Mempool update time!

First an underreported piece of news:

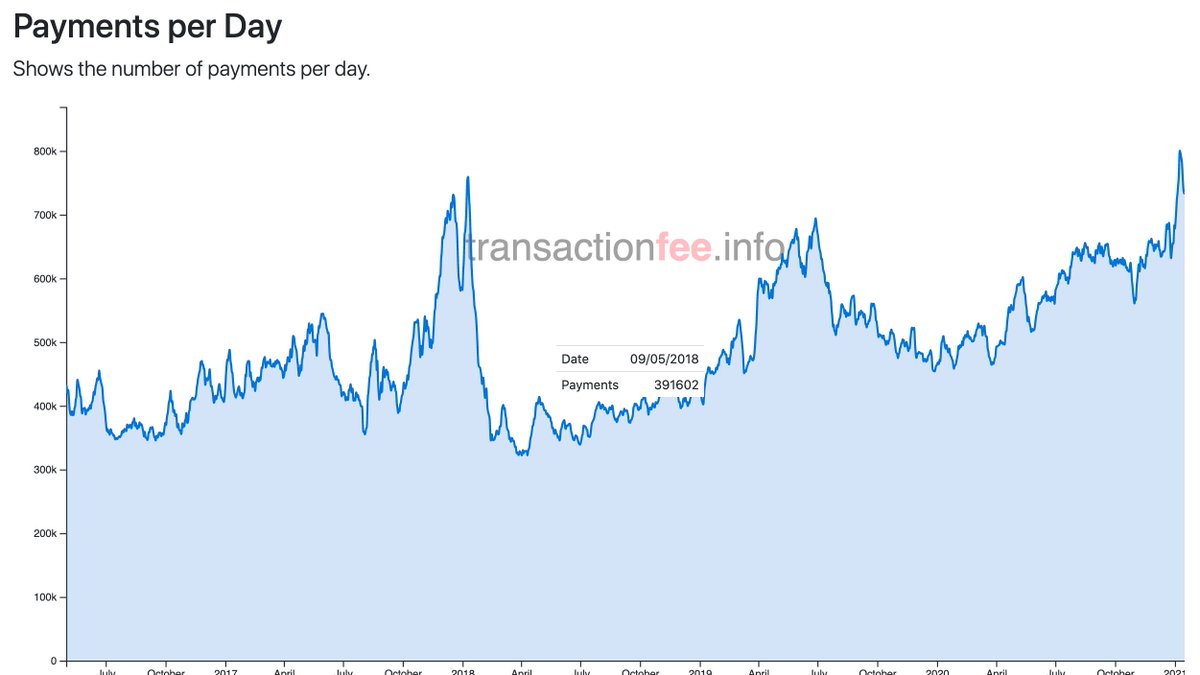

Bitcoin payments per day hit an all-time-high* in the past weeks, higher than the peak of the previous bull run.

Thread

First an underreported piece of news:

Bitcoin payments per day hit an all-time-high* in the past weeks, higher than the peak of the previous bull run.

Thread

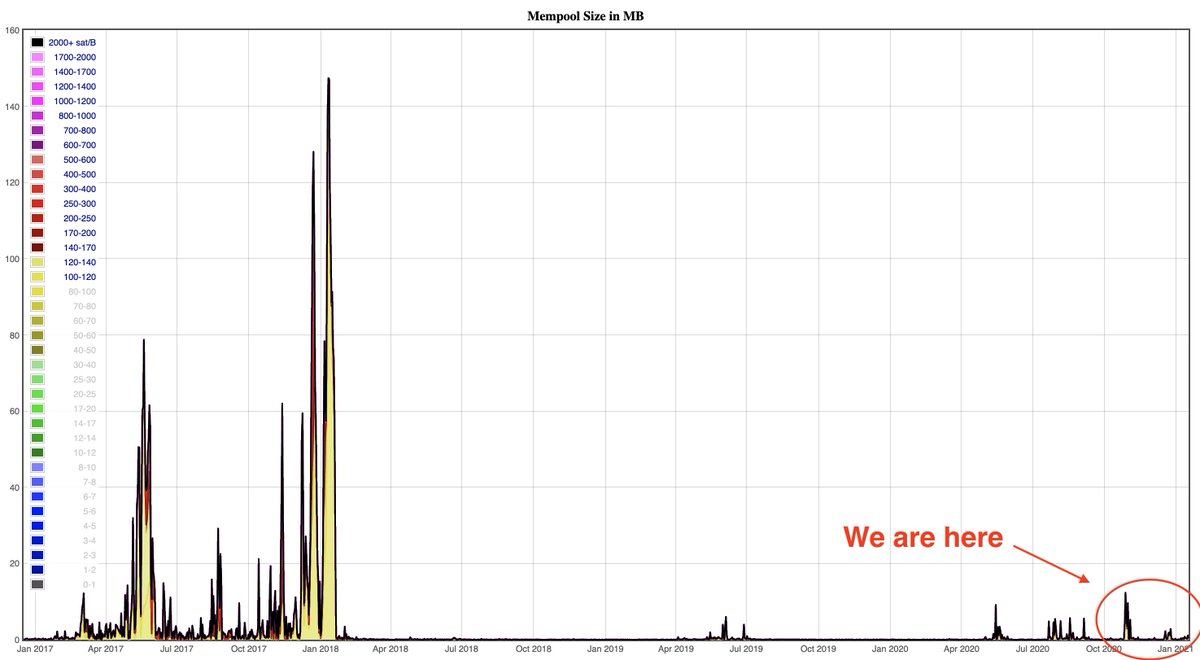

Given this, it's astonishing how well the mempool is holding up and and how comparatively low the transaction fees are.

Weird as it sounds, and even though fees are quite high quite often, it's enough to zoom out on the chart for high-fee periods. Here with a min of 100 sat/B:

Weird as it sounds, and even though fees are quite high quite often, it's enough to zoom out on the chart for high-fee periods. Here with a min of 100 sat/B:

To check this out for yourself here's the mempool page: https://jochen-hoenicke.de/queue/#0,all . Use the filter buttons on the left of the chart to exclude low-fee transactions as they come in at random times depending on when big entities consolidate their 10s of megabytes of utxs.

Biggest contributing factor to this is that most exchanges have now implemented payment batching which scales incredibly well for when many people are buying and withdrawing coins. Had that upgrade not happened we would have been in a much more dire situation now.

A funny aspect of this is that Coinbase is now the probably fastest and cheapest way to send a bitcoin payment. They batch 100 at a time, so even though they pay top-dollar fees for next block confirmation you only pay 1/100th of that.

This points to IMO an intrinsic aspect of centralization vs decentralization - centralized solutions at scale are more efficient, decentralization comes at a cost.

So where are we in terms of "the fee market"? Well during US business hours it's pretty clear to everyone that the fee market is quite active, even though big swings IMO make it unreliable.

During the past two weekends the mempool hasn't cleaned out fully, so one could MAYBE infer that we're seeing a tendency towards a 24/7 fee market. But given the extreme volatility the past weeks I would strongly doubt this is a new normal. It will pass after a few weeks of lull.

Speculation: How bad can it get if bitcoin really moons?

It's unlikely to reach 2017 levels of bad. We have batching, segwit, fee estimation is a USP now, stablecoins moved to other chains, alts, Lightning, and so on. It can get worse than now but doubtfully worse than 2017.

It's unlikely to reach 2017 levels of bad. We have batching, segwit, fee estimation is a USP now, stablecoins moved to other chains, alts, Lightning, and so on. It can get worse than now but doubtfully worse than 2017.

I'd give it a >50% chance that my March 2018 prediction on fees will hold even during this bull run https://twitter.com/ziggamon/status/975067727785349121

For those who want to read further you can read my past threads on the subject:

May '19: https://twitter.com/ziggamon/status/1134490575925927936

May '20 https://twitter.com/ziggamon/status/1264233430314823691

For those who want to read further you can read my past threads on the subject:

May '19: https://twitter.com/ziggamon/status/1134490575925927936

May '20 https://twitter.com/ziggamon/status/1264233430314823691

To devs reading this: Remember optimization math: If we reduce load by 90% we increase throughput 10x.

And if you're at an exchange reading this - it's late, but it's not too late to set up Lightning.

And if you're at an exchange reading this - it's late, but it's not too late to set up Lightning.

From a usability perspective it’s IMO desirable is for fees to be as consistent as possible.

We’re seeing volatility decline (albeit fr extremely high levels) which is very promising.

We’re seeing volatility decline (albeit fr extremely high levels) which is very promising.

Read on Twitter

Read on Twitter