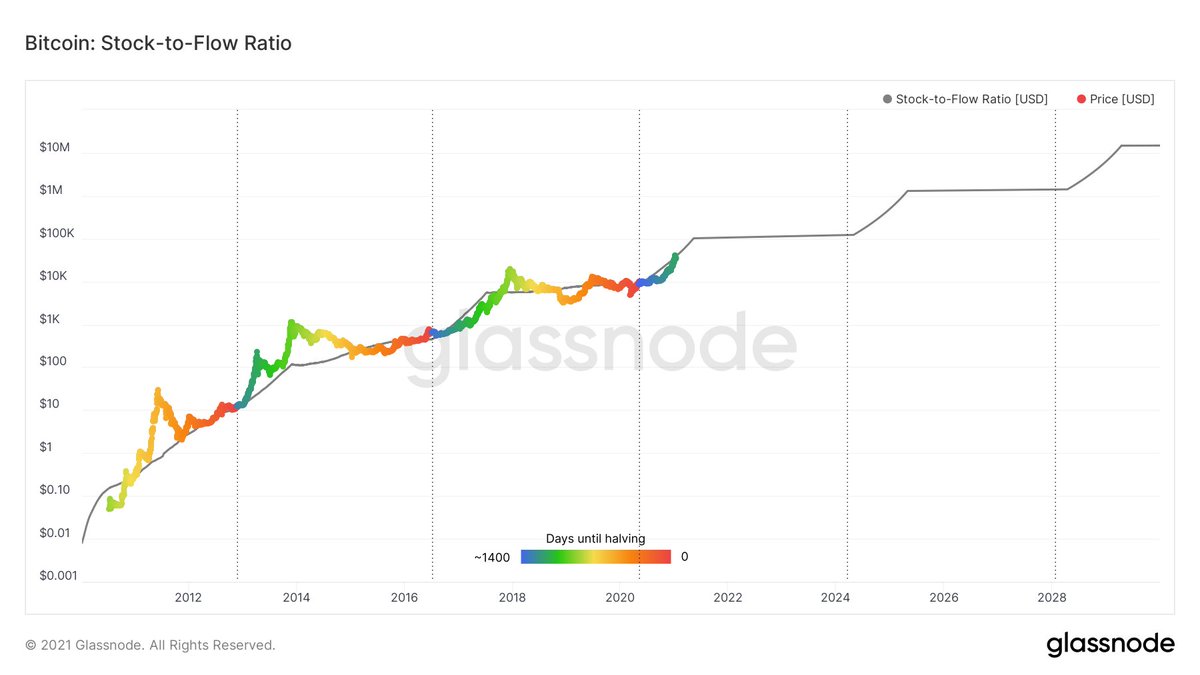

3/ Bitcoin’s stock-to-flow ratio doubles every four years due to its algorithmic pre-programmed halving events.

Price CANNOT be driven up too fast without a majority of the world's capital understanding Bitcoin. Let me explain why.

Price CANNOT be driven up too fast without a majority of the world's capital understanding Bitcoin. Let me explain why.

4/ For if a small minority attempted to buy as much Bitcoin as they could, the price would get overbid until mining sell pressure grows too much for the small minority.

5/ Example: In 2021, roughly 328,500 BTC will be mined. At $10M per BTC, that is $3.2 Trillion USD. A small minority cannot create that much buy pressure.

6/ This is why Bitcoin’s price is a function of BOTH its scarcity AND society’s understanding of Bitcoin’s existence.

7/ Halving events do drive the price up, but the halving events cannot be front run by a small minority of individuals because the small minority of individuals will not be able to buy up the newly mined coins that will be forced sold by miners at drastically higher prices.

8/ This leads the price to settle around equilibrium points of scarcity and the level of global adoption.

Since Bitcoin’s price is driven by those 2 key factors, if they both continue increasing over time, Bitcoin will continue to experience exponential price rises.

Since Bitcoin’s price is driven by those 2 key factors, if they both continue increasing over time, Bitcoin will continue to experience exponential price rises.

9/ Once enough of the world's capital understands the implications of Bitcoin's existence, we will likely reach escape velocity. https://twitter.com/citizenbitcoin/status/1327276810363670529?lang=en

Read on Twitter

Read on Twitter