Why BTC dropped 89% in 2018.

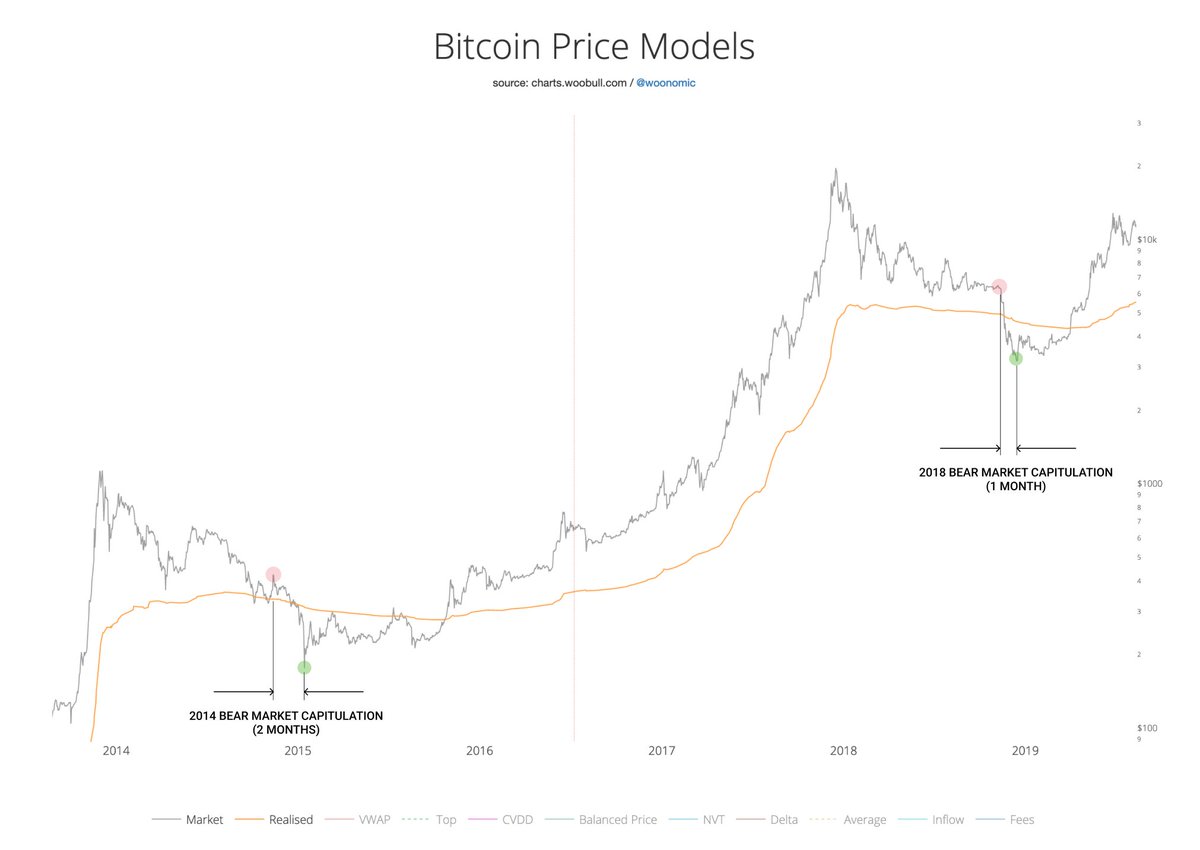

The mania phase of the last bull market, where BTC went 10k->20k Q4 2017, drew in a ton of weak hands under FOMO.

In all exponential rallies, weak hands have to be tested and shaken out as part of the price discovery mechanism. https://twitter.com/prettyboytizzy_/status/1350691805038321666

The mania phase of the last bull market, where BTC went 10k->20k Q4 2017, drew in a ton of weak hands under FOMO.

In all exponential rallies, weak hands have to be tested and shaken out as part of the price discovery mechanism. https://twitter.com/prettyboytizzy_/status/1350691805038321666

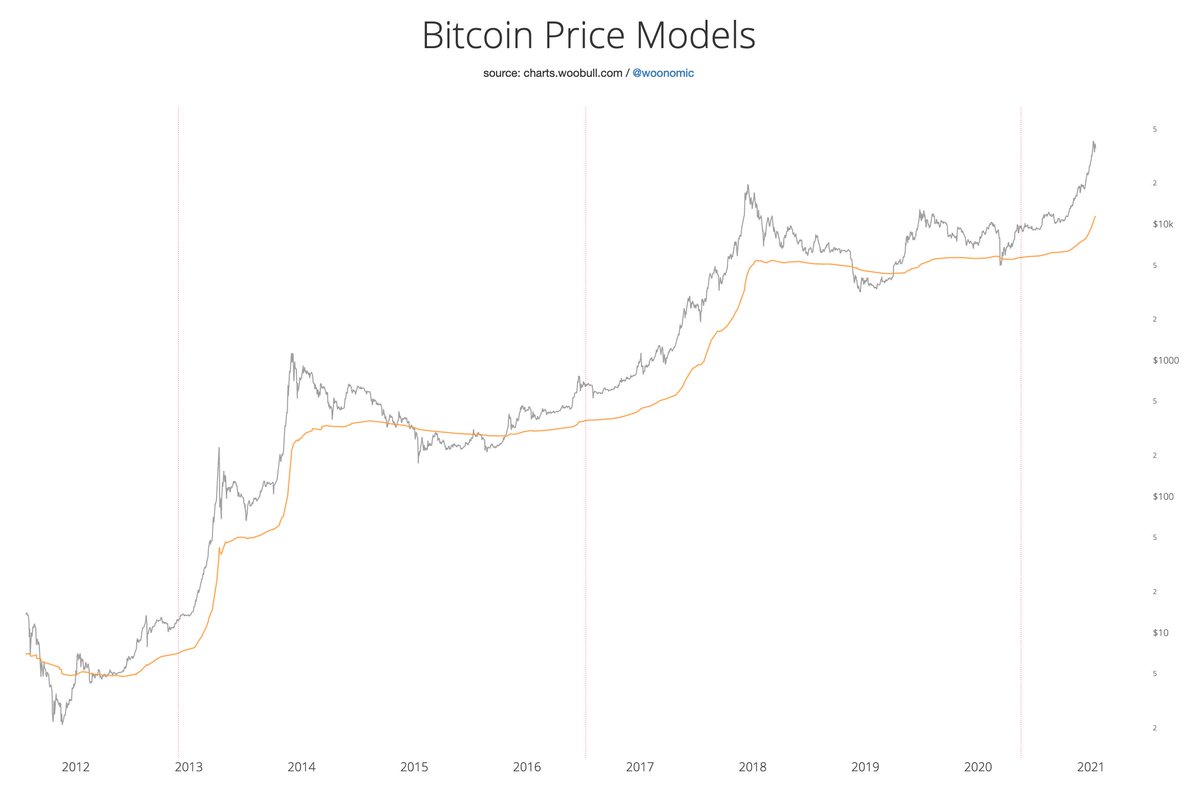

Realised Price (orange) tracks the dollars stored in BTC's network. The price OVERSOLD below the money stored in the network.

Weak hands (buyers who buy under FOMO) always capitulate allowing strong handed thoughtful buyers to get bargains.

This happens in EVERY bear cycle.

Weak hands (buyers who buy under FOMO) always capitulate allowing strong handed thoughtful buyers to get bargains.

This happens in EVERY bear cycle.

The sharp capitulation we saw 2018 was a consequence of BTC developing highly liquid derivative markets (BitMEX and clones) gaining volume dominance over spot markets (where organic investors buy on).

This allowed speculators to push the price around more than usual.

This allowed speculators to push the price around more than usual.

Also note that studying the macro cycle via capital flows on the blockchain gave a very good readout that the bear market floor was not in during that band above $6k in 2018. It was a very new area of study back then. https://twitter.com/woonomic/status/1056797766112997378?s=20

Once the shake out of weak hands completes, the price discovery mechanism allows price to move upwards.

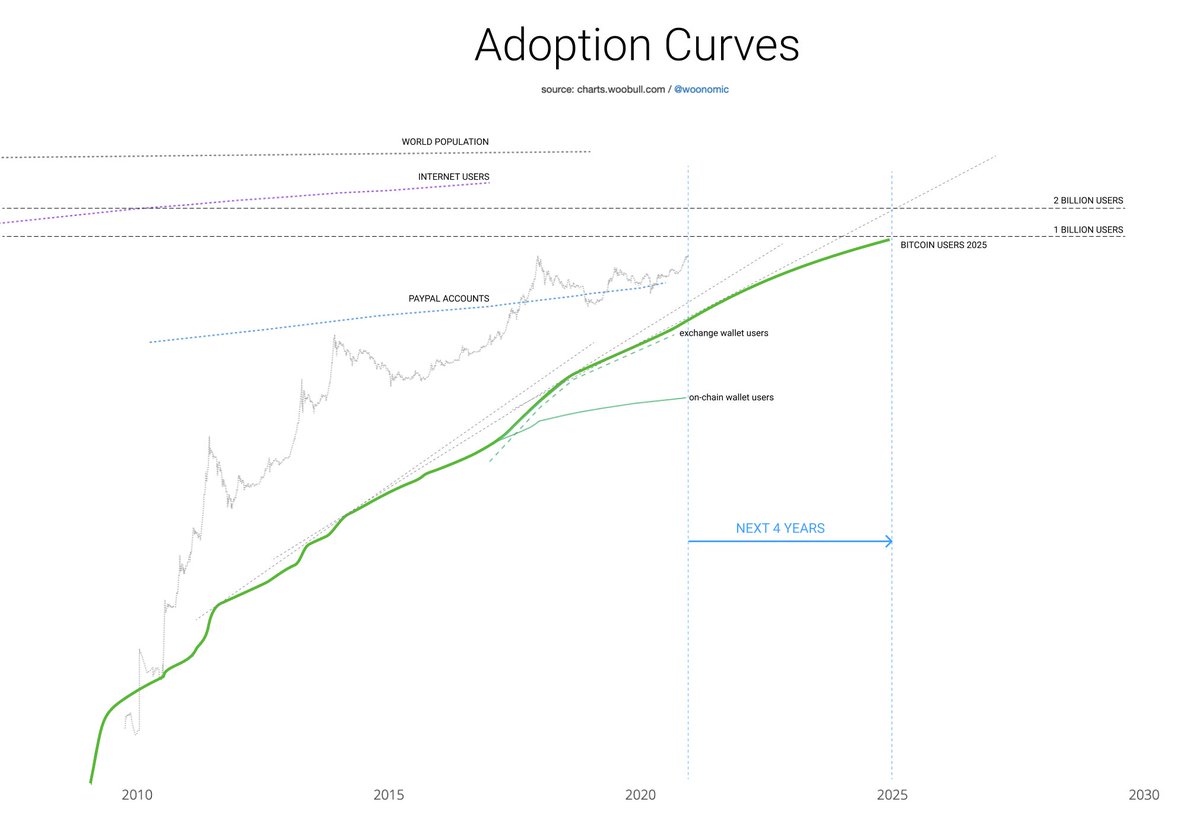

This emerging asset class is driven by its global adoption as a digital age Store of Value network.

Here's the adoption chart and extrapolation for the next 4 years.

This emerging asset class is driven by its global adoption as a digital age Store of Value network.

Here's the adoption chart and extrapolation for the next 4 years.

The narrative for each bear and bull market changes cycle to cycle, but the effective mechanism is the same.

I've found little value reading market news and industry narratives, IMO tracking capital flows in relation to the behaviour patterns of participants is better.

I've found little value reading market news and industry narratives, IMO tracking capital flows in relation to the behaviour patterns of participants is better.

Correction: It was a 85% drop. Well done those who did the fact checking.

Read on Twitter

Read on Twitter