Friends asked me about which tokens they should buy to invest in #DeFi. I researched some index providers and found @indexcoop, @powerpoolcvp @PieDAO_DeFi, but surprisingly my winner was @ndxfi, a newly launched protocol offering passive portfolio management strategies.

Why?

Why?

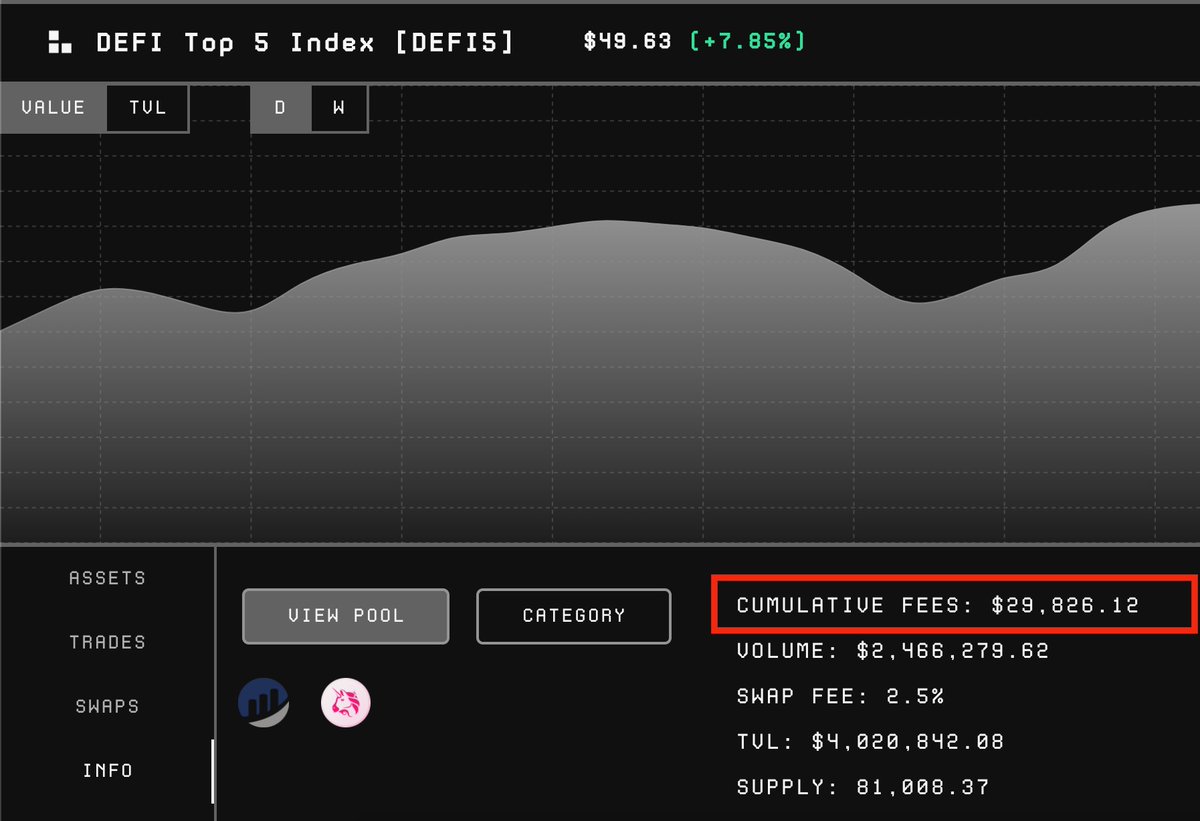

1/ @ndxfi soft launched in December while the kick off happened little more than a week ago through its liquidity mining program. The launch offers two capitalization-weighted indices, DEFI5 ( $uni, $comp, $aave, $crv, $snx) and CC10 ( DEFI5 + $link, $yfi, $uma, $mkr, $omg )

2/ What makes @ndxfi stand out is their innovative approach to generate extra income instead of just replicating the performance of a select basket of tokens. Income is generated by providing the underlying tokens as liquidity for trading through a forked @BalancerLabse pool.

3/ Not only does this generate extra fees paid by traders swapping the pool's tokens but it is designed such that the swapping brings tokens to their target weights. As a consequence, the index management does not incur rebalancing costs (gas + trading fees + slippage).

4/ You might wonder how does the index pool manages to increase the proportion of a token whose external price (other exchanges) rises relative to one whose external price declines.

5/ Don’t AMMs work the opposite way in that liquidity providers end up with less of the token rising in price and more of the one declining in price (a.k.a impermanent loss)?

6/ That is right and it’s why the Indexed pools charge a 2.5% swap fee minimizing arbitrage that takes token prices in line with external prices while still allowing for price discovery within the pool.

7/ At the same time, price incentives are being dynamically set to meet target weights (aka smart pools). Arbitrage opportunities arise to move tokens towards their dynamic target weights. Say DEFI5 pool hast to little $uni arbitrage arises to swap $uni for any other pool token.

8/ Lets recap all this:

@ndxfi:

Value appreciation of the index tokens + Trading fees earned - small arbitrage losses

vs.

Regular index performance:

Value appreciation of the index tokens - rebalancing costs (gas + trading fees + slippage) - management fee

@ndxfi:

Value appreciation of the index tokens + Trading fees earned - small arbitrage losses

vs.

Regular index performance:

Value appreciation of the index tokens - rebalancing costs (gas + trading fees + slippage) - management fee

9/ Furthermore @ndxfi being a newly launched protocol currently runs its liquidity mining program and distributes $ndx for providing liquidity or staking its DEFI5 or CC10 indices. Staking my CC10, I currently earn 450% APY in $ndx on top of my CC10 performance.

10/ $ndx is the governance token of the @ndxfi protocol and provides participation in decision making and revenue.

Currently, there is no fee to index holders and thus no cash flow going to $ndx holders. But governance can decide to introduce fees as AUM grows in the future.

Currently, there is no fee to index holders and thus no cash flow going to $ndx holders. But governance can decide to introduce fees as AUM grows in the future.

11/ Last but not least an airdrop is planned, possibly rewarding early adopters holding DEFI5 or CC10, providing liquidity or interacting in some other form with the protocol, adding to the attractiveness of getting involved early on.

12/ The founding team is composed of two non-anon devs @d1ll0nk and @xGozzy. Prior to building @ndxfi, @d1ll0nk built Tiramisu, a custom l2 chain for @Dharma_HQ and @xGozzy built @ValidityCrypto.

13/ Security: The core smart contracts have been audited by two independent security experts: @cleanunicorn, a former auditor for @Consensys diligence, and @Mudit__Gupta, the lead blockchain engineer at @PolymathNetwork.

14/ Established security firms have not been a guarantee for safety in #DeFi, thus the audits undertaken are of similar quality imo. The best indication of safety is time without exploits and thus each day passing since launch is further validation of security.

15/ Given the fine construction of these indices and the liquidity mining program running for the next three months with a potential airdrop, @ndxfi is the provider of my choice and the one I recommend. Accumulating $ndx offers you participation in the upside of this new protocol

16/ With currently around $8m TVL, @0mllwntrmt3 founder of the popular #DeFi option protocol @HegicOptions already made an investment via @mollyandalpha of 90,000$ offering a promising partnership. https://twitter.com/mollyandalpha/status/1349632460196294659

17/ There are definitely benefits that could come out of this relationship such as @HegicOptions offering options on @ndxfi indices additionally to its current offering of $eth and $btc. Who would not like an easy way to hedge their #Defi portfolio in a single transaction?

18/ We're only beginning to see the value that can be unlocked by deploying the underlyings of passive #DeFi indices into the wider DeFi ecosystem.

Maybe a partnership with some yield optimizing gods @AndreCronjeTech @bantg @iearnfinance would make sense...

Maybe a partnership with some yield optimizing gods @AndreCronjeTech @bantg @iearnfinance would make sense...

19/ With regards to lending protocols a diversified index offers much more value ( & security) in terms of collateral than its individual underlyings. I think we will see @compoundLabs @aave @cream adapt those as collateral very soon.

20/ The ETF industry is a huge market in traditional finance and will be one in #DeFi as well. I think @ndxfi has some very interesting primitives and I will actively participate in its governance going forward.

Read on Twitter

Read on Twitter