Keystone XL's impending cancellation is a psychological blow to oilmen and a real loss to Alberta taxpayers. It does not impact the investment return for Alberta crude oil resources or any company in Alberta in a real sense. /1

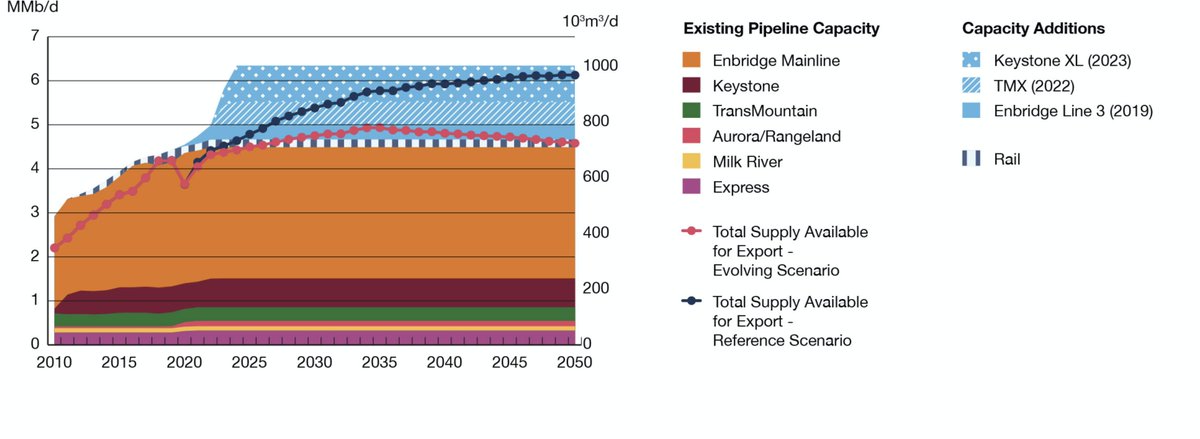

That's because the pipeline capacity is not required unless Alberta oil production steps up to exceed the additional capacity of TransMountain and Enbridge Line 3. These pipes together add ~1 MMbbl/d of export capacity. In the regulator's base (high) case, KXL needed in 2030./2

That's even if rail goes to zero, as it should under excess pipe conditions. This is the public, CER position. My opinion is the production story is quite a bit more bearish than that. Don't forget that the breakeven price of new SAGD adds is likely in the US$50/bbl range. /3

Mining is worse.

The misunderstood quality of Alberta oil resource is a real consequence of the constant homerism and cheerleading by, I'm sorry, nonstrategic Calgarians. Commodity businesses are really simple. People must buy your product and they hate it. /4

The misunderstood quality of Alberta oil resource is a real consequence of the constant homerism and cheerleading by, I'm sorry, nonstrategic Calgarians. Commodity businesses are really simple. People must buy your product and they hate it. /4

In a commodity business, people will go to great lengths to avoid buying your product. Even, say, exercising (riding the bike to work). That means, stay with me here, you can't increase demand. The winner is the company with low supply cost. /5

When it came to supply costs, I had to look Calgary managers in the eye and tell them they weren't competitive. There were projects that made money at whatever the price of oil was, if it was a good day, but... /6

... that's not how you build a commodity business to last. Lasting competitive advantage in oil comes from top quartile supply costs. Full stop. And SAGD is rarely that, even ignoring future costs such as emissions. /7

The good projects around Christina Lake work. There's not enough of that to yield enough barrels to grow Alberta production > 1MMbbl/d. And then, we had better not be using oil anymore in 30 years. Shale, at least, pays back invested capital in the first three years. /8

Oil sands does not. So. The resource will probably not grow. The two new pipes that are coming will be enough for a decade even if oil production grows, and it won't. So why did @jkenney underwrite all of $TRP's losses? /9

I do not know the answer to that question. And this is not a deal where Alberta taxpayers bought the pipeline, owning the gains and losses, as we do with TMX. Instead, this was a deal where Alberta accepts all losses up to a $6b cap, with a sliver of equity kicker (1.5b). /10

I didn't understand it at the time. I understand it less now.

But the key is, if you have money in the market, the blow is purely psychological. (Unless you are an Alberta taxpayer. In that case, think about calling your elected representative to complain). /11

But the key is, if you have money in the market, the blow is purely psychological. (Unless you are an Alberta taxpayer. In that case, think about calling your elected representative to complain). /11

I really hope the analysis was more thorough than "Rachel bought a pipeline so I'd better lay some pipe."

Could the mere presence of KXL make it more likely that capital gets invested in Alberta oil? Like am I missing a feedback? /12

Could the mere presence of KXL make it more likely that capital gets invested in Alberta oil? Like am I missing a feedback? /12

That pipeline capacity feedback really only works when you are at the margin of capacity. There isn't functionally much difference between 1 MMbbl/d of excess capacity and 2 MMbbl/d. /13

Where KXL would have helped is if Enb Line 5 is shut down. But really what I'd do to avoid that is stop calling people I need to negotiate with "brain dead." /end

Oh, I forgot. Check this thread by @S_HastingsSimon on why the CER's oil outlook is too bullish from the demand side. https://twitter.com/S_HastingsSimon/status/1334208270177771520

Read on Twitter

Read on Twitter