Future LPs: I'll always want to make it easy to co-invest w/me.

Future LPs: I'll always want to make it easy to co-invest w/me. Micro-VCs tend to be allocation-rich but capital-poor. If you're an LP way outside the VC ecosystem, you likely have the opposite prob. That makes for a potential perfect pairing! https://oper8r.substack.com/p/benchmarks-demystifying-vc-co-investing

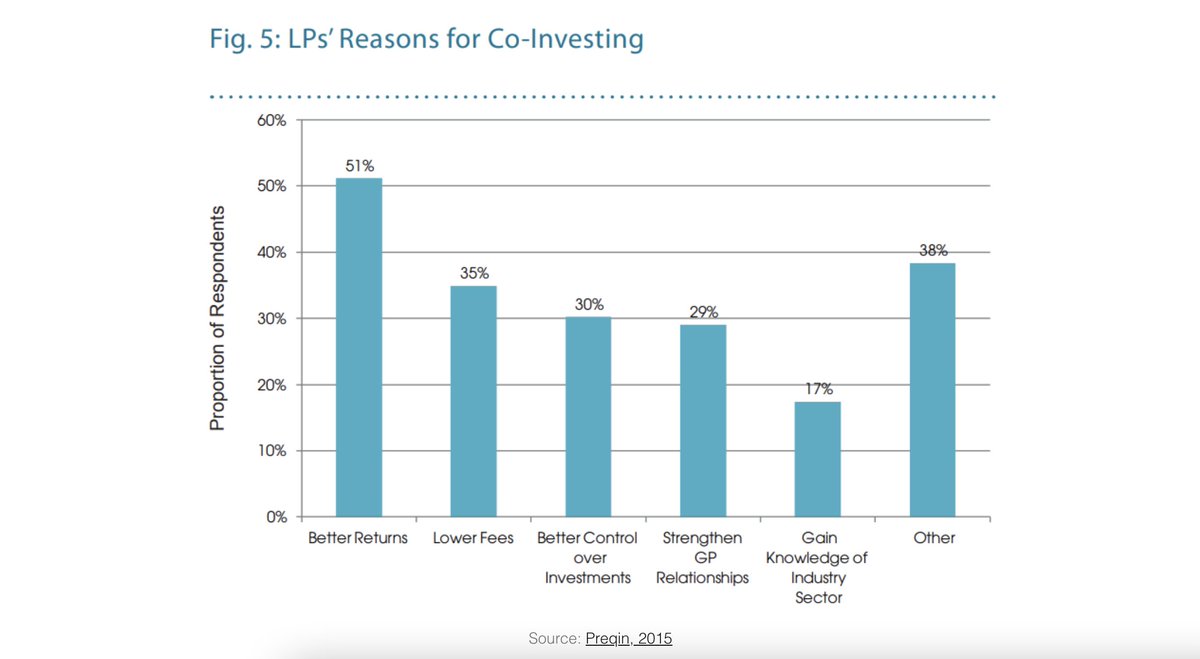

LPs: below are reasons to co-invest with your micro-fund managers.

LPs: below are reasons to co-invest with your micro-fund managers.1/better returns

2/lower fees

3/better control of investment

4/strengthen GP relationship

5/gain knowledge of industry sector

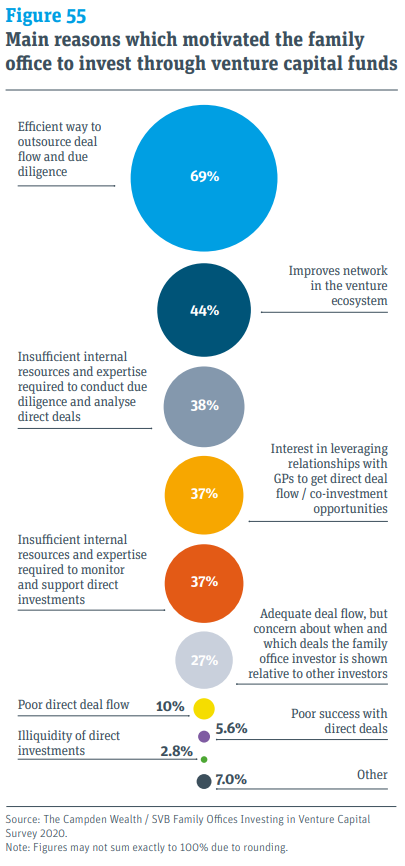

Family offices wondering why it makes sense to invest in micro-funds: some reasons

Family offices wondering why it makes sense to invest in micro-funds: some reasons

1/efficient way to outsource deal flow + due diligence

2/improves network in venture ecosystem

3/insufficient internal resources/expertise for dd

4/ interest in leveraging relationship w/GPs

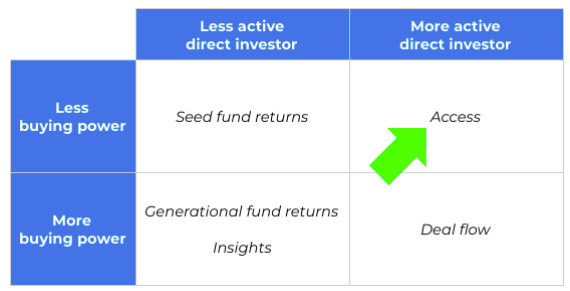

Emerging fund managers: lets work with LPs who can benefit from their investment in us the most.

Emerging fund managers: lets work with LPs who can benefit from their investment in us the most. https://oper8r.substack.com/p/framework-not-all-lps-invest-in-emerging

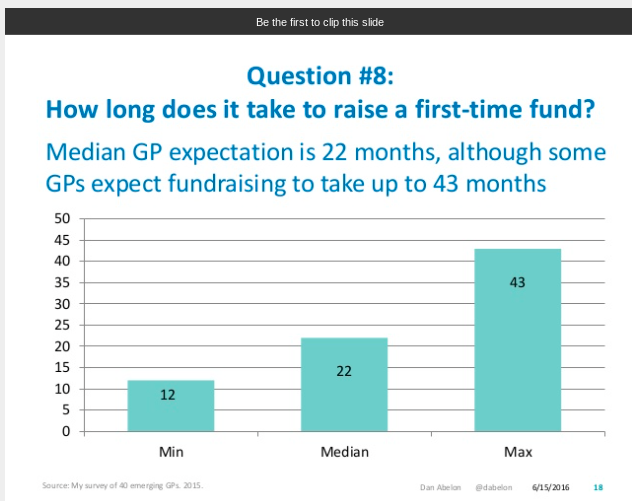

Aspiring fund managers: I love this observation that @oper8rio makes: SPVs can let VCs and LPs date before getting married rather quickly.

Aspiring fund managers: I love this observation that @oper8rio makes: SPVs can let VCs and LPs date before getting married rather quickly. "Compared to the median of >650 days to raise a blind pool, 26 days to close an SPV should look very attractive to a VC - or an LP."

Read on Twitter

Read on Twitter