1/ Quick thread on why options hedging is going to drive $BTC higher. Options trading has exploded in both stock and crypto markets, and it is having a significant impact on the underlying prices of assets like $BTC and $TSLA.

2/ When you buy a call option, most likely you are buying it off a market maker. This is someone (likely some kind of professional shop) who is collecting premium. You are making a leveraged bet that $BTC will go up, and they are playing the volatility game.

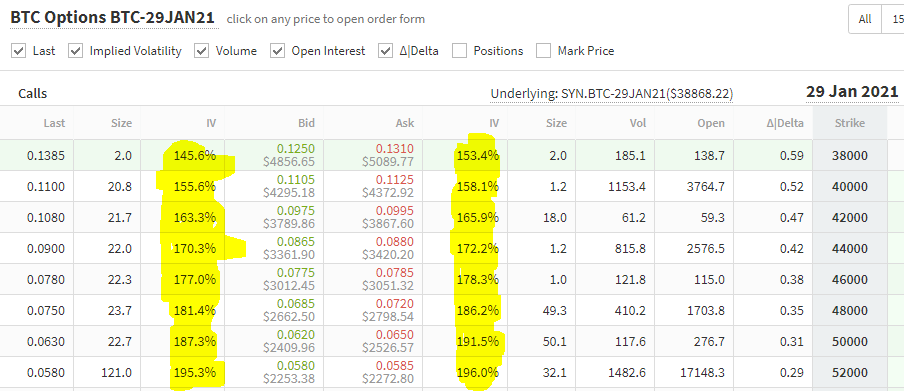

3/ Each option has an implied volatility, based on its current price; higher IV = higher premiums. So when the market maker sells you an option, they are hoping the market moves less than the IV suggested by the premium they charge you.

4/ In bitcoin, you might buy an option at 190 vol, in this case the market maker needs BTC to move less than 10% a day to make money. If BTC moved on average 1% a day, you can calculate IV by taking the square root of trading days (365 in crypto) = 19.1. At 10% a day it is 191.

5/ There are two main risks for the market maker; Delta is the risk that the option finishes in the money. Gamma is the rate of change of that Delta. A call option which is far out of the money (29 Jan $52k call) has a fairly low probability of finishing in the money, e.g. 5%

6/ So if the market maker sells 10 BTC worth of calls , they would need to buy 0.5 BTC (5%) to be hedged. But as $BTC spot price goes higher, the Delta grows, because the probability of the option ending in the money goes up.

7/ Therefore as $BTC price rises, Delta goes up, and the market maker needs to buy more coins to hedge, driving price up further. A self fulfilling prophecy.

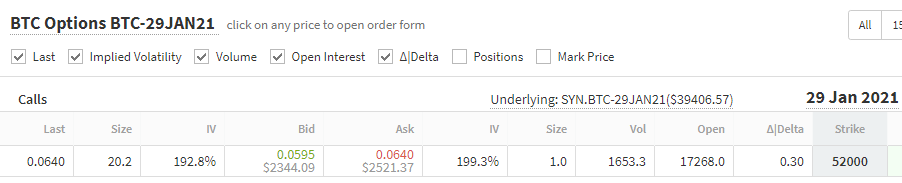

8/ On @DeribitExchange a whale has 17k coins worth of 29 Jan $52k calls. A market maker sold the whale those calls, and will need to buy a shit load of coins to hedge if price starts to rally closer to the $52k strike.

9/ If the probability of $BTC being above $52k by Jan 29 increases to just 25%, the market maker will need to buy 4,250 BTC just to hedge this one set of options.

10/ So go and buy some calls on @DeribitExchange, then lets get this rally started and make those market makers feel naked! cc @zhusu @kyled116

send it @RaoulGMI

Read on Twitter

Read on Twitter