1. The revelation that Gary Bell would like to use his family trust to delist Bell Equipment (of which his trust is a 70% owner) raises a thicket of governance challenges

Let's step through them... https://twitter.com/RonnieSSiphika/status/1350855357816569856

Let's step through them... https://twitter.com/RonnieSSiphika/status/1350855357816569856

2. Now, South African corporate law is poorly developed, so courts often look to other common law jurisdictions when deciding novel cases

Were IA Bell to propose an acquisition of Bell minorities, it would be almost identical to McMullin v. Beran, a case decided in the US

Were IA Bell to propose an acquisition of Bell minorities, it would be almost identical to McMullin v. Beran, a case decided in the US

3. In that case, an 80% shareholder had directors on the board of the target. The shareholder proposed an acquisition; the board accepted

Note the similarities: IA Bell will soon own 70% of Bell, and two IA Bell directors (Gary and Ashley Bell) are directors of Bell Equipment

Note the similarities: IA Bell will soon own 70% of Bell, and two IA Bell directors (Gary and Ashley Bell) are directors of Bell Equipment

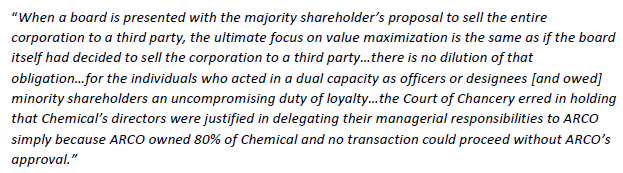

4. The problem is that by virtue of their seats on the board of the target, the directors proposing the deal still owed duties of loyalty, care, and good faith to the target's shareholders. Quoting the court:

5. Before Gary Bell publicly announced his desire to use his one company to buy his other company, other Bell directors could have plausibly claimed ignorance that their company was in play (haha)

This principle was established in Bershad v. Curtiss-Wright Crop.

This principle was established in Bershad v. Curtiss-Wright Crop.

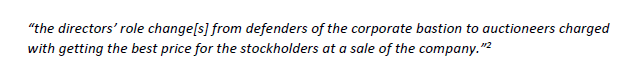

6. And now we come to a third common law principle, established in Revlon, Inc. v. MacAndrews & Forbes Holdings...

When a board knows its company is in play, it must act as "auctioneers" to get the best price:

When a board knows its company is in play, it must act as "auctioneers" to get the best price:

7. In summary: Bell's board has just been publicly alerted by their chairman that he hopes to acquire the company using his family trust

In order not to incur personal liability, they now must appoint a committee of independent directors to explore a sale of the business

In order not to incur personal liability, they now must appoint a committee of independent directors to explore a sale of the business

Read on Twitter

Read on Twitter