1) This article on Tether has been making the rounds and I wanted to put a few thoughts out there. TL;DR There are certainly risks associated with Tether, but I think this article itself has little real substance. https://crypto-anonymous-2021.medium.com/the-bit-short-inside-cryptos-doomsday-machine-f8dcf78a64d3

2) Disclaimer: None of this should be construed as financial advice. DYOR. And, while I personally believe Tether is *likely* a non-issue, there are certainly issues with transparency that they would do well to resolve.

3) First, let's address the NY AG lawsuit, which seems to be a favorite talking point for many Tether skeptics. It's important to note that the suit isn't directly alleging that Tether is insolvent--rather, it is alleging *misuse* of Tether funds (1) for Bitfinex losses.

4) Some food for thought: this lawsuit isn't new. It's been around since April 2019, and has certainly been one of the most high-profile developments in the space. Meanwhile, institutional funds and companies have collectively shoveled *billions* into Bitcoin the past few months.

5) These institutions certainly aren't stupid. Would they really forego research into one of the biggest present market risk factors and blindly throw money into Bitcoin?

6) An axiom: Financial markets are competitive with intelligent, rational players. The above, combined with this axiom, should make you wonder if Tether really is as big an issue as the skeptics make it out to be. (Or at the very least, if it is a *critical long-term* issue)

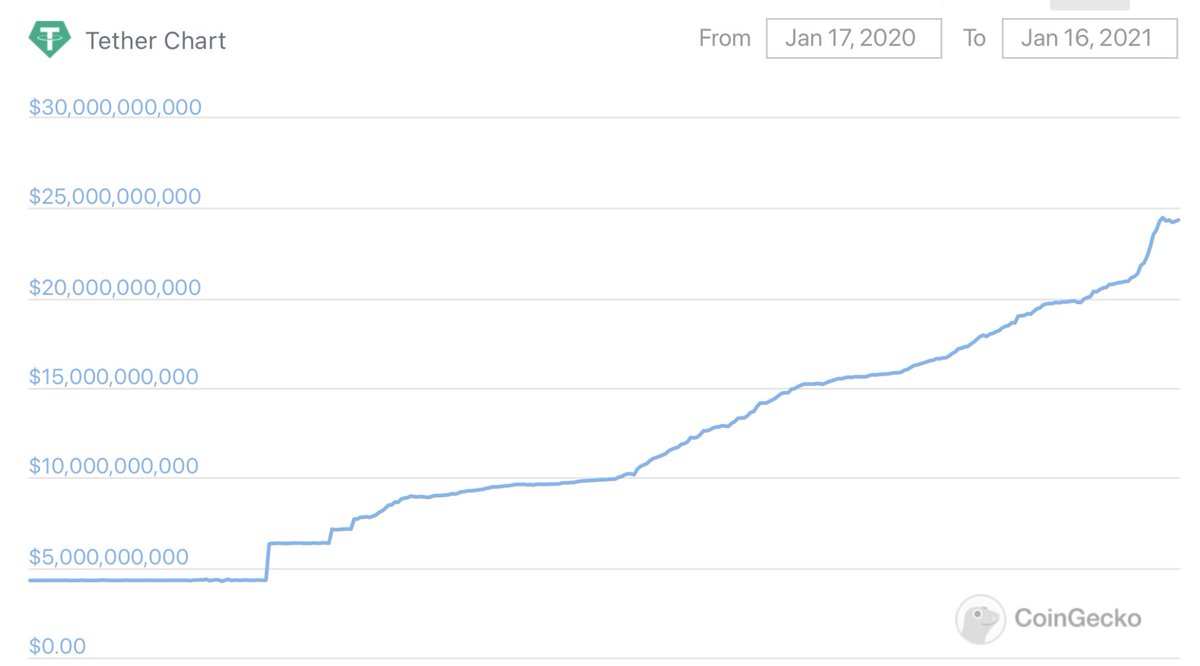

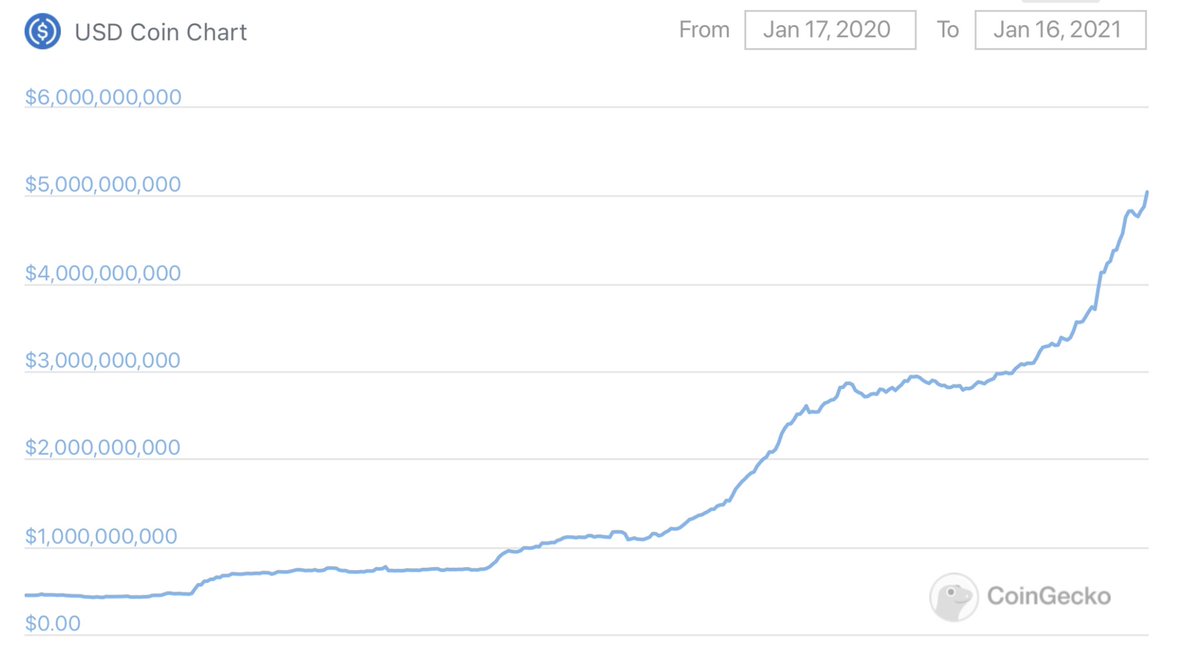

7) Now going back to the article itself. One of the points the author makes is that the issuance of Tether is seemingly sketchy. But if we compare the past issuance of USDT to USDC (by market cap), we can see that demand grew very similarly between the two:

8) Another point the author makes is about Tether issuance and its relationship with Bitcoin price (which they admit themselves that they haven't conclusively analyzed). In particular, the author points out that Tether issuance seems to be correlated with the Bitcoin price.

9) This observation doesn't seem troubling to me. It makes sense that demand for Tether would be correlated for demand for Bitcoin. Tether makes it easy to conduct cryptocurrency trades as a USD stand-in in the crypto ecosystem. And a similar correlation can be noted of USDC.

10) See also (2) in the links in the last Tweet for a podcast in which the former head of Circle's OTC desk talks about his experience with/views on Tether.

11) Let's move on to the bit about offshore exchanges using USDT while Coinbase uses USDC. Not surprising at all--Coinbase is part of the consortium that issues USDC. Why would they support a competing stablecoin (and split market liquidity) that has less solid regulatory rep?

12) As for the exchange promotions, I'm not really sure what the author is trying to get at here. Coinbase (a dominant player) isn't giving away free money while other (mostly smaller) exchanges looking for more customers are => Tether is a scam? lol

13) And finally, the supposed lack of Bank reserves. I'm not going to pretend like I've scoured the ends of the Earth looking for where Tether may have stashed their funds (I haven't). But the public availability of the data the author points out, combined with my belief...

13.5) ...in at least an ounce of market efficiency in liquid markets like those of Tether and that Tether is presently still trading at ~$1 suggest to me the author has incomplete information. Why haven't the mentioned "well-capitalized hedge fund managers" acted on this yet?

14) In any case, based on (anecdotal) testimonials from institutional players it seems Tether has at least enough reserves for day-to-day ops. A bank run remains a major potential issue, but that's different from a fraudulent operation (and would impact the market differently) https://twitter.com/paoloardoino/status/1349477895497019392

15) As a side note, the credibility of the author is severely brought into question with quotes like "I...assumed Tether was now old news and would surely have been pulled from the markets, and dismissed it as a factor in my buying decision" and...

15.33) ..."in early January, a forum post caught my eye...On January 8th, I saw this post on Hacker News about Tether manipulating the price of Bitcoin. That shook me: I’d assumed Tether had been purged from the crypto markets, yet apparently it was still around." and...

15.67) ..."This worried me. Most of my wealth was exposed in the form of Bitcoin, and Bitcoin seemed like it might be exposed to Tether. And Tether’s issuing company was under active investigation." (the list goes on and on)

16) Anyone who isn't just a tourist to the cryptocurrency markets knows how big of a presence Tether has. How much knowledge about the cryptocurrency markets does the author really have?

17) And that's not even considering quotes like "I suspected Bitcoin would be inflation-resistant because of its enforced scarcity" (b/c the rest of the market definitely wouldn't have priced that in  ), the cliché smoking gun conversation, the pervasive references...

), the cliché smoking gun conversation, the pervasive references...

), the cliché smoking gun conversation, the pervasive references...

), the cliché smoking gun conversation, the pervasive references...

17.5) ...to "The Big Short", or the general theatrical writing style that, to me, paint the author as a self-aggrandizing charlatan who believes they're smarter than the market merely by using investing platitudes and tropes. Market efficiency be damned.

18) So to conclude, IMO this article amounts to little more than a fear-mongering sensationalist hit piece. *That's not to say I believe that Tether is 100% a non-issue*, but lazy journalism like this is unproductive and only muddies the waters for substantive discussion.

19) The lack of transparent audits and the possibility of a bank run continue to be risk factors for the cryptocurrency markets, but I think it's a leap to call Tether a clear and obvious fraud.

20) As for my personal strategy regarding Tether, I have a leveraged-long USDCUSDT position (i.e short USDT against USDC) as a hedge against any Tether collapse to help me sleep at night

Appendix) Sources/Interesting side pieces:

(1) https://ag.ny.gov/press-release/2019/attorney-general-james-announces-court-order-against-crypto-currency-company

(2) https://open.spotify.com/episode/4p0TREhRen8c3LsYvJFRmN?si=VR2dt28IQFedMYHlPE-SWg (tether discussion starts at 50:30)

(3) https://btconometrics.medium.com/bitcoin-and-usd-tether-beb4d0285648 (Does Tether Printing Cause Bitcoin Price Movement?)

(1) https://ag.ny.gov/press-release/2019/attorney-general-james-announces-court-order-against-crypto-currency-company

(2) https://open.spotify.com/episode/4p0TREhRen8c3LsYvJFRmN?si=VR2dt28IQFedMYHlPE-SWg (tether discussion starts at 50:30)

(3) https://btconometrics.medium.com/bitcoin-and-usd-tether-beb4d0285648 (Does Tether Printing Cause Bitcoin Price Movement?)

Read on Twitter

Read on Twitter