So, I did some rough analysis on what the market is pricing in for Tesla

TL;DR: Tesla’s current valuation implies the energy transition could move faster than people think, and its shareholders expect it to become the largest, most profitable car maker

Thread

TL;DR: Tesla’s current valuation implies the energy transition could move faster than people think, and its shareholders expect it to become the largest, most profitable car maker

Thread

First, a disclaimer:

This is a quick analysis intended to sketch out what one would need to believe for a certain valuation of Tesla; it is obviously not investment advice nor is it my employer's view

This is a quick analysis intended to sketch out what one would need to believe for a certain valuation of Tesla; it is obviously not investment advice nor is it my employer's view

Now let’s get to it. To say clean energy equities have soared recently is putting it mildly. Which begs the question: what would these companies need to deliver? Or put differently: what does their market valuation currently imply?

With its continuing share price gains continuing to bewilder those bearish on the stock, Tesla makes an interesting case study for what one would need to believe in terms of fundamentals to justify its valuation.

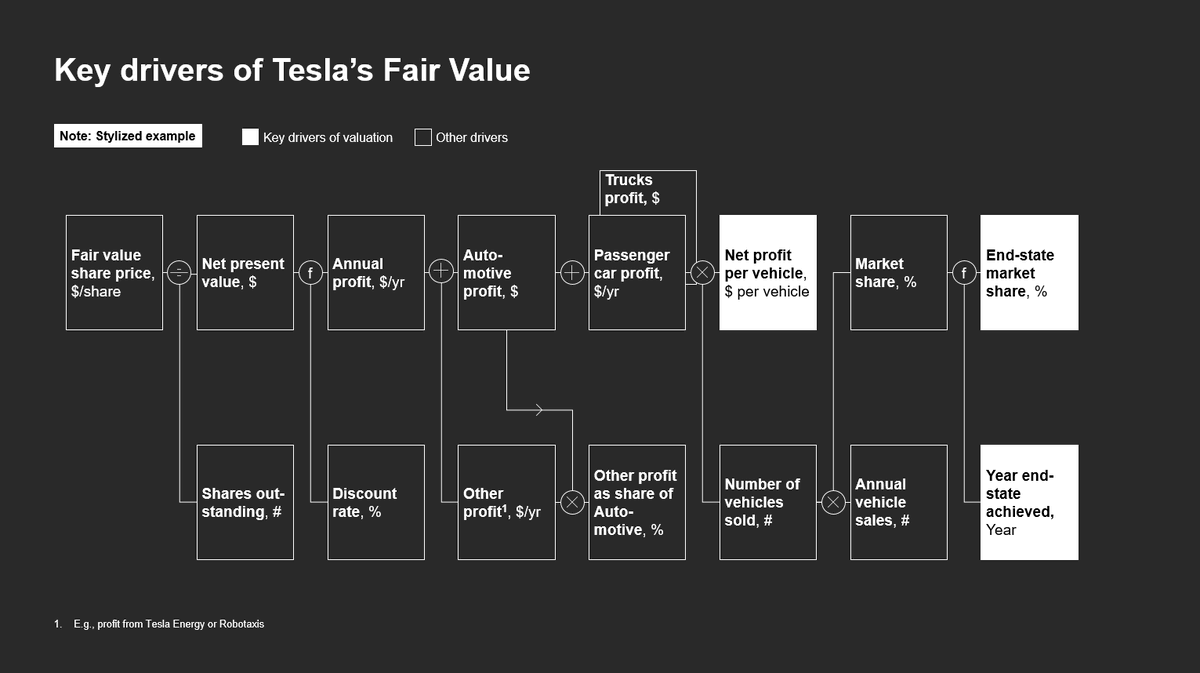

So here’s what I did: I distilled Tesla down to a set of simple value drivers for its Automotive business (split by passenger cars and trucks) and non-Automotive (everything else), and evaluated the extent to which each driver would need to perform as implied by the valuation

There are three drivers that stand out:

1/ Tesla’s end-state market share of the global car/truck market

2/ The year Tesla first achieves this market share

3/ Net profit per (average) vehicle

1/ Tesla’s end-state market share of the global car/truck market

2/ The year Tesla first achieves this market share

3/ Net profit per (average) vehicle

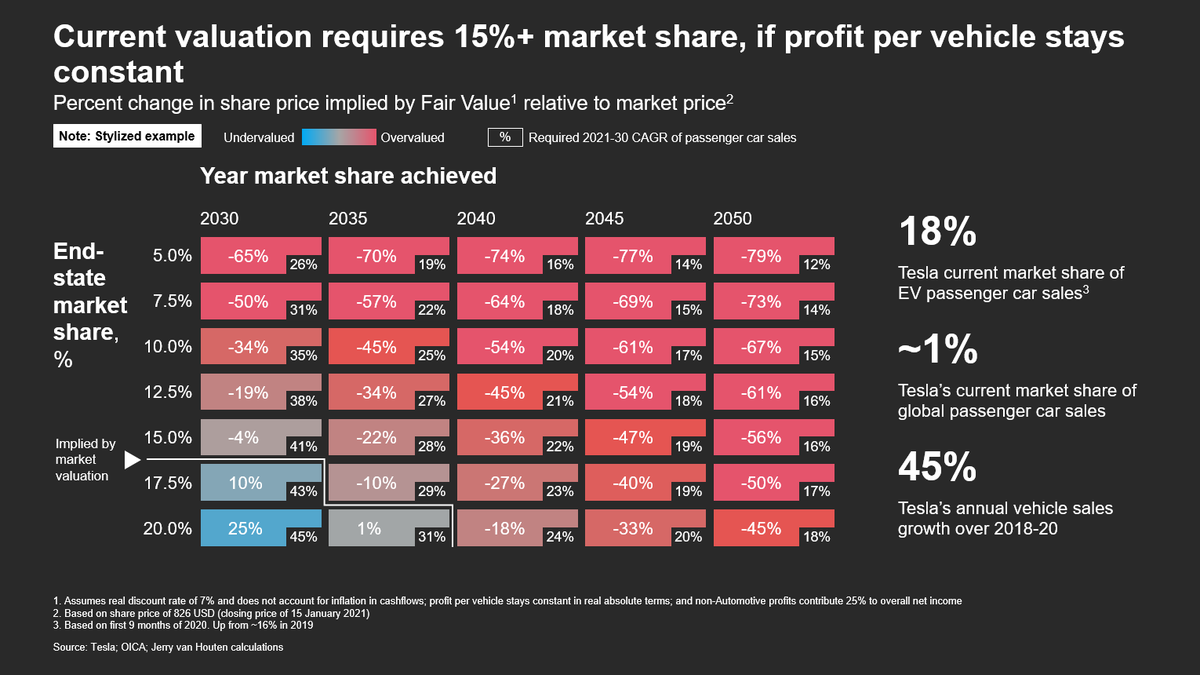

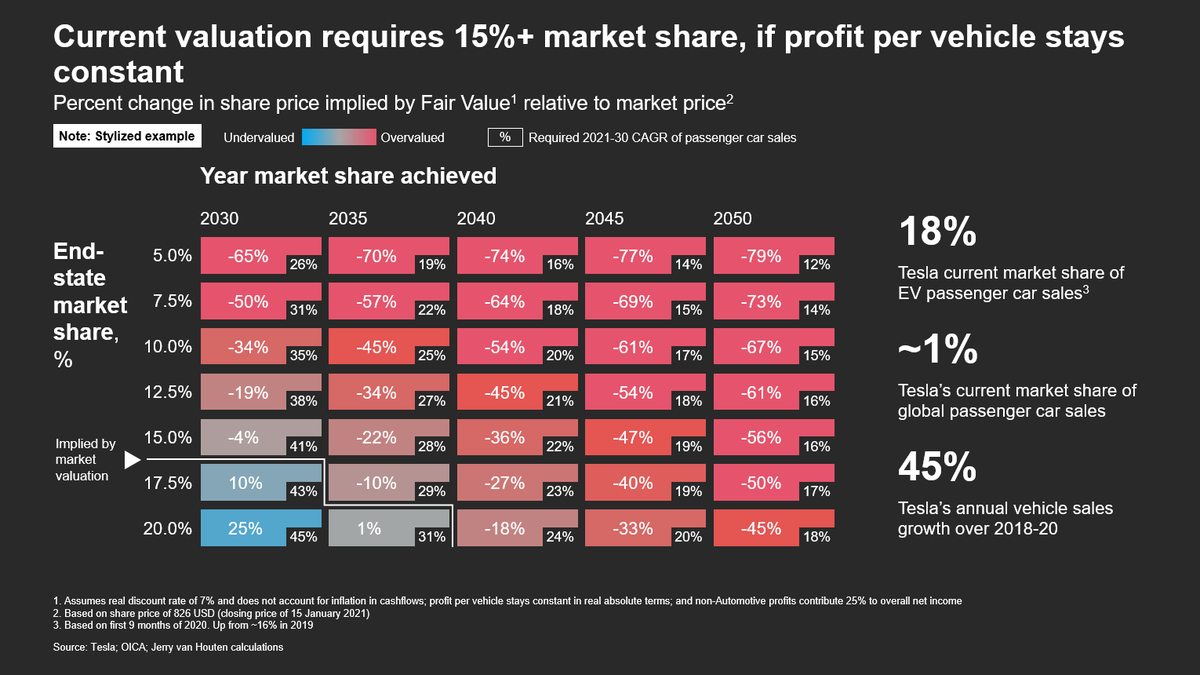

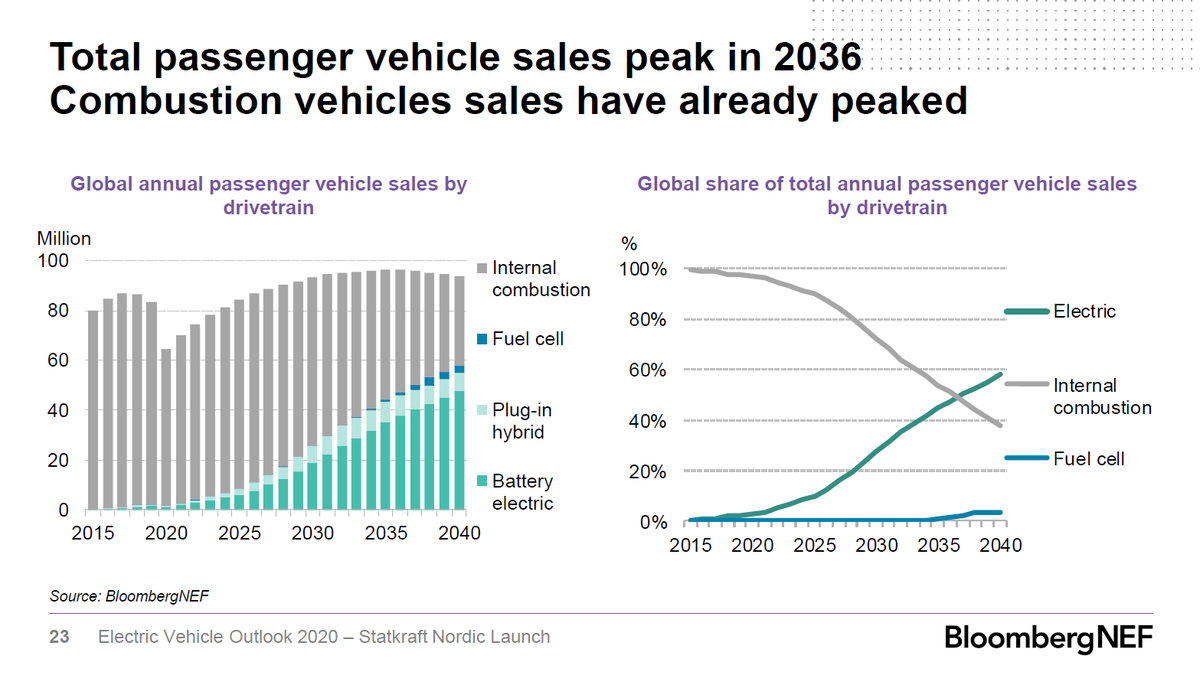

Let’s dive into 1 and 2: At today’s level of profitability, Tesla would need to achieve 15%+ of the global market for cars (and trucks) by 2030. While less than its current share of the EV market (18%), this would require it to keep growing at about its current rate of 45%/yr

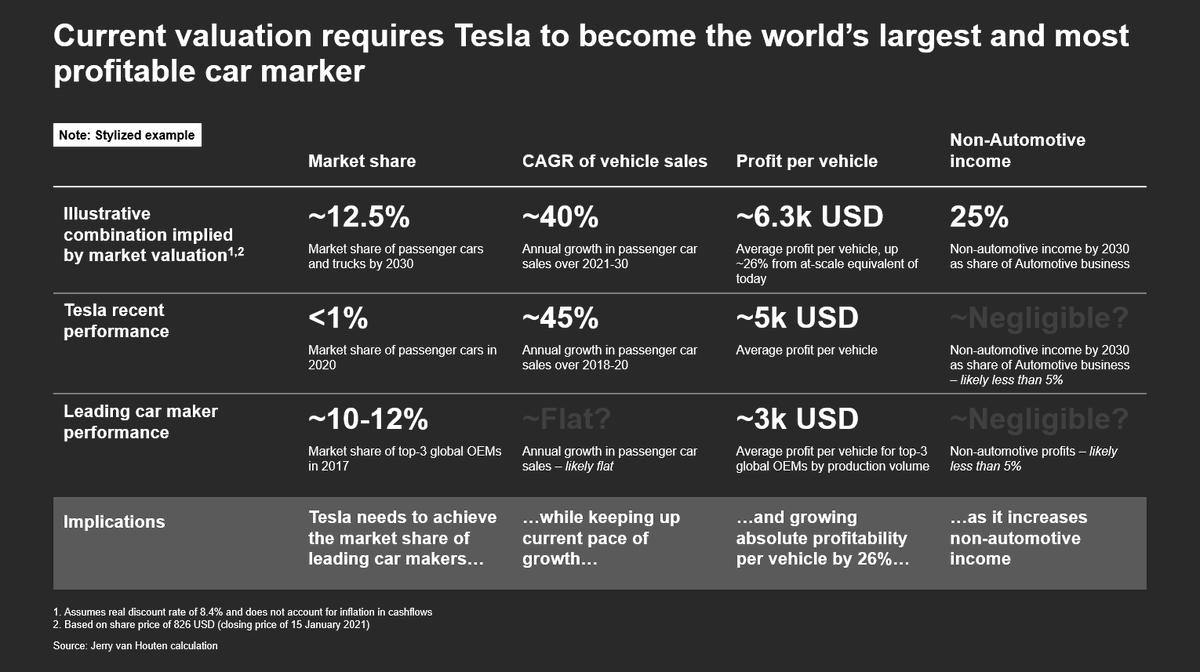

Let’s turn to 3: Profitability. Tesla could increase this to make the required market share more palatable. However, at 2030 market shares equivalent to those of current top-3 car makers (10-12%), Tesla needs an avg profit per car of 6-8k – several multiples of mass-market peers

This means that at the current valuation, the market expects Tesla become world’s largest car maker that achieves more than twice the profit per vehicle than current mass-market car makers. Here's how that compares:

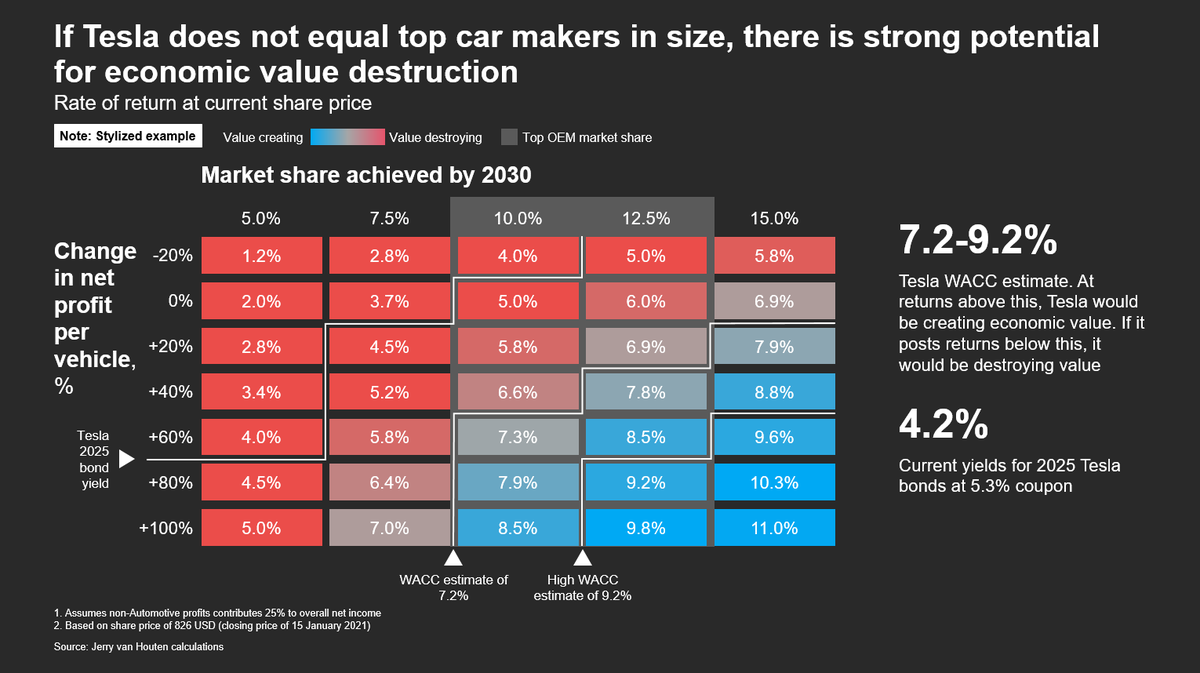

Should it not succeed in pulling off this feat, there is strong potential value economic value destruction: the rate of return implied at today’s share price at various combinations of profitability and market share might not exceed its weighted cost of capital of 7-9%

So what does all this mean? I’ll leave you to judge which combination of levers is most realistic for Tesla. But I do have some thoughts...

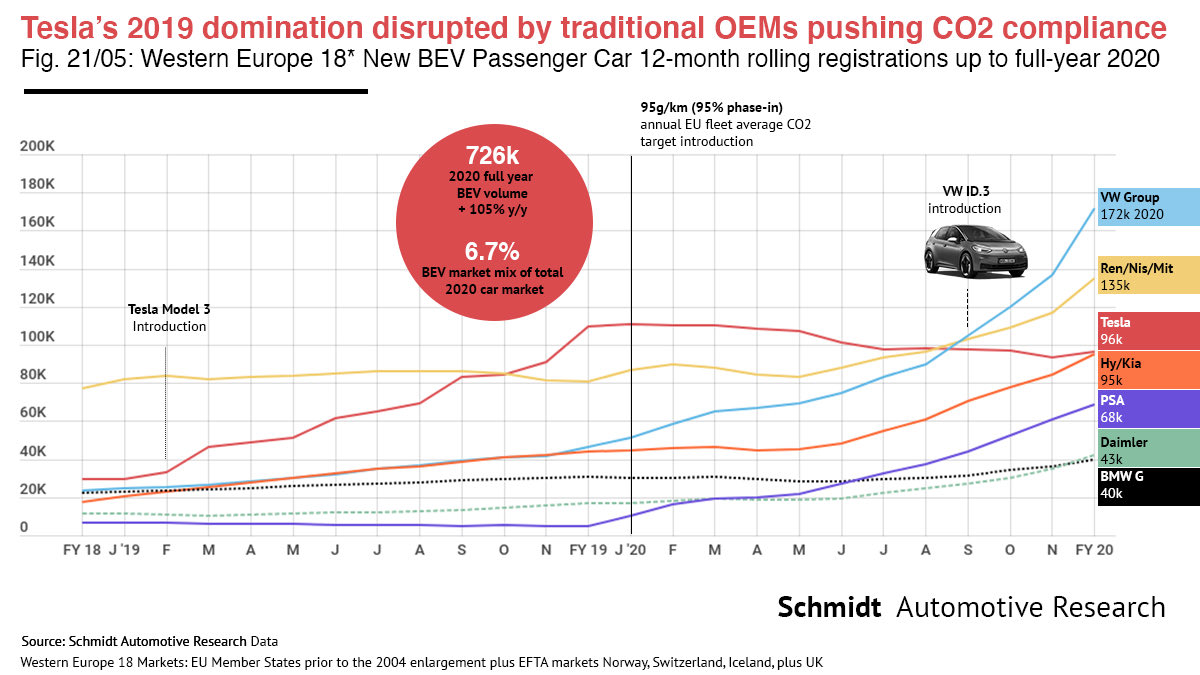

1/ Recent valuations imply extreme investor certainty on Tesla's outperformance relative to contemporary peers. While Tesla leads on several fronts today (OTA update, design, autonomy?), I wonder with how much certainty one can say this lead can be kept for decades to come

2/ Tesla's ambitions beyond automotive, such as Energy, are also implied to dominate their markets. In my assumptions above, Tesla’s Energy business is implied to grow to a 60-85bn business in turnover…

2 (ctd) / …if half of this is energy storage (vs panels) that implies an 80% market share of @BloombergNEF's ~250GWh/yr by 2030. Since such dominance seems unlikely, I wonder whether regulators will move fast enough to help unlock the energy storage market further

3/ As battery cost reductions lead to car price deflation (similar to renewables & electricity costs, as @MCL1965 points out), this means Tesla profit margins would need to increase just to keep absolute profit per vehicle constant

4/ An accelerated energy transition may be likelier than people think, if Tesla's valuation is to be believed. Should Tesla stay at its current 18% market share of EVs in the example above, this implies a 70% share of EV sales by 2030 compared to 28% by @BloombergNEF's EVO

So there it is. None of this is new thinking of course (it is the bread and butter of equity research analysts, after all), but I hope it helps frame a discussion around what beliefs one should form on Tesla for incremental dollars invested

Read on Twitter

Read on Twitter