Things do not look good on the expected inflation front. A thread in a few charts:

International wheat prices have increased 37% from since June. Eventual smuggling, and another shortage and price increase cannot be ruled out

Chat source @RenCap

1/

International wheat prices have increased 37% from since June. Eventual smuggling, and another shortage and price increase cannot be ruled out

Chat source @RenCap

1/

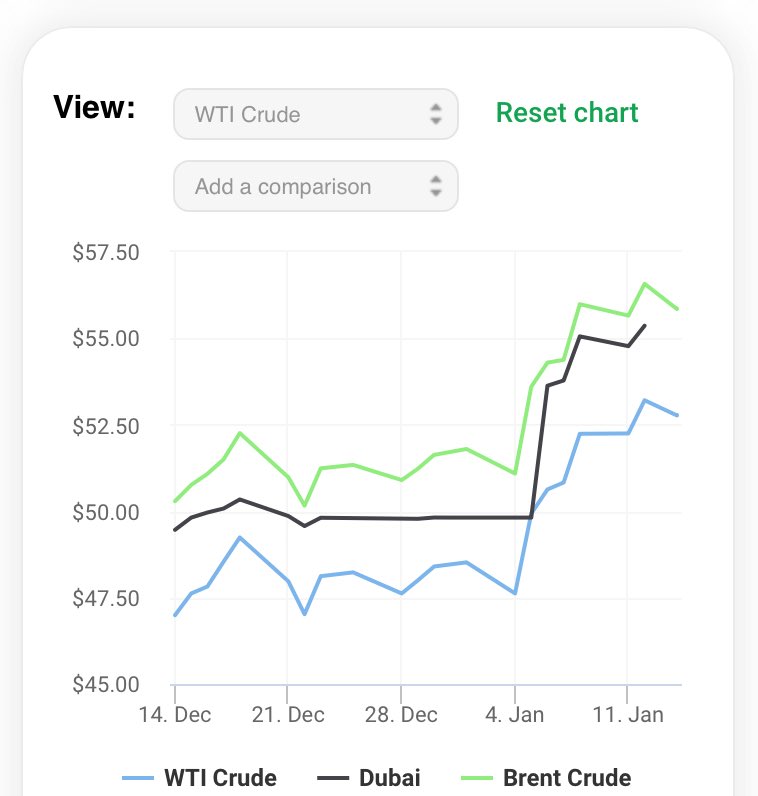

Crude oil prices have been steadily increasing -- means more upward pressure on local petrol prices, electricity prices, and eventually second-round effects of inflation

2/

2/

Container/shipping prices are hitting their all-time highs, which means imports will be more expensive, cost eventually being passed onto consumers

3/

3/

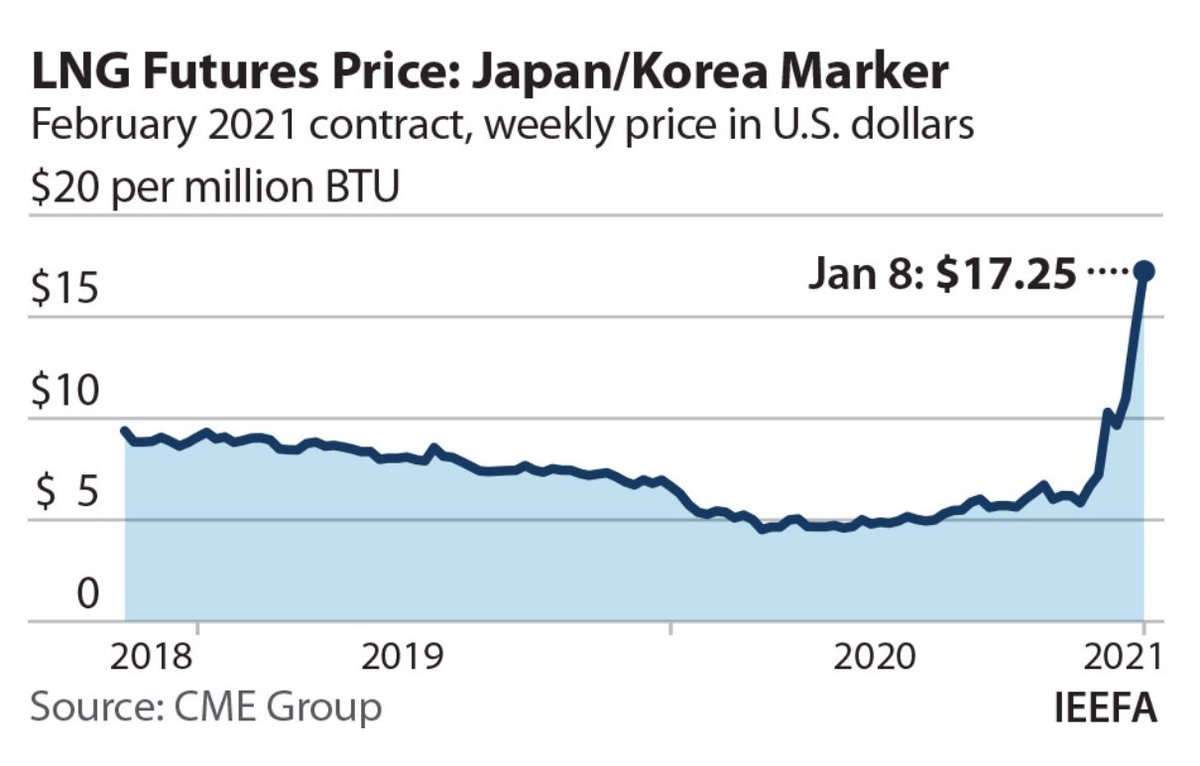

LNG prices have been on a roll lately. Some suppliers have refused to honor February contracts for Pakistan, which means more shortage of LNG, and higher spot prices, meaning potentially higher energy inflation

4/

4/

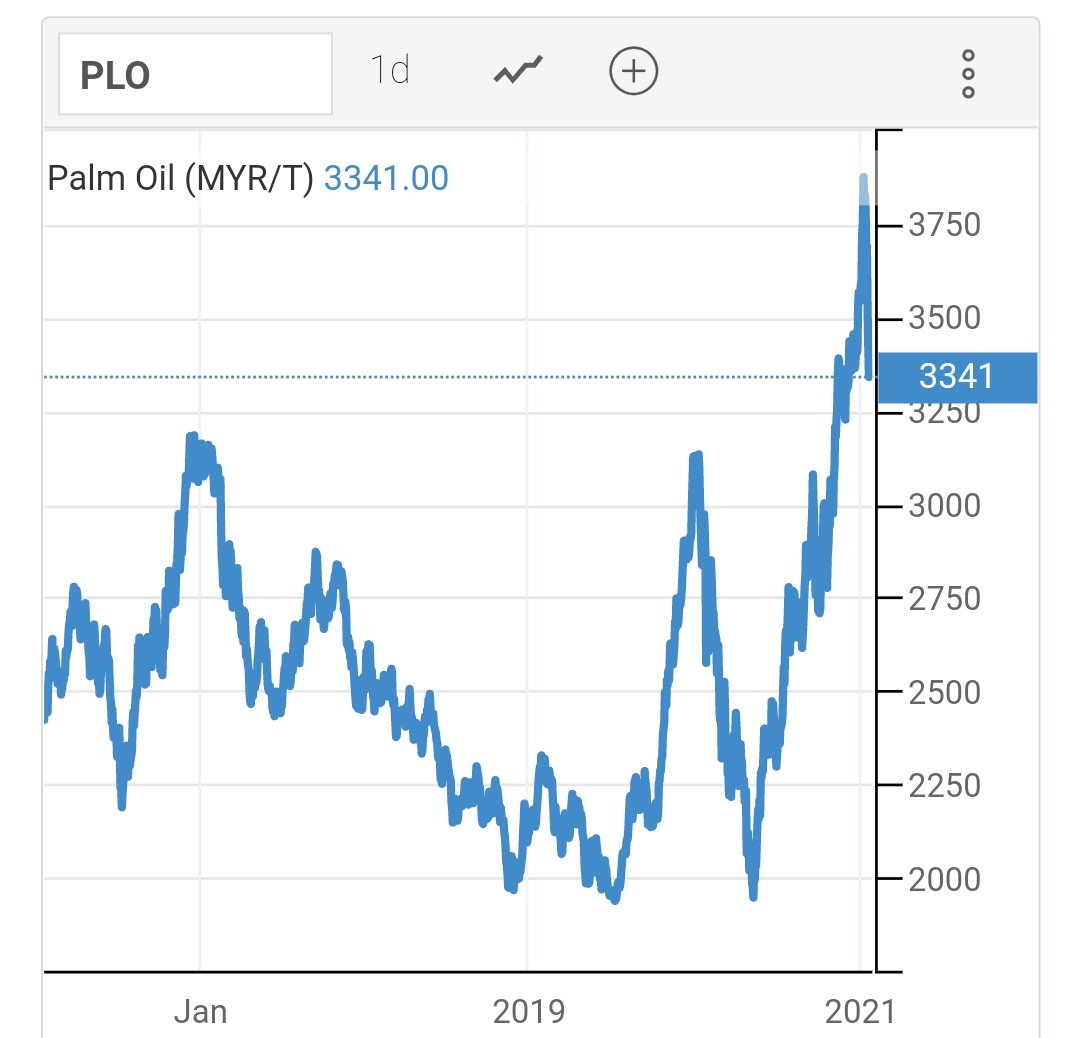

Palm oil prices have been on a tour, only declining slightly in last two weeks. This will affect price of edible oil, etc. In the country, hence fueling more food inflation

5/

5/

If global prices, and supply scenario is any indication we may see higher prices, and inflation in the near-term largely driven by cost-push factors. For how long we continue maintaining a negative real rate remains to be seen

/6

/6

Read on Twitter

Read on Twitter