Some folks are arguing advanced monthly payment of CTC under an AFA-style policy like the one Biden is proposing would lead to confusion and headaches in the case of clawbacks. Previous advanced payment programs with the EITC are cited as evidence. AFAIK this is incorrect.

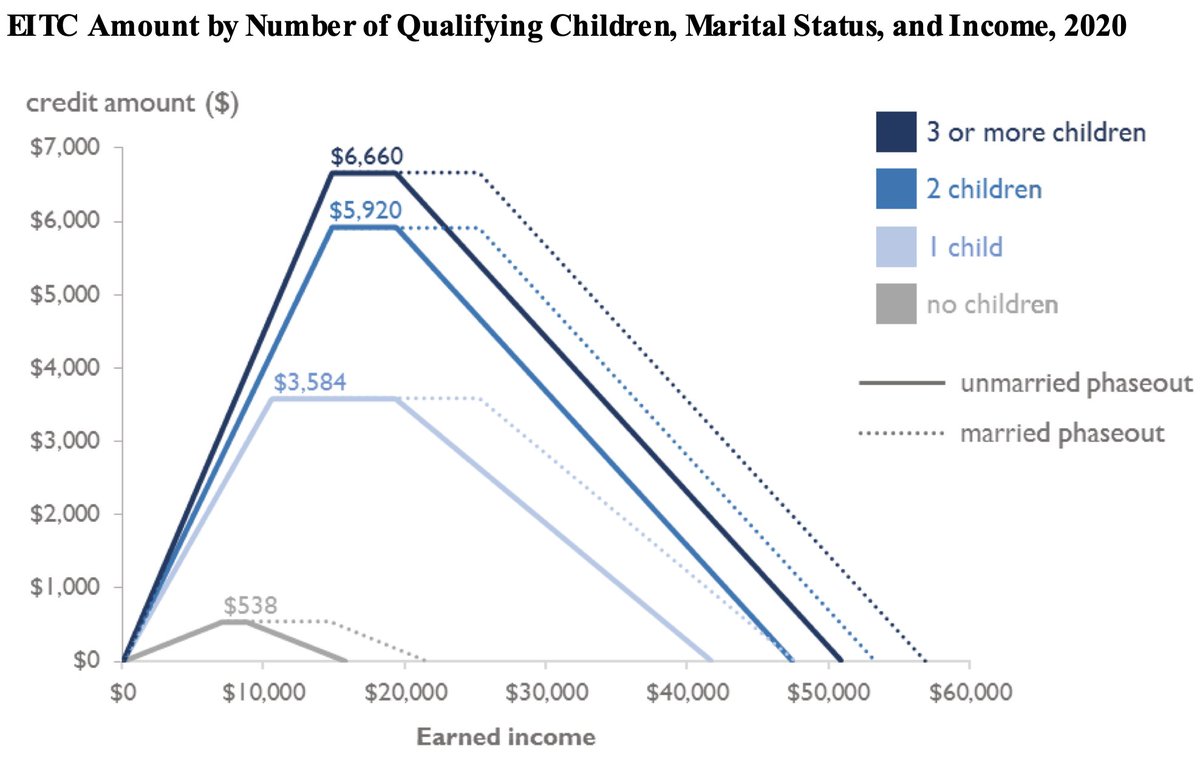

Specific structure of EITC - with large benefit amounts and phase ins/outs ranging from 16% to 45% - make it really hard to estimate annual income ahead of time. This is especially the case for those in the $0-$51K range who are eligible for it. AFA structure is very different.

Because CTC would be fully refundable with phaseout thresholds starting at $130K for singles/$180K for married (AGI I think so maybe higher gross income), any wrong estimate under those income thresholds wouldn't effect advanced credit amount. No year-end reconciliation needed.

For beneficiaries with incomes higher than $130K/$180K, an estimate that's off a bit would require year-end reconciliation. Is this a big problem? Unlikely. The phaseout is much smaller (5%) and beneficiaries are pretty well off so they can afford to pay back a few extra dollars.

Even if you think this is a big problem (I don't at all), the source is the phaseout rather than administration as a tax credit. You would have same issues if a new social security office administered a benefit with phaseouts.

There is lots of evidence from countries around the world that a fully refundable child tax credit with low phrase out rates and high phaseout thresholds wouldn't have any of the big problems some critics are attributing to it. Folks should be aware of this.

Read on Twitter

Read on Twitter