THREAD | Win Rate vs. Reward:Risk

As traders, we often hear about these concepts. Hopefully I can show you why they're useless as isolated metrics, but very powerful when combined.

(1/12)

As traders, we often hear about these concepts. Hopefully I can show you why they're useless as isolated metrics, but very powerful when combined.

(1/12)

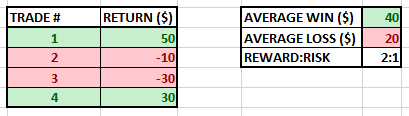

Win Rate is the probability that a trade will result in profit, averaged out over the sample.

Our example strategy has traded 4 times: 2 wins, 2 losses, giving a Win Rate of 50%.

(2/12)

Our example strategy has traded 4 times: 2 wins, 2 losses, giving a Win Rate of 50%.

(2/12)

It's human tendency to want to be 'right,' but a '95% winning strategy' means nothing without it being qualified by at least reward and risk.

I wouldn't want to trade a strategy which returns $1 19 trades in a row and then wipes out my account on the 20th, would you?

(3/12)

I wouldn't want to trade a strategy which returns $1 19 trades in a row and then wipes out my account on the 20th, would you?

(3/12)

Reward:Risk is the ratio between how much we stand to win and how much we stand to lose on a trade, averaged out over the sample. Whether that be for a specific strategy, your entire trading career, your grandma selling her hobby knitwear...

(4/12)

(4/12)

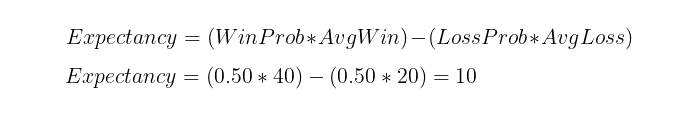

Expectancy is how we measure our expected returns, were we to keep trading in the same way.

We can calculate the Expectancy of a trading strategy with the formula below. Our example strategy gives us a positive value (therefore we expect to profit over the long term).

(5/12)

We can calculate the Expectancy of a trading strategy with the formula below. Our example strategy gives us a positive value (therefore we expect to profit over the long term).

(5/12)

Sample size and the law of large numbers are vital here. Clearly, we are going to get a more accurate result if we have 1000 trades to take our average values from compared to just the 4 from our example strategy.

(6/12)

(6/12)

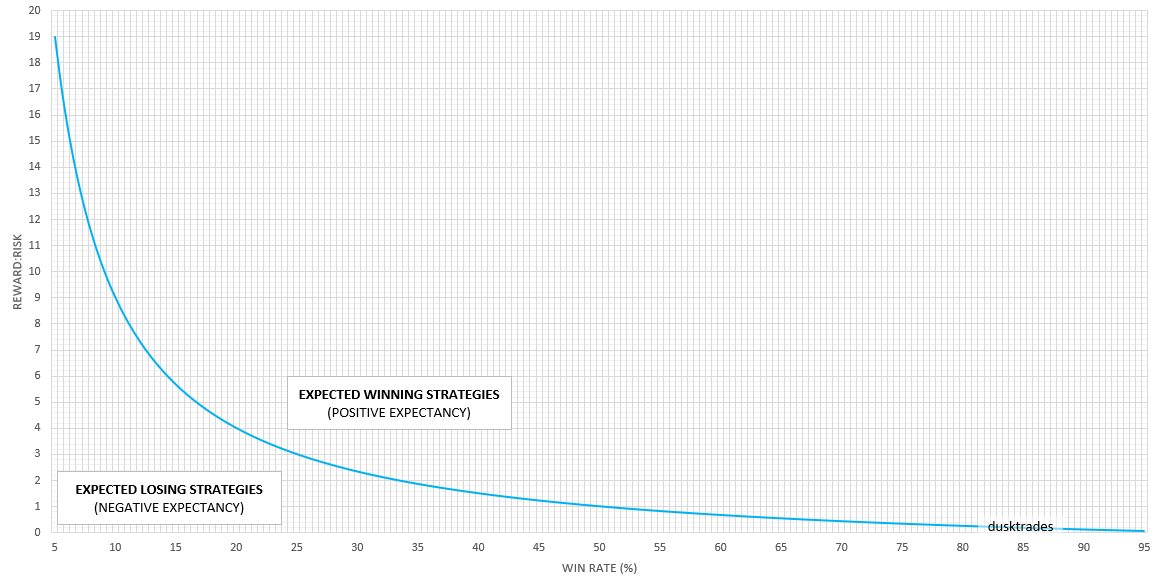

We can also visualise the relationship between Win Rate, Reward:Risk, and Expectancy.

Profitable/unprofitable trading in the long run can be reduced down to this breakeven line. Don't get carried away, a theoretical edge is just one of the pillars of trading success.

(7/12)

Profitable/unprofitable trading in the long run can be reduced down to this breakeven line. Don't get carried away, a theoretical edge is just one of the pillars of trading success.

(7/12)

How do I apply this?

If you're already trading a strategy: you can go back through the setups, work out your average win and average loss, work out what percentage of them were winners, and plug them into the Expectancy formula.

(8/12)

If you're already trading a strategy: you can go back through the setups, work out your average win and average loss, work out what percentage of them were winners, and plug them into the Expectancy formula.

(8/12)

If you're thinking about trading a strategy: you can include it in your workflow by backtesting the setups and working out the Expectancy over historical data. Is the strategy worthwhile? How can you exploit the edge further?

(9/12)

(9/12)

What can we take away from this?

Taking the time to journal and track these sorts of statistics can give you more accurate trading expectations, verify your edge, and improve confidence which leads to more disciplined trading.

(10/12)

Taking the time to journal and track these sorts of statistics can give you more accurate trading expectations, verify your edge, and improve confidence which leads to more disciplined trading.

(10/12)

Some ideas for the curious who want to take this further: how your expectancy evolves over time, how your trade frequency and position size affects your annualised expectancy, diversifying strategies across the expectancy curve...

(11/12)

(11/12)

Thanks for reading. If these threads go down well I will release some more.

Share, bookmark, study, implement.

(12/12)

Share, bookmark, study, implement.

(12/12)

Thanks to the guys below who I continue to learn tons from every day. Drop them a follow if you haven't already for whatever reason.

@CryptoCred

@KoroushAK

@MacroCRG

@Murfski_

@TraderKoz

@spicyofc

@CryptoCred

@KoroushAK

@MacroCRG

@Murfski_

@TraderKoz

@spicyofc

Read on Twitter

Read on Twitter