1/22 Compounding #crypto. This thread breaks down a working compounding strategy that is risk-less, stress-less, and time-wise manageable - in order to 35X your funds over a year. Best for the beginners with < $10k initial fund! Read it, I PROMISE it won’t disappoint.

2/22 First about holding, there are great coins that each just did 10X to 20X from March 2020 to their current price and they still continue like #BTC  #XLM #ETH #LTC #ADA #VET #LINK #BNB

#XLM #ETH #LTC #ADA #VET #LINK #BNB  #DOT

#DOT  #YFI #BAT #XRP #TRX and more. I hope you have a gigantic bag on each of them.

#YFI #BAT #XRP #TRX and more. I hope you have a gigantic bag on each of them.

#XLM #ETH #LTC #ADA #VET #LINK #BNB

#XLM #ETH #LTC #ADA #VET #LINK #BNB  #DOT

#DOT  #YFI #BAT #XRP #TRX and more. I hope you have a gigantic bag on each of them.

#YFI #BAT #XRP #TRX and more. I hope you have a gigantic bag on each of them.

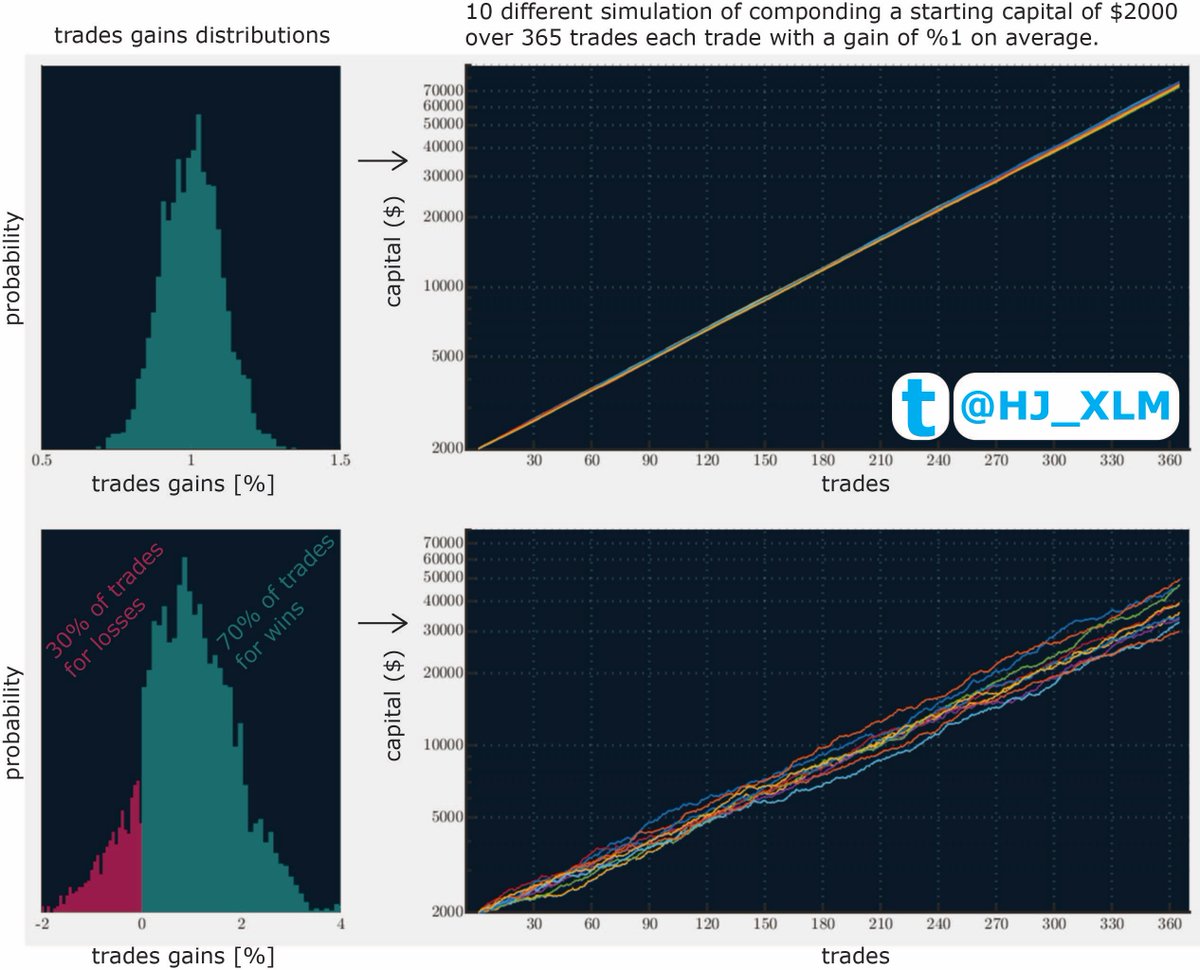

3/22 This compounding strategy comes down to this single line:

$2000*(1+0.01)^365 = $75566

All you need is 1 hour of your time every day, at your own place, at your own schedule, and a starting capital (e.g. $2000), and I will outline here how and what resources to use.

$2000*(1+0.01)^365 = $75566

All you need is 1 hour of your time every day, at your own place, at your own schedule, and a starting capital (e.g. $2000), and I will outline here how and what resources to use.

4/22 Let’s break it down for an initial fund of $2000. The 0.01 is for trades with 1% gain, such as buy a coin at $100 and sell it at $101, buy at $50 and sell at $50.5, or buy at $0.100 and sell at $0.101, basically scalp. Do this daily with all your fund for 365 days (a year).

5/22 I prefer compounding USD using its pairs with the 20 highest cap coins (just because these have highest liquidity on the exchanges and are safer), but you could compound your coin of interest using its USD, BTC, ETH (etc) pairs, especially when its on uptrend. Fair?

6/22 Time, risk, and stress manageable. Your fund is sitting on USD so you don’t need to worry about crypto volatility during your work, sleep, or family, but it increases with an excellent daily rate. You set aside an hour every single day to catch your %1 gain. How? Next.

7/22 During the times when market is most volatile, e.g., the last hour of daily candle closing, are obviously ideal to do your trades. You could also do multiple smaller trades to ultimately fill your 1%. How to get your daily 1% gains? Just buy low, sell high! But how? Next.

8/22 Doing 1% trade in an hour wouldn't be a big deal. It is not a 15%, even using indicators like MACD/RSI/CandlePatterns on the exchanges you can easily do the %1 gain each time. A challenge here is to manage it daily! I will provide here practical tips and a strategy.

9/22 There are excellent resources to leverage to boost your daily %1 trades: Exceptional tweeter accounts who post daily charts: @LisaNEdwards @nebraskangooner @CastilloTrading @tradingroomapp @crypto_birb @CryptoCobain, use them as a guide for market sentiment each day.

10/22 Review trading resources at https://elliottwave-forecast.com/ and educational resources by @KoroushAK @PhilakoneCrypto @girlgone_crypto and keep up with them! These could take a week to provide you more than enough knowledge needed for your %1 trades.

11/22 @TradingView is the best to chart coins. You can use its pine editor to customize/extend the # of indicators you can use even with basic membership (0 fees). Just YouTube "pine tradingview" and use your Math skills. DM me for help on this or for customized indicators.

12/22 I recently got @BinanceUS, verification was quick, the app has a great UI, it’s instantaneous, a lot of trading pairs with high liquidity on high caps, and importantly it has USD pairings. Sometimes I'd paranoid (perhaps I shouldn’t had though) what if USDT tanks.

13/22 With USD pairs, I compound USD, so my funds are on the real $$$ amounts all the time except the short trade_duration. On trading fees: with @BinanceUS turn on the “use #BNB  for 25% discount”. Each day before your trade, buy some BNB (like worth $15 for $10k trade).

for 25% discount”. Each day before your trade, buy some BNB (like worth $15 for $10k trade).

for 25% discount”. Each day before your trade, buy some BNB (like worth $15 for $10k trade).

for 25% discount”. Each day before your trade, buy some BNB (like worth $15 for $10k trade).

14/22 It is always better to place multiple laddered orders (e.g., worth $500 at $100.000, $500 at $100.001, & $500 at $100.002) rather than one big order ($1500 at $100). Monitor the order book while placing.

15/22 When not trading, you could ladder buys at multiple lower (weighted more to lowest) fib levels. Use the range (Open - Low) of daily candles for setup insights. You would be surprised with occasional +5% catches by wicks doing nothing. Good for fees, losses and quiet days.

16/22 Final months are going to be the most challenging as the position size would be the largest, still not big deal if trading with high caps. But might be best to divide each day’s trade on few coins to not get chopped on one, and to extend last 2 months to 4.

17/22 In this strategy, it is better to avoid small cap pairs to not get stock on a trade for days. Also set yourself a threshold amount (e.g., $100 for loss) and don’t be afraid to cut orders if they go south. Don’t get disappointed when this happens.

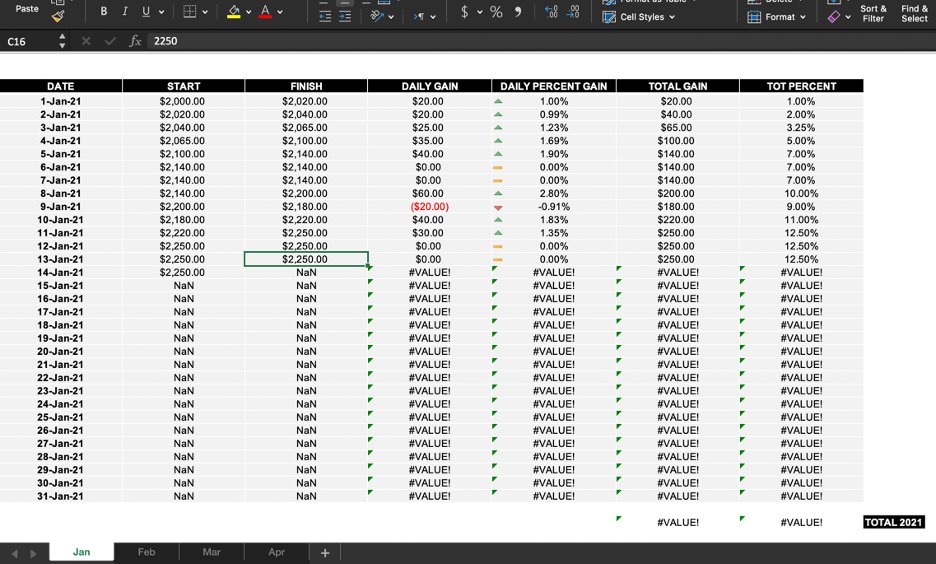

18/22 Use a programmed Excel to record and keep track of your daily results. This should be as simple as entering your daily balance (from your exchange) to the excel at the end of your trading day to see and record the results (10 seconds). Ping me, I can share the excel.

19/22 This is all about a simple feasible plan, an execution strategy and resources, and your discipline. That is all. Use these very core resources and customize your strategy - based on what level of trading you are and your skills. How? Next.

20/22 The rule was: C*(1+perc/100)^N. Decide how much initial capital you start with (C, e.g., $2000), set yourself a reasonable daily percent gain target (perc, %1), and plan for the number of days (N, 365). Plug it into google, adjust the variables and tailor your plan.

21/22 Have your plan, stick to your rules, keep improving your knowledge on the foundation of the projects, keep sharpening your trading skills, and keep rocking. Thank you for reading! Good luck! Don’t forget a like/retweet if you think this could be helpful for someone!

22/22 If new to @BinanceUS, it would really be appreciated if you register with my Referral ID: 52310757 if you find this helpful. The ID is also on my tweeter cover photo. @HJ_XLM! Thanks a lot! https://www.binance.us?ref=52310757binance.us/?ref=52310757

Final note. Consider someone initiating a startup, a content creator, or one running a business, the amount of time, resources, and effort that goes into this Compounding Strategy (to make the consistent +%1 daily gains) is honestly incredibly low, yet the result is comparable.

Read on Twitter

Read on Twitter