1/5 I'm working on a M1 and/or M2 corrected version of the #Bitcoin  Price Temperature (BPT) and am weighing on which version I'll focus on primarily, could use some feedback

Price Temperature (BPT) and am weighing on which version I'll focus on primarily, could use some feedback

I'll summarize my own thoughts in this

Poll: Which money supply version would you correct for?

Price Temperature (BPT) and am weighing on which version I'll focus on primarily, could use some feedback

Price Temperature (BPT) and am weighing on which version I'll focus on primarily, could use some feedback

I'll summarize my own thoughts in this

Poll: Which money supply version would you correct for?

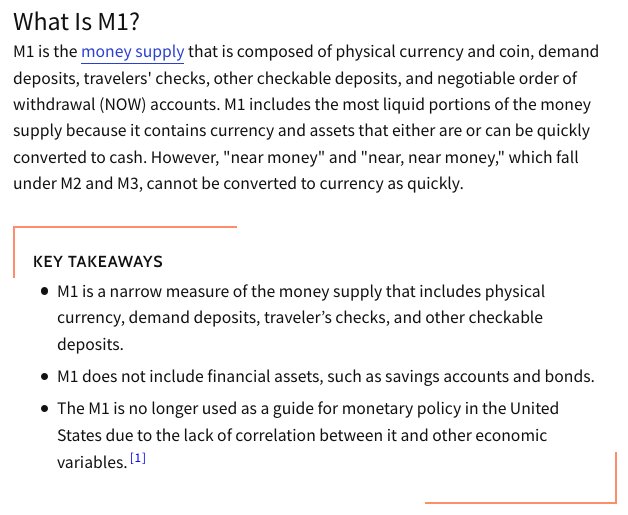

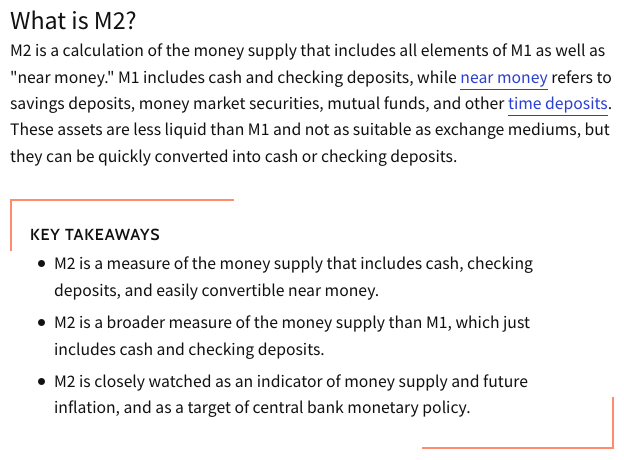

2/5 Let's look at the definitions of M1 and M2 first. On @Investopedia, they are described as in the attached figures.

For completeness, the source URL's:

- M1: https://www.investopedia.com/terms/m/m1.asp

- M2: https://www.investopedia.com/terms/m/m2.asp

Also useful, by @khanacademy: https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/ap-financial-sector/definition-measurement-and-functions-of-money-ap/v/money-supply-m0-m1-and-m2

For completeness, the source URL's:

- M1: https://www.investopedia.com/terms/m/m1.asp

- M2: https://www.investopedia.com/terms/m/m2.asp

Also useful, by @khanacademy: https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/ap-financial-sector/definition-measurement-and-functions-of-money-ap/v/money-supply-m0-m1-and-m2

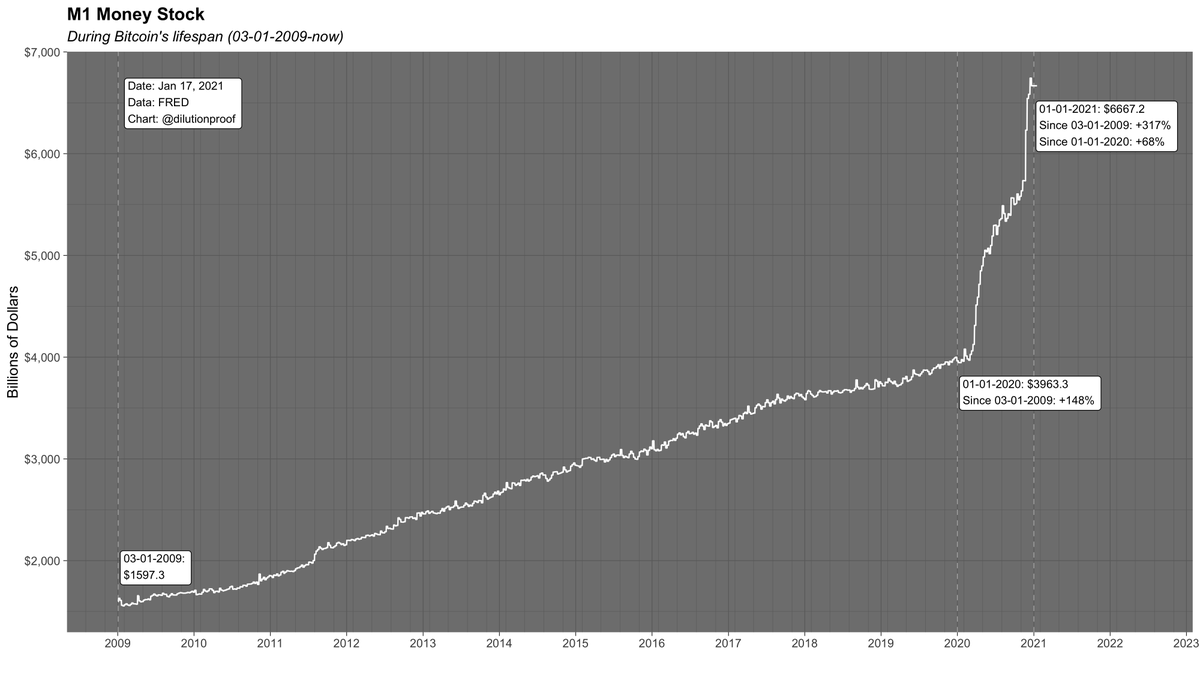

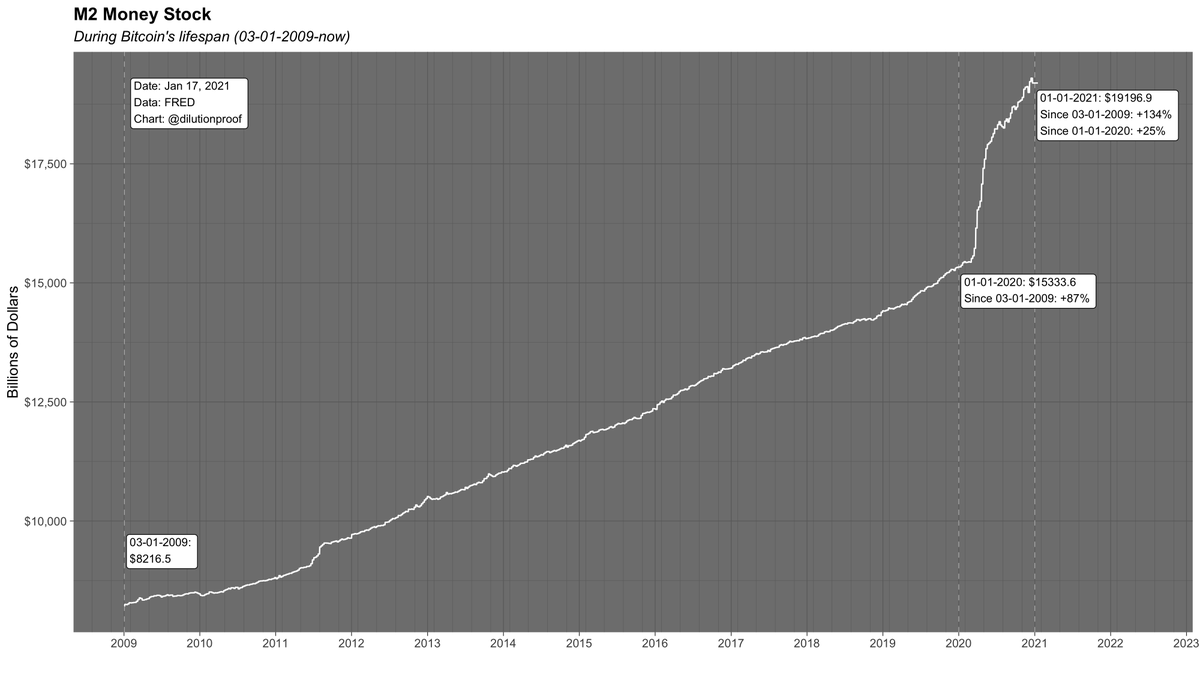

3/5 The reason I'm considering correcting for M1 or M2 monetary inflation is that both absolutely exploded in 2020, potentially influencing the #Bitcoin  price and thus the true relative BPT values if the assumption that this monetary inflation may cause asset inflation is correct

price and thus the true relative BPT values if the assumption that this monetary inflation may cause asset inflation is correct

price and thus the true relative BPT values if the assumption that this monetary inflation may cause asset inflation is correct

price and thus the true relative BPT values if the assumption that this monetary inflation may cause asset inflation is correct

4/5 That said, I feel like I should focus on the broader definition of potentially investable money that circulates in the economy, which is M2

This aligns with the last point on the @investopedia M2 page that states M2 is watched by central banks as well for policy decisions

This aligns with the last point on the @investopedia M2 page that states M2 is watched by central banks as well for policy decisions

5/5 I think that I am fairly confident in focussing on M2 here for the rationale described above, but would love to get some feedback or counter-arguments

If you have a clear opinion on this and could answer the poll (in tweet 1) or comment below it would be much appreciated!

If you have a clear opinion on this and could answer the poll (in tweet 1) or comment below it would be much appreciated!

Read on Twitter

Read on Twitter