My meta-analysis on corporate tax competition is out in European Journal of Political Economy. The results point to tax competition as a major factor in explaining reductions in corporate tax rates. Data and specification choices affect results: Thread /1

https://www.sciencedirect.com/science/article/pii/S0176268021000033

https://www.sciencedirect.com/science/article/pii/S0176268021000033

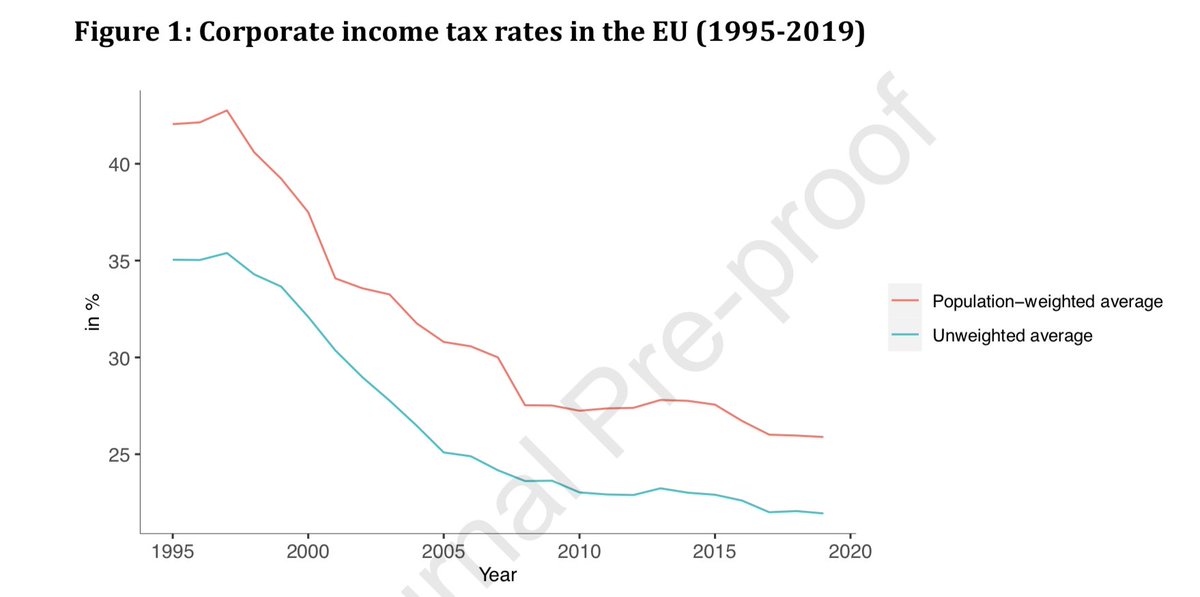

Statutory corporate income tax rates have declined substantially in EU countries over the past decades. However, it's not straightforward to what extent these observed declines in corporate tax rates are explained by tax competition; it could also be due to other factors. /2

The literature doesn't provide general conclusions on magnitude of corporate tax competition: while several papers report clear empirical support for corporate tax competition, other papers either find no clear support or at least present mixed evidence. Meta-analysis can help /3

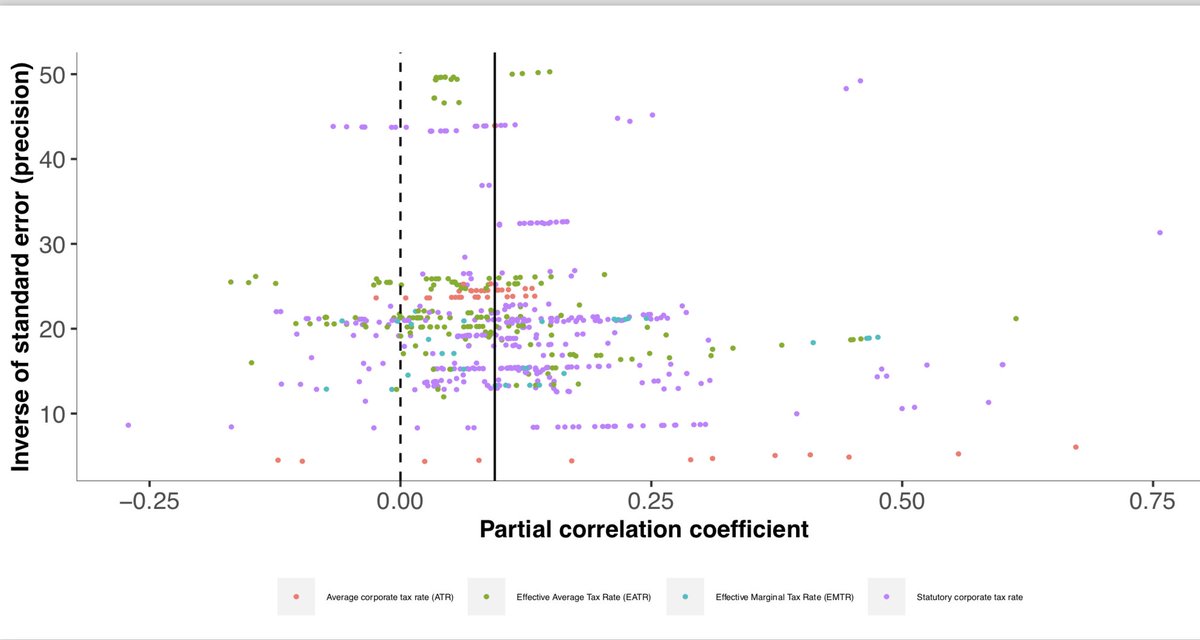

I use a novel dataset consisting of 604 observations on corporate tax competition reported in 33 primary studies. The precision-weighted average of the reported results points to the presence of corporate tax competition. /4

A one percentage point decline in corporate tax rates in competitor jurisdictions is, on average, associated with a fall in the corporate tax rate at home by about 0.8% – with the 95% confidence interval ranging from 0.7% to 0.9%. /5

Tax competition, on average, is indeed a major factor in explaining falling corporate income tax rates over the last decades. Obviously, this finding does not imply that competitive pressures have been equally strong in all countries. /6

The last point is supported by further results from the meta-regression analysis, which indicate that country size and partisan politics moderate the magnitude of the effect of corporate tax competition, respectively. /7

The paper is *open access*: https://www.sciencedirect.com/science/article/pii/S0176268021000033#da0010

The code and data files required to reproduce all the findings of the paper are available via Github: https://github.com/heimbergecon/comp-meta.

/end

The code and data files required to reproduce all the findings of the paper are available via Github: https://github.com/heimbergecon/comp-meta.

/end

Read on Twitter

Read on Twitter