Relative value is a heavily-used term in credit markets. Here's a quick glimpse at how quickly it can get out of control

Setup is late April 2020. Mortgage credit is in disarray, with Congress passing a bill saying no one needs to make mortgage payments

0/

Setup is late April 2020. Mortgage credit is in disarray, with Congress passing a bill saying no one needs to make mortgage payments

0/

No one knows how various bonds will be treated, but one sub-sub-sector that's completely falling apart is GSE CRT.

These are super thin, subordinated tranches of large pools of GSE loans. Pre-covid, a lot of MREITs had been levered long the SUPER junior bonds

1/

These are super thin, subordinated tranches of large pools of GSE loans. Pre-covid, a lot of MREITs had been levered long the SUPER junior bonds

1/

But then they (and other levered players) got margin called and had to liquidate portfolios which resulted in some quite crazy low TRACE prints in March and April.

We're talking bonds in the 20s, that were trading in the 120s less than two months ago

2/

We're talking bonds in the 20s, that were trading in the 120s less than two months ago

2/

This is a sector I haven't participated in since 2018 (thought it was getting too expensive then... I was wrong)

But within days I've built out a comp sheet, and I'm following EVERY bond print in the CRT universe (thanks TRACE)

3/

But within days I've built out a comp sheet, and I'm following EVERY bond print in the CRT universe (thanks TRACE)

3/

And maybe 3? 4? people on the whole street are actually buying the sub bonds... in like $1mm-$2mm increments.

But everyone watches TRACE like a hawk, because people want to know where bonds are trading and tries to back into assumptions

4/

But everyone watches TRACE like a hawk, because people want to know where bonds are trading and tries to back into assumptions

4/

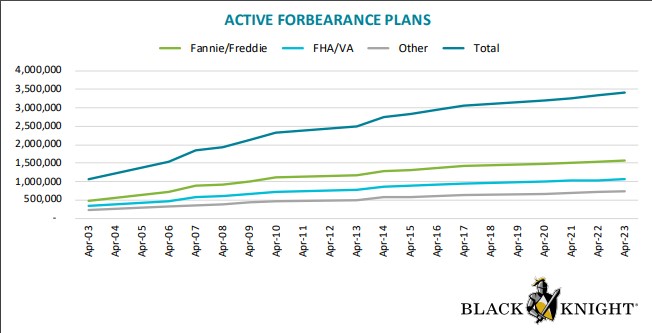

We're all cooking up crazy assumptions as $BKI data shows forbearance (effectively delinquency) skyrocketing with no end in sight

I am running DQs at a mindboggling 20% (remember GFC DQs peaked at 10%)

5/

I am running DQs at a mindboggling 20% (remember GFC DQs peaked at 10%)

5/

But the temptation to buy these SUPER-levered bonds is high. After finagling Intex inputs for days? weeks? I conclude that buying bonds at ~13% YTM is good "relative value"

HY CDX is already in the 600s and that's enough of a cushion

6/

HY CDX is already in the 600s and that's enough of a cushion

6/

So reluctantly, I participate in a couple of BWICs. Bid 43, topped. Second bid 43-18, topped. Ugh.

Next one. Bid 46-01, topped. Second bid 47-05, "you buy bonds cover 46-09"

OH NO. What did I do? Did I just move the market a point?

7/

Next one. Bid 46-01, topped. Second bid 47-05, "you buy bonds cover 46-09"

OH NO. What did I do? Did I just move the market a point?

7/

And indeed I did. TRACE let the whole world know.

4 other brokers "hey we saw STACR 2018-xyz trade at __. I can offer similar at 2 points higher"

YTM is now 12.5%

8/

4 other brokers "hey we saw STACR 2018-xyz trade at __. I can offer similar at 2 points higher"

YTM is now 12.5%

8/

Next day, another print away... 48-24 for $500k in bonds

I'm thinking "people are figuring out these are cheap" Bid 49-16. Topped. F it. 50-12

WHOLE sector up 2 points in a day

YTM is now 12%, very sensitive at low prices

9/

I'm thinking "people are figuring out these are cheap" Bid 49-16. Topped. F it. 50-12

WHOLE sector up 2 points in a day

YTM is now 12%, very sensitive at low prices

9/

Take a break for day. Prints in 52h

What's happening? "No way people's yield bogeys are changing... must be assumptions are off"

Time to finagle assumptions to get same yield outcome, and put out an OWIC. Need to be aggressive

10/

What's happening? "No way people's yield bogeys are changing... must be assumptions are off"

Time to finagle assumptions to get same yield outcome, and put out an OWIC. Need to be aggressive

10/

Bonds keep trading. 1 point up EVERY trade.

10am 53h

2pm 54h

next day: 56h

EVERY single trade is literally moving this $10B market

11/

10am 53h

2pm 54h

next day: 56h

EVERY single trade is literally moving this $10B market

11/

Need to buy bonds... CANT miss out. 60 bid.

bonds trade away: 62

THEY MUST KNOW SOMETHING

63 bid... finally some bonds

And boom Black Knight data is positive:

12/ https://www.blackknightinc.com/blog-posts/4-7m-homeowners-now-in-forbearance-but-pace-is-slowing-considerably/

bonds trade away: 62

THEY MUST KNOW SOMETHING

63 bid... finally some bonds

And boom Black Knight data is positive:

12/ https://www.blackknightinc.com/blog-posts/4-7m-homeowners-now-in-forbearance-but-pace-is-slowing-considerably/

F 12%, we need to happy with 10% YTM

Now the justifications start:

"it can't be that bad, housing will be fine"

"govt will have backstop"

"are we even trying to make money here"

assumptions reset again. bids higher mh60s

13/

Now the justifications start:

"it can't be that bad, housing will be fine"

"govt will have backstop"

"are we even trying to make money here"

assumptions reset again. bids higher mh60s

13/

HY is tightening. Market is healing. bid l70s, still high singles YTM, but "we need to think in total return"

offers start flowing. SELF DOUBT.

Was I too aggressive? Did I move the market 10 points in a week? Is there a dip coming?

Bonds trade away 73. BID 75. F THAT GUY.

14/

offers start flowing. SELF DOUBT.

Was I too aggressive? Did I move the market 10 points in a week? Is there a dip coming?

Bonds trade away 73. BID 75. F THAT GUY.

14/

Broker: "hey I know you like X but I have Y at 60"

Y = GARBAGE bond that's WAY worse

3 weeks ago = NO f-ing way I'm ever touching Y. Who in their right mind would buy that?

Updated mindset = What if my assumptions are off? What if Y is the jugular play? Bid 59. Hit

15/

Y = GARBAGE bond that's WAY worse

3 weeks ago = NO f-ing way I'm ever touching Y. Who in their right mind would buy that?

Updated mindset = What if my assumptions are off? What if Y is the jugular play? Bid 59. Hit

15/

CANT MISS OUT. THESE ARE GOING TO 90.

PM is fully bought in (at prices 60% higher than literally 3 weeks ago)

YOLO time. IB to broker "I want ALL bonds of this kind... here are standing bids "

YTM? Who cares. Intex takes too long to load, and they're moving up anyway

16/

PM is fully bought in (at prices 60% higher than literally 3 weeks ago)

YOLO time. IB to broker "I want ALL bonds of this kind... here are standing bids "

YTM? Who cares. Intex takes too long to load, and they're moving up anyway

16/

So how did it end?

Bonds traded h80s/l90s in June. In less than 2 months, some bonds had DOUBLED in price. Obviously I didn't buy that many in the 40s, I think most were actually in the h50s/l60s. So much was about when sellers stepped up.

17/

Bonds traded h80s/l90s in June. In less than 2 months, some bonds had DOUBLED in price. Obviously I didn't buy that many in the 40s, I think most were actually in the h50s/l60s. So much was about when sellers stepped up.

17/

The relative value of these securities reset about ~50 times in 25 trading sessions. At first, every trade was analyzed. Every tick was counted. And by the end, price was irrelevant. Conviction increased whenever a competing bid came in.

18/

18/

The frenzy created by the mix of fluid data, aggressive brokers, and pressure for performance fed on itself until the bonds basically reached a point where NOBODY could justify buying them. I sold most of them in the 90s and moved on.

They're wrapped around par today

19/

They're wrapped around par today

19/

All of 2020 and now 2021 has been full of these.

But bonds have ceilings: only so much above par that someone wants to pay. No such concept exists in equities, which has resulted in some wild moves

end/

But bonds have ceilings: only so much above par that someone wants to pay. No such concept exists in equities, which has resulted in some wild moves

end/

Read on Twitter

Read on Twitter