Bonus season has arrived, when bankers and traders take home a significant portion of their annual compensation in a single lump-sum payment.

The story of how Wall Street started this ritual has origins in the distant past https://trib.al/XhUdcsP

The story of how Wall Street started this ritual has origins in the distant past https://trib.al/XhUdcsP

In the 19th-century U.S., businesses rewarded employees with modest Christmas gifts:

A holiday turkey for laborers

A holiday turkey for laborers

A gold coin for white-collar workers

A gold coin for white-collar workers

These tokens of appreciation were meaningful to workers. But they weren’t a form of compensation https://trib.al/XhUdcsP

A holiday turkey for laborers

A holiday turkey for laborers A gold coin for white-collar workers

A gold coin for white-collar workersThese tokens of appreciation were meaningful to workers. But they weren’t a form of compensation https://trib.al/XhUdcsP

Occasionally these gifts served more practical ends.

The Woolworth family, founders of the eponymous chain of five-and-dime stores, began distributing Christmas bonuses in the 1890s https://trib.al/XhUdcsP

The Woolworth family, founders of the eponymous chain of five-and-dime stores, began distributing Christmas bonuses in the 1890s https://trib.al/XhUdcsP

Shop-floor clerks were paid at a rate of $5 for every year of service, with a maximum of $25 per employee

But the Woolworths had an ulterior motive: They wanted to limit employee turnover during the critical holiday season https://trib.al/XhUdcsP

But the Woolworths had an ulterior motive: They wanted to limit employee turnover during the critical holiday season https://trib.al/XhUdcsP

These bonuses had much in common with the industrial world, which began to give workers a small stake in the business in the hopes that it would lessen the appeal of strikes and unions.

These proposals rarely worked because they cost too much money https://trib.al/XhUdcsP

These proposals rarely worked because they cost too much money https://trib.al/XhUdcsP

It fell to a very different kind of business to make profit-sharing a reality: the world of high finance.

And it was the most powerful, influential financier of the era who first put the idea into practice: J. Pierpont Morgan https://trib.al/XhUdcsP

And it was the most powerful, influential financier of the era who first put the idea into practice: J. Pierpont Morgan https://trib.al/XhUdcsP

At the dawn of the 20th century, Morgan presided over a vast investment banking empire.

In 1901, he orchestrated a merger that led to the creation of U.S. Steel. When Christmas rolled around, Morgan played Santa Claus https://trib.al/XhUdcsP

In 1901, he orchestrated a merger that led to the creation of U.S. Steel. When Christmas rolled around, Morgan played Santa Claus https://trib.al/XhUdcsP

"There is no one more generous than the financial magnate when the market goes his way,” reported one newspaper.

Morgan gave every employee at his namesake firm a one-time cash gift equivalent to an entire year’s salary https://trib.al/XhUdcsP

Morgan gave every employee at his namesake firm a one-time cash gift equivalent to an entire year’s salary https://trib.al/XhUdcsP

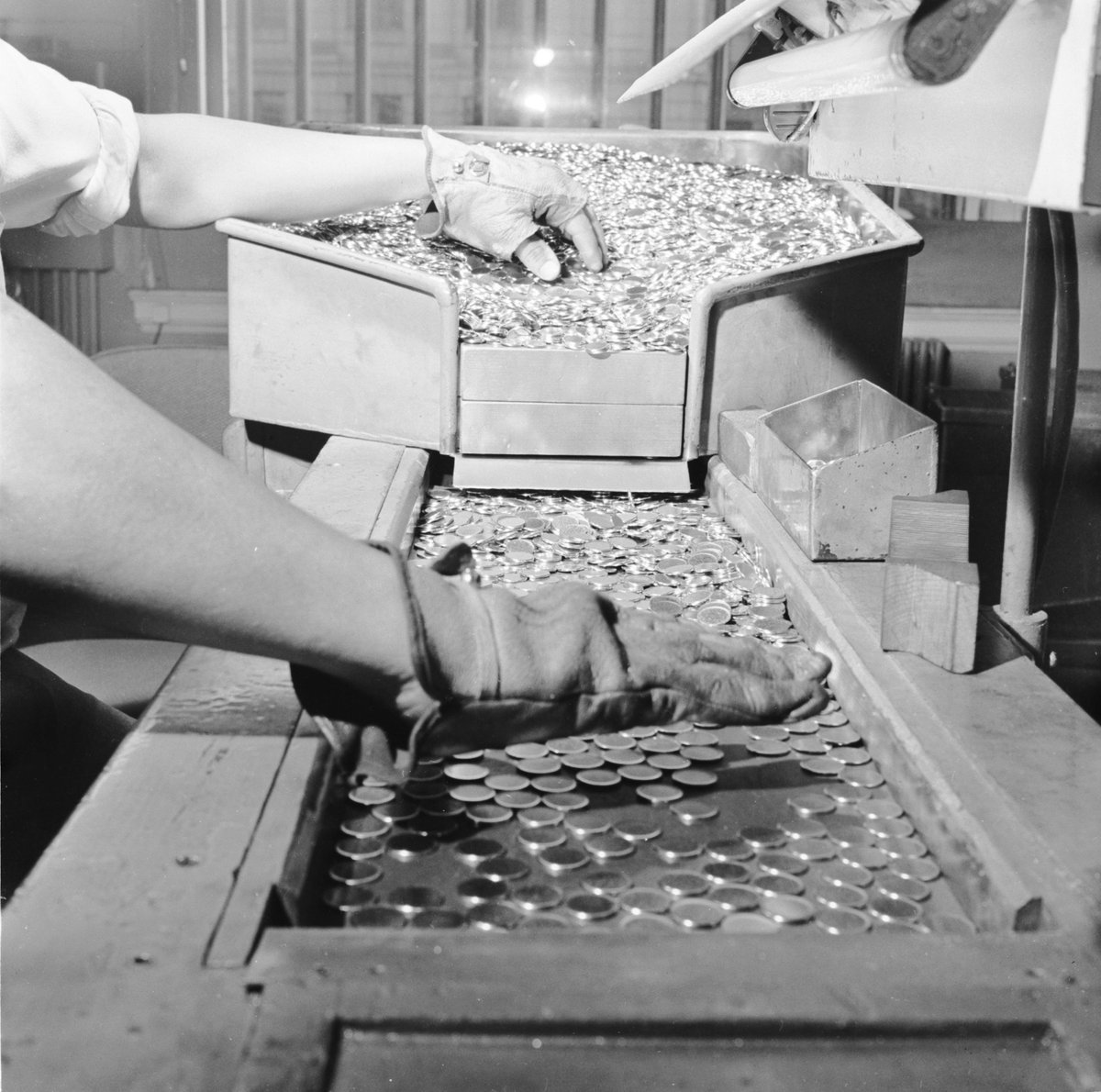

In 1902, Morgan had seven kegs of newly minted coins delivered to his office so that he could bestow the massive bonuses using piles of gold.

The practice soon spread to other firms, yet some held off on giving bonuses until the new year https://trib.al/XhUdcsP

The practice soon spread to other firms, yet some held off on giving bonuses until the new year https://trib.al/XhUdcsP

There were many different approaches. Some bonuses were based on:

Loyalty: The more years, the bigger the bonus

Loyalty: The more years, the bigger the bonus

Rank: The higher up, the bigger the gift

Rank: The higher up, the bigger the gift

In yet others, employees deemed more deserving for some reason might receive the biggest payouts https://trib.al/XhUdcsP

Loyalty: The more years, the bigger the bonus

Loyalty: The more years, the bigger the bonus Rank: The higher up, the bigger the gift

Rank: The higher up, the bigger the giftIn yet others, employees deemed more deserving for some reason might receive the biggest payouts https://trib.al/XhUdcsP

By the end of 1928, Wall Street was paying out an estimated $100 million in bonuses to its employees, or approximately $1.5 billion in today’s dollars.

The Great Depression, though, quickly put an end to this: There were no bonuses https://trib.al/XhUdcsP

The Great Depression, though, quickly put an end to this: There were no bonuses https://trib.al/XhUdcsP

It would be many years before they would return to anything approximating the levels seen at the height of the Roaring Twenties. And when they did, Wall Street was a different place:

More regulated

More regulated

More institutionalized

More institutionalized

Less profitable

Less profitable

https://trib.al/XhUdcsP

More regulated

More regulated More institutionalized

More institutionalized Less profitable

Less profitablehttps://trib.al/XhUdcsP

Some bankers talked about eliminating them altogether.

But old habits die hard. When the stock market started booming again in the 1980s, the holiday bonus once again played a starring role in employee compensation, fattening the take-home pay employees https://trib.al/XhUdcsP

But old habits die hard. When the stock market started booming again in the 1980s, the holiday bonus once again played a starring role in employee compensation, fattening the take-home pay employees https://trib.al/XhUdcsP

Despite multiple crises, the bonus system remains alive and well in the 21st century.

It may not come in the form of a bag of gold coins, but the bonus has become a Wall Street tradition in its own right https://trib.al/XhUdcsP

It may not come in the form of a bag of gold coins, but the bonus has become a Wall Street tradition in its own right https://trib.al/XhUdcsP

Read on Twitter

Read on Twitter