Why $HEC/Talkspace, the leading digital and virtual behavioral healthcare company, is a sleeping giant with massive upside potential!

Why $HEC/Talkspace, the leading digital and virtual behavioral healthcare company, is a sleeping giant with massive upside potential!- Proprietary tech

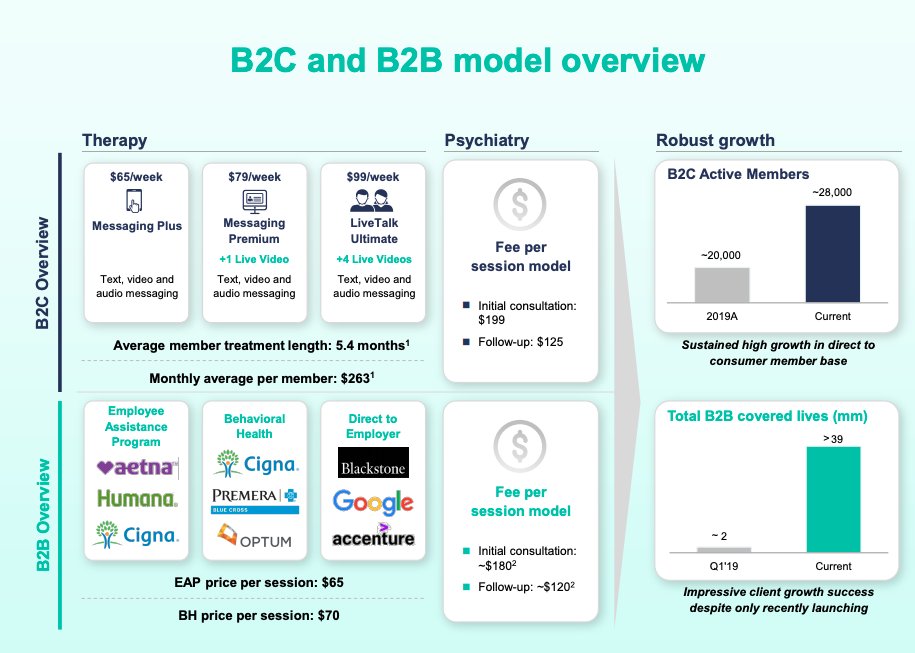

- Massive B2B opportunities

- Heavy backers + top MGMT

- Already profitable

*Current Price: $11.50

Time for a thread!

Talkspace was founded in 2012 by couple Oren and Roni Frank after a transformative experience in couples therapy that saved their marriage. The company began as a group therapy platform but has evolved to a company offering online psychotherapy from licensed therapists. $HEC

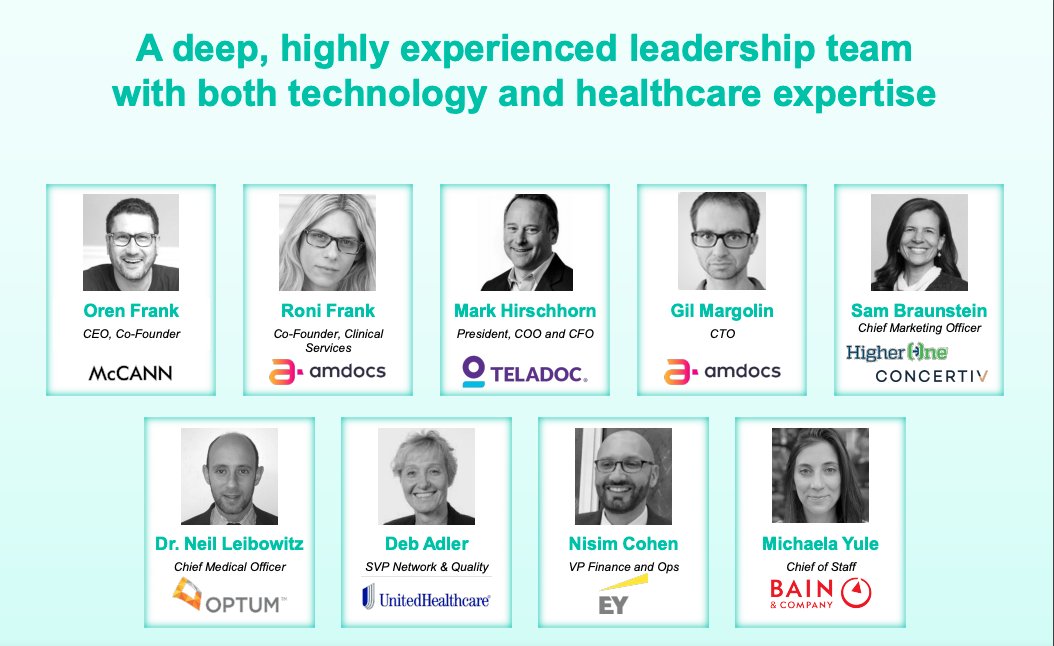

The company has a well stacked management team with experience from various blue-chip and global companies across different industries such as McCann, Amdocs, UnitedHealthcare, EY, and Bain. $HEC

In Feb 2020, the company appointed Mark Hirschhorn as President, CFO, and COO.

Hirschhorn served as COO and CFO of Teladoc $TDOC, the nation's leading provider of telehealth services.

Hirschhorn served as COO and CFO of Teladoc $TDOC, the nation's leading provider of telehealth services.

He joined Teladoc in 2012 and grew the company from $10M in revenue with 45 employees to $500M in revenue and 2,500 employees when he left at the end of 2018. While at Teladoc, Hirschhorn was responsible for its M&A strategy, including the acquisition of BetterHelp. $HEC

Funding: The company is backed by multiple funds including Qumra Capital, Norwest Venture Partners, Spark Capital, SoftBank, Compound Ventures and FirstTime.

Yes, SoftBank! https://www.talkspace.com/online-therapy/talkspace-announces-31-million-series-c-funding/

Yes, SoftBank! https://www.talkspace.com/online-therapy/talkspace-announces-31-million-series-c-funding/

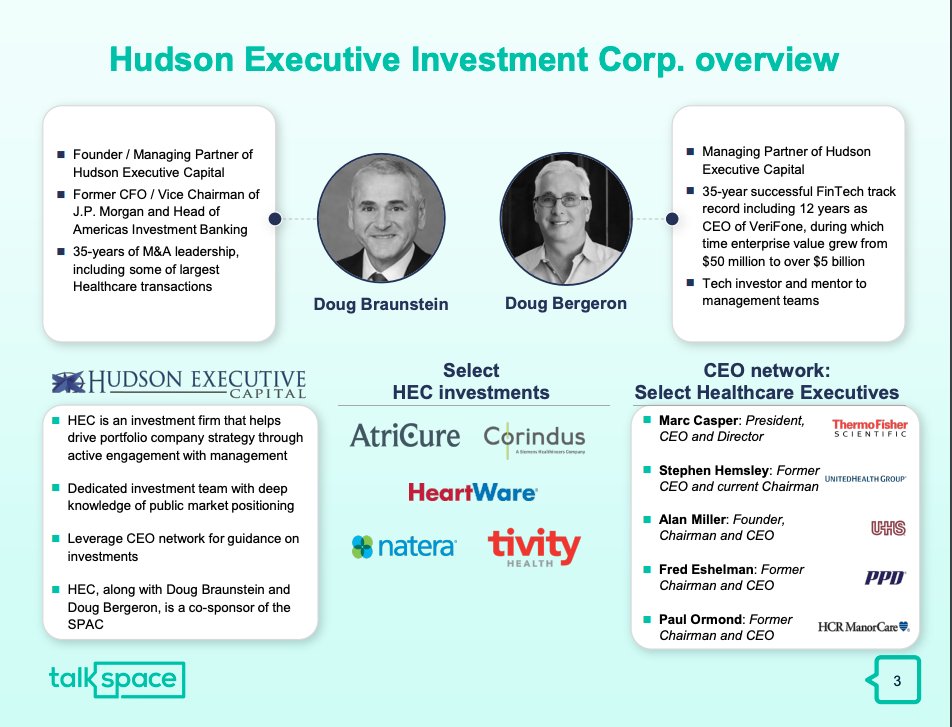

SPAC Management: $HEC is formed by Hudson Executive Capital, Douglas L. Braunstein, and Douglas G. Bergeron. HEC is an event-driven investment firm managing over $1.5B in assets. Braunstein is founder and co-managing partner of HEC and the frmr CFO and Vice Chairman of JP Morgan.

Talkspace $HEC has world-class ambassadors and advocates such as Olympic swimmer Michael Phelps and Demi Lovato.

Talkspace $HEC has been investing heavily over the past couple years in the AI and technology space to better service patients in a systematic, efficient manner. https://www.bloombergquint.com/businessweek/talkspace-using-ai-for-therapy-during-mental-health-crisis

Talkspace $HEC company snapshot:

- 2 million members served

- 39 million commercial covered lives

- 46,000 active members

- 2,650 providers

- 68% of members saw improvement in symptoms

- 2 million members served

- 39 million commercial covered lives

- 46,000 active members

- 2,650 providers

- 68% of members saw improvement in symptoms

Virtual therapy is the future.

COVID or not, it's here to stay. There are multiple hurdles and processes around in-person therapy that virtual has an upperhand on $HEC

COVID or not, it's here to stay. There are multiple hurdles and processes around in-person therapy that virtual has an upperhand on $HEC

Talkspace $HEC has achieved massive growth both from a B2C to a B2B perspective. In my opinion, the real opportunity lies in the B2B space:

- Employee assistance programs

- Behavioral Health

- Direct to Employer

- Employee assistance programs

- Behavioral Health

- Direct to Employer

Current B2B clients include blue-chip and Fortune 500 companies like Google, Cigna, Humana, Blackstone and Accenture.

Companies will continue to invest in the health and wellness of their employees and it will shift from a perk that's good to have to a necessity. $HEC

Companies will continue to invest in the health and wellness of their employees and it will shift from a perk that's good to have to a necessity. $HEC

Cities, colleges, schools, and public institutions will start pulling out of their budgets and subsidies to enable online therapy for its residents, students, and employees. $HEC https://thisisreno.com/2020/12/talkspace-contract-approved-unanimously-by-city-council/

Swarthmore College Goes Virtual and Partners with Talkspace $HEC

https://swarthmorephoenix.com/2020/09/17/caps-goes-virtual-and-partners-with-talkspace/

https://swarthmorephoenix.com/2020/09/17/caps-goes-virtual-and-partners-with-talkspace/

Talkspace Announces First University Partnership with Williams College $HEC https://www.prnewswire.com/news-releases/talkspace-announces-first-university-partnership-with-williams-college-300914660.html

Kenzie Academy Partners with Talkspace $HEC https://www.kenzie.academy/blog/kenzie-academy-partners-with-talkspace/

Therapy in the sports world has become a huge topic due to the immense pressure that athletes face on a daily basis. $HEC

USA TRIATHLON PARTNERS WITH TALKSPACE TO OFFER ONLINE MENTAL HEALTH THERAPY FOR U.S. NATIONAL TEAM ATHLETES https://www.teamusa.org/USA-Triathlon/News/Articles-and-Releases/2020/May/18/USA-Triathlon-Partners-with-Talkspace-to-Offer-Online-Mental-Health-Therapy

USA TRIATHLON PARTNERS WITH TALKSPACE TO OFFER ONLINE MENTAL HEALTH THERAPY FOR U.S. NATIONAL TEAM ATHLETES https://www.teamusa.org/USA-Triathlon/News/Articles-and-Releases/2020/May/18/USA-Triathlon-Partners-with-Talkspace-to-Offer-Online-Mental-Health-Therapy

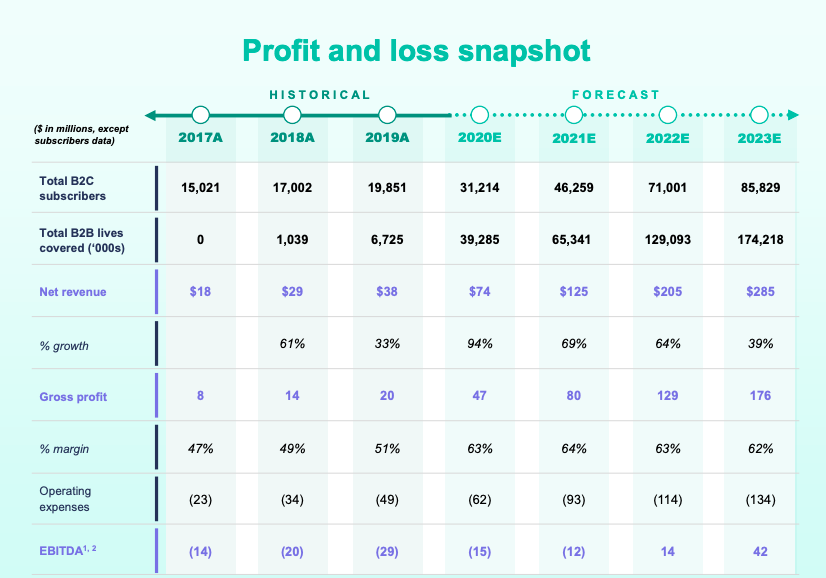

Talkspace $HEC is currently profitable and has grown 94% in 2020. The company expects to grow another 69%, 64%, and 39% until 2023.

Talkspace $HEC will use the proceeds from the SPAC transaction to fund further growth which includes international expansion and M&A.

Last November, the company acquired Lasting, the leading relationship counseling app. https://www.businesswire.com/news/home/20201112005199/en/Talkspace-Announces-Acquisition-of-Leading-Relationship-Counseling-App-Lasting

Last November, the company acquired Lasting, the leading relationship counseling app. https://www.businesswire.com/news/home/20201112005199/en/Talkspace-Announces-Acquisition-of-Leading-Relationship-Counseling-App-Lasting

Additionally, in November 2020 it was reported that Talkspace $HEC was actually an acquisition target by Teladoc or Amwell. https://www.businessinsider.com/talkspace-considering-selling-online-therapy-platform-2020-11

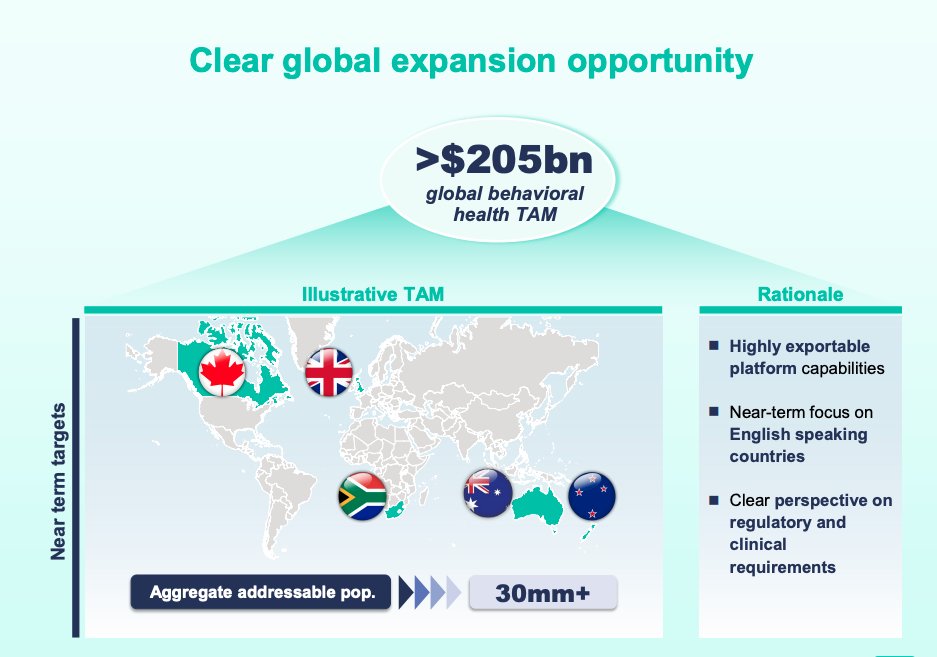

There is a huge opportunity for Talkspace $HEC to grow further and expand their footprint in English-speaking countries such as Canada, UK, South Africa, Australia and New Zealand.

Talkspace $HEC is always listed in the top 3 best online therapy platforms across multiple media outlets.

Observer: https://observer.com/2020/10/best-online-therapy-review-of-online-mental-health-and-counseling-services/

Discover: https://www.discovermagazine.com/sponsored/best-online-therapy-services-the-top-6-virtual-therapy-sites-and-apps

CNET: https://www.cnet.com/health/online-therapy-services-to-help-with-anxiety-depression-stress/

Insider: https://www.insider.com/best-online-therapy

Observer: https://observer.com/2020/10/best-online-therapy-review-of-online-mental-health-and-counseling-services/

Discover: https://www.discovermagazine.com/sponsored/best-online-therapy-services-the-top-6-virtual-therapy-sites-and-apps

CNET: https://www.cnet.com/health/online-therapy-services-to-help-with-anxiety-depression-stress/

Insider: https://www.insider.com/best-online-therapy

Hope you enjoyed!

Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit.

Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit.

Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit.

Disclaimer: Nothing contained in this thread should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific profit.

Read on Twitter

Read on Twitter