1)

@SoFi - $IPOE DD Thread:

Summary:

- @chamath (watch video in link)

- Silicon Valley Darling

- Great Management

- Fintech

- Tech Disruptor (most recently $LMND)

- Galileo and further acquisitions to vertically integrate

- Bank Charter Goals

https://cnbc.com/video/2021/01/07/palihapitiya-to-take-online-lender-sofi-public-via-spac.html

@SoFi - $IPOE DD Thread:

Summary:

- @chamath (watch video in link)

- Silicon Valley Darling

- Great Management

- Fintech

- Tech Disruptor (most recently $LMND)

- Galileo and further acquisitions to vertically integrate

- Bank Charter Goals

https://cnbc.com/video/2021/01/07/palihapitiya-to-take-online-lender-sofi-public-via-spac.html

2)

Management

- Executives with strong ties to @GoldmanSachs TMT Inv Bank

- CEO Anthony Noto extremely impressive guy, former @NFL CFO, most recently former COO , CFO at @Twitter

- Chamath has quoted Noto as "being money" in career, go back 10 years

https://finance.yahoo.com/video/sofi-ceo-company-outlook-spac-152020474.html

Management

- Executives with strong ties to @GoldmanSachs TMT Inv Bank

- CEO Anthony Noto extremely impressive guy, former @NFL CFO, most recently former COO , CFO at @Twitter

- Chamath has quoted Noto as "being money" in career, go back 10 years

https://finance.yahoo.com/video/sofi-ceo-company-outlook-spac-152020474.html

3)

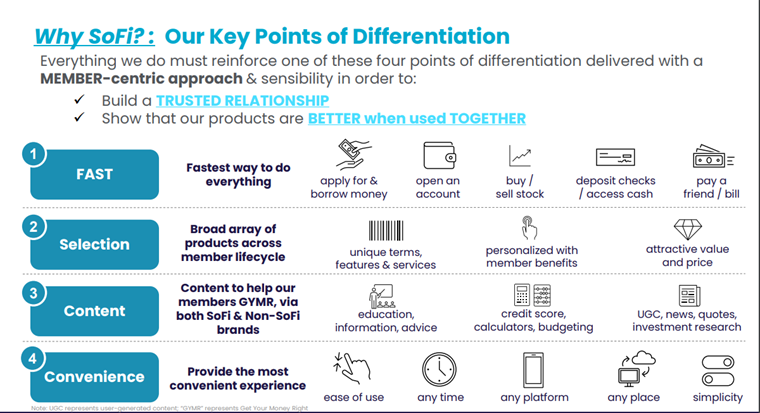

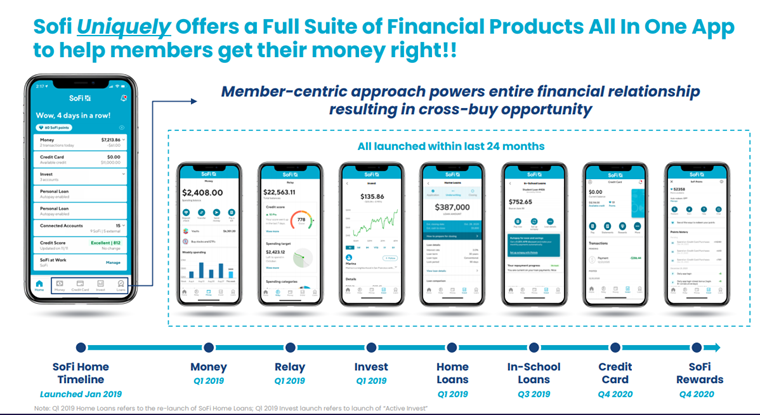

@SoFi is a disruptor to the traditional way of banking. It's large suite of online services include:

- Banking

- @Samsung Money by SoFi

- Credit Card w/ @Mastercard

- Investing

- Crypto w/ @coinbase

- Loan Service

These services all have been rolled out since Jan 2019

@SoFi is a disruptor to the traditional way of banking. It's large suite of online services include:

- Banking

- @Samsung Money by SoFi

- Credit Card w/ @Mastercard

- Investing

- Crypto w/ @coinbase

- Loan Service

These services all have been rolled out since Jan 2019

4)

SoFi Stadium:

- Opened Sept '20 in Inglewood, CA

- Home to two NFL teams Rams and Chargers

- Hosting 2022 Super Bowl

- Hosting WrestleMania in 2023

- Hosting CFB Title Game 2023

- Opening and closing ceremonies of 2028 LA Olympic Games

Insane future branding opportunities!

SoFi Stadium:

- Opened Sept '20 in Inglewood, CA

- Home to two NFL teams Rams and Chargers

- Hosting 2022 Super Bowl

- Hosting WrestleMania in 2023

- Hosting CFB Title Game 2023

- Opening and closing ceremonies of 2028 LA Olympic Games

Insane future branding opportunities!

5)

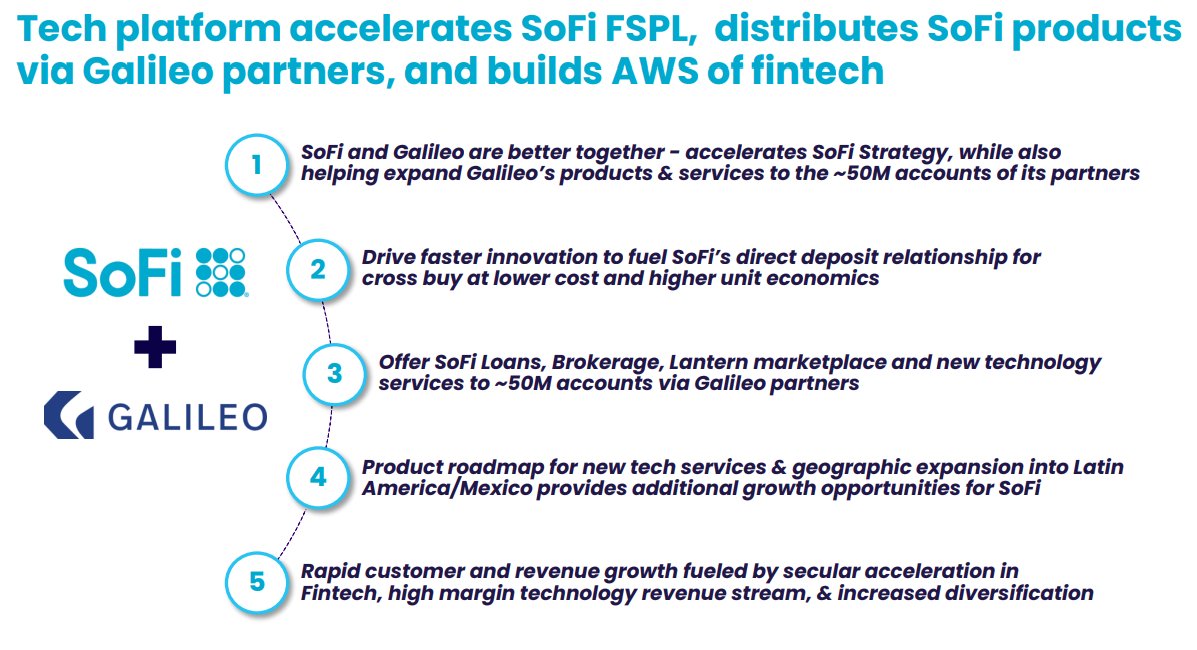

- Acquired the API & financial processing platform Galileo for $1.2B in April '20

- "Fintech's Tech"

- "AWS of Fintech"

- Galileo solutions used by Skrill (hi $BFT), Chime, MoneyLion, Robinhood, Shipt, InteractiveBrokers etc

- $911M '25 proj Net Rev

https://www.forbes.com/sites/jeffkauflin/2020/04/07/sofi-is-buying-payments-company-galileo-for-12-billion/?sh=7232ae10235f

- Acquired the API & financial processing platform Galileo for $1.2B in April '20

- "Fintech's Tech"

- "AWS of Fintech"

- Galileo solutions used by Skrill (hi $BFT), Chime, MoneyLion, Robinhood, Shipt, InteractiveBrokers etc

- $911M '25 proj Net Rev

https://www.forbes.com/sites/jeffkauflin/2020/04/07/sofi-is-buying-payments-company-galileo-for-12-billion/?sh=7232ae10235f

6)

Further acquisitions to vertically integrate:

- SoFi is getting an insane amount of cash on the balance sheet from $IPOE deal for future acq. to speed up growth process

- SoFi tried acq. Apex Clearings in Feb '19 but settled for minority stake https://www.businessinsider.com/sofi-invested-in-apex-after-failing-to-acquire-it-2019-2

Further acquisitions to vertically integrate:

- SoFi is getting an insane amount of cash on the balance sheet from $IPOE deal for future acq. to speed up growth process

- SoFi tried acq. Apex Clearings in Feb '19 but settled for minority stake https://www.businessinsider.com/sofi-invested-in-apex-after-failing-to-acquire-it-2019-2

7)

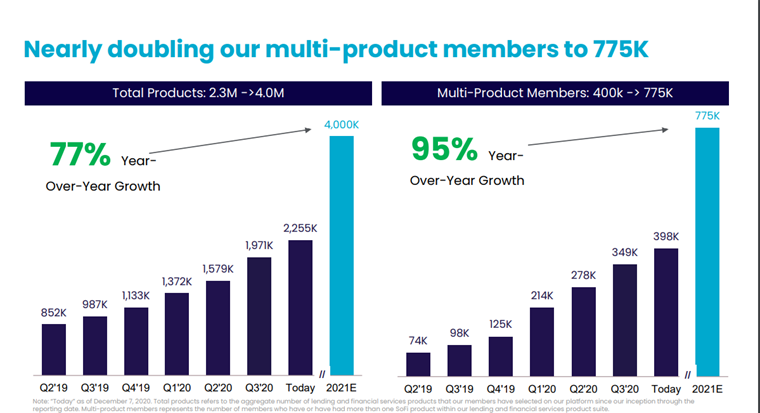

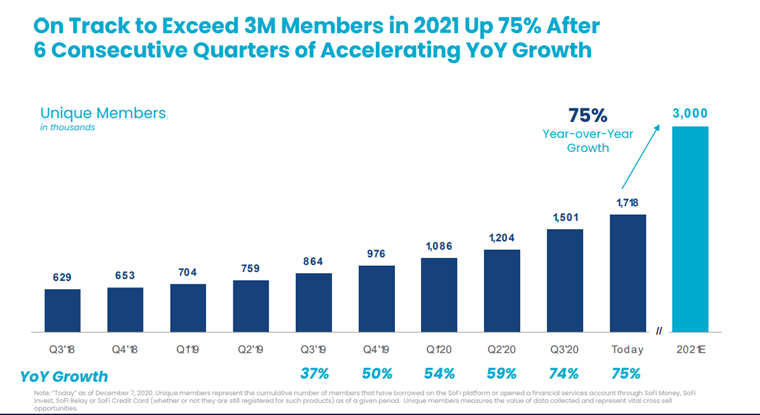

SoFi users:

- Unique and multi-platform member projected growth looks fantastic

- 75% current unique members YoY growth, proj 3M users in '21

- 77% total products YoY growth, proj 4M products used in '21

- 95% multi-product members YoY growth, proj 775K MP members in '21

SoFi users:

- Unique and multi-platform member projected growth looks fantastic

- 75% current unique members YoY growth, proj 3M users in '21

- 77% total products YoY growth, proj 4M products used in '21

- 95% multi-product members YoY growth, proj 775K MP members in '21

8)

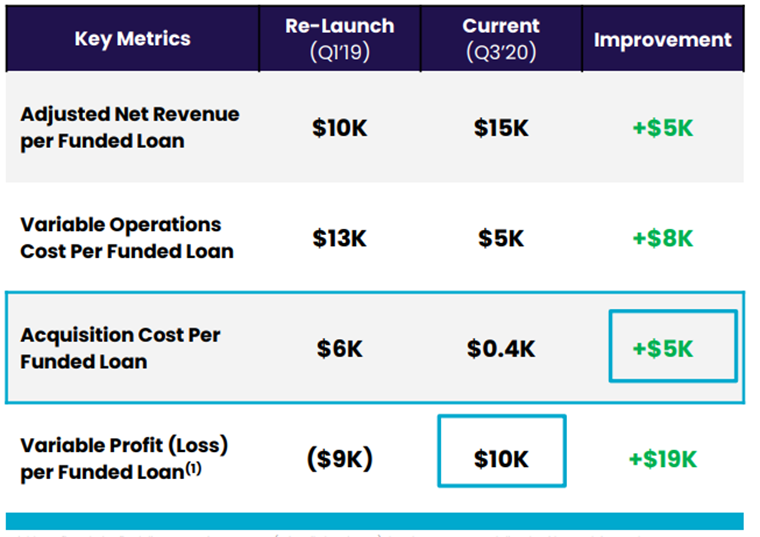

Improving Opportunity Costs:

- From App Launch (Q1 '19) to Current (Q3 '20) SoFi pays only $400 per funded loan compared to 6k previously

- In same time period, went from a net loss per funded loan of 9k to a net profit of 10K (!)

Improving Opportunity Costs:

- From App Launch (Q1 '19) to Current (Q3 '20) SoFi pays only $400 per funded loan compared to 6k previously

- In same time period, went from a net loss per funded loan of 9k to a net profit of 10K (!)

9)

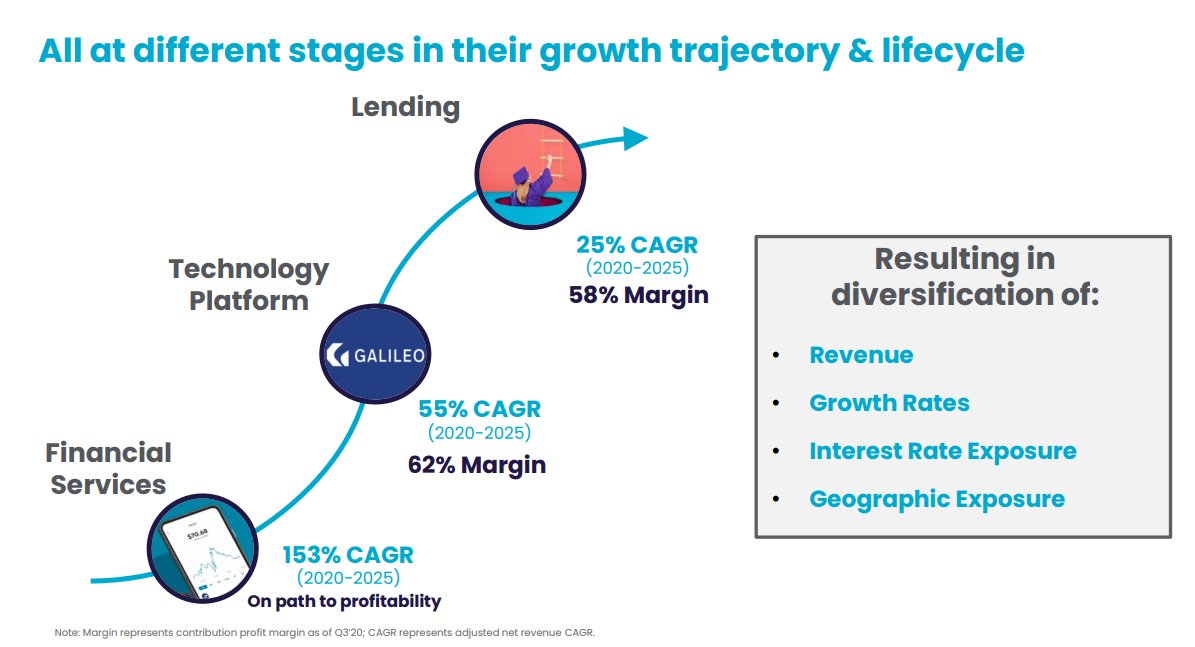

Margin on SoFi Segments:

- SoFi sees best margins of 62% from Technology Platform (Galileo) and proj 55% CAGR ('20-'25)

- Lending margins of 58% (AAA Rating Lender)

- Financial Services (app) not yet profitable but expansive proj growth of 153% CAGR ('20-'25)

Margin on SoFi Segments:

- SoFi sees best margins of 62% from Technology Platform (Galileo) and proj 55% CAGR ('20-'25)

- Lending margins of 58% (AAA Rating Lender)

- Financial Services (app) not yet profitable but expansive proj growth of 153% CAGR ('20-'25)

10)

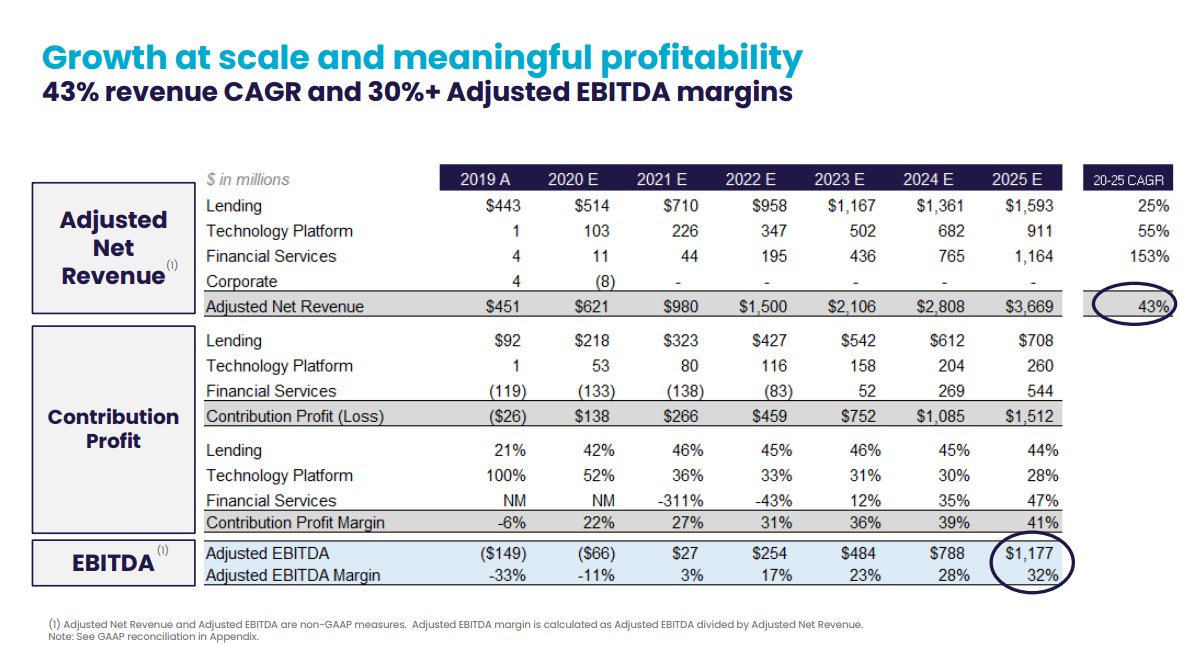

SoFi Financials:

2019 Actual: $451M Rev, $26M net loss at -6% margin

2020 Proj: $621M rev, $138M net profit at 22% margin

2025 Proj: $3.66B rev, $1.51B net profit at 41% margin

Going public at the right time!

SoFi Financials:

2019 Actual: $451M Rev, $26M net loss at -6% margin

2020 Proj: $621M rev, $138M net profit at 22% margin

2025 Proj: $3.66B rev, $1.51B net profit at 41% margin

Going public at the right time!

11)

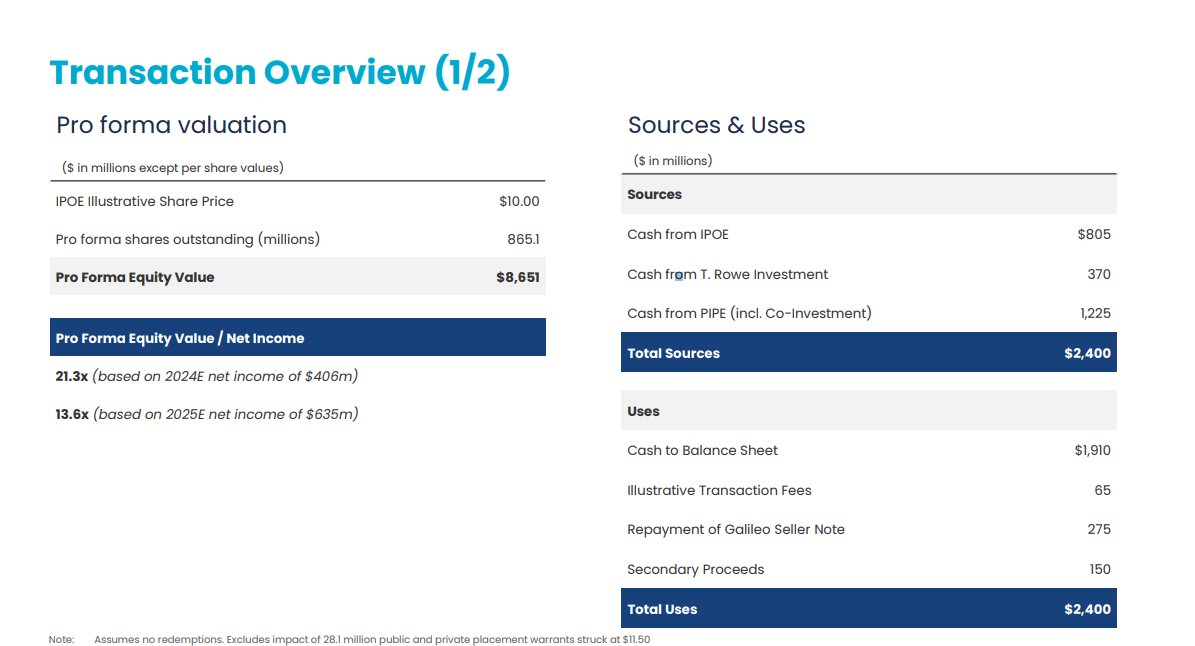

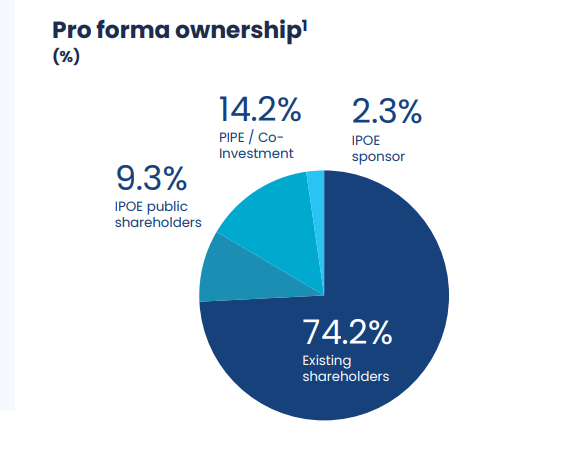

$IPOE SoFi Pro-Forma Details:

- $8.6B Pro Forma Equity Value @ $10.00 common

- $17.4B Pro Forma Equity Value @ 1/15 price $20.16

- $2.4B in cash advancements to SoFi (1.2B PIPE)

- $1.9B cash use for balance sheet

- 9.3% $IPOE public ownership

- Q1 '21 merger completion

$IPOE SoFi Pro-Forma Details:

- $8.6B Pro Forma Equity Value @ $10.00 common

- $17.4B Pro Forma Equity Value @ 1/15 price $20.16

- $2.4B in cash advancements to SoFi (1.2B PIPE)

- $1.9B cash use for balance sheet

- 9.3% $IPOE public ownership

- Q1 '21 merger completion

12)

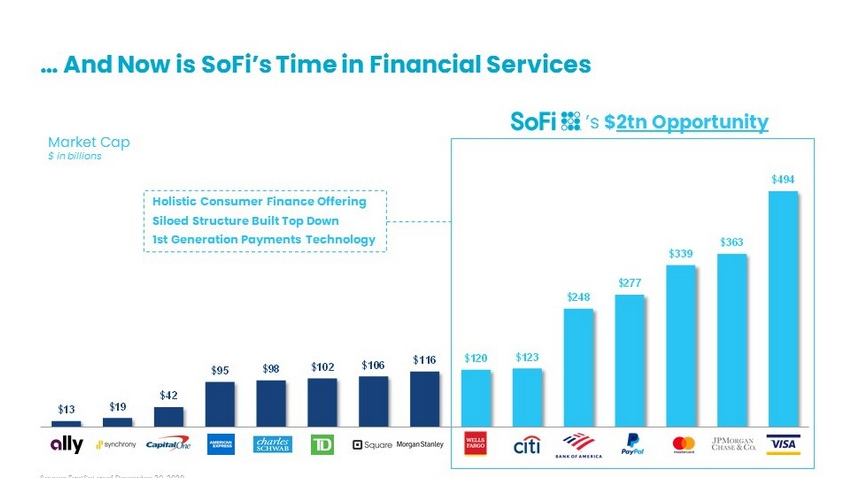

Final thoughts:

- 7.2/10 on the @Doc_Steve_Brule PBF scale for "tech disruptor" "fintech"

- Chamath paid up for this deal, not one of the "best" looking deals rn but TAM is there

- Great management and long term vision

- Conviction needed at this $ level for company future

Final thoughts:

- 7.2/10 on the @Doc_Steve_Brule PBF scale for "tech disruptor" "fintech"

- Chamath paid up for this deal, not one of the "best" looking deals rn but TAM is there

- Great management and long term vision

- Conviction needed at this $ level for company future

13)

My Outlook:

- Currently 3rd largest position in trading account

- Load up on warrants to redeem imo, best play at 1 to 1

- Roth IRA hold long term

- Lots of future catalysts to stay happy

Thank you for reading! I had a lot of fun doing this, im open to any opinions!

My Outlook:

- Currently 3rd largest position in trading account

- Load up on warrants to redeem imo, best play at 1 to 1

- Roth IRA hold long term

- Lots of future catalysts to stay happy

Thank you for reading! I had a lot of fun doing this, im open to any opinions!

14)

Link Dump for further reading if you choose:

S-4

https://www.sec.gov/Archives/edgar/data/1818874/000110465921002757/tm211402-1_s4.htm

8K https://www.sec.gov/Archives/edgar/data/1818874/000110465921003189/tm212725d1_8ka.htm

Investor Presentation-

https://www.sec.gov/Archives/edgar/data/1818874/000110465921001951/tm211973d1_ex99-2.htm

Recent CEO interview

https://finance.yahoo.com/video/sofi-ceo-company-outlook-spac-152020474.html

https://www.cnbc.com/2020/05/27/sofi-ceo-anthony-noto-40percent-of-trading-on-platform-is-through-fractional-shares.html

https://www.cnbc.com/2020/06/16/sofi-disruptor-50.html https://www.paymentsjournal.com/galileo-financial-technologies-powerful-apis-and-a-penchant-to-reduce-card-fraud-losses-drive-this-fast-growing-fintech-provider/

Link Dump for further reading if you choose:

S-4

https://www.sec.gov/Archives/edgar/data/1818874/000110465921002757/tm211402-1_s4.htm

8K https://www.sec.gov/Archives/edgar/data/1818874/000110465921003189/tm212725d1_8ka.htm

Investor Presentation-

https://www.sec.gov/Archives/edgar/data/1818874/000110465921001951/tm211973d1_ex99-2.htm

Recent CEO interview

https://finance.yahoo.com/video/sofi-ceo-company-outlook-spac-152020474.html

https://www.cnbc.com/2020/05/27/sofi-ceo-anthony-noto-40percent-of-trading-on-platform-is-through-fractional-shares.html

https://www.cnbc.com/2020/06/16/sofi-disruptor-50.html https://www.paymentsjournal.com/galileo-financial-technologies-powerful-apis-and-a-penchant-to-reduce-card-fraud-losses-drive-this-fast-growing-fintech-provider/

15)

Forgot I didn't add this part into thread, but here are my price targets for $IPOE, and remember guys just my opinion!

Pre-merger run up $30-35

EOY 2021 $50+

LT 2022+ $100+

About as safe of a long term investment gets for a SPAC imo! I have faith in Chamath and Noto

Forgot I didn't add this part into thread, but here are my price targets for $IPOE, and remember guys just my opinion!

Pre-merger run up $30-35

EOY 2021 $50+

LT 2022+ $100+

About as safe of a long term investment gets for a SPAC imo! I have faith in Chamath and Noto

Read on Twitter

Read on Twitter