How does the correction in gold compare to past corrections during the bull market?

For this, i look at gold bull runs 1976-1980, 2002-2008, 2009-2011, and the latest run since 2019.

(1)

For this, i look at gold bull runs 1976-1980, 2002-2008, 2009-2011, and the latest run since 2019.

(1)

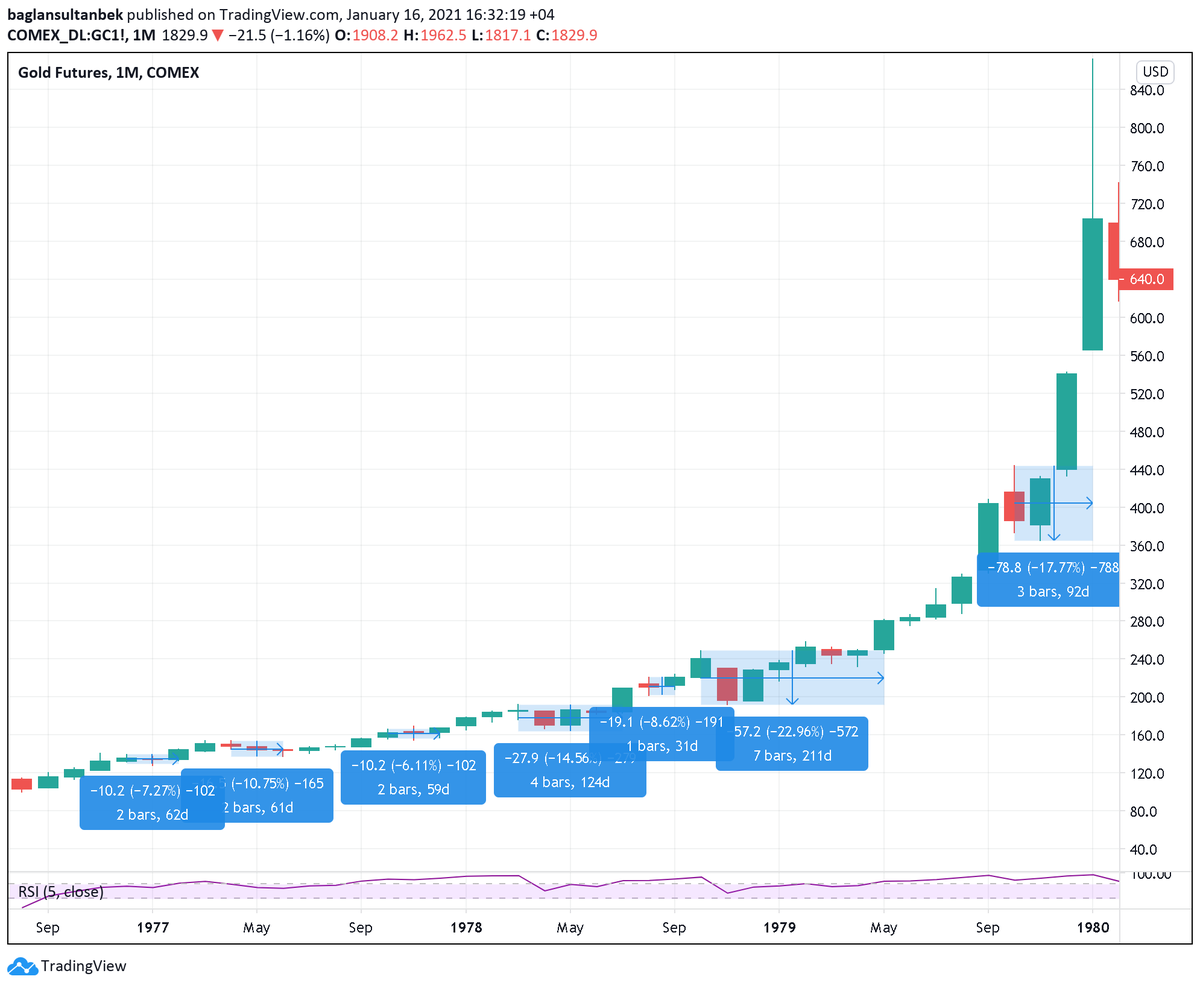

1976-1980.

7 corrections, shortest duration of 1 month and longest 7 months. Two corrections over 15%.

Notice that in all corrections price low is achieved early in correction after which price slow goes up.

7 corrections, shortest duration of 1 month and longest 7 months. Two corrections over 15%.

Notice that in all corrections price low is achieved early in correction after which price slow goes up.

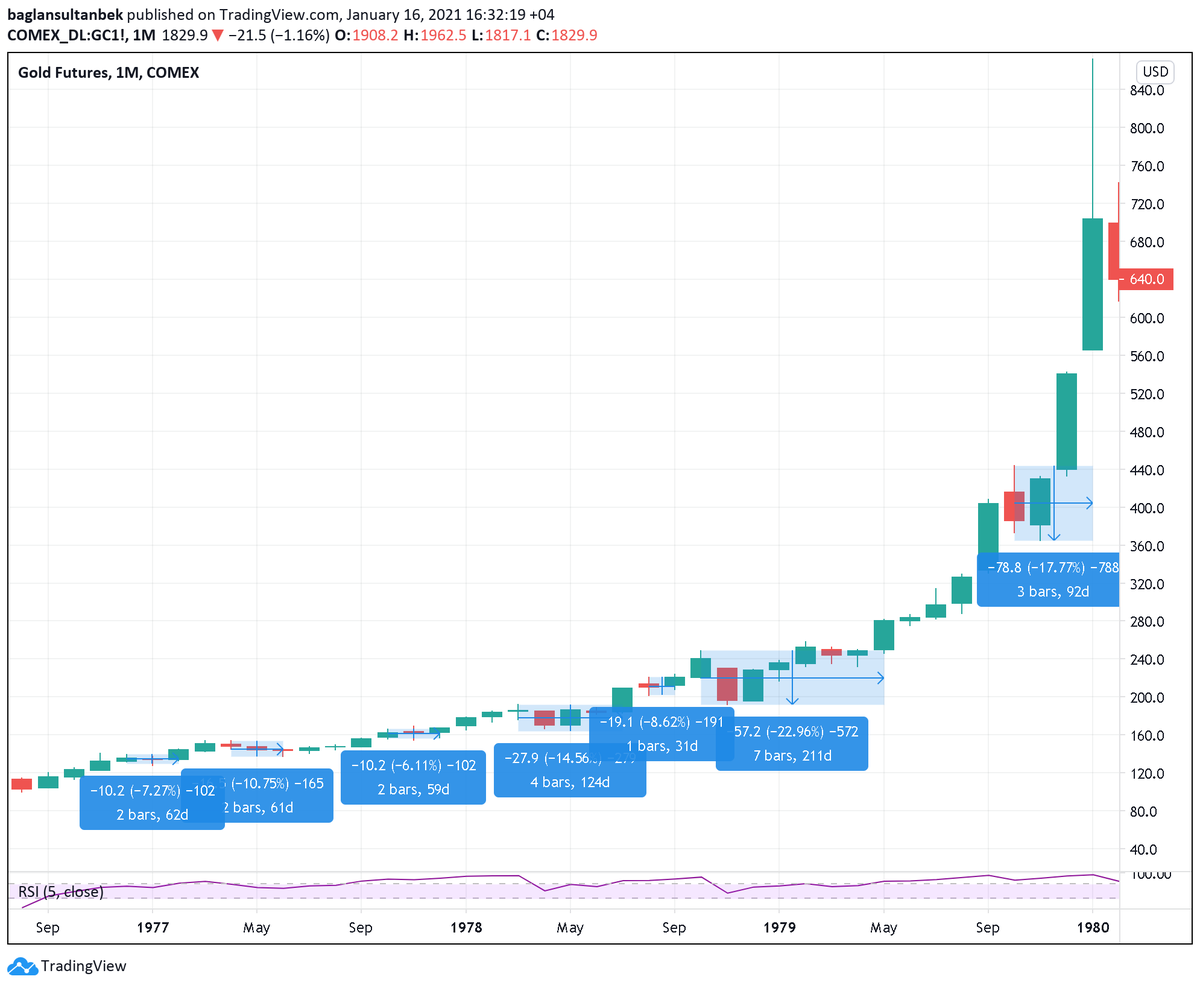

2002-2008

8 corrections, from 1 month to 14 months! Two corrections over 15%, including an exhausting 14 month consolidation over 25%.

Notice that here also in all corrections price low is achieved early in correction after which price slow goes up.

8 corrections, from 1 month to 14 months! Two corrections over 15%, including an exhausting 14 month consolidation over 25%.

Notice that here also in all corrections price low is achieved early in correction after which price slow goes up.

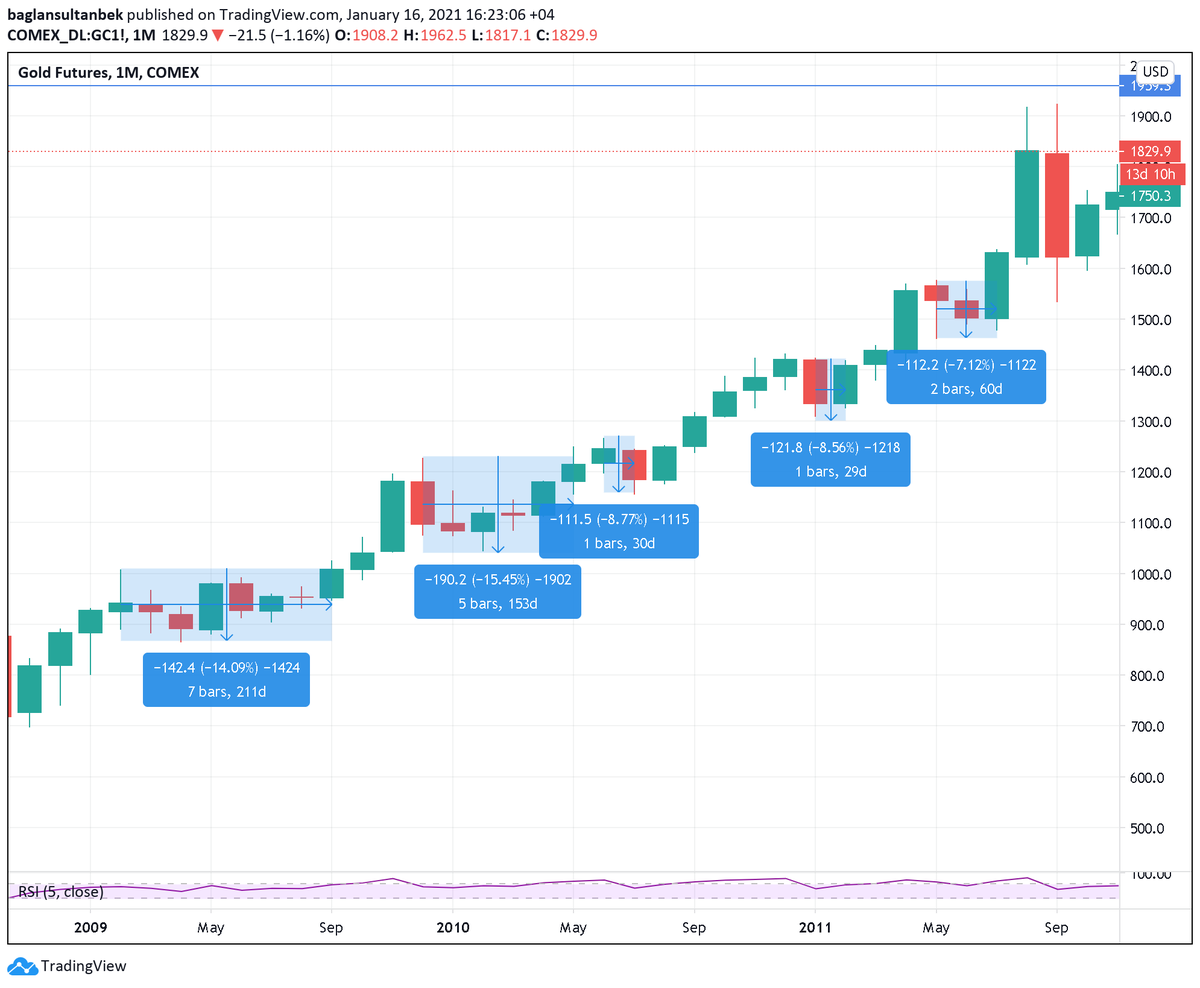

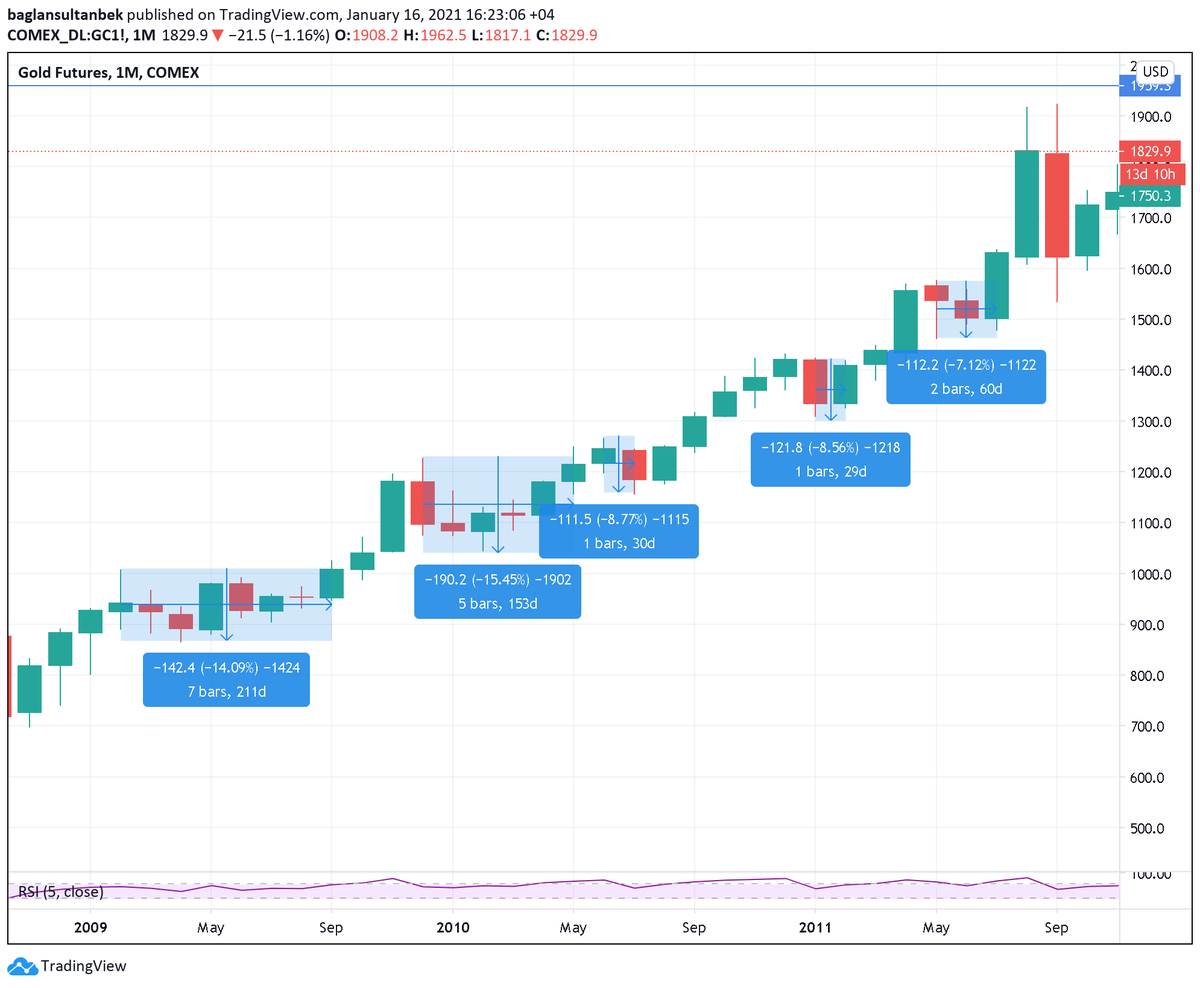

2009-2011

5 corrections from 1 to 7 months. One over 15%.for 7 months.

Notice here as well that in all corrections price low is achieved early in correction after which price slow goes up.

5 corrections from 1 to 7 months. One over 15%.for 7 months.

Notice here as well that in all corrections price low is achieved early in correction after which price slow goes up.

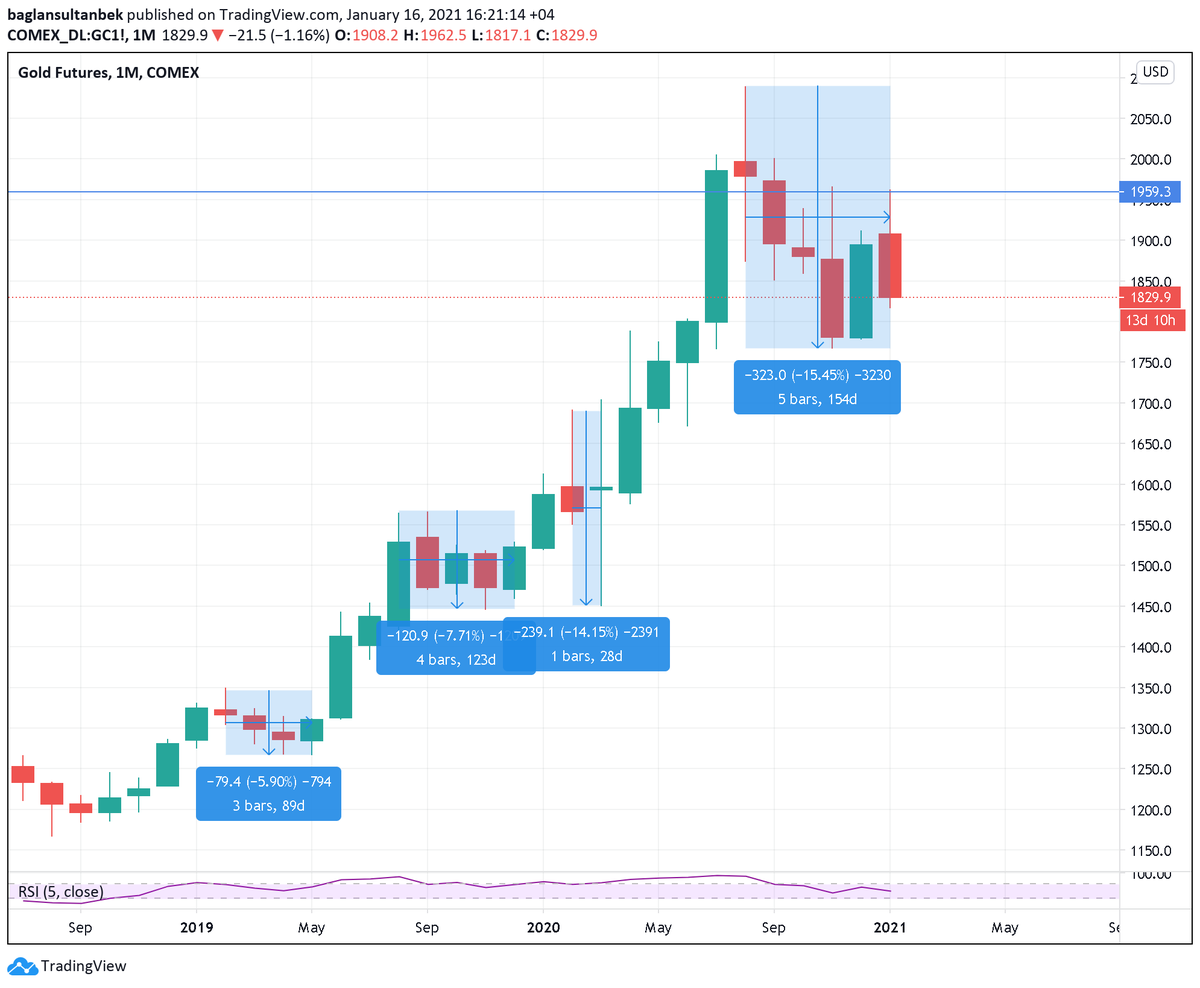

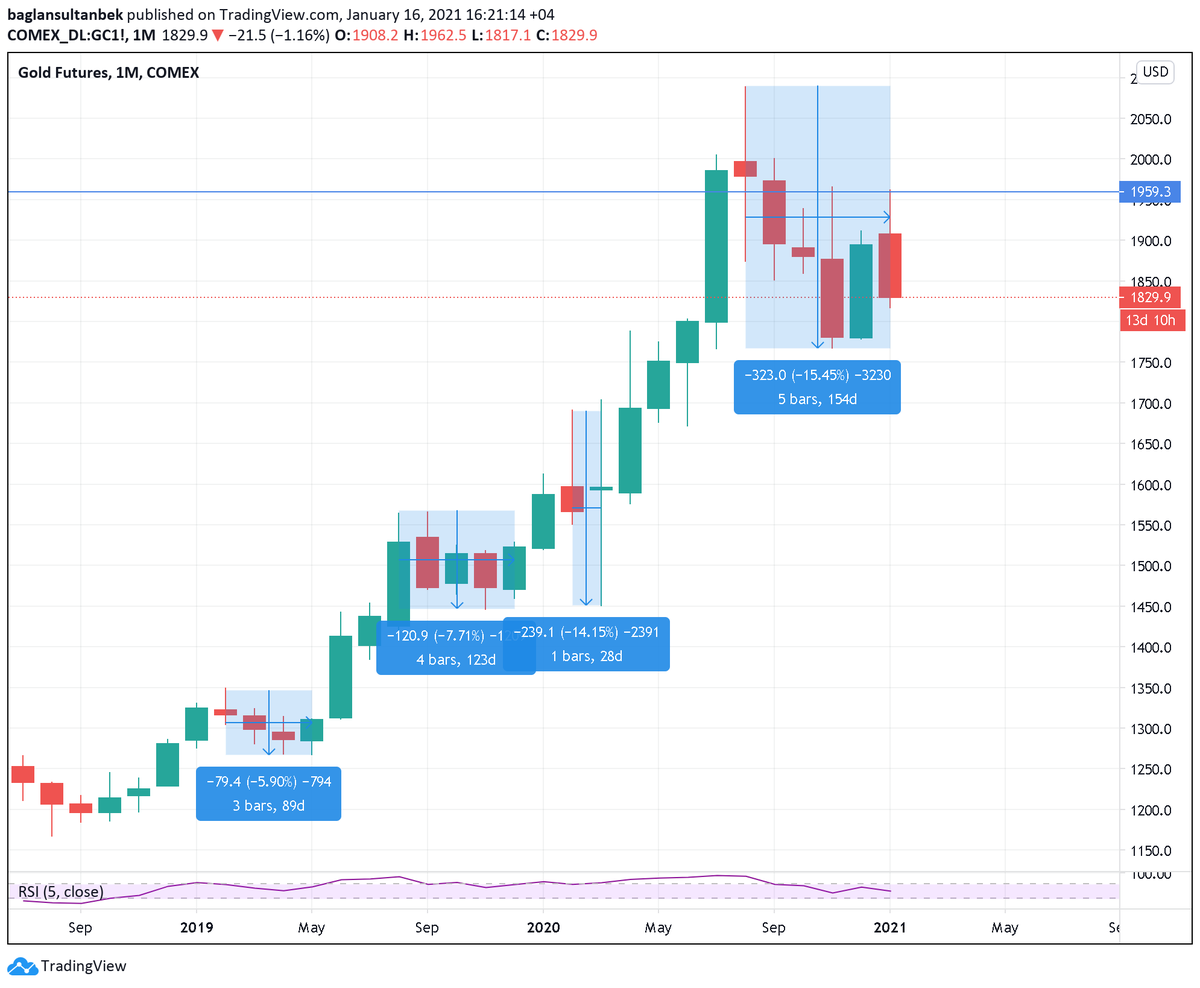

The current consolidation is in month 5 now.

Key messages:

1. Very unlikely that gold price breaks the low of $1767 so late during the consolidation. if it does, it will be first in history.

2. Very likely sideway grind before reaching ATH.

Key messages:

1. Very unlikely that gold price breaks the low of $1767 so late during the consolidation. if it does, it will be first in history.

2. Very likely sideway grind before reaching ATH.

If the price does break below 1767, then get ready for 12-14 month of pain before we get back to ATH.

Read on Twitter

Read on Twitter