1/ Yesterday I pushed out a report covering the various angles of growth observed across the NFT ecosystem.

2020 was a monumental year for NFTs, and the stage is well and truly set for another record-setting year in 2021.

https://www.delphidigital.io/reports/nfts-a-multifaceted-ecosystem/

https://www.delphidigital.io/reports/nfts-a-multifaceted-ecosystem/

2020 was a monumental year for NFTs, and the stage is well and truly set for another record-setting year in 2021.

https://www.delphidigital.io/reports/nfts-a-multifaceted-ecosystem/

https://www.delphidigital.io/reports/nfts-a-multifaceted-ecosystem/

2/ For those of you new to the topic, take a moment to familiarize with what non-fungible tokens are as well as how they might become a core driver of the evolution of online content.

Don't be afraid to let the imagination wander!

Don't be afraid to let the imagination wander!

3/ Whilst data remains relatively fragmented, the numbers of active marketplace users is clearly growing with almost $90M in sales.

Largely driven by 4 major categories:

Largely driven by 4 major categories:

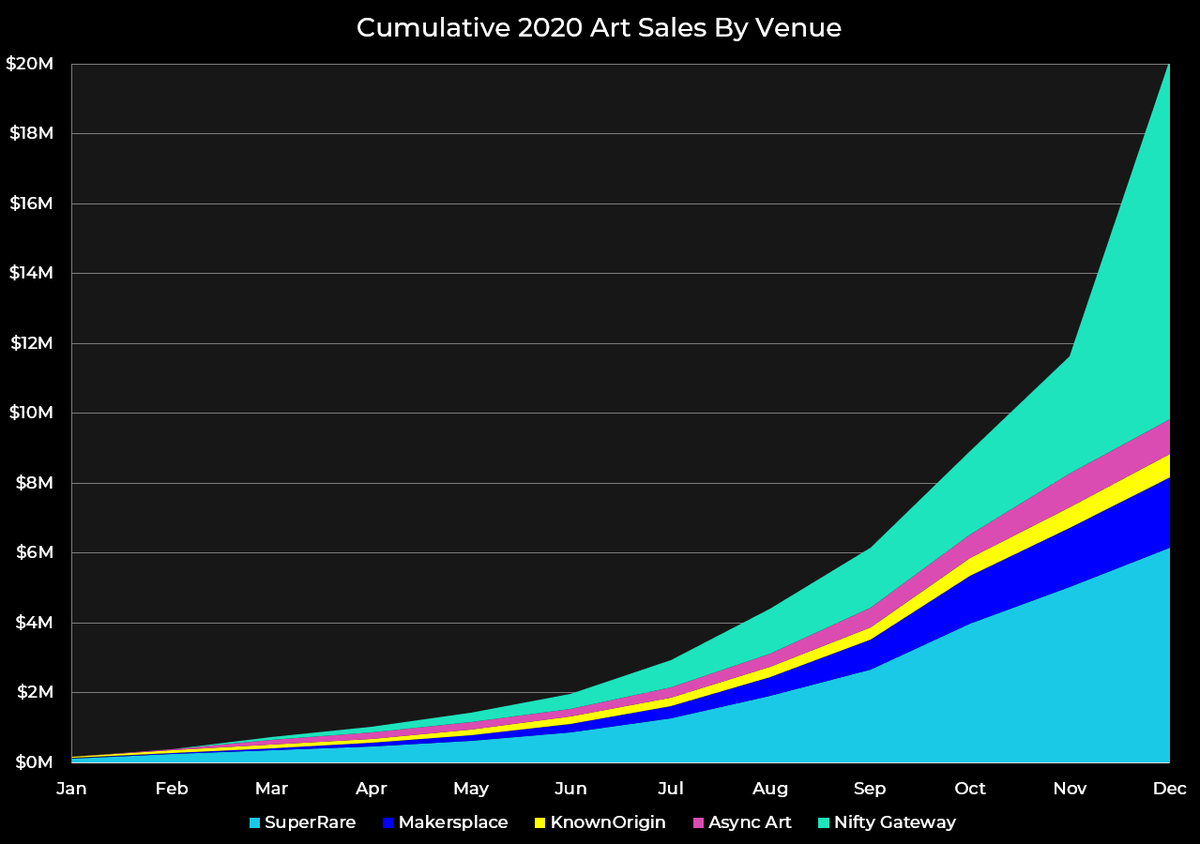

- Crypto Art (>$20M)

- Crypto Sandboxes/Virtual Worlds (>$16M)

- Video Games (>$15M)

- Collectibles ($16M)

Largely driven by 4 major categories:

Largely driven by 4 major categories:- Crypto Art (>$20M)

- Crypto Sandboxes/Virtual Worlds (>$16M)

- Video Games (>$15M)

- Collectibles ($16M)

4/ The dip in marketplace activity due to high gas fees during the "DeFi Summer" is notable: as activity and sales declined.

Interestingly, we see that throughout the year the amount of NFTs sold per month declined whilst average sale price went up.

Interestingly, we see that throughout the year the amount of NFTs sold per month declined whilst average sale price went up.

5/ This is likely indicative of gas fees forcing users to focus on buying quality over quantity, whilst smaller transactions on mainnet were prohibitively expensive forcing them to shift to layer 2s such as Matic, or not take place at all.

6/ We have seen a dramatic expansion of options for investment as more projects explore tapping into this emergent universal digital representation layer.

Meanwhile, there's maturing financial infrastructure for things like fractionalization, indexing, and lend/borrow activity.

Meanwhile, there's maturing financial infrastructure for things like fractionalization, indexing, and lend/borrow activity.

7/ The exchange landscape remains dominated by the universal marketplaces, but we are seeing activity fracture into specialized venues.

We expect this trend to continue as in the long run, not all users will be happy to mix focus and governance cross-category.

We expect this trend to continue as in the long run, not all users will be happy to mix focus and governance cross-category.

8/ Crypto Art was arguably the breakout NFT sector of 2020. It's clear that this category has found product-market fit earlier than others.

This is perhaps attributable to the clear value propositions toboth collectors and creators, alongisde fewer scalability concerns.

This is perhaps attributable to the clear value propositions toboth collectors and creators, alongisde fewer scalability concerns.

9/ Nifty Gateway exploded onto the scene by drawing in talented creators from outside the ecosystem to participate in their drop model.

Their pipeline seems as full as ever with @JustinRoiland next Tuesday!

Eager to see if other exchanges do similar. https://twitter.com/pierskicks/status/1338590621217550344?s=20

Their pipeline seems as full as ever with @JustinRoiland next Tuesday!

Eager to see if other exchanges do similar. https://twitter.com/pierskicks/status/1338590621217550344?s=20

10/ The four leading crypto sandboxes continue to battle it out. These are places and platforms as much as they are games.

The projects remain largely distinguised by community and aesthetics rather than stand out feature sets.

https://twitter.com/pierskicks/status/1330954450312318977

The projects remain largely distinguised by community and aesthetics rather than stand out feature sets.

https://twitter.com/pierskicks/status/1330954450312318977

11/ Crypto Games:

- New biz models unlocked

- Higher ARPUs than traditional game industry

- 700K game assets sold in 2020

- Axie grew users 11.6x

- Play to Earn exploding in emerging markets

New tools to:

- Bootstrap adoption

- Promote loyalty

- Enable community governance

- New biz models unlocked

- Higher ARPUs than traditional game industry

- 700K game assets sold in 2020

- Axie grew users 11.6x

- Play to Earn exploding in emerging markets

New tools to:

- Bootstrap adoption

- Promote loyalty

- Enable community governance

12/ The collectibles market has seen strong activity driven by sports-themed projects such as @SorareHQ and @nba_topshot.

@flow_blockchain's flagship NBA title did more secondary market volume in its first year than the Top 10 WAX projects combined.

More brands and IP in 2021.

@flow_blockchain's flagship NBA title did more secondary market volume in its first year than the Top 10 WAX projects combined.

More brands and IP in 2021.

13/ @maticnetwork + @Immutable lead the ETH NFT scaling charge. If successful at scale, L2s could erode the core value propositions of purpose-built chains like Flow.

Competing chains risk undermining the "universal digital representation layer" concept.

Time will tell.

Competing chains risk undermining the "universal digital representation layer" concept.

Time will tell.

14/ Lastly, we touch upon the DeFi-NFT Symbiosis.

DeFi brings NFTs additional utility and financial infrastructure, NFTs will bring DeFi a universe of collateral including real-world assets.

https://twitter.com/pierskicks/status/1347172685961338883

DeFi brings NFTs additional utility and financial infrastructure, NFTs will bring DeFi a universe of collateral including real-world assets.

https://twitter.com/pierskicks/status/1347172685961338883

fin/ More in the report!

If you're not yet subbed to Delphi Digital you're missing out.

Get ahead of the game. https://www.delphidigital.io/research/

If you're not yet subbed to Delphi Digital you're missing out.

Get ahead of the game. https://www.delphidigital.io/research/

Read on Twitter

Read on Twitter