It’s time to talk about the largest eCommerce company in the world. Here is the breakdown on $AMZN, otherwise known as Amazon.

Current Price: $3,109.5213

52/Wk High: $3,552.25

52/Wk Low: $1,626.03

Market Cap: $1.6 Trillion

Read below for the breakdown!

Current Price: $3,109.5213

52/Wk High: $3,552.25

52/Wk Low: $1,626.03

Market Cap: $1.6 Trillion

Read below for the breakdown!

Amazon ($AMZN) is the largest eCommerce company in the world, not only boasting a massive eCommerce footing but investments in advanced technologies and digital content.

As of the past few months, Amazon has been flat and down into the beginning of 2021, begging the question as to whether Amazon stock is a buy.

Breaking down Amazon’s significant stock price according to TREFIS ( @trefis), 46.6% of the stock price is based on the Amazon Web Services segment.

Furthermore, 36% is based on the North America segment, 15.6% on the International segment, and 1.8% is based on Amazon’s cash and or net of debt.

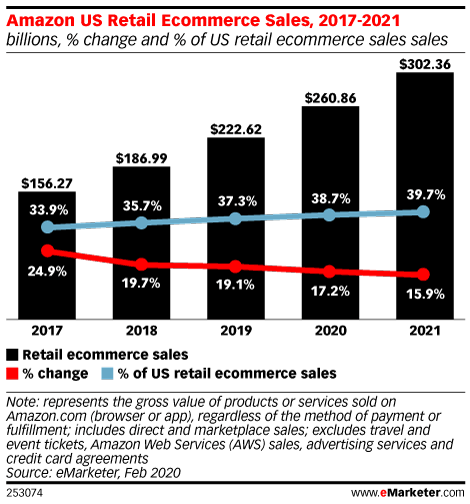

Now, as many know, Amazon is the largest US eCommerce company, maintaining 39.7% of the US eCommerce market based on sales, and is projected to hold the number one spot for some time.

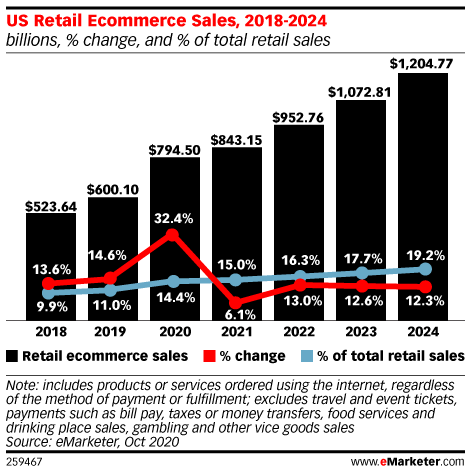

Not only that, but US retail eCommerce still has an astounding amount of growth. In fact, as of 2020, US eCommerce only represented 14.4% of all US retail sales.

Given the data many expect Amazon to continue to grow at significant rates for years to come therefore only further supporting Amazon’s bull case for the next ten to twenty years.

Shifting into the most recent quarter, Amazon reported a Q3 beat, with an EPS of $12.40, much better than the expected EPS consensus estimate of $7.41. On a year over year basis, Amazon’s EPS improved 192.43%.

Amazon went on to report a 37% year over year increase in net sales, bring the total net sales to a whopping $96.1 billion in the third quarter. For better comparison, the same time 2019 net sales level was $70.0 billion.

As for operating income, Amazon reported a Q3 operating income level of $6.2 billion, much better than the same time 2019 level of $3.2 billion.

When it comes to operating cash flow, Amazon reported a solid 56% increase in operating cash flow to $55.3 billion and a net income level of $6.3 billion.

Not only did operating cash flow significantly increase but free cashflow did as well, with Amazon reporting a Q3 free cash flow level of $29.5 billion, much better than the same time 2019 level of $23.5 billion.

As for guidance Amazon delivered solid Q4 2020 guidance.

- Net Sales: $112 to $121 Billion

- Operating Income: $1 to $4.5 Billion

- Net Sales: $112 to $121 Billion

- Operating Income: $1 to $4.5 Billion

Taking a look at the balance sheet the numbers are strong.

Total Debt: $50.574 Billion

Total Liabilities: $199.404 Billion

Total Assets: $282.179 Billion

Cash & Short Term Inv: $68.402 Billion

Total Debt: $50.574 Billion

Total Liabilities: $199.404 Billion

Total Assets: $282.179 Billion

Cash & Short Term Inv: $68.402 Billion

On a valuation basis, Amazon is expensive but not too far gone.

Price to Earnings: 91.59x

Price to Sales: 4.51x

Price to Book: 18.97x

Price to Cash Flow: 30.65x

Price to Earnings: 91.59x

Price to Sales: 4.51x

Price to Book: 18.97x

Price to Cash Flow: 30.65x

Management has been quite effective and performed well.

Return on Equity: 24.95%

Return on Assets: 7.22%

Return on Invested Capital: 11.32%

Return on Equity: 24.95%

Return on Assets: 7.22%

Return on Invested Capital: 11.32%

Given the numbers, the analysts are bullish with a mean price target of $3,816/share, representing a 23.08% gain.

It is also important to note that the high price target is $4,350/share, representing a 40.29% gain, while the low price target is $3,048/share, representing a -1.70% downside.

The big money is also quite involved with 56.97% of Amazon being owned by institutions. Top holders include The Vanguard Group, BlackRock Institutional Trust, and State Street Global Advisors.

On a technical basis, Amazon could be presenting an opportunity. According to the six-month charts, the MACD has started to trend to the downside with minimal momentum within a range of -2.33 down to -15.36.

The six-month charts are also indicating an RSI of 42.57 and CCI of -128.08, both of which are on the low end.

In short, Amazon is a strong long term and mid-term buy, boasting solid earnings growth, a growing eCommerce market, and a digital revolution that many believe is just getting started.

https://www.runningwiththemoney.com/post/is-amazon-a-buy

EAT - SLEEP - PROFIT

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

EAT - SLEEP - PROFIT

Disclaimer: This is not direct financial advice, simply an opinion based on independent research.

Read on Twitter

Read on Twitter