$TIGR - 148% Growth MACHINE

$TIGR - 148% Growth MACHINE

Taking advantage of the massive influx of Asian IPOs

Taking advantage of the massive influx of Asian IPOs AND from the rise in STOCK TRADING in ASIA

AND from the rise in STOCK TRADING in ASIA Can it FIGHT against $BABA $FUTU and $TCEHY

Can it FIGHT against $BABA $FUTU and $TCEHY

Here is an EASY thread

$TIGR was founded in 2014 and provides online brokerage services in

Hong Kong

Hong Kong

Mainland China

Mainland China

Australia

Australia

New Zealand

New Zealand

Singapore

Singapore

USA (currently expanding)

USA (currently expanding)

Overseas clients accounted for 20% of the newly funded accounts in Q3 ’20

Overseas clients accounted for 20% of the newly funded accounts in Q3 ’20

Hong Kong

Hong Kong Mainland China

Mainland China  Australia

Australia  New Zealand

New Zealand Singapore

Singapore USA (currently expanding)

USA (currently expanding) Overseas clients accounted for 20% of the newly funded accounts in Q3 ’20

Overseas clients accounted for 20% of the newly funded accounts in Q3 ’20

The company is backed by Interactive Brokers (9.5% stake) and Xiaomi (14.1% stake)

· Wu Tianhua (CEO & Founder) holds around 25% of the shares

· It went public on the Nasdaq in March 2019 and raised $ 103m to fund its global expansion https://www.scmp.com/business/companies/article/2187433/xiaomi-backed-online-broker-serves-chinese-stock-traders-aims

and raised $ 103m to fund its global expansion https://www.scmp.com/business/companies/article/2187433/xiaomi-backed-online-broker-serves-chinese-stock-traders-aims

· Wu Tianhua (CEO & Founder) holds around 25% of the shares

· It went public on the Nasdaq in March 2019

and raised $ 103m to fund its global expansion https://www.scmp.com/business/companies/article/2187433/xiaomi-backed-online-broker-serves-chinese-stock-traders-aims

and raised $ 103m to fund its global expansion https://www.scmp.com/business/companies/article/2187433/xiaomi-backed-online-broker-serves-chinese-stock-traders-aims

The company is growing FAST

The company is growing FAST· By the end of Q4 ’18, it counted 82k funded accounts

and $ 2.4B in account balance

and $ 2.4B in account balance· It now counts over 214k funded accounts (up 111% YoY), the total account balance reached $ 10.9B, up 189% YoY

And growth is NOT slowing down

And growth is NOT slowing down· Total revenues increased by 148% YoY and reached $ 38m as the company added 46.8k accounts in Q3 only

· Commissions reached $ 19.5m, up 212% form $ 6.2m a year earlier driven by an increase in usage

Here is from the Q3 2020 results

“In the third quarter, we added 46,800 funded accounts, 7X the quarterly growth rate in the same period last year […]”

“Clients also continued to allocate more of their assets to our platform [...]"

“In the third quarter, we added 46,800 funded accounts, 7X the quarterly growth rate in the same period last year […]”

“Clients also continued to allocate more of their assets to our platform [...]"

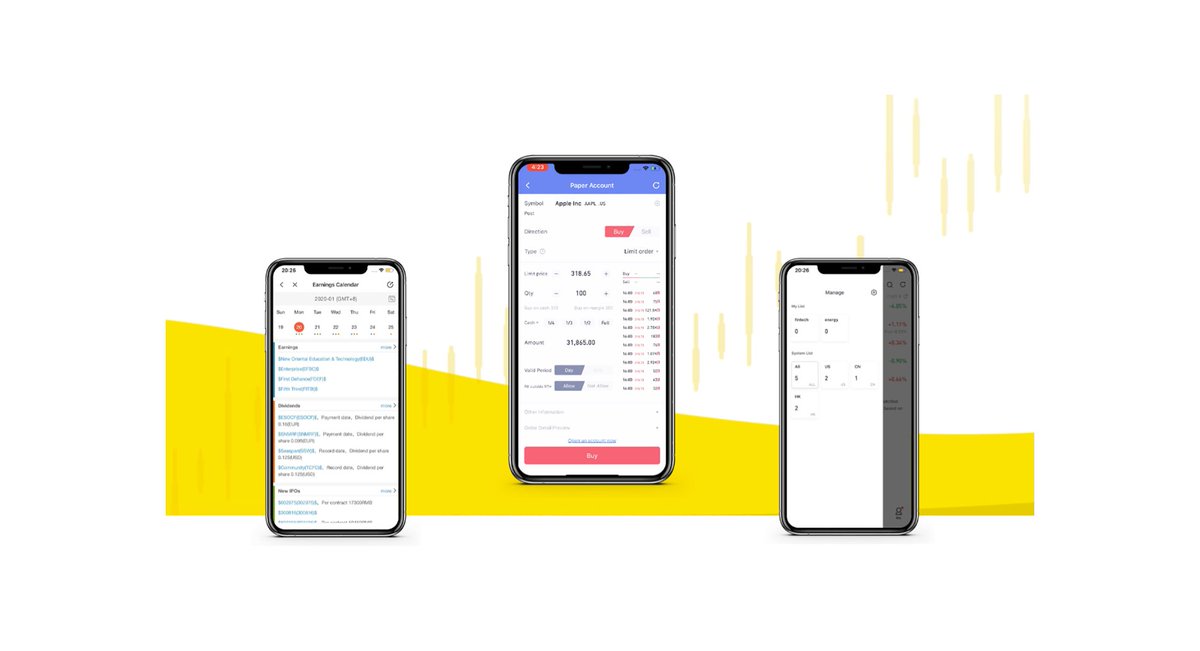

Digital Brokerage Services

Digital Brokerage Services

Through its investing platform “Tiger Trade”

it provides brokerage services with access to AU, SG, HK, CN and US stocks

it provides brokerage services with access to AU, SG, HK, CN and US stocksIt also provides market data, news feeds, educational briefs and an investor community through http://Laohu8.com

Their client base consists mainly in the emerging affluent Chinese population - taking advantage of generational shift in wealth management

But it is also rapidly expanding in Singapore, Australia and New Zealand

But it is also rapidly expanding in Singapore, Australia and New Zealand

But it is also rapidly expanding in Singapore, Australia and New Zealand

But it is also rapidly expanding in Singapore, Australia and New Zealand

Website visits increased by 306% in Singapore from July to December 2020 and reached 183k monthly visits

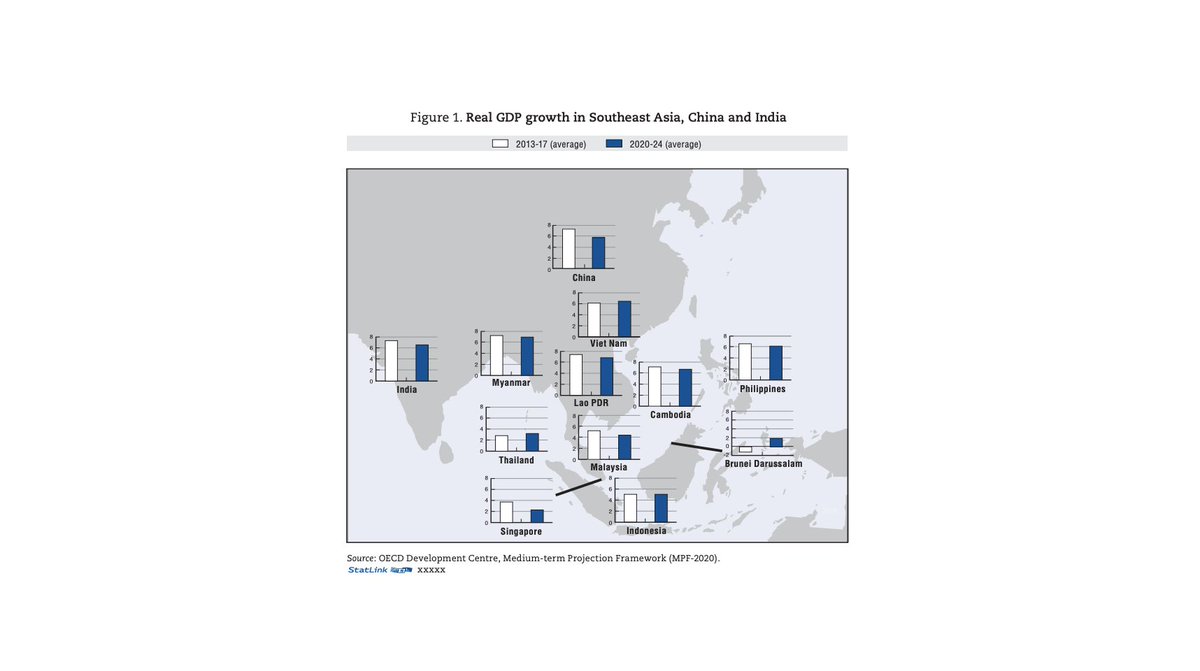

Website visits increased by 306% in Singapore from July to December 2020 and reached 183k monthly visits With reports pointing to an entry into Indonesia, a country with 270m inhabitants and forecasted to grow its GDP by +5% / year well into 2025 https://www.thejakartapost.com/adv/2020/12/16/tiger-brokers-helping-indonesian-investors-trade-global-markets-supported-by-nasdaq-data.html

With reports pointing to an entry into Indonesia, a country with 270m inhabitants and forecasted to grow its GDP by +5% / year well into 2025 https://www.thejakartapost.com/adv/2020/12/16/tiger-brokers-helping-indonesian-investors-trade-global-markets-supported-by-nasdaq-data.html

The market opportunity is LARGE

According to a study by BCG, China’s household wealth is set to increase by about $ 14T by 2023 and reach $ 35T

According to a study by BCG, China’s household wealth is set to increase by about $ 14T by 2023 and reach $ 35T

Driven by the liberalisation of the Chinese economy and growing wealth as the economy pivots from industry to services

Driven by the liberalisation of the Chinese economy and growing wealth as the economy pivots from industry to services

According to a study by BCG, China’s household wealth is set to increase by about $ 14T by 2023 and reach $ 35T

According to a study by BCG, China’s household wealth is set to increase by about $ 14T by 2023 and reach $ 35T Driven by the liberalisation of the Chinese economy and growing wealth as the economy pivots from industry to services

Driven by the liberalisation of the Chinese economy and growing wealth as the economy pivots from industry to services

Sill according to BCG, the Assets Under Management (AUM) in China is set to grow by 11% to 15% per year over the 2018 - 2025 period

Sill according to BCG, the Assets Under Management (AUM) in China is set to grow by 11% to 15% per year over the 2018 - 2025 period As the number of High Net Worth Individuals (invest. assets of at least $ 850k) will surge by 44% and now stands at around 1,67m individuals

As the number of High Net Worth Individuals (invest. assets of at least $ 850k) will surge by 44% and now stands at around 1,67m individuals

“As China’s economy continues to grow and liberalize, we expect the country’s asset management market to more than double by 2025, becoming the second largest after the US, with technology playing a critical role. “ By Qin Xu et Al. https://www.bcg.com/publications/2019/global-asset-managers-can-step-in-as-china-opens-up

According to UBS and the Financial Times, the Chinese mutual fund industry is set to reach RMB 47T ($ 7.5T) by 2025, up from RMB 11T in 2017

According to UBS and the Financial Times, the Chinese mutual fund industry is set to reach RMB 47T ($ 7.5T) by 2025, up from RMB 11T in 2017 Driven by easing regulation aimed at boosting China’s investment scene https://www.ft.com/content/ca76b3a8-398a-11e8-8b98-2f31af407cc8

Driven by easing regulation aimed at boosting China’s investment scene https://www.ft.com/content/ca76b3a8-398a-11e8-8b98-2f31af407cc8

“Beijing unveiled far-reaching reforms in November intended to accelerate the growth of China’s under-developed investment industry with less than 5 per cent of Chinese household assets held in mutual funds.”

Chris Flood for the Financial Times

Chris Flood for the Financial Times

Looking past China, $TIGR also has a considerable opportunity in South East Asia

Indonesia alone counts over 270m habitants

Indonesia alone counts over 270m habitants

The Philippines count over 107m inhabitants

The Philippines count over 107m inhabitants

Vietnam counts 96.6m inhabitants

Vietnam counts 96.6m inhabitants

The OECD forecasts GDP to grow by around 4 to 6% / YEAR

The OECD forecasts GDP to grow by around 4 to 6% / YEAR

Indonesia alone counts over 270m habitants

Indonesia alone counts over 270m habitants  The Philippines count over 107m inhabitants

The Philippines count over 107m inhabitants Vietnam counts 96.6m inhabitants

Vietnam counts 96.6m inhabitants The OECD forecasts GDP to grow by around 4 to 6% / YEAR

The OECD forecasts GDP to grow by around 4 to 6% / YEAR

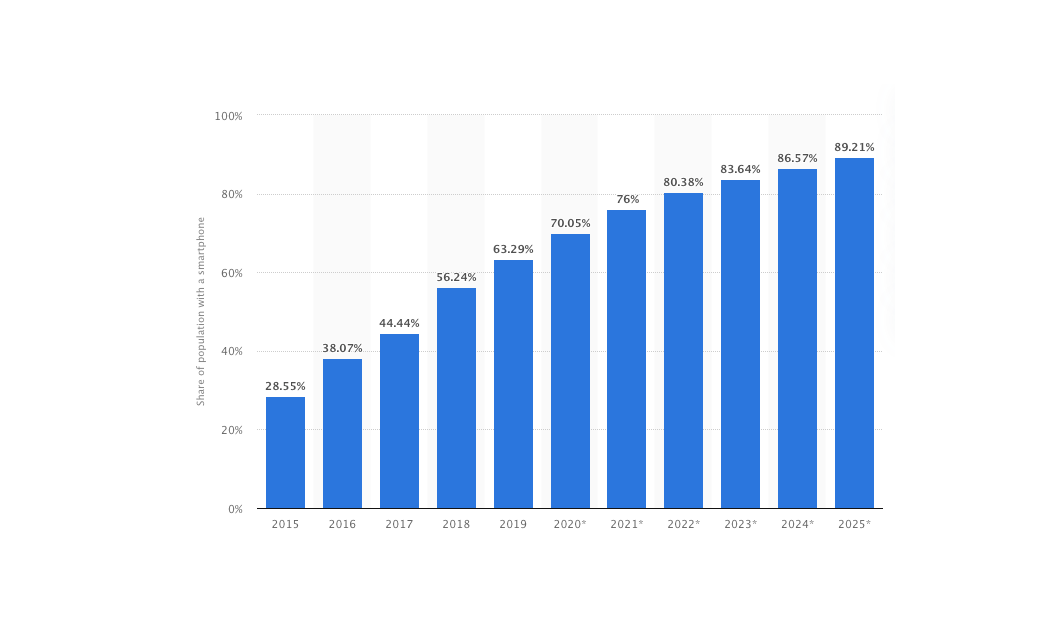

According to KPMG (2019 data), only 27% of those living in South East Asia have a bank account, translating into 438m unbanked individuals

According to KPMG (2019 data), only 27% of those living in South East Asia have a bank account, translating into 438m unbanked individuals Limited infrastructure restrains access to banking services - this changes as smartphone penetration rises https://www.techinasia.com/talk/438m-unbanked-southeast-asia-fintech

Limited infrastructure restrains access to banking services - this changes as smartphone penetration rises https://www.techinasia.com/talk/438m-unbanked-southeast-asia-fintech

And smartphone penetration is rising fast:

Smartphone penetration stood at 29% in 2015 in Indonesia and is projected to reach 90% by 2025

Smartphone penetration stood at 29% in 2015 in Indonesia and is projected to reach 90% by 2025

Smartphone penetration stood at 29% in 2015 in Indonesia and is projected to reach 90% by 2025

Smartphone penetration stood at 29% in 2015 in Indonesia and is projected to reach 90% by 2025

“This translates to opportunity – especially for fintech companies."

"Traditional banking and finance firms are starting to take note of the potential arising from incorporating technology into their business [...]” from The Asean Post https://theaseanpost.com/article/banking-southeast-asias-unbanked-0

"Traditional banking and finance firms are starting to take note of the potential arising from incorporating technology into their business [...]” from The Asean Post https://theaseanpost.com/article/banking-southeast-asias-unbanked-0

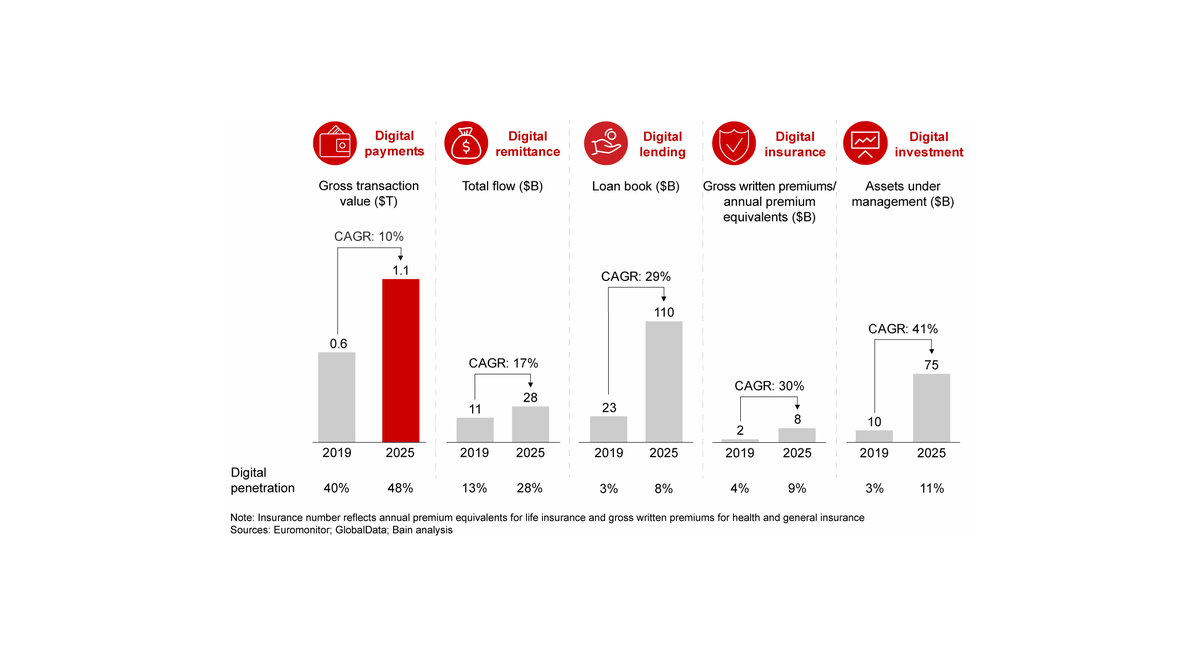

According to Bain & Company, the Assets Under Management in the SEA region are set to grow from $ 10B to $ 75B over the 2019 - 2025 period

According to Bain & Company, the Assets Under Management in the SEA region are set to grow from $ 10B to $ 75B over the 2019 - 2025 period Representing a CAGR of 41% - the fastest growing financial segment - and driven by increasing digital penetration

Representing a CAGR of 41% - the fastest growing financial segment - and driven by increasing digital penetration

“[…] fintechs benefit from a more flexible cost structure and ability to build cleaner technology stacks, allowing them to provide competitive pricing and better user experiences” Florian Hoppe et Al. https://www.bain.com/insights/fulfilling-southeast-asias-digital-financial-services-promise/

The Chinese and SEA markets offer considerable opportunities as wealth rises and banking penetration increases

$TIGR is growing at a rapid pace in its home market, offering access to a broad set of markets at a low cost - all while entering foreign markets

$TIGR is growing at a rapid pace in its home market, offering access to a broad set of markets at a low cost - all while entering foreign markets

$TIGR is growing at a rapid pace in its home market, offering access to a broad set of markets at a low cost - all while entering foreign markets

$TIGR is growing at a rapid pace in its home market, offering access to a broad set of markets at a low cost - all while entering foreign markets

But what about their competition? The Android store reveals that $TIGR is still the smaller player:

Tiger Brokers has 4.4 stars

Tiger Brokers has 4.4 stars  and 717 ratings

and 717 ratings

Futubull (from $FUTU) has 4.5 stars

Futubull (from $FUTU) has 4.5 stars  and 5,200 ratings

and 5,200 ratings

Webull (from $BABA) has 4.5 stars

Webull (from $BABA) has 4.5 stars  and 77,900 ratings

and 77,900 ratings

Tiger Brokers has 4.4 stars

Tiger Brokers has 4.4 stars  and 717 ratings

and 717 ratings Futubull (from $FUTU) has 4.5 stars

Futubull (from $FUTU) has 4.5 stars  and 5,200 ratings

and 5,200 ratings Webull (from $BABA) has 4.5 stars

Webull (from $BABA) has 4.5 stars  and 77,900 ratings

and 77,900 ratings

Tiger Brokers is a founder-led company with strong tech & markets experience

Wu Tianhua is CEO and founder of Tiger Brokers

Wu Tianhua is CEO and founder of Tiger Brokers

Worked for 9 years at YouDao (part of $NTES)

Worked for 9 years at YouDao (part of $NTES)

Earned a Master’s Degree in Computer Science from the Tsinghua University

Earned a Master’s Degree in Computer Science from the Tsinghua University

Wu Tianhua is CEO and founder of Tiger Brokers

Wu Tianhua is CEO and founder of Tiger Brokers Worked for 9 years at YouDao (part of $NTES)

Worked for 9 years at YouDao (part of $NTES) Earned a Master’s Degree in Computer Science from the Tsinghua University

Earned a Master’s Degree in Computer Science from the Tsinghua University

John Fei Zeng is CFO of Tiger Brokers

John Fei Zeng is CFO of Tiger Brokers Previously Director of Global Capital Market at UBS (China) and Exec. Director of Equity Capital Markets at Goldman Sachs (China)

Previously Director of Global Capital Market at UBS (China) and Exec. Director of Equity Capital Markets at Goldman Sachs (China) Received an MBA from NY University and an undergraduate degree from the U. of Southern California

Received an MBA from NY University and an undergraduate degree from the U. of Southern California

Financial Check

Financial Check

Sales reached $ 38m in Q3 ’20, up 148% from $ 15.3m a year earlier

Sales reached $ 38m in Q3 ’20, up 148% from $ 15.3m a year earlier Commissions accounted for $ 19.5m, up 211% from $ 6.2m a year earlier

Commissions accounted for $ 19.5m, up 211% from $ 6.2m a year earlier Operating expenses stood at $ 28m, up 69% from $ 16.5m a year earlier

Operating expenses stood at $ 28m, up 69% from $ 16.5m a year earlier

Operating income reached $ 7.4m versus a loss of $ 2.5m a year earlier

Operating income reached $ 7.4m versus a loss of $ 2.5m a year earlier Current assets stood at $ 2.1B versus $ 1.9B in current liabilities

Current assets stood at $ 2.1B versus $ 1.9B in current liabilities

Tiger’s growth rates and international expansion show that it can deliver on its vision and take advantage of the growing investment landscape in China

Tiger’s growth rates and international expansion show that it can deliver on its vision and take advantage of the growing investment landscape in China· At this point, the market growth may absorb more than one player and $TIGR has a strong position

Regulatory Watch

Regulatory Watch

Overall, the regulatory environment in China is becoming more open as access to markets is being provided to foreign institutions and investors

Overall, the regulatory environment in China is becoming more open as access to markets is being provided to foreign institutions and investors

Of course, one should not forget that under certain events, the governing bodies might take restrictive actions (e.g. AntGroup IPO, Alibaba) https://www.wsj.com/articles/ant-group-ipo-postponed-by-shanghai-stock-exchange-11604409597

Of course, one should not forget that under certain events, the governing bodies might take restrictive actions (e.g. AntGroup IPO, Alibaba) https://www.wsj.com/articles/ant-group-ipo-postponed-by-shanghai-stock-exchange-11604409597

On the good side:

“If you’re any financial institution, a fund manager big or small, China is now an open market to you […] It is really a high point of openness and capital market development for China” Fraser Howie, taken from Financial Times https://www.ft.com/content/a5392f07-9deb-4573-beb1-88a946f00df5

“If you’re any financial institution, a fund manager big or small, China is now an open market to you […] It is really a high point of openness and capital market development for China” Fraser Howie, taken from Financial Times https://www.ft.com/content/a5392f07-9deb-4573-beb1-88a946f00df5

THE BOTTOM LINE

THE BOTTOM LINE

$TIGR is growing at a fast clip as it provides the trading tools a new generation of investors require

$TIGR is growing at a fast clip as it provides the trading tools a new generation of investors require It differentiates itself with access to numerous markets, low costs, intuitive app and stock market news feeds

It differentiates itself with access to numerous markets, low costs, intuitive app and stock market news feeds

The trading market is set to boom in China as wealth is being built up and the amount if investable assets increases dramatically

The trading market is set to boom in China as wealth is being built up and the amount if investable assets increases dramatically The company is also expanding in wealthy and developed markets such as Singapore, Australia and New Zealand and is rapidly gaining market share

The company is also expanding in wealthy and developed markets such as Singapore, Australia and New Zealand and is rapidly gaining market share

As some reports reveal, $TIGR also has its eyes set on Indonesia and other growing SEA markets, unlocking considerable growth levers

As some reports reveal, $TIGR also has its eyes set on Indonesia and other growing SEA markets, unlocking considerable growth levers The investment and fintech scene may come under scrutiny as China tries to retain the reigns of its economy

The investment and fintech scene may come under scrutiny as China tries to retain the reigns of its economy

Competition is intense with Alibaba’s Webull and the Tencent-backed $FUTU

Competition is intense with Alibaba’s Webull and the Tencent-backed $FUTU  We start a medium stake in $TIGR

We start a medium stake in $TIGR

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Google Play Store

✑ Financial Times

✑ Wall Street Journal

Sources

✑ Investor presentation

✑ Company website

✑ Google Play Store

✑ Financial Times

✑ Wall Street Journal

✑ Boston Consulting Group

✑ Bain & Company

✑ UBS

✑ Global Times

✑ Tech In Asia

✑ The Asean Post

✑ KPMG

✑ OECD

✑ Bain & Company

✑ UBS

✑ Global Times

✑ Tech In Asia

✑ The Asean Post

✑ KPMG

✑ OECD

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

Want to get UNDER HYPED companies delivered straight to your inbox

Want to get UNDER HYPED companies delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter