Mistakes of omission are multiple times more costly than mistakes of commission.

e.g.

Buy stock A for 10K$

Year 5 value: bankrupt= 0$

Loss: 10K$

Do not buy stock B for 10K$

Year 5 value: 50K$

Opportunity loss: 40K$

This is an extremely important concept to grasp in this game.

e.g.

Buy stock A for 10K$

Year 5 value: bankrupt= 0$

Loss: 10K$

Do not buy stock B for 10K$

Year 5 value: 50K$

Opportunity loss: 40K$

This is an extremely important concept to grasp in this game.

You can safely take a more traditional risk/reward view of your holdings.

Traditional market gurus will tell you that it is unwise and you should diversify into safer equities i.e. blue chips.

They are wrong.

This strategy maximized returns and mimics venture capital.

Traditional market gurus will tell you that it is unwise and you should diversify into safer equities i.e. blue chips.

They are wrong.

This strategy maximized returns and mimics venture capital.

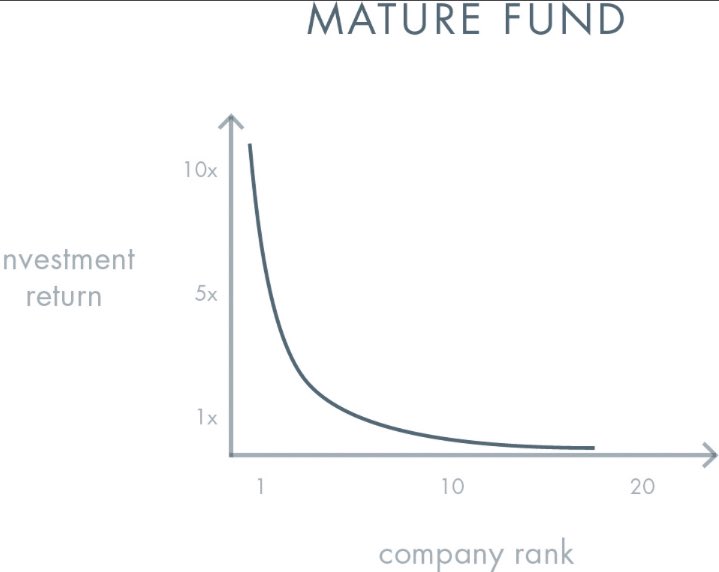

The goal is to have your portfolio follow the “Power Law”

One winner in your holdings should outweigh all the rest of your portfolio combined.

From Peter Thiel’s Zero To One, here is what companies in a fund should return.

One winner in your holdings should outweigh all the rest of your portfolio combined.

From Peter Thiel’s Zero To One, here is what companies in a fund should return.

Market investors don’t often think this way.

First, one must completely put aside finance curriculum: EMT, beta for risk, sharpe ratio, diversification, etc.

They are not only not particularly useful but also very detrimental to your returns.

First, one must completely put aside finance curriculum: EMT, beta for risk, sharpe ratio, diversification, etc.

They are not only not particularly useful but also very detrimental to your returns.

Second, one must find winners and focus on them while getting rid of losers as quickly as possible.

Once you find winners, selling them is usually a mistake.

As long as a company is performing and growing, why would you sell away part of your rights to those future profits?

Once you find winners, selling them is usually a mistake.

As long as a company is performing and growing, why would you sell away part of your rights to those future profits?

That is the hardest part but once you understand the uneven returns of the Power Law, it enables you to take on more risks.

You will prefer bets in companies that have a big potential and hold them for a very very long time.

You will prefer bets in companies that have a big potential and hold them for a very very long time.

In the example above, I used a stock that became a 5-bagger after 5 years. But companies often return 20x, 50x, and even 100x.

Think about your opportunity loss in those cases.

If you catch only one of those, it wouldn’t matter much if another of your holdings went to 0.

Think about your opportunity loss in those cases.

If you catch only one of those, it wouldn’t matter much if another of your holdings went to 0.

Of course this strategy worked best during in this historic bull market.

It is not guaranteed to always work and can suffer big drawdowns.

The key is selecting the right companies, and ones that can survive.

It is not guaranteed to always work and can suffer big drawdowns.

The key is selecting the right companies, and ones that can survive.

Some can take this an excuse to be reckless, to bet on emerging industries: crypto, EV, cannabis, etc. and long-shots.

Many investors and VCs do this everyday.

Many investors and VCs do this everyday.

If you have capital to deploy and markets are rewarding you for ideas rather than business acumen, why would you stop at anything?

Any emerging sector or new tech would be a good initiative if the market is full of participants willing to fund them.

Any emerging sector or new tech would be a good initiative if the market is full of participants willing to fund them.

However, you are effectively now funding ideas and stories rather than businesses.

Those stories can keep unfolding if more $ flow in.

I would never bet against them, especially in an environment of endless cheap money supply.

Those stories can keep unfolding if more $ flow in.

I would never bet against them, especially in an environment of endless cheap money supply.

To do this right and steer away from potential mistakes, the key is sticking to what works, and what you know.

This strategy can work in bad times, if executed properly.

Companies that don’t need to raise capital are a must, at least for me...

This strategy can work in bad times, if executed properly.

Companies that don’t need to raise capital are a must, at least for me...

Read on Twitter

Read on Twitter