I rarely do this on a macro-level but here's a more top down view of what Goldman Sachs Expects for 2021:

They expect the FED to stay VERY accommodative

They expect the FED to stay VERY accommodative

(no rate hikes) for the foreseeable future

They expect Global GDP to recover strongly to 5.4% in 2021

They expect Global GDP to recover strongly to 5.4% in 2021

They expect the FED to stay VERY accommodative

They expect the FED to stay VERY accommodative (no rate hikes) for the foreseeable future

They expect Global GDP to recover strongly to 5.4% in 2021

They expect Global GDP to recover strongly to 5.4% in 2021

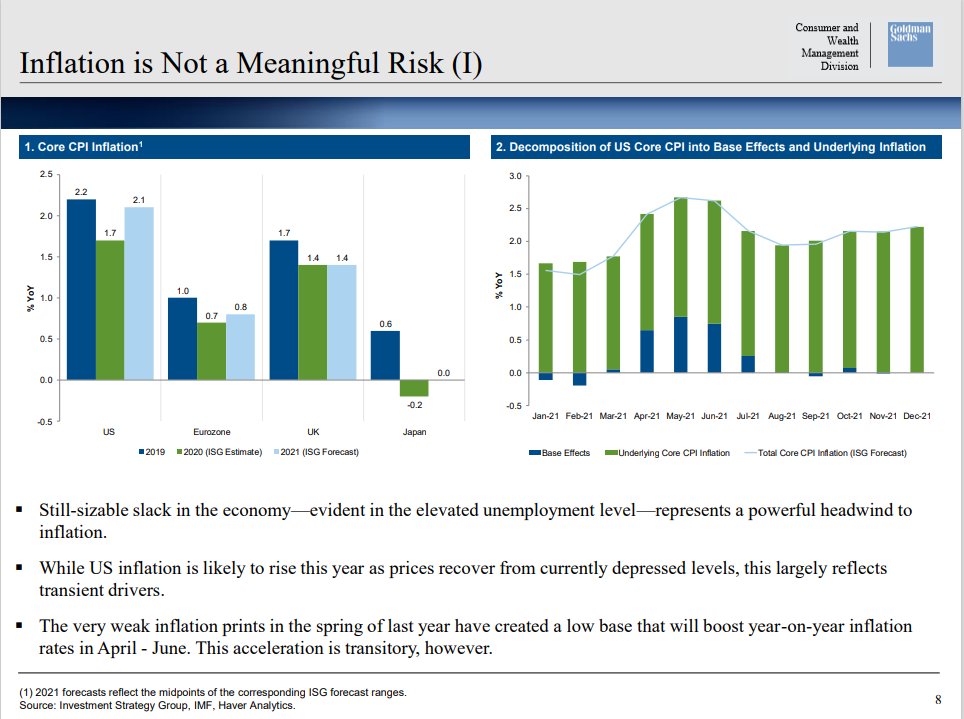

They don't expect Inflation to be an issue for now

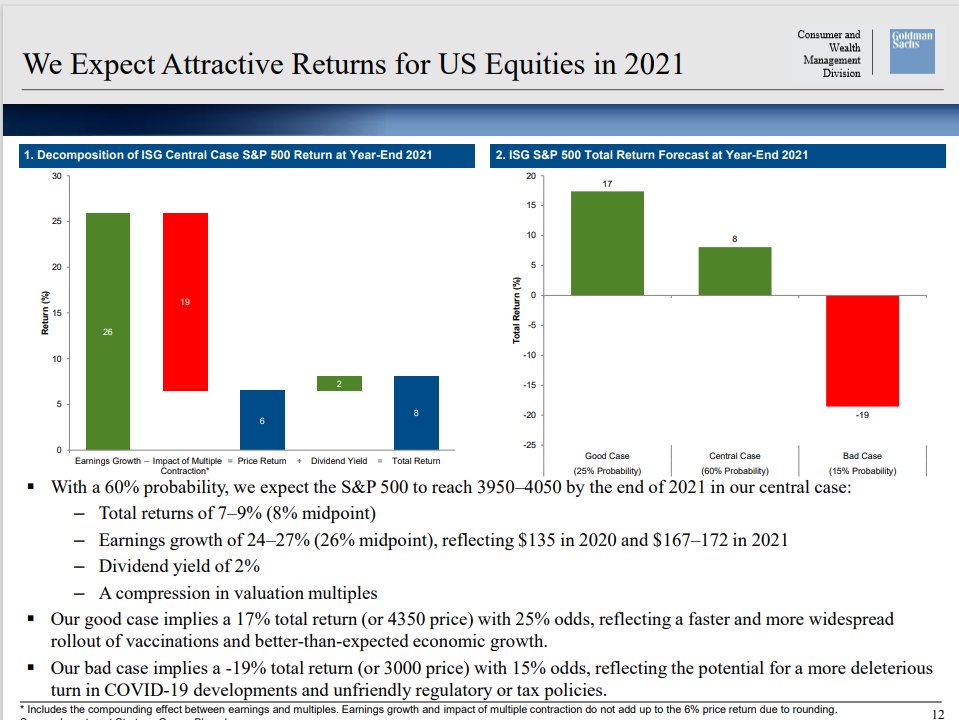

They don't expect Inflation to be an issue for now They expect Total return in 2021 of about 8% for US equity and 8.6% for the MSCI All Country Index

They expect Total return in 2021 of about 8% for US equity and 8.6% for the MSCI All Country Index

Good case Scenario for US Equities: +17% in 2021

Good case Scenario for US Equities: +17% in 2021 Bad Case Scenario for US Equities: -19% in 2021

Bad Case Scenario for US Equities: -19% in 2021 Base Case Scenario for US Equities: 8% in 2021

Base Case Scenario for US Equities: 8% in 2021

The Implied Equity Risk Premium(ERP) is still attractive at 3.5% and is considerably better than the negative ERP during the Tech Bubble

The Implied Equity Risk Premium(ERP) is still attractive at 3.5% and is considerably better than the negative ERP during the Tech Bubble

CC: @saxena_puru @mukund

Equities are likely to have positive return 87% of the time when the economy has been expanding, as is the case now.

Equities are likely to have positive return 87% of the time when the economy has been expanding, as is the case now.

Since 2018. there has been NEGATIVE Fund flow into Equities

Since 2018. there has been NEGATIVE Fund flow into Equities  There is a $3.1 trillion difference between equity outflows and cash/bond inflows since 2019, suggesting

There is a $3.1 trillion difference between equity outflows and cash/bond inflows since 2019, suggestingplenty of capacity for investors to rebalance into equities.

Risks to their 2021 Outlook: Covid, US-China Relationship, Domestic Policies, "Techlash", Cybersecurity, Geopolitical and Recession.

Risks to their 2021 Outlook: Covid, US-China Relationship, Domestic Policies, "Techlash", Cybersecurity, Geopolitical and Recession.

Shocks like pandemics, tsunamis and wars are inevitable, but since they cannot be predicted, it is best to ride them out

Shocks like pandemics, tsunamis and wars are inevitable, but since they cannot be predicted, it is best to ride them out

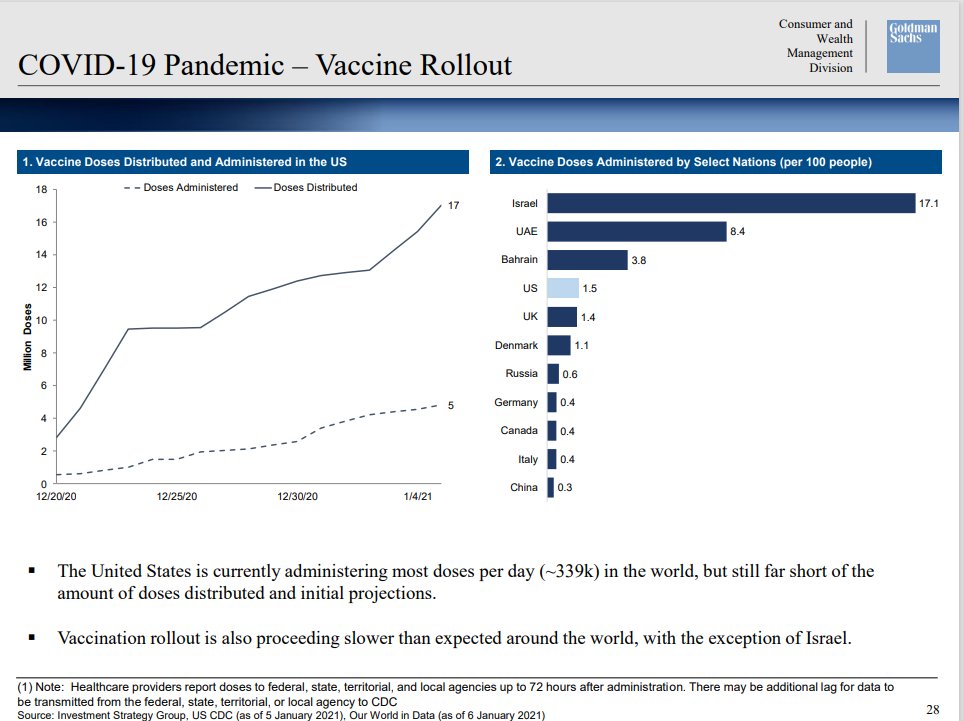

The United States is currently administering most doses per day (~339k) in the world, but still far short of the amount of doses distributed and initial projections.

The United States is currently administering most doses per day (~339k) in the world, but still far short of the amount of doses distributed and initial projections.

Key Takeaways:

Strong pickup in global growth

Strong pickup in global growth

Accommodative monetary and fiscal policy

Accommodative monetary and fiscal policy

Low risk of recession:

Low risk of recession:

Abundance of risks:

Abundance of risks:

Attractive portfolio returns:

Attractive portfolio returns:

Stay invested:

Stay invested:

US preeminence is intact

US preeminence is intact

Strong pickup in global growth

Strong pickup in global growth Accommodative monetary and fiscal policy

Accommodative monetary and fiscal policy Low risk of recession:

Low risk of recession: Abundance of risks:

Abundance of risks: Attractive portfolio returns:

Attractive portfolio returns:  Stay invested:

Stay invested:  US preeminence is intact

US preeminence is intact

Current High Conviction Portfolio (By Size)

Current High Conviction Portfolio (By Size)

Longs:

$SDGR

$NGA

$CCIV

$FSLY

$ABNB

$W

$BFT

$AJAX

$NGAB.U

$APSG

$BTCG

Please share with your followers as you see fit:

CC:

@mukund

@saxena_puru

@BrianFeroldi

@JonahLupton

@TheMarkCooke

@LuoshengPeng

@GrowthStockDoc

@SpacGuru

@howardlindzon

@jablamsky

@JoeySolitro

CC:

@mukund

@saxena_puru

@BrianFeroldi

@JonahLupton

@TheMarkCooke

@LuoshengPeng

@GrowthStockDoc

@SpacGuru

@howardlindzon

@jablamsky

@JoeySolitro

Read on Twitter

Read on Twitter