Playtika $PLTK one of the leading mobile game developers in the world IPOed this week raising $1.9 billion by offering 69.5 million shares at $27 each (closed at $31.6) valued at a Market cap of $13 billion.

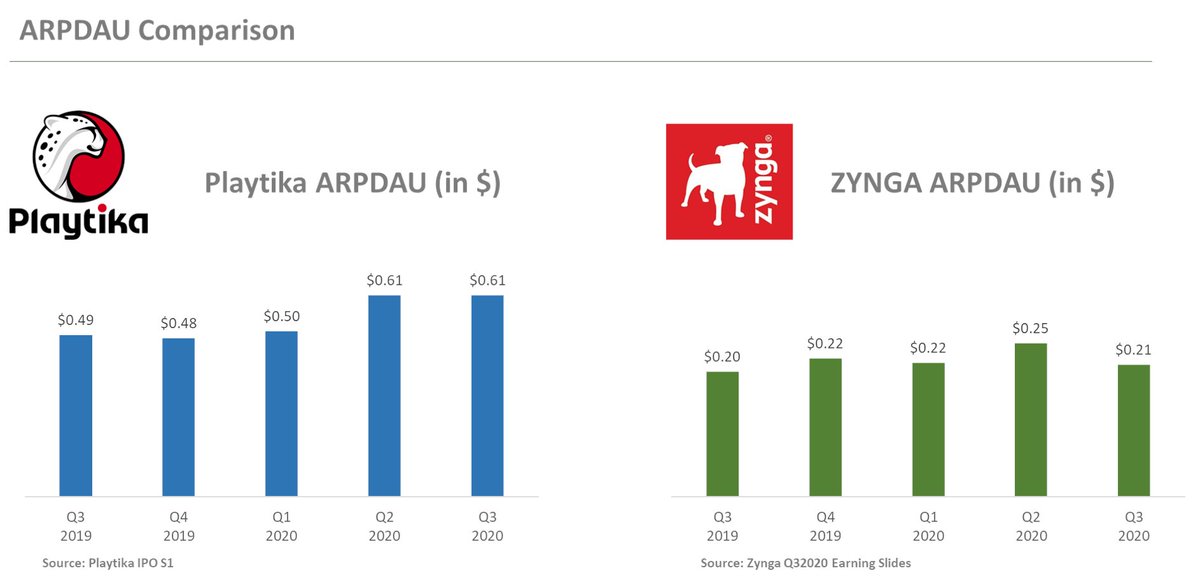

From its S1, the Company definitely has some of the best-in-class KPI metrics in the mobile gaming industry. Incredible ARPDAU (Average Revenue per Daily Active User) figure for $PLTK $0.57c vs. $ZYGA $0.21c as of Q32020.

Playtika and Zynga are somewhat similar in terms of their mobile games portfolio, Playtika’s casino-themed games accounted for 57.4% and casual games 42.6% of its revenues whereas, Zynga's account for 71% from casual games and 20% from social slots & casual cards themed games.

This exposure to casino themed games is the main factor for Playtika’s superiority in terms of ARPDUA. However, Zynga’s portfolio genre diversification and recent success in its M&A activities could be important differentiator factors vs. Playtika.

For Playtika, there are 3 important topics to watch for its future performance;

IDFA effects on its UA ability of whale users =

IDFA effects on its UA ability of whale users =  targetting,

targetting,  CPI

CPI

M&A ability to diversify its portfolio and identifying the right targets

M&A ability to diversify its portfolio and identifying the right targets

US Sports betting companies targeting same users

US Sports betting companies targeting same users

IDFA effects on its UA ability of whale users =

IDFA effects on its UA ability of whale users =  targetting,

targetting,  CPI

CPI M&A ability to diversify its portfolio and identifying the right targets

M&A ability to diversify its portfolio and identifying the right targets US Sports betting companies targeting same users

US Sports betting companies targeting same users

Read on Twitter

Read on Twitter