Freeman Gold $FMAN is one of my top picks for 2021. I co-founded this last year w/ some key partners including @sluzcap. Founders benefitted from key guys on the $KNT technical team vetting the Lemhi Project for us. Trading at $0.50, the same price of the $10.3m bought deal

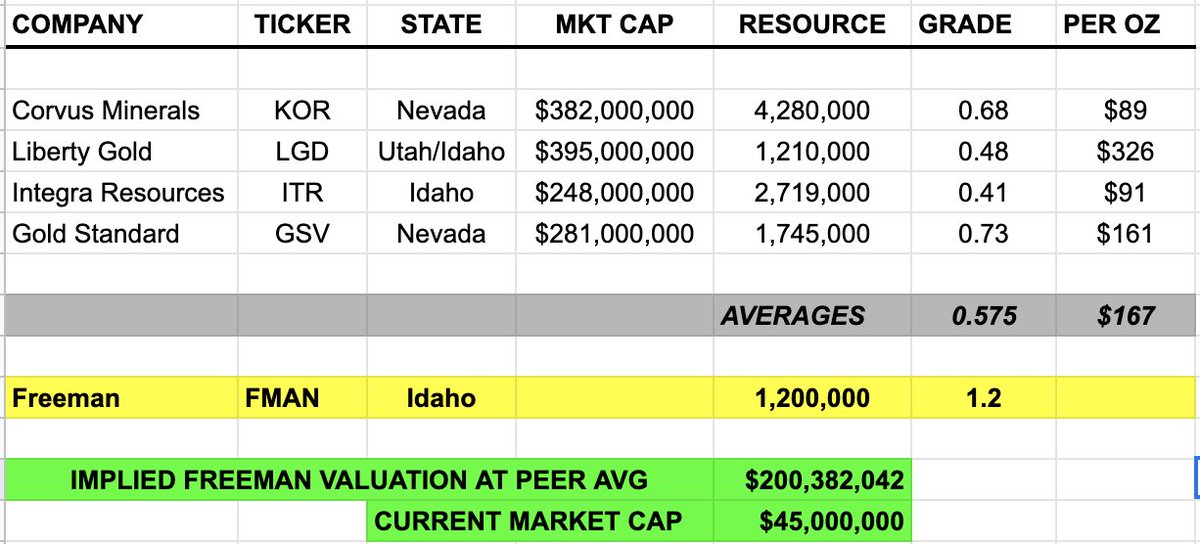

$FMAN Represents great value, despite the currently weak gold tape. Value proposition for $FMAN:

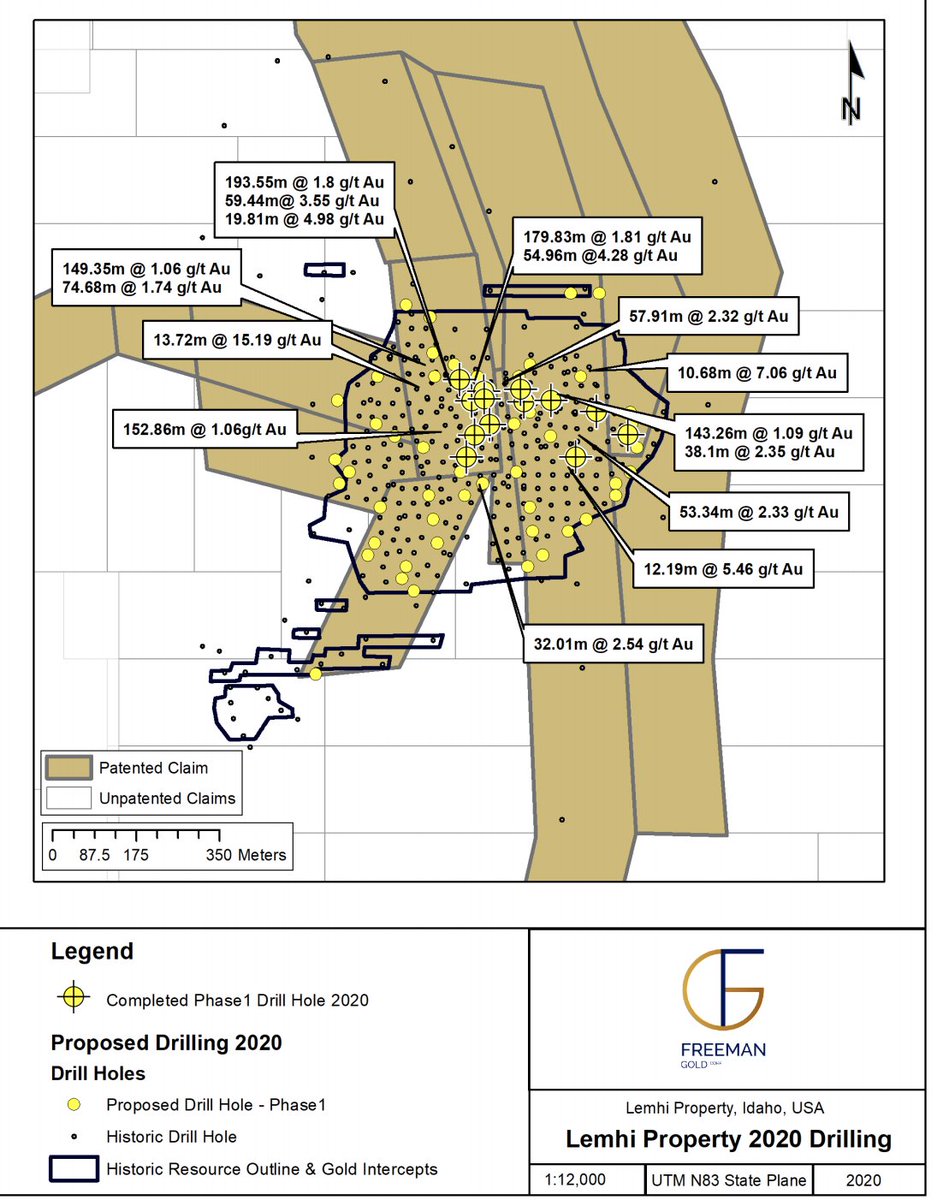

-Over 320 holes drilled historically w/ a historical resource of approx. 1.2m oz at 1 g/t Au (primarily in oxides), open at depth, along strike and largely untested regionally

-Over 320 holes drilled historically w/ a historical resource of approx. 1.2m oz at 1 g/t Au (primarily in oxides), open at depth, along strike and largely untested regionally

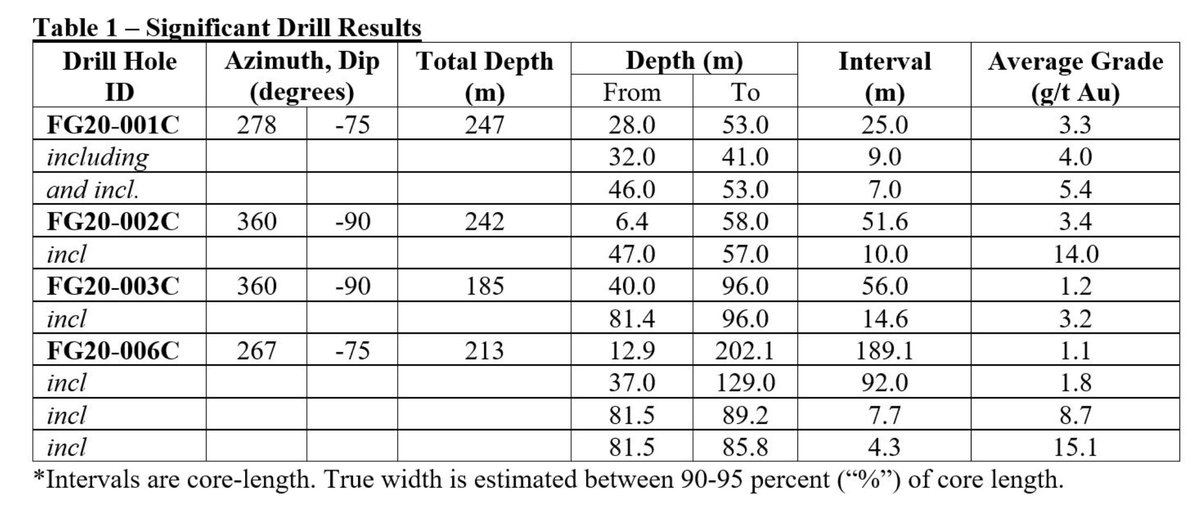

$FMAN just released the first 4 holes of a 34 hole drill program highlighted by:

-189.1m of 1.1 g/t Au

-51.6m of 3.4 g/t Au

-10m of 14 g/t Au

-189.1m of 1.1 g/t Au

-51.6m of 3.4 g/t Au

-10m of 14 g/t Au

These holes tell me that the historical data can be relied upon. In the US finding this kind of grade, near surface, in oxides is rare and should be in high demand w/ majors.

Validation of this is seen with Yamana Gold $YRI ~5% ownership of $FMAN. They see the upside of 2-3m oz

Validation of this is seen with Yamana Gold $YRI ~5% ownership of $FMAN. They see the upside of 2-3m oz

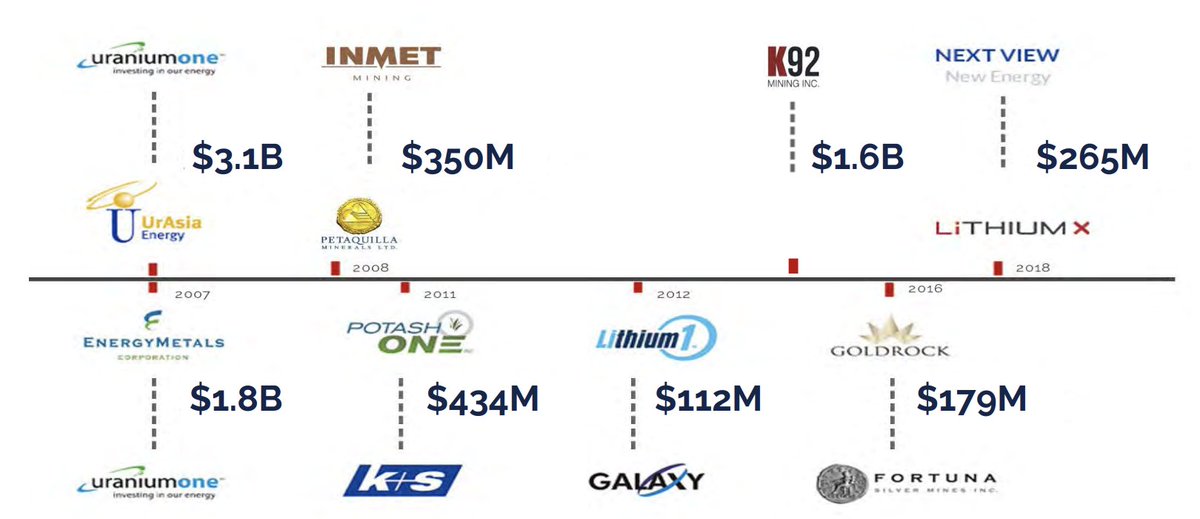

The Excellent Team highlighted by:

-CEO Will Randall who discovered and developed the main asset which Lithium X bought that lead to them getting bought out for over $250m

-Director @CantoreVictor CEO of Amex Exploration $AMX which has gone from $.05-$4 on a discovery in Québec

-CEO Will Randall who discovered and developed the main asset which Lithium X bought that lead to them getting bought out for over $250m

-Director @CantoreVictor CEO of Amex Exploration $AMX which has gone from $.05-$4 on a discovery in Québec

-Director @SimonMarcotte38 who was one of the top Institutional Salesmen On Bay St for years

-Director @RonaldS_AuCu formerly one of the top gold analysts on Bay St

-Advisor Paul Matysek, one of the best mining entrepreneurs of the last 20 years w/ billions of dollars in buyouts

-Director @RonaldS_AuCu formerly one of the top gold analysts on Bay St

-Advisor Paul Matysek, one of the best mining entrepreneurs of the last 20 years w/ billions of dollars in buyouts

Read on Twitter

Read on Twitter