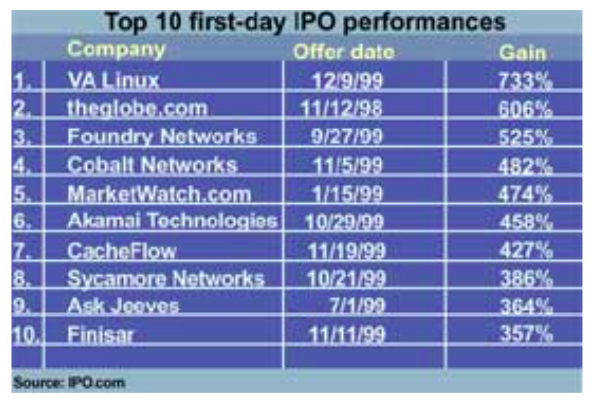

We all know IPO's pop, but then what? The table below shows the ten biggest first day pops of the last 25 years. 9 occurred in 1999. #11 would be $bidu at 354%...#12 would appear to be $ncno at 195%. Anyway, let's see how father time treated the 1-day pop long-term holders.

#10-Finisar

$28.6 1st day close and $4.2bl mkt cap. Acquired 2019 for $3.2bl. -20% or so over 20 years...not bad.

$28.6 1st day close and $4.2bl mkt cap. Acquired 2019 for $3.2bl. -20% or so over 20 years...not bad.

#9 Ask Jeeves

IPO close $65. Would be trading sub $1 by 2001. Would make an amazing comeback and be acquired by $iac for $28 or just under $2bl in 2005. So you lost like 50% in about 5 years.

IPO close $65. Would be trading sub $1 by 2001. Would make an amazing comeback and be acquired by $iac for $28 or just under $2bl in 2005. So you lost like 50% in about 5 years.

#8 Sycamore Networks

Closed $184 day 1 or $14.4bl. Shut down in 2013. Paid out just under a billion in special dividends. -90% over 13 years. I thought this one was a game changer so don't feel bad.

Closed $184 day 1 or $14.4bl. Shut down in 2013. Paid out just under a billion in special dividends. -90% over 13 years. I thought this one was a game changer so don't feel bad.

#7 Cacheflow

Before there was $fsly web latency was all about these cache guys. Later renamed Blue Coat Systems. Stock closed $126 day 1 or a little over $4bl. Thomas Bravo would buy it in 2011 for $25 or $1.3bl. -70% or so over 11 years.

Before there was $fsly web latency was all about these cache guys. Later renamed Blue Coat Systems. Stock closed $126 day 1 or a little over $4bl. Thomas Bravo would buy it in 2011 for $25 or $1.3bl. -70% or so over 11 years.

#6 Akamai

This was super hyped day 1 and hit $13bl and $145 despite just $1.5ml in ttm rev. Its a $17bl company today, but after some dilution at the current price of $106 $akam holders are down 27% in 21 years.

This was super hyped day 1 and hit $13bl and $145 despite just $1.5ml in ttm rev. Its a $17bl company today, but after some dilution at the current price of $106 $akam holders are down 27% in 21 years.

#5 Marketwatch dot com

Priced $17 and closed $97.5. Sold Dow Jones in 2005 for $18. -82% over 5years

Priced $17 and closed $97.5. Sold Dow Jones in 2005 for $18. -82% over 5years

#4 Cobalt Networks

Closed $128 or roughly $3.5bl. Sold to Sun Microsystems for about $2bl in stock in 2000. You lost about 45% in a year.

Closed $128 or roughly $3.5bl. Sold to Sun Microsystems for about $2bl in stock in 2000. You lost about 45% in a year.

#3 Foundry Networks

Networking favorite popped to $156 on day one or roughly $10bl. Sold to Brocade for $19.25 or just about $3bl in 2008. Didn't dig up the exact share count but you lost something over 60% here.

Networking favorite popped to $156 on day one or roughly $10bl. Sold to Brocade for $19.25 or just about $3bl in 2008. Didn't dig up the exact share count but you lost something over 60% here.

#2 The http://Globe.com

This 1998 dotcom debacle priced at $9 and closed at $63.5. You had lost 99.99% by 2001 when it was trading at 10c. It shut down in 2003.

This 1998 dotcom debacle priced at $9 and closed at $63.5. You had lost 99.99% by 2001 when it was trading at 10c. It shut down in 2003.

Read on Twitter

Read on Twitter