#PersonalFinanceMythBusters

#1 Avoid funds or investments that charge a higher fee.

Rentech's Medallion fund charges 5% and 44% fee and has delivered a 66% return. If a manager has consistently delivered superior post-fee returns, you'll benefit way more than the fee.

#1 Avoid funds or investments that charge a higher fee.

Rentech's Medallion fund charges 5% and 44% fee and has delivered a 66% return. If a manager has consistently delivered superior post-fee returns, you'll benefit way more than the fee.

#PersonalFinanceMythBusters

#2 Don't use credit cards

Problem is not with credit cards but with discipline. Like with anything else in life.

If you are disciplined (pay back on time), there are many rewards. Also free credit. If not, you'll get into a vicious cycle.

#2 Don't use credit cards

Problem is not with credit cards but with discipline. Like with anything else in life.

If you are disciplined (pay back on time), there are many rewards. Also free credit. If not, you'll get into a vicious cycle.

#PersonalFinanceMythBusters

#3 Spend only on experiences, not possessions

Spend on what makes YOU happy. Not your social circle. Not what the world tells you will make you happy.

Could be a luxurious trip, or the fastest sports car or that gorgeous bag or jumping off a plane.

#3 Spend only on experiences, not possessions

Spend on what makes YOU happy. Not your social circle. Not what the world tells you will make you happy.

Could be a luxurious trip, or the fastest sports car or that gorgeous bag or jumping off a plane.

#PersonalFinanceMythBusters

#4 Value/Growth/Momentum/ Quant Investing makes money

There are many ways to make money in the market. Find a style/manager that jibes with your investing style and behaviour. Discipline makes money. More than style.

#4 Value/Growth/Momentum/ Quant Investing makes money

There are many ways to make money in the market. Find a style/manager that jibes with your investing style and behaviour. Discipline makes money. More than style.

#PersonalFinanceMythBusters

#5 More complex the products, superior the returns

If you want excitement, go to the casino. Don't invest in what you don't understand. Take the time, understand the risks.

#5 More complex the products, superior the returns

If you want excitement, go to the casino. Don't invest in what you don't understand. Take the time, understand the risks.

#PersonalFinanceMythBusters

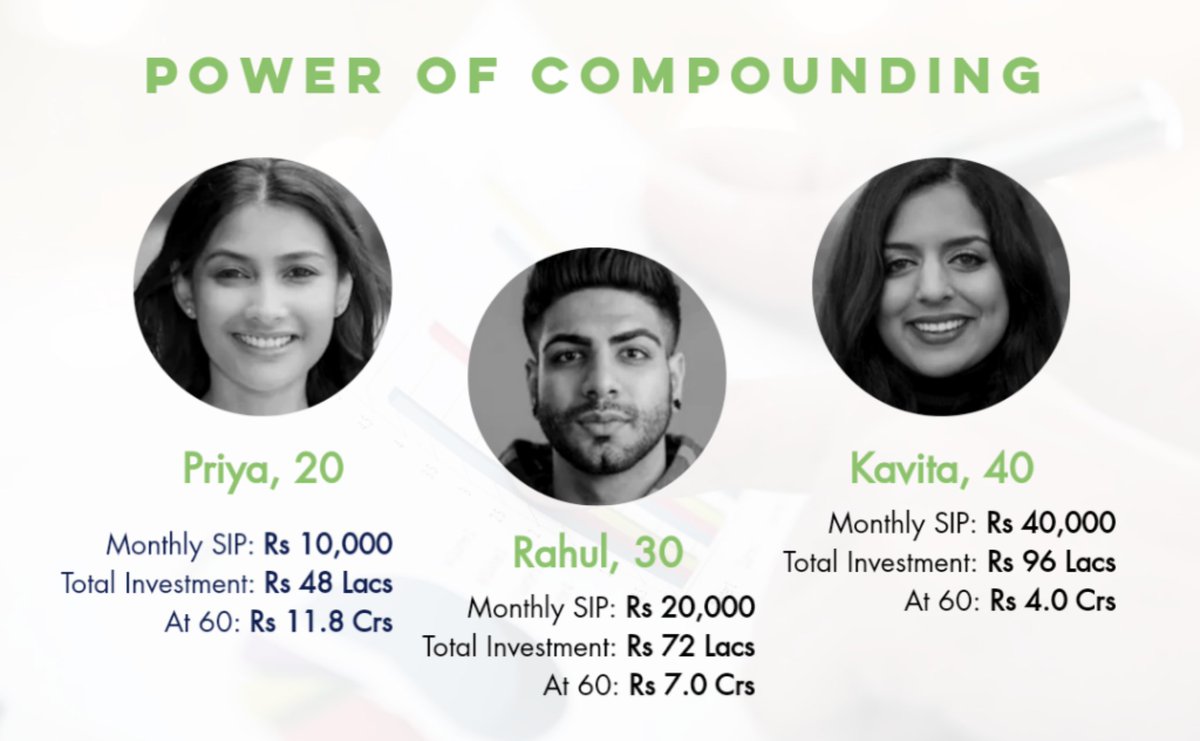

#6 I'll invest when I have more money

You can start investing with as little as Rs 500. How long you invest matters a lot more than how much you invest. Start today. #MagicOfCompounding

#6 I'll invest when I have more money

You can start investing with as little as Rs 500. How long you invest matters a lot more than how much you invest. Start today. #MagicOfCompounding

#PersonalFinanceMythBusters

#7 I'm too young to think about retirement

Retirement is no longer 60. There is no job security. No one gets a lifelong pension. (Except maybe the government).

Play with this to see what you'd need https://www.mywealthguide.com/retirement-calculator

#7 I'm too young to think about retirement

Retirement is no longer 60. There is no job security. No one gets a lifelong pension. (Except maybe the government).

Play with this to see what you'd need https://www.mywealthguide.com/retirement-calculator

#PersonalFinanceMythBusters

#8 I invest in insurance

Insurance is for protection. To manage risk from an unforeseen event. Seperate investment from protection.

A phone also takes pictures, but would you rather use that or a DSLR, to photograph your wedding ?

#8 I invest in insurance

Insurance is for protection. To manage risk from an unforeseen event. Seperate investment from protection.

A phone also takes pictures, but would you rather use that or a DSLR, to photograph your wedding ?

#PersonalFinanceMythBusters

#9 I invest in only no risk products

There are two kinds of risks. One that you see - capital loss. The other that you don't - opportunity cost.

If you can afford to take risk, but don't, that is also a huge risk to your networth.

#9 I invest in only no risk products

There are two kinds of risks. One that you see - capital loss. The other that you don't - opportunity cost.

If you can afford to take risk, but don't, that is also a huge risk to your networth.

#PersonalFinanceMythBusters

#10 It's available for free online

You always pay. It could be money, it could be time. But payment has to be made.

You can google your symptoms and take meds or you can go to a doctor. Similarly in finance, risk of little knowledge can be expensive

#10 It's available for free online

You always pay. It could be money, it could be time. But payment has to be made.

You can google your symptoms and take meds or you can go to a doctor. Similarly in finance, risk of little knowledge can be expensive

Read on Twitter

Read on Twitter