Rising Housing Wealth (thread) https://oregoneconomicanalysis.com/2021/01/14/rising-housing-wealth/

Economists increasingly bullish on economic outlook primarily due to incomes being up, and consumer spending largely following suit. At least spending on what is allowed, or on activities not feared due to the virus. But it's not just income, wealth is rising too

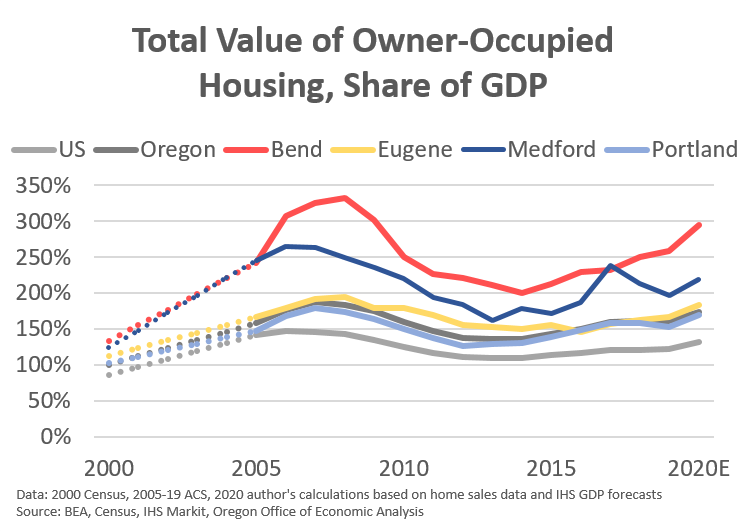

Given home prices and a rising ownership rate, the total value of owner-occupied housing is increasing faster than the economy.

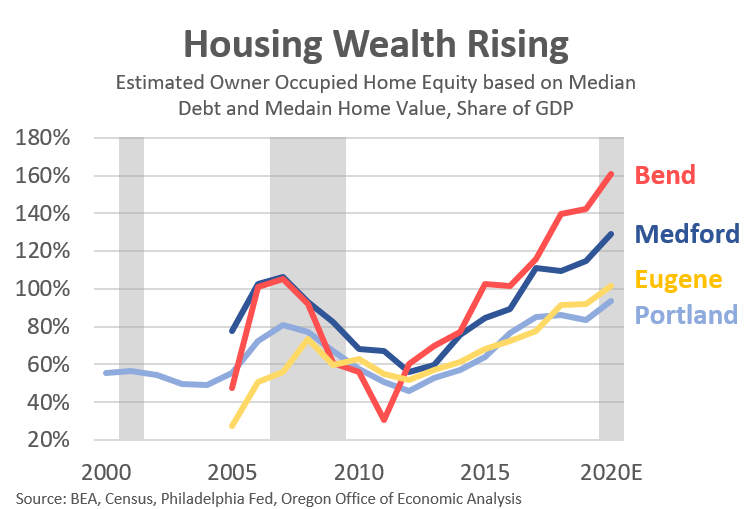

That overstates the situation because that is only values, and doesn't account for mortgage debt. What matters is home equity. That's harder to estimate, but building off median debt/valuations paints an even stronger housing wealth picture

While home equity is important for personal finance, what are the macro implications? That's a bit harder to gauge. Much of the research focuses on consumer spending out of that wealth.

The marginal propensity to consumer out of housing wealth has been estimated at 5-7%. That means if your home equity increases $10,000, you might spend an extra $500-700. More recent estimates peg it more like 4%, or $400.

Some of that spending may be a draw down of existing savings, or higher credit card usage. But larger amounts need to come from mortgage equity withdrawal via a cash-out refinance or home equity line of credit, etc

What do people do with their equity? Most spend it on home improvements (& furnishings). A lot is saved to be spent/invested in the years ahead. Some debt consolidation. Little is used for other types of spending, like autos. Equity is not usually treated as ATM, that's good!

Besides that, we know personal savings and home equity is major source of capital for small businesses. Given the pandemic, some the increase in mortgage equity withdrawal this year could be plugged back into businesses to keep them afloat.

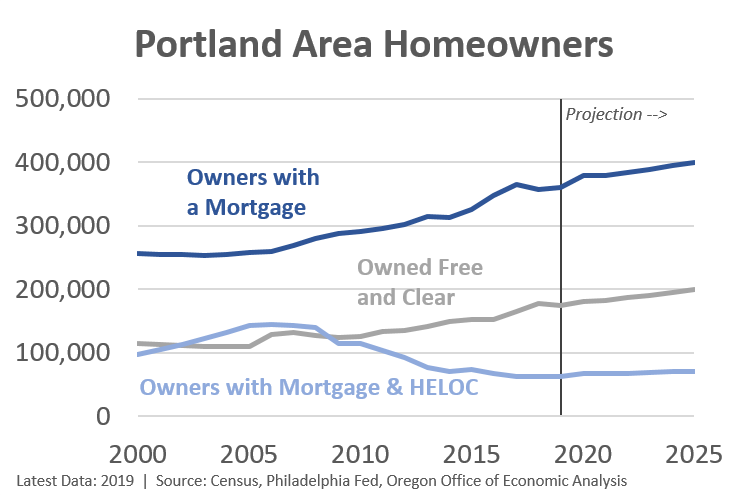

Furthermore, we know we have a rising number of homeowners without a mortgage. These long-time owners have paid off their debt and are sitting on a sizable amount of equity.

Equity withdrawal is fairly rare for HHs in their 60s and 70s. And downsizing isn't really a thing. It is likely these households may wait until the money is needed for long-term care, or their finances need additional support.

Overall, owners are in better equity position than in recent decades. Can support additional spending/finances if needed.

Of course it's not all good news that housing wealth is in part a function of underbuilding housing, and a system where housing is the best/only path to wealth for most HHs in middle and lower part of distribution.

Stay tuned. Have more coming on comparing housing wealth across metros (e.g. Bend is off the charts but its economy and demographics look nothing like other high housing wealth locales), and broader update to stockpile of unrealized capital gains. /end

Read on Twitter

Read on Twitter