The emergence of the DeFi sector exemplifies what happens when preparation meets opportunity.

Its growth and sustained expansion is inspiring to say the least.

Here’s some data showing just how far the sector has come since last summer, and my thoughts on its future...

Its growth and sustained expansion is inspiring to say the least.

Here’s some data showing just how far the sector has come since last summer, and my thoughts on its future...

At the start of 2020, DeFi was a small part of the crypto market that was only in its infancy.

TVL passed $1b for the first time in June, hovering around ~$500m in the first half of the year.

TVL passed $1b for the first time in June, hovering around ~$500m in the first half of the year.

An integral ethos of this ecosystem is that liquidity attracts liquidity, and prior to the summer food farming craze, the relative lack of liquidity provided little incentive for new money to enter the ecosystem.

The food farming craze devolved rapidly from an attractive way to draw liquidity to a game of musical chairs... (of which I became a champion of)

Nonetheless, it served its purpose, and kick started (what I believe) will be a macro, decade-long, trend.

Nonetheless, it served its purpose, and kick started (what I believe) will be a macro, decade-long, trend.

The same principles underlying the food farming craze are still drawing massive volume and liquidity to the space, but in a far more sustainable manner...

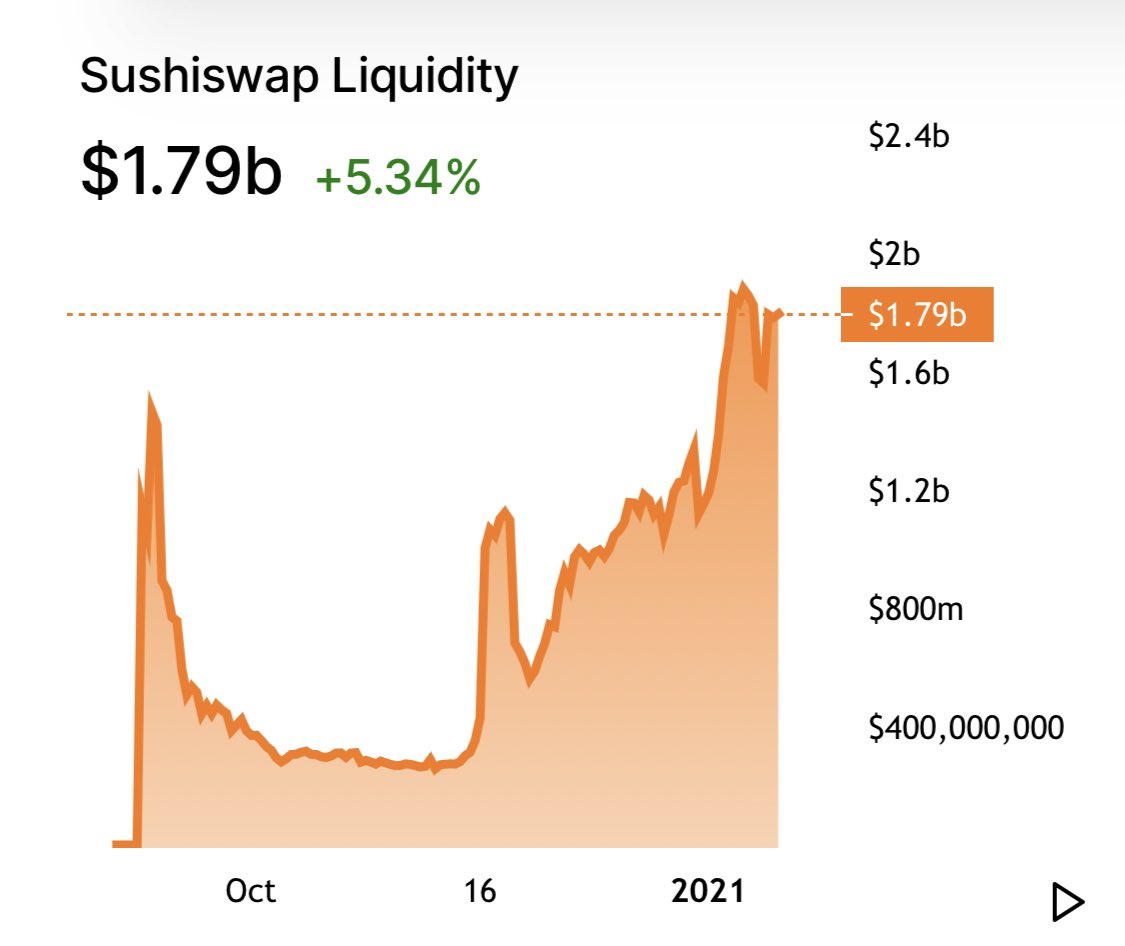

An example of this are the menus offered by @SushiSwap, which have onboarded billions of $ in liquidity to the platform.

An example of this are the menus offered by @SushiSwap, which have onboarded billions of $ in liquidity to the platform.

Uniswap isn’t offering any direct liquidity incentives, though this hasn’t stopped it from capturing massive amounts of liquidity due to the trading volume on the platform.

It’s honestly quite incredible how both Uniswap and SushiSwap have both been seeing expanding volume/liquidity in tandem.

The DEX/AMM race is no longer a zero-sum game it seems.

The DEX/AMM race is no longer a zero-sum game it seems.

DeFi literally went from being fringe to an integral part of the crypto market in just a few months...

What’s craziest about it is that it hasn’t even gone mainstream yet... technical and monetary hurdles (gwei) will likely hamper adoption in the short-term.

What’s craziest about it is that it hasn’t even gone mainstream yet... technical and monetary hurdles (gwei) will likely hamper adoption in the short-term.

Anyways, short-term I believe that “in-the-know” money is already in DeFi, or actively being deployed. As such, the growth curve may begin slowing.

Developments like ETH 2.0 and other scaling solutions will likely incubate long-term growth.

Developments like ETH 2.0 and other scaling solutions will likely incubate long-term growth.

The introduction of on-chain credit, non-collateralized lending (i.e., @maplefinance) and yield-strategy aggregators ( @saffronfinance_, @yaxis_project, @iearnfinance) will all incubate mainstream growth.

Once these types of user-friendly solutions become pervasive and easy for “normies” to use, I believe DeFi *will* become a viable TradFi competitor...

This is when we’ll see exponential growth in the usage and size of the sector.

This is when we’ll see exponential growth in the usage and size of the sector.

Read on Twitter

Read on Twitter