*THREAD*

Scalp vs Swing Intraday trades and FOMO of “I can’t close it’s going higher.”

You’ll find yourself often caught between these feelings.

Looking at LTF for an entry, the market moves +10% and suddenly you find yourself looking to turn it into a swing.

Scalp vs Swing Intraday trades and FOMO of “I can’t close it’s going higher.”

You’ll find yourself often caught between these feelings.

Looking at LTF for an entry, the market moves +10% and suddenly you find yourself looking to turn it into a swing.

The likely outcome in the MAJORITY of situations is:

Price pumping

Feel great about PNL

Look for higher targets

Price corrects

PNL drops

Either panic close before reversal

Or close at Break Even

The process is damaging to your balance and your psychology.

Price pumping

Feel great about PNL

Look for higher targets

Price corrects

PNL drops

Either panic close before reversal

Or close at Break Even

The process is damaging to your balance and your psychology.

The reason is that your LTF entry is often unsuited as a swing entry point and if it is, your mentality is not prepared or able to hold for the swings.

This is an issue scalpers have to battle consistently. They will nail 3-4% moves while watching price often run 8-12% after.

You have to understand why you took your entry, what your expectations are and how you can manage the trade.

You have to understand why you took your entry, what your expectations are and how you can manage the trade.

Converting from a LTF trade into a HTF one comes down to greed. We see green PNL and automatically start getting carried away with expectation.

In these conditions however there needs to be some grace given to that thought process. It’s possible but under management.

In these conditions however there needs to be some grace given to that thought process. It’s possible but under management.

If you’re trading LTF you have so much opportunity so you can’t feel bad about closing. You are also free to enter the same market on a new set up. Nothing freezes you out.

You have a couple of options to deal with this process:

1. If you’re trading a scalp, take your profit, be happy, move to the next set up. As scalpers we have multiple opportunities to join trends and multiple markets. Just move on to the next flip opportunity.

1. If you’re trading a scalp, take your profit, be happy, move to the next set up. As scalpers we have multiple opportunities to join trends and multiple markets. Just move on to the next flip opportunity.

2. Ride your position until the LTF trend is broken. You won’t exit at the top but you’ll know you’ve pushed your position to the limits of what is technically achievable during a LTF run.

3. If you want to run your scalp into a swing you have to imagine your PNL is $0. Your PNL should not matter to you as you’re not at target. Do not become fixated with your PNL dropping (because it will).

If you are unable to do that, focus on taking profit and moving on.

If you are unable to do that, focus on taking profit and moving on.

The crazy thing is that when price is moving we feel FOMO for closing a position “it’s going to go more, I can’t close now, I’ll chase price higher if I do.”

We tend to venture down a psychological confirmation path when we see green PNL. We automatically assume 2 things:

1. Price will go higher towards our new target.

2. We will manage the position well until that happens. (In reality we often don’t even think about this point.)

1. Price will go higher towards our new target.

2. We will manage the position well until that happens. (In reality we often don’t even think about this point.)

You have to remember the reality of the situation which is that you will not operate perfectly and you will not complete these things perfectly despite your mind convincing you that you will.

The market never makes it easy.

The market never makes it easy.

Now in the current climate there are differences you need to take into account:

1. Markets in price discovery should be treated differently. There is no resistance.

2. Markets are aggressively bought up from lows, manage your thought process.

3. Don’t look to short.

1. Markets in price discovery should be treated differently. There is no resistance.

2. Markets are aggressively bought up from lows, manage your thought process.

3. Don’t look to short.

Play strength, manage your psychology, take profit and don’t get greedy. The market can absolutely rip apart your unrealised gains in record time.

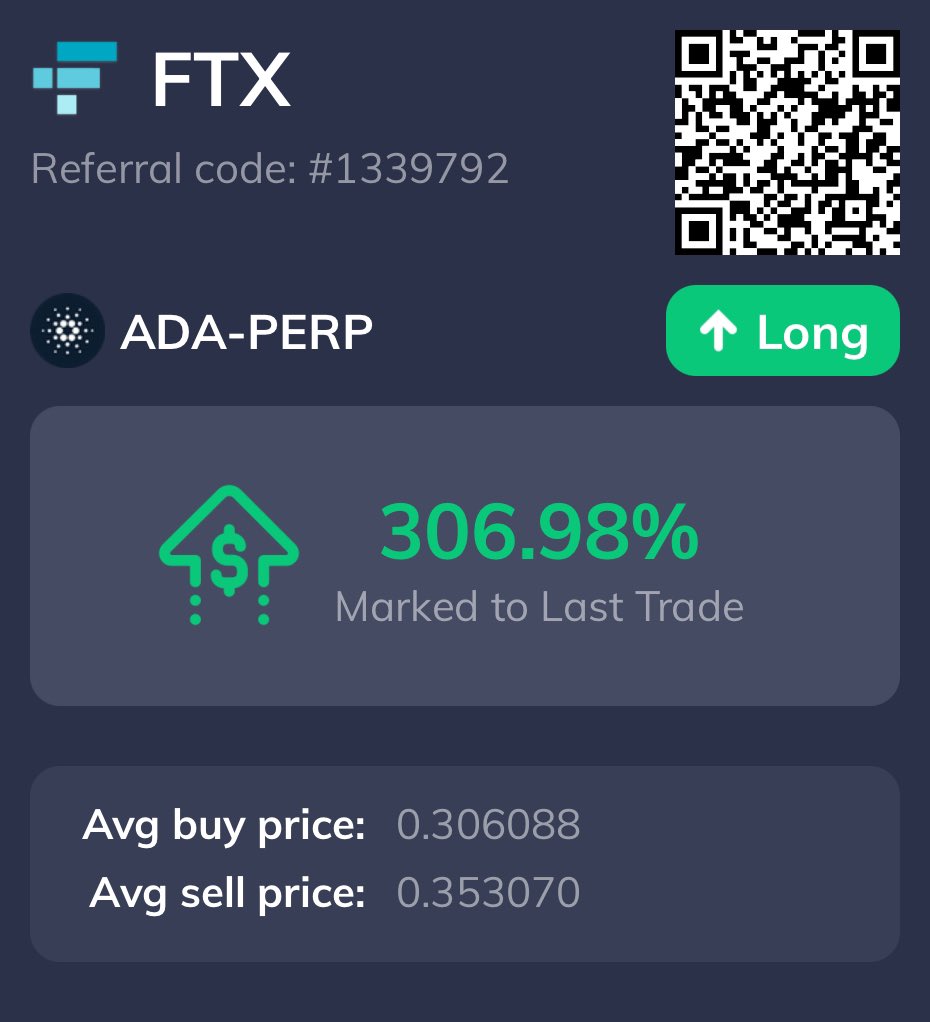

Here’s an example of an $ADA trade I took last night and fully closed today for +17%.

$ADA might push higher but for me it’s a big win, easily hits my monthly target in a single trade and I’m very happy with the result. I pay myself and move on.

$ADA might push higher but for me it’s a big win, easily hits my monthly target in a single trade and I’m very happy with the result. I pay myself and move on.

These conditions provide opportunity day after day, LTF and HTF, make sure you do not become fixated by your PNL total and making sure you try to make your big move in one trade.

The ape szn culture is fantastic in that the underlying message is GET LONG. Solid advice, you don’t want to be short in this market right now. But you also have to take profit and manage risk. The markets are volatile and while it’s good for gains, mistime an entry and its gg.

Stay safe, enjoy the szn and lock in money.

One last thing I wanted to add. If you want to be more degenerate and build a bigger position, compound don’t go all at once.

Build a base position.

Wait for pullback on LTF and add size.

Repeat until happy with degeneracy levels.

Far more effective than the coin flip all in.

Build a base position.

Wait for pullback on LTF and add size.

Repeat until happy with degeneracy levels.

Far more effective than the coin flip all in.

Read on Twitter

Read on Twitter