Zillow Group: Transformation Underway

-- Founded in 2006, $ZG started as an online platform where sellers could list their homes for sale or rent. Over time, $ZG became well known for its Zestimate feature, which has estimates of the value of over 135M homes.

-- Founded in 2006, $ZG started as an online platform where sellers could list their homes for sale or rent. Over time, $ZG became well known for its Zestimate feature, which has estimates of the value of over 135M homes.

-- $ZG's primary business (known as the media business) makes money through advertising. Part of the advertising business consists of standard display advertising: $ZG sells its ad properties to third party advertisers.

-- However, the company’s bread and butter ad business is Premium Agent, which generates leads for real estate agents and landlords. When a user searches for homes in a neighborhood, ads for local agents and lenders (who pay for the placements) appear alongside the homes.

-- $ZG's advertising business has succeeded because its websites attract millions of visitors per year. Since $ZG's 2011 IPO, revenue for its media business has grown ~30x. In 2015, $ZG acquired Trulia, so it now owns the two dominant platforms for browsing the home market.

-- Shelter-in has increased traffic to $ZG's websites because people 1) have more free time and 2) are rethinking their housing.

-- In 3Q20, $ZG reported 236M unique monthly visitors to its websites (+21% y/y) and 2.8B visits in the quarter (+32% y/y).

-- In 3Q20, $ZG reported 236M unique monthly visitors to its websites (+21% y/y) and 2.8B visits in the quarter (+32% y/y).

-- Despite having built a great advertising business that's cash flow positive and enjoys a steady stream of traffic, $ZG made the decision in 2018 to enter the much more riskier instant buying (iBuying) market as part of an effort to transform to Zillow 2.0.

-- iBuying addresses a very real problem. Selling a home is often an arduous months-long process full of uncertainty and disruption that involves prepping the home, showing the home, negotiating over price, and completing a stack of paperwork.

-- Zillow Offers cures these headaches. With Zillow Offers, a seller answers questions about their home and $ZG makes a cash offer for it, charging a 6-9% fee depending on the condition of the home and other factors. The transaction takes two weeks instead of three months.

-- Given that the average real estate transaction fee is 6%, a seller essentially pays a premium in exchange for instant liquidity and a hassle-free sale.

-- On its end, $ZG uses years of data to price homes such that it can perform light repairs and sell the homes for a profit.

-- On its end, $ZG uses years of data to price homes such that it can perform light repairs and sell the homes for a profit.

-- There are obvious challenges to this model. First, iBuying is heavily capital intensive as it costs millions of dollars to purchase homes. Second, $ZG is exposed to housing market risk. If prices plummet, it could be left with hundreds of homes worth much less than it paid.

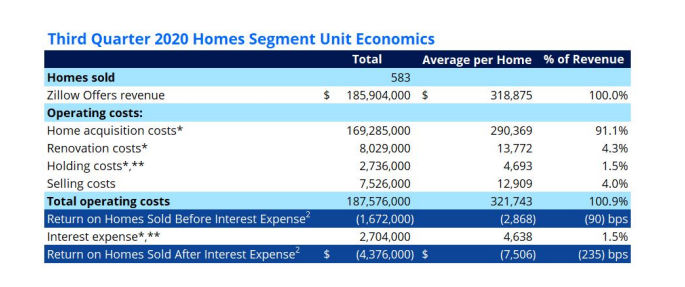

-- Third, the margins are thin. Since the launch of Zillow Offers, $ZG has reported negative unit economics for the business segment. In 3Q20, $ZG lost an average of $2868 per home before interest expense and $7506 after.

-- In other words, $ZG is using cash flow generated from its media business to fund its speculative and risky iBuying business. Why would it do this? The answer appears to be that $ZG believes that iBuying will redefine the real estate transaction.

-- $ZG's CEO Rich Barton: "I would argue that it is just as likely that you will succeed if you swing for the fences as if you bunt, and the outcome will be more magical."

-- With Zillow Offers, $ZG is swinging for the fences. Over the next few years, it aims to ramp up the business to buy 5,000 homes per month and generate $20B in annual revenue. At this scale, $ZG expects the business to generate a positive EBIT margin of 4-5%.

-- Scaling the iBuying business could improve the margin as $ZG realizes cost benefits. For example, saving money on home renovation costs by building out networks of contractors and saving money on materials through bulk purchases.

-- $ZG is also building an ecosystem of services around the buying and selling of a home, including mortgage, title insurance, and moving services. These are straightforward fee for service offerings that $ZG can bundle with the home transaction.

-- Essentially, $ZG is aiming to create a flywheel effect where a seller sells on Zillow Offers and turns around and uses Zillow's platform (meaning zero customer acquisition cost) to find and buy a new house, using Zillow's services to finance and complete the transaction.

-- Fundamentally, $ZG is also betting on a significant transformation of real estate, namely that enough sellers will choose the speed, certainty, and convenience of iBuying over the traditional and potentially more profitable real estate transaction process.

-- While there are a number of risks (accuracy of pricing models, ability to improve costs, willingness of consumers to adopt iBuying), $ZG's investment in iBuying could also be the decision that makes the company a dominant player in the future of real estate. Time will tell.

Read on Twitter

Read on Twitter