Let’s have a thread on this Final Root Cause analysis. http://www.caiso.com/Documents/Final-Root-Cause-Analysis-Mid-August-2020-Extreme-Heat-Wave.pdf

To start, I want to say that in aggregate I don’t disagree with the finding that there were multiple additive causes of this event and there are no silver bullets here.

One of my largest gripes with this analysis begins before beginning to read it. Why are the agencies at fault here doing the analysis? Why doesn’t the governor bring in an unbiased third party to review? I feel the recommendations found would be very different.

#1 Climate change induced heat wave caused realized load to exceed RA and planning targets.

I can’t disagree that higher temps caused an increase load. However I do have issue with a few things from this section.

I can’t disagree that higher temps caused an increase load. However I do have issue with a few things from this section.

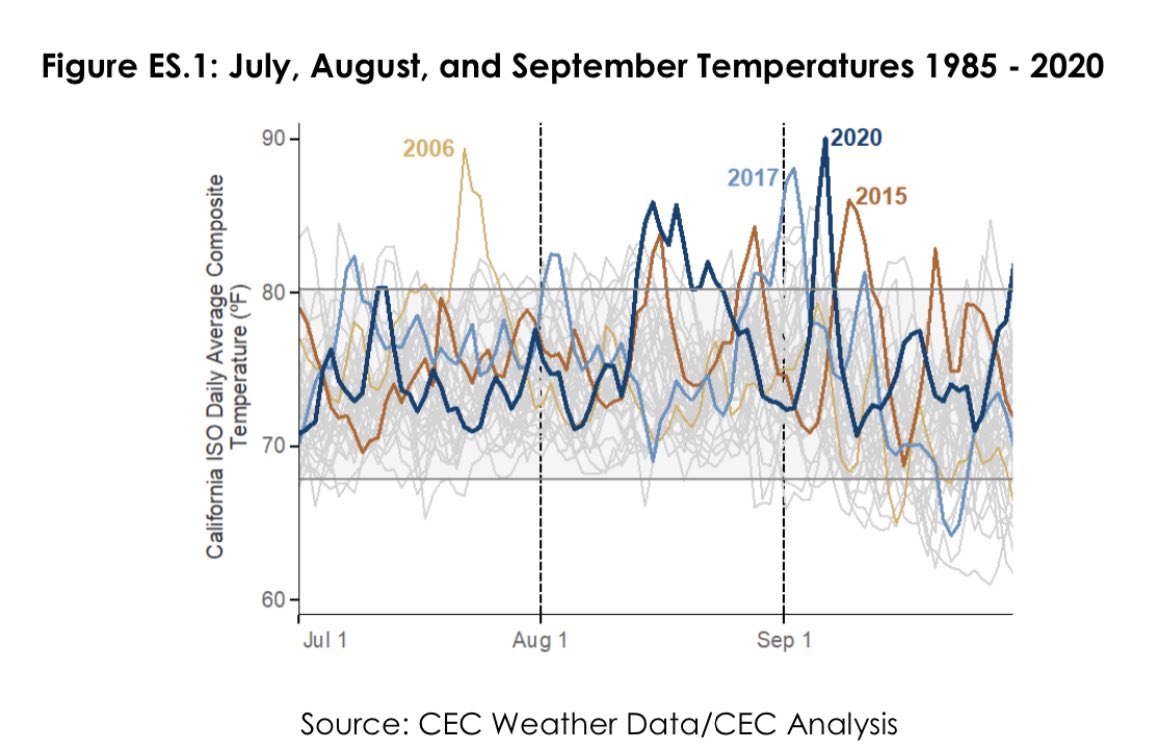

They state the mid August heat wave was a 1 in 30 year event. Look at their graph here. That peak certainly doesn’t look 1 in 30 to me when 2015 and 2017 had peaks right there.

Another issue I have is with the recommendations around this cause. They never mention modifying their forecast assumptions! If it’s a given that this is climate induced why are they forecasting based on historical instead of expected forward temperatures using the trend?

#2 reason given is that the planning targets have not kept pace with their net peak requirements.

Again, I can’t disagree.

But portions of their analysis is spotty at best.

Again, I can’t disagree.

But portions of their analysis is spotty at best.

This is one of the issues that happened on the 15th, but it’s unclear what exactly happened. Did the CAISO sced algorithm dispatch the unit down or was there a comms issue from the scheduling coordinator to the plant? They claim both in this sentence without further clarity.

This third issue raised is where my blood pressure begins to rise. They break this down into 3 sections.

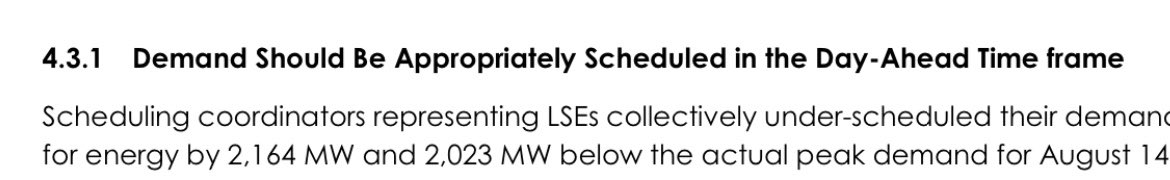

This first one lays blame on the LSE’s realized load was greater than their Day Ahead position.

There’s a number of issues with this claim. Let’s start with what is the purpose of a DAM. The core reason for having the DAM is to provide participants a financial hedge.

There’s a number of issues with this claim. Let’s start with what is the purpose of a DAM. The core reason for having the DAM is to provide participants a financial hedge.

There is no market more fundamentally volatile than a nodal real time electricity market, and providing a hedge allows both load and gen to be able to reduce their risk exposure to a great extent.

What the DAM was never meant to secure all gen for all load in the next day.

What the DAM was never meant to secure all gen for all load in the next day.

The BA is supposed to have processes in place to ensure enough gen is procured to meet its load + reserves. Hence why there are RUC processes before and after the DAM that secure gen out of market for the grid. This is supported by their 3rd section also here.

Making 100% load scheduling in DA a design target is very poor form and takes all financial risk decisions out of the LSE’s hands. The LSE’s will then lose out on the opportunity to purchase their load at lower real time prices when the Caiso market overprices hours in the DA.

Also, if you always schedule your expected load at your 50% expectation, you will be buying more load than you need half the time in day ahead! This will have further depressive effects on RT prices and hurting the hedge’s actual performance even more.

From my view, if load or gen are 100% hedged in the DA, it’s a sign that the combined DA and RT market has a broken design or the traders are a bit lazy...

Their next stated issue is stated to be with convergence (known as virtual or inc/dec in other markets) bidding.

This plus the last section really started to get me to think the CAISO doesn’t have the strongest grasp on the purpose of a number of their market mechanisms.

This plus the last section really started to get me to think the CAISO doesn’t have the strongest grasp on the purpose of a number of their market mechanisms.

To lay blame on virtuals for operational issues belies a basic misunderstanding of the purpose of their existence. These only exist in the DAM.

Again, we need to frame that the DAM is meant to be a financial only construct.

Again, we need to frame that the DAM is meant to be a financial only construct.

Caiso claims virtuals ‘play an important role in aligning loads and resources for the next day’.

I can’t overstate this. That is NOT what virtuals do. At all.

Their reason for existence is to drive convergence for DA and RT prices. That’s it.

I can’t overstate this. That is NOT what virtuals do. At all.

Their reason for existence is to drive convergence for DA and RT prices. That’s it.

To model and price the value of electricity at all nodes in a system T-24h requires a number of modeling shortcuts for feasibility and on top of this the uncertainties that far forward are large. Also, these virtuals only profit if they succeed in improving the DART spread.

Now they may have self imposed issues with their DA results causing issues in operations, but they should be clear that’s a CAISO process problem and not a virtual issue. This feels like a cop-out to not accept blame by pushing it onto an issue most don’t understand.

With that said, they then admit the DA scheduling problem was actually a RUC software issue in the next section! So why even bring up the previous section?

If you read that 3rd paragraph, you’ll actually see that this doesn’t even sound like a software bug but more like they had a parameter set incorrectly in their software. Where are the recommendations to have better software and testing paradigms?

Some other points that I don’t see noted in this Final Analysis, where is the blame with the Caiso RT pricing mechanisms when DR is deployed or missing price signals from poor AS scarcity pricing design?

Where is the recommendation that moving to a regional market with a singular BA over the top would have helped to mitigate this problem? Wouldn’t that be good to reiterate to the governor?

Finally, an outside observer would recommend to the governor to consolidate these responsibilities into a single entity. The breakdown of these responsibilities between the CPUC, CEC, and CAISO causes confusion, delay, and makes ambiguous who holds ultimate responsibility.

This is all without going into their RA program issues as that is an issue shared among many markets. I’d recommend they all follow ERCOT’s lead.

Read on Twitter

Read on Twitter