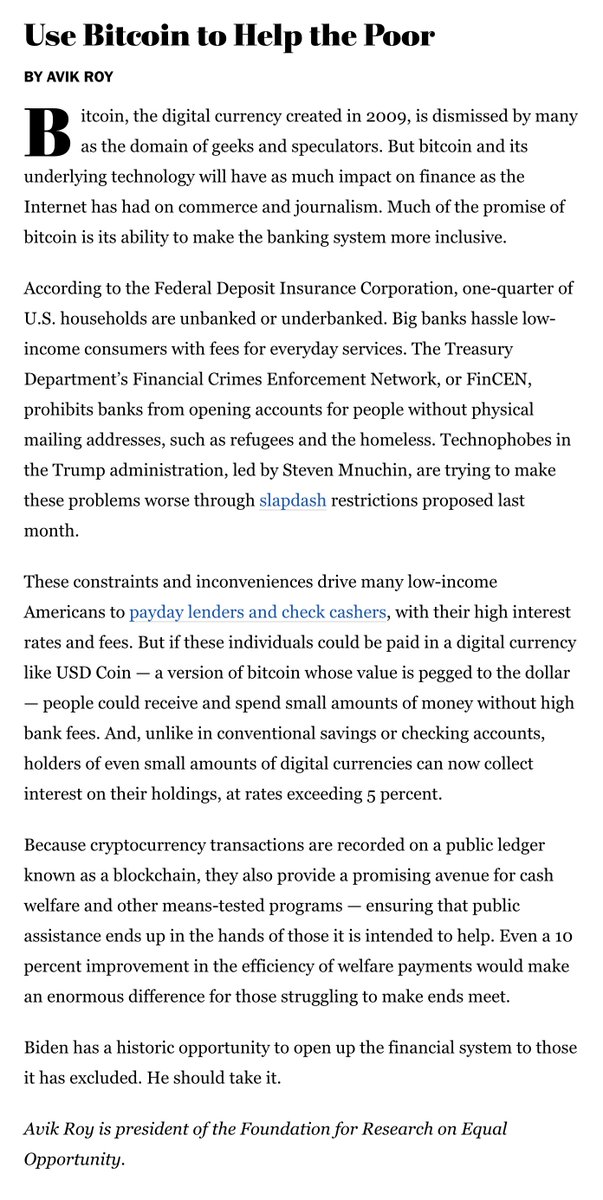

The @WashingtonPost Magazine asked me to propose a surprising idea for President-Elect Biden to take up. I make the case that Biden should use #Bitcoin  to help the poor. https://www.washingtonpost.com/graphics/2021/lifestyle/magazine/biden-should/

to help the poor. https://www.washingtonpost.com/graphics/2021/lifestyle/magazine/biden-should/

to help the poor. https://www.washingtonpost.com/graphics/2021/lifestyle/magazine/biden-should/

to help the poor. https://www.washingtonpost.com/graphics/2021/lifestyle/magazine/biden-should/

25% of U.S. households are unbanked or underbanked. Paying people in dollar-pegged versions of bitcoin, often called "stablecoins," can enable these low-income families to earn interest on their savings, at rates exceeding 5%.

And because the blockchain records all relevant transactions on a public ledger, Bitcoin's underlying technology can ensure that public assistance ends up in the hands of those it is intended to help. Even a 10% efficiency gain could have profoundly beneficial welfare effects.

Read on Twitter

Read on Twitter