-Crypto Options Thread-

Lately, I've been fascinated by crypto options platforms, centralized and decentralized.

According to statistics by @FIAconnect, trading activity for derivative markets rose by almost 14% in 2019 - 34.47b contracts (19.24b futures/15.23b options)

(1/16)

Lately, I've been fascinated by crypto options platforms, centralized and decentralized.

According to statistics by @FIAconnect, trading activity for derivative markets rose by almost 14% in 2019 - 34.47b contracts (19.24b futures/15.23b options)

(1/16)

Tapping into that industry is going to be huge for the future of decentralized finance in the world of legacy products.

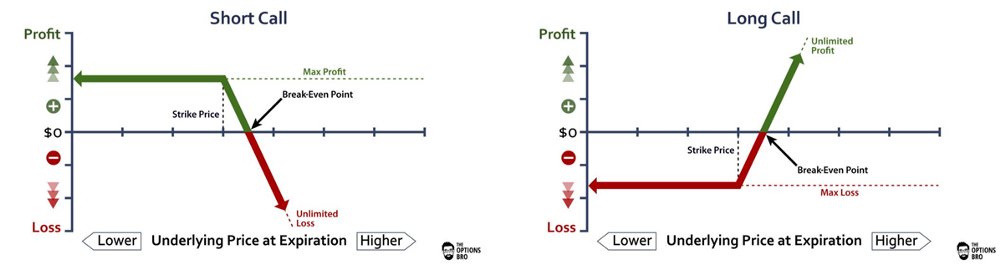

Options are a great tool for hedging, as well as going long/short with lower risk than simply acquiring a contract.

(2/16)

Options are a great tool for hedging, as well as going long/short with lower risk than simply acquiring a contract.

(2/16)

Your maximum loss can't be higher than the amount you paid for the option. Buying $ETH calls instead of contracts lowers the risk to one's capital in case of a big retracement/dump. It goes the other way with puts.

(3/16)

(3/16)

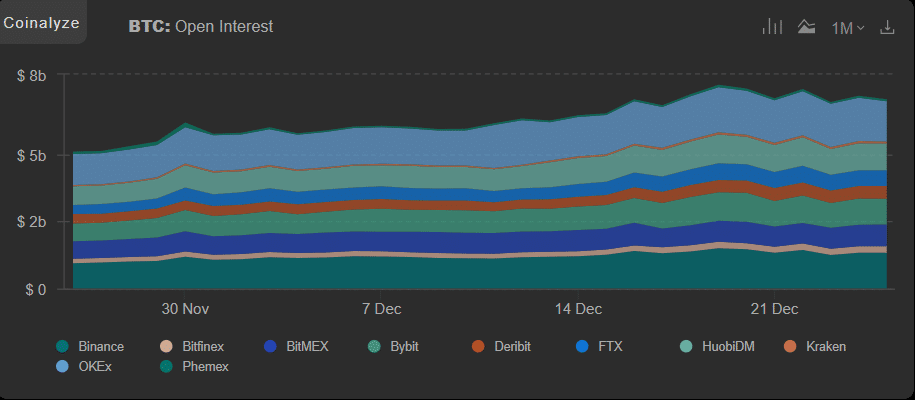

Today, centralized solutions ( @binance , @FTX_Official , @DeribitExchange, etc) are dominating the market, offering either American or European options.

Rising names like @fin_nexus @opyn_ @AuctusProject and @Opium_Network are also ones to look out for.

(4/16)

Rising names like @fin_nexus @opyn_ @AuctusProject and @Opium_Network are also ones to look out for.

(4/16)

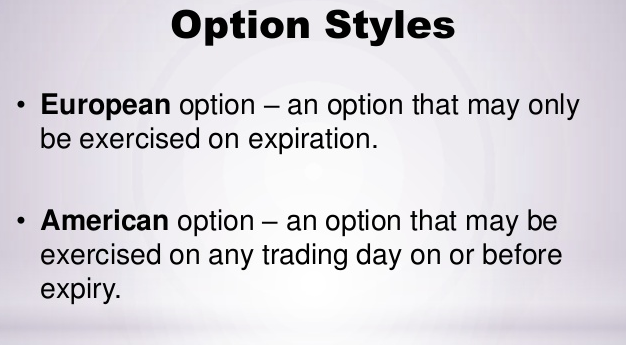

Quick sidestep: The main difference between the two option types is when each can be exercised. A European option can be exercised only at the expiration date, whereas the American option can be exercised anytime before the expiration date. There are other differences.

(5/16)

(5/16)

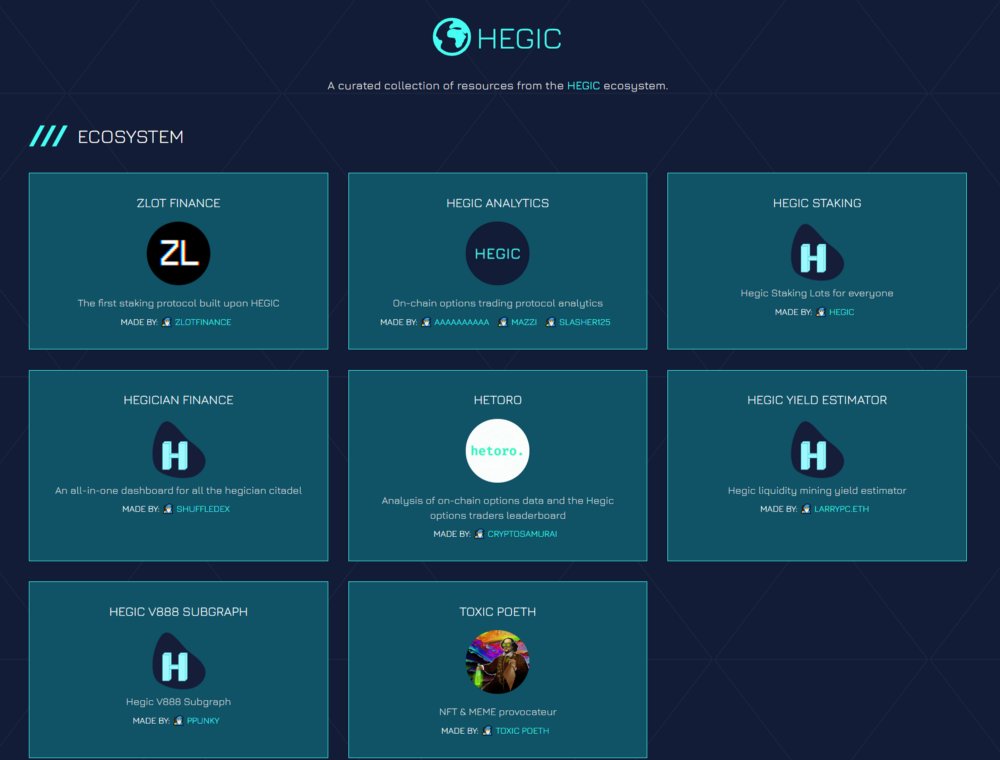

Decentralized solutions such as $UMX (acquired @ethoptio), Deriswap ( @AndreCronjeTech ) and AMM-powered @HegicOptions are trying to grab a piece of the pie, with $HEGIC trailblazing and leading the charge, spearheaded by the very talkative @0mllwntrmt3

) and AMM-powered @HegicOptions are trying to grab a piece of the pie, with $HEGIC trailblazing and leading the charge, spearheaded by the very talkative @0mllwntrmt3

(6/16)

) and AMM-powered @HegicOptions are trying to grab a piece of the pie, with $HEGIC trailblazing and leading the charge, spearheaded by the very talkative @0mllwntrmt3

) and AMM-powered @HegicOptions are trying to grab a piece of the pie, with $HEGIC trailblazing and leading the charge, spearheaded by the very talkative @0mllwntrmt3 (6/16)

Hegic completed a very successful initial bonding curve offering (IBCO). It guaranteed the same price for all participants, effectively cementing a pseudo price floor while also increasing/decreasing the token value linearly to the number of participants. Raised >31k $ETH

(7/16)

(7/16)

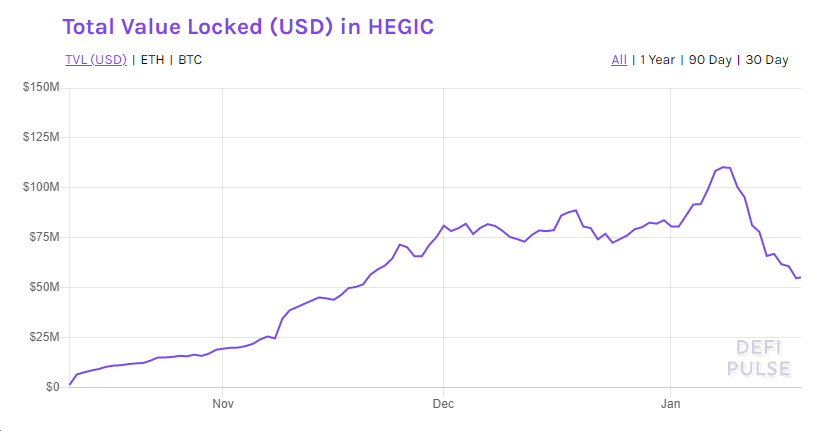

@HegicOptions debuted the Hegic v888 version around the middle of October. Unlike the previous iteration, v888 sports a dual pool model, $WBTC and $ETH calls & puts, $HEGIC liquidity mining ($rHEGIC), and more.

(8/16)

(8/16)

Moreover, unlike traditional exchanges which offer fixed-term options contracts, Hegic uses a pooled liquidity model a-la @compoundfinance.

(9/16)

(9/16)

This means buyers and sellers can directly transact with the pool instead of with each other. @DeribitExchange option sellers for example need to pick a strike price and expiry date. On Hegic, funds are pooled and used as liquidity to sell any type of option.

(10/16)

(10/16)

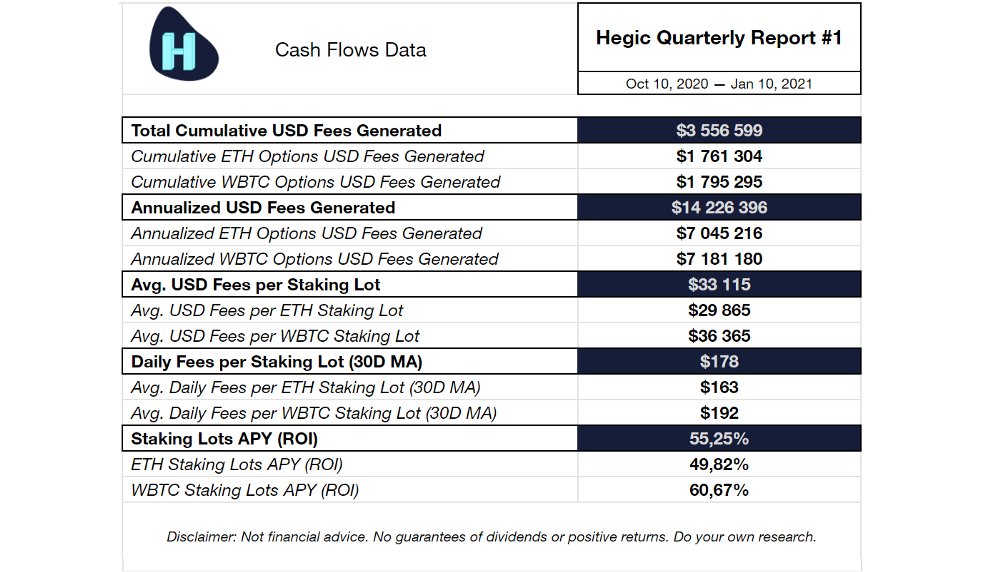

Hegic holders with over 888k tokens (~$240k atm) can stake their holdings in lots. Lot owners earn protocol fees on options bought and sold by users. There is a maximum of lots allowed. Enter $zLOT, a protocol that allows small $HEGIC bag holders to pool up for a lot.

(11/16)

(11/16)

As @coinmonks expressed in his 'Comparison of Decentralized Options platforms', the dual pool model provides increased flexibility for users.

For an additional breakdown and a great article:

https://medium.com/coinmonks/an-update-of-a-comparison-of-decentralized-options-platforms-91b14d3a6170

(12/16)

For an additional breakdown and a great article:

https://medium.com/coinmonks/an-update-of-a-comparison-of-decentralized-options-platforms-91b14d3a6170

(12/16)

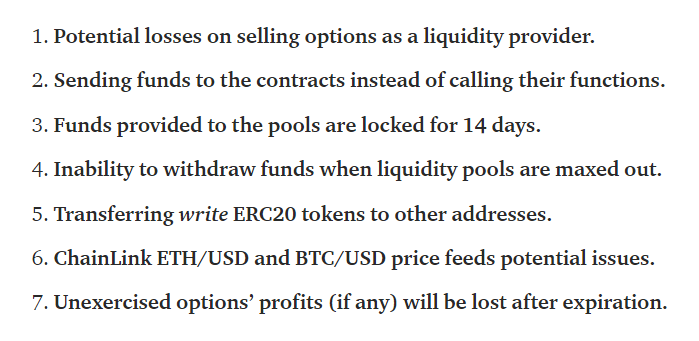

Hegic is not without risks. For one, major bugs in the smart contracts can prove to be extremely hazardous. In addition, Hegic's pricing model is different than the market standard (Black Scholes equation), i.e. using Implied Volatility (IV) in weird, unorthodox manners.

(13/16)

(13/16)

Not only that, @0mllwntrmt3 herself expressed several risks in interacting with the platform. They can be found here:

https://medium.com/hegic/hegic-protocol-risks-breakdown-d3dcf8c85d01

(14/16)

https://medium.com/hegic/hegic-protocol-risks-breakdown-d3dcf8c85d01

(14/16)

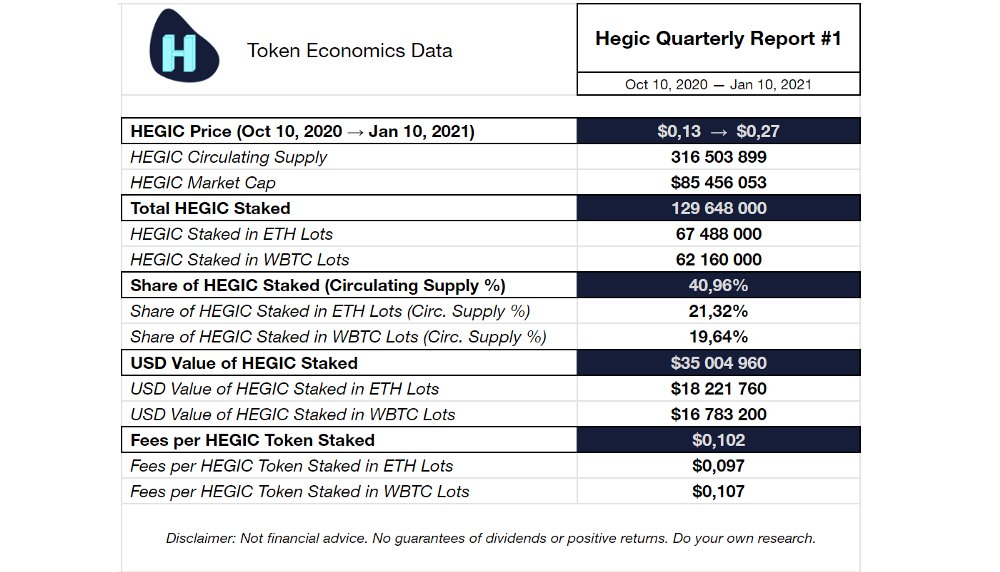

Nonetheless, the future is bright for $HEGIC.

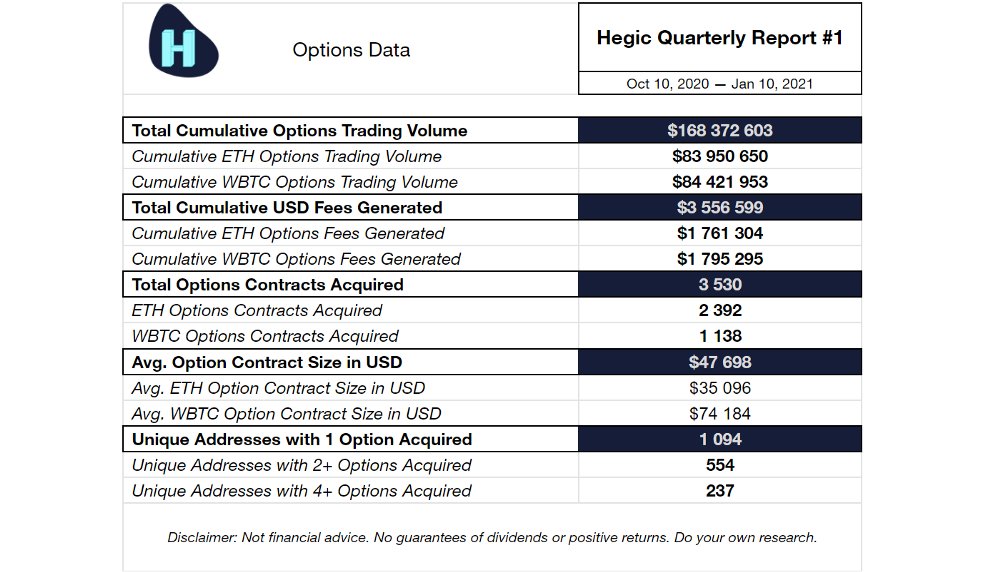

Some numbers from the quarterly report:

- Total cumulative fees >$3.5m,

- Total contracts acquired >3.5k,

- Total cumulative volume >$168m

$HEGIC's current price: $0.268, market cap: ~86m accounting for circulating supply.

(15/16)

Some numbers from the quarterly report:

- Total cumulative fees >$3.5m,

- Total contracts acquired >3.5k,

- Total cumulative volume >$168m

$HEGIC's current price: $0.268, market cap: ~86m accounting for circulating supply.

(15/16)

As more #defi protocols expand and inter-connect, more permissionless derivative market solutions will pop into existence. $Hegic may not be the one sitting on the throne, but for now, it's gunning for that crown. More bullish on it than other solutions rn.

(16/16)

(16/16)

Addendum: I guess I have to throw in @CharmFinance into the mix, they launched today!

Read on Twitter

Read on Twitter