Southampton’s 2019/20 financial results covered a “successful” season when they improved their position in the Premier League from 16th to 11th under manager Ralph Hasenhüttl, but their finances were significantly impacted by COVID-19. Some thoughts follow #SaintsFC

#SaintsFC pre-tax loss widened from £41m to £76m, as revenue fell £23m (15%) from £150m to £127m and profit on player sales decreased £7m from £21m to £14m, while total expenses grew £5m. Loss after tax increased from £34m to £62m.

#SaintsFC £23m revenue fall was driven by broadcasting’s £19m (17%) decrease from £113m to £94m, mainly due to 6 Premier League games being played after 30 June accounts close. Match day was also down £2.6m (15%) to £14.5m, while commercial dipped £1.1m (6%) to £18.7m.

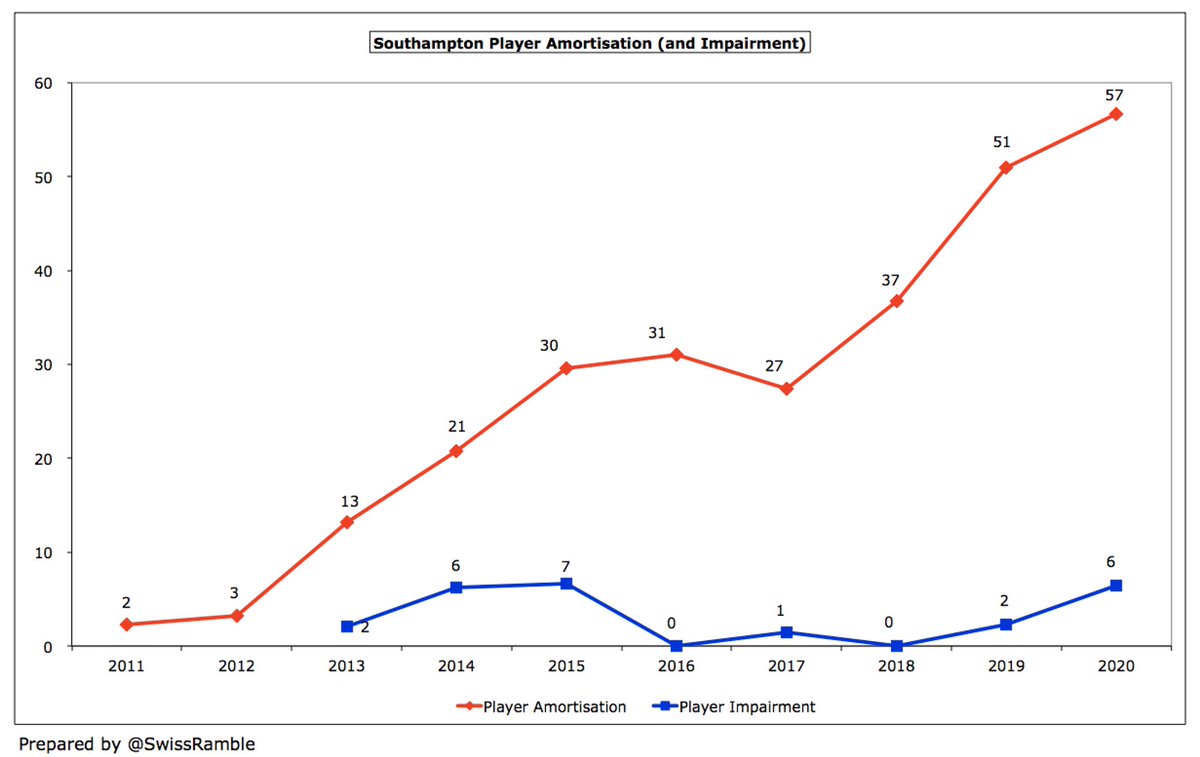

#SaintsFC wage bill fell slightly by £1m (1%) to £114m, while other expenses were £9m (24%) lower at £29m. On the other hand, player amortisation rose £6m (11%) to £57m and there were £10.8m exceptional costs (player impairment £6.4m and onerous contracts £4.4m), up from £2.3m.

#SaintsFC £76m loss before tax is 2nd highest to date in 2019/20 Premier League, only surpassed by #EFC £140m, but better than #THFC £68m and #MUFC £21m. Due to the pandemic, it is likely that other clubs will also post substantial losses when they publish their 19/20 accounts.

Without COVID #SaintsFC revenue would have been £31m higher at £158m, i.e. £8m (5%) higher than prior year (£21m deferred to 2020/21 accounts and £10m foregone). Allied to £2m net cost saving, the loss would have been “only” £43m, around the same as 2018/19.

#SaintsFC profit from player sales fell from £21m to £14m, mainly Gallagher to #BRFC and Austin to WBA plus add-ons from previously sold players. Premier League profits from this activity lower in 2019/20, e.g. #MUFC £18m and #THFC £15m are similar to Southampton.

#SaintsFC explained that their ability to generate profits from player trading was significantly impacted by the summer 2020 transfer window not opening until July, after the financial year ended. Transfer market also depressed by the pandemic reducing clubs’ spending power.

Player trading has been a key part of the #SaintsFC strategy. In the 5 years up to 2018/19 they made a hefty £205m profit from this activity with only #CFC £332m and #LFC £306m ahead of them. For more context, #AFC, #MCFC and #MUFC only made £170m, £147m and £60m respectively.

That said, #SaintsFC profit from player sales has declined 2 years in a row, from £69m in 2018 (mainly Virgin van Dijk to #LFC) to £21m in 2019, then £14m in 2020. The 2021 accounts will include the sales of Pierre-Emile Höjbjerg to #THFC and Harrison Reed to #FFC.

#SaintsFC have now reported losses in the last two seasons, totaling £117m, which has almost entirely wiped out the preceding five consecutive profitable years, which were worth £126m in total, including £42m in 2017 and £35m in 2018.

#SaintsFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for cash operating profit, as it strips out player sales and exceptional items, fell from £(4)m to £(16)m, the worst in the Premier League (though likely to be overtaken by others).

At an operating level (i.e. excluding player sales and interest), #SaintsFC loss increased from £60m to £87m. Very few Premier League clubs post operating profits, but Southampton’s loss is (currently) one of the highest this season, though nowhere near as bad as #EFC £175m.

#SaintsFC revenue has now fallen 3 years in a row by 31% from the £182m peak in 2017 to £127m in 2020, mainly due to less TV money (absence of Europa League £13m and COVID-impacted Premier League revenue), though match day has also dropped £8m (35%).

Due to the impact of the pandemic, #SaintsFC £127m revenue looks like it is one of the smallest in the Premier League, though other clubs are likely to be lower after they publish 2019/20 accounts. Either way, miles below the “Big Six”, e.g. #MUFC £509m, #CFC £407m & #THFC £392m.

#SaintsFC 15% revenue reduction over prior year in 2019/20 is in line with other clubs who have reported to date like #MUFC 19% and #THFC 15%. #EFC only saw a 1% decrease, as their numbers included once-off £30m payment for stadium naming rights option.

Based on 2018/19 accounts, #SaintsFC were just outside the top 30 in the Deloitte Money League, which ranks clubs globally by revenue. They were 23rd the previous year and as high as 18th in 2016/17. That said, they were only £4m below the 30th placed club.

#SaintsFC broadcasting income slumped £20m (17%) from £113m to £93m, due to revenue from 6 games slipping to 2020/21 accounts (plus rebate to broadcasters), offset by better Premier League finishing position. One of the lowest in PL, but other clubs will also fall in 2019/20.

As the 2019/20 season was extended beyond the June accounting close, #SaintsFC Premier League TV money was lower, though £19m revenue has been deferred into 2020/21 accounts. Accounts note that 2019/20 figure was based on estimated league position as of 30th June.

It is worth noting the impact of European qualification on a club’s broadcasting income, especially the Champions League, which was worth between £88m for #MCFC and £61m for #THFC in 2020. Europa League participants earn less, but still ranged from £17m to £25m.

#SaintsFC match day revenue fell £3m (15%) from £17m to £14m, their lowest since 2012, due to the suspension of the season, then playing 4 games behind closed doors after the resumption. Income very low compared to the elite clubs, e.g. #THFC earn around 7 times as much (£95m).

As 4 games played behind closed doors, #SaintsFC average attendance fell from 30,139 to 23,428, though up to 29,675 for those games with fans in attendance. Remained 14th highest in Premier League. Prices reduced for two-thirds of season ticket holders in 2019/20.

#SaintsFC commercial income fell £1m (6%) from £20m to £19m, though had been rising until COVID meant £5.7m revenue foregone and £1.6m deferred to 2020/21, due to reduction in conferences and postponement of Killers gig. Firmly in bottom half of Premier League.

#SaintsFC ended their club record shirt sponsorship (reportedly £7.5m a year) with Chinese company LD Sports after only 12 months of 3-year agreement, replaced by http://Sportsbet.io for 2020/21. Kit supplier deal is with Under Armour, while sleeve sponsor is Virgin Media.

#SaintsFC wage bill slightly decreased by £1m (1%) to £114m, which means that wages have been essentially flat for the last 4 years, but over that period the wages to turnover ratio has worsened from 62% to 90%, due to the fall in revenue.

#SaintsFC £114m wage bill is currently 11th highest in Premier League, around £50m below #EFC £165m, though other clubs’ wages may well drop when 2019/20 accounts are published.

The increase in #SaintsFC wages to turnover ratio to 90% means that this is the highest (worst) in the Premier League, just above #EFC 89%, though could be overtaken when other clubs publish 2019/20 accounts. Excluding impact of the pandemic, it would have fallen to 72%.

#SaintsFC directors remuneration nearly halved from £2m to £1.2m with the highest paid director seeing pay decrease from £728k to £598k. This is relatively low for the Premier League, especially compared to #MUFC £3.1m and #THFC £3.0m.

#SaintsFC player amortisation, the annual charge to write-down transfer fees over the life of a player’s contract, rose by £6m (15%) from £51m to £57m. Also booked £6.4m impairment charge to reduce the value of certain players (maybe Guido Carrillo?), up from prior year’s £2.3m.

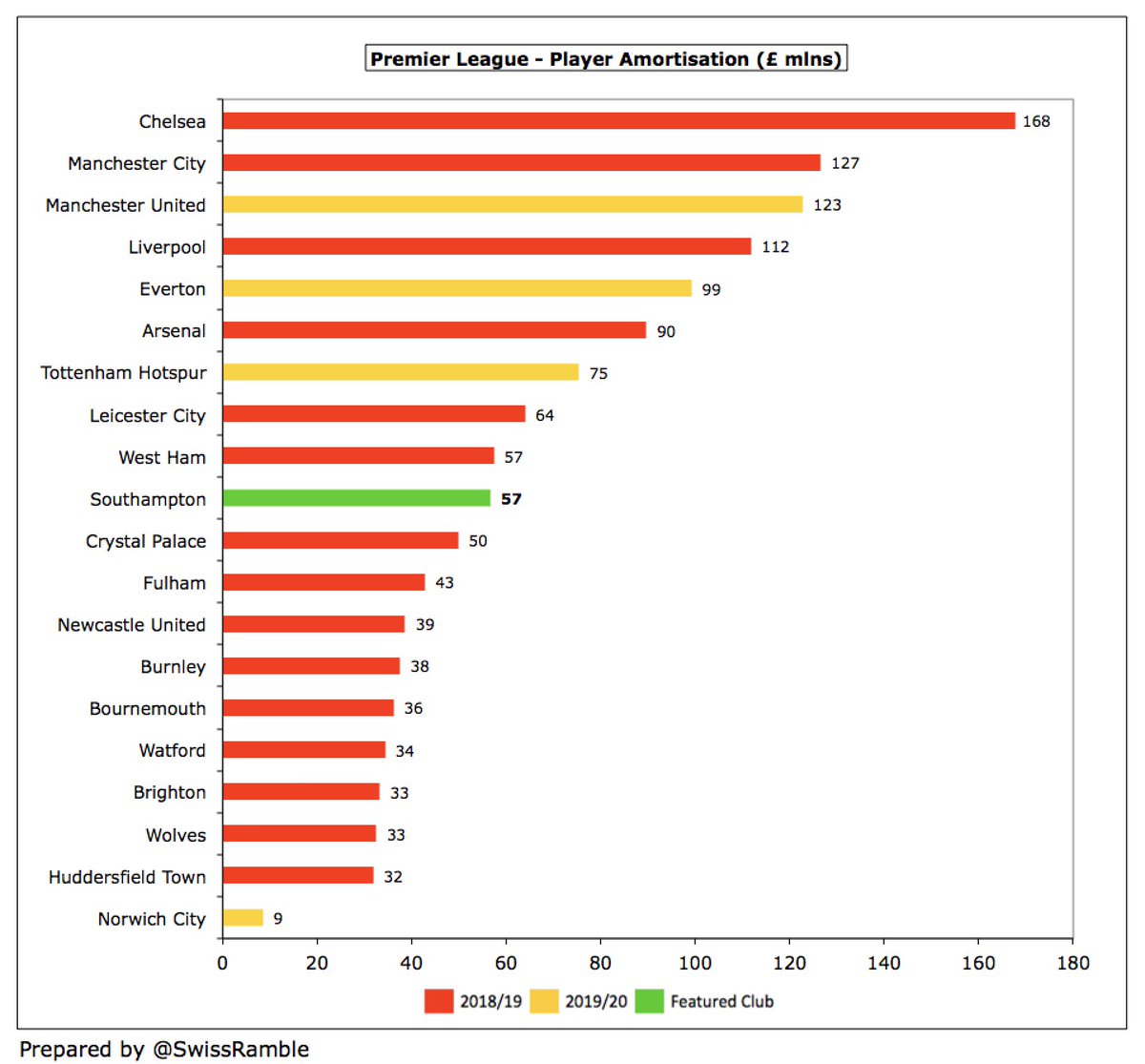

As a result, #SaintsFC £57m player amortisation has more than doubled in just 3 years, though is still mid-table in the Premier League, just behind #WHUFC. For some perspective, it is around than a third of big spending #CFC £168m.

#SaintsFC spent £24m on player purchases, including Che Adams and Moussa Djenepo, down from £67m prior year and £86m in 2018. Fairly low for the Premier League, though clubs did cut back expenditure last season. That said, Southampton have splashed out £361m in last 6 years.

#SaintsFC annual gross transfer spend averaged £60m in last 6 years, but £45m player sales means that net spend has only been £15m. The 2020/21 accounts will include acquisitions of Ibrahim Diallo (Brest), Kyle Walker-Peters ( #THFC) and Mohammed Salisu (Valladolid).

#SaintsFC gross debt rose sharply from £32m to £92m, largely comprising £78m loan from MSD Holdings repayable in 2025 and £12m bank loan repayable in 2 equal instalments over next 2 years. Previous £20m working capital facility repaid during the year.

Managing Director Toby Steele was at pains to emphasise that the big loan the club took out just before the accounts closed was “absolutely to mitigate against the effects of COVID-19” and not to fund transfer spend (“a war chest for January or the summer”).

Despite the increase, #SaintsFC £92m gross debt is fairly standard for the Premier League. Five clubs owe more than £200m: #THFC £831m lead the way (new stadium), followed by #MUFC £526m, #EFC £409m, #BHAFC £280m and #AFC £209m. Other clubs will have increased debt in 2019/20.

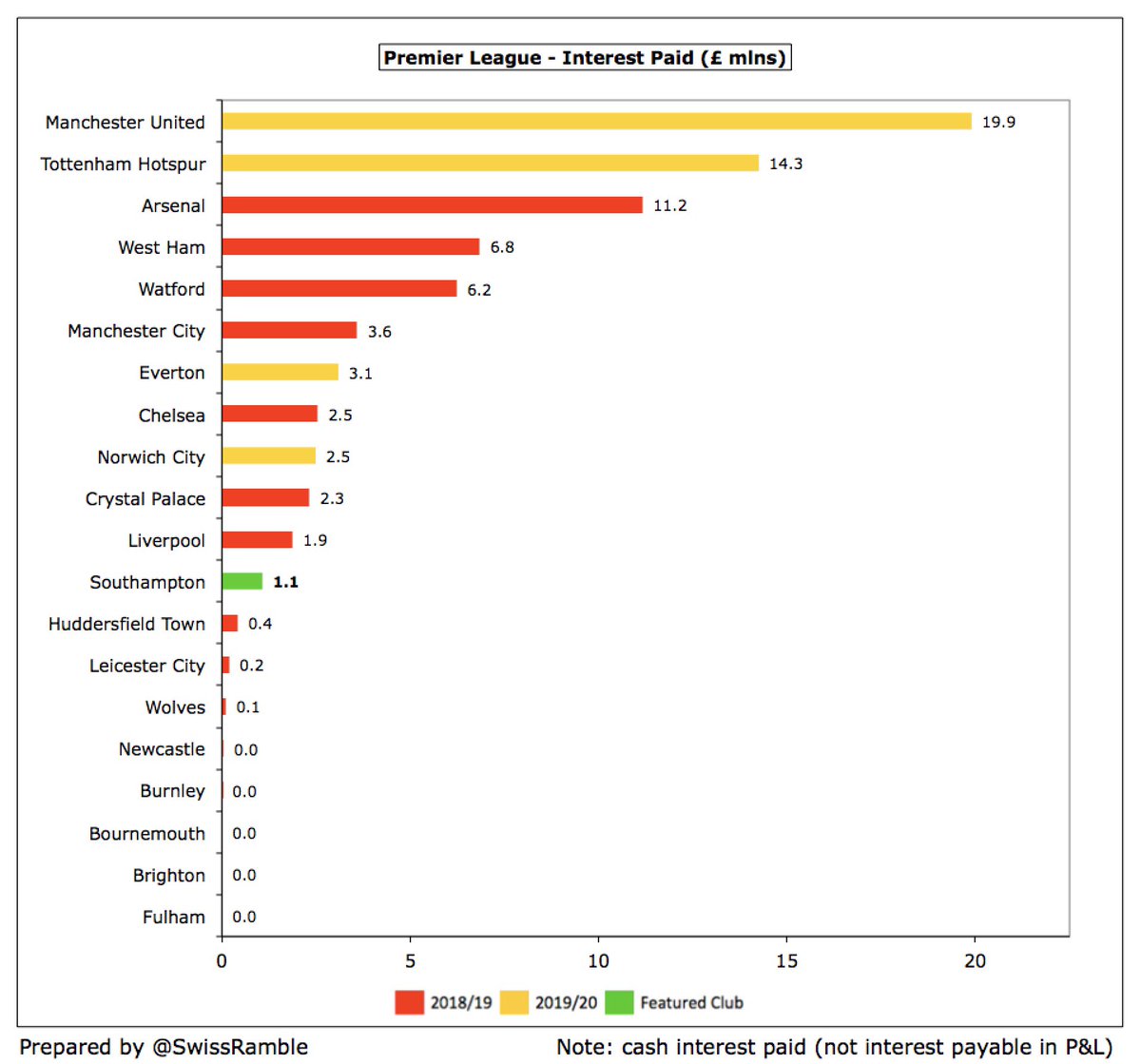

#SaintsFC paid £1.1m interest, down from £2.0m, but this will increase, due to MSD £78.8m loan charging a hefty 9.14% (£7.2m a year). The other £12.5m of bank loans is at 1.065%. Some Premier League clubs have much higher charges, though many owners provide interest-free loans.

Worth noting that #SaintsFC have reduced transfer fees debt (stage payments) from £90m to £55m. There is £12m owed by other clubs, so net payable is £43m. In addition, £30m contingent liabilities potentially payable, mainly dependent on player appearances.

#SaintsFC generated £15m cash from operations, then spent £33m (net) on player purchases, £3m on capital expenditure (mainly hospitality areas at the stadium) and £1m interest. This was funded by £62m of bank loans, giving net cash inflow of £40m.

#SaintsFC cash rose from £47m to £87m, 4th highest in the Premier League. However, this is a bit misleading, as it is largely due to the new loan. Steele: “While the cash reserves remain in a good place, the losses being made every month will continue eating into that figure.”

No owner funding for #SaintsFC in the last 5 years, which is a big change. Instead, generated £63m from operations and £62m from external loans. Invested £19m in infrastructure, repaid £13m owner loans, had £11m (net) player purchases and £10m interest. Cash balance up £72m.

Owner Gao Jisheng has not invested any money into #SaintsFC, as he wants the club to be self-sustaining. It has been reported in the media that the Chinese businessman is keen to sell his 80% stake, but he remains the owner for the time being.

On the pitch, #SaintsFC continue to make progress under Ralph Hasenhüttl, but these financial results highlight the challenges that the pandemic poses to all football clubs, plus Southampton’s reliance on profitable player trading. The loss necessitated taking on much more debt.

Read on Twitter

Read on Twitter